The world’s largest asset manager, BlackRock, said a portfolio allocation of up to 2% is "reasonable" for investors who wish to hold Bitcoin, in their latest Investment Perspectives report.

They begin the report by noting that "bitcoin cannot be compared to traditional assets," but from a portfolio construction perspective, Samara Cohen (CIO of ETFs) and her team suggest that the so-called "Magnificent 7" group of mega-cap tech stocks is a useful starting point.

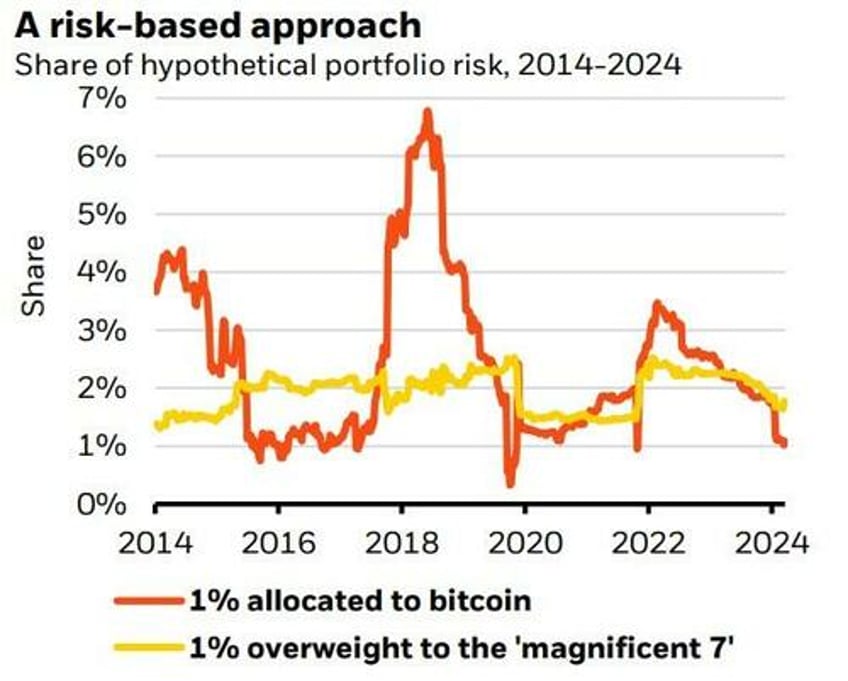

"Those stocks represent single portfolio holdings that account for a comparatively large share of portfolio risk as with bitcoin.

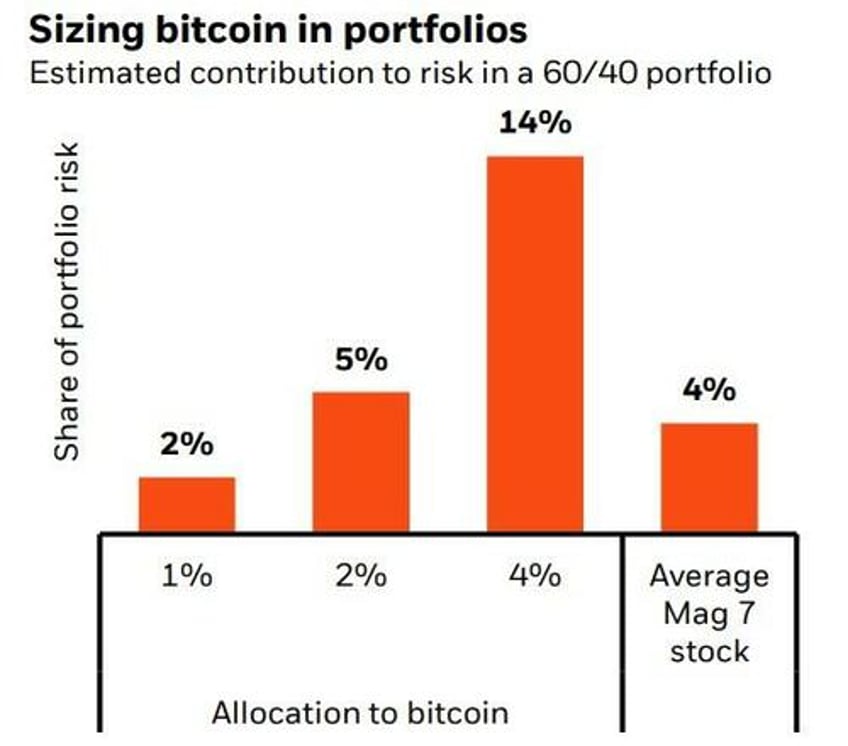

In a traditional portfolio with a mix of 60% stocks and 40% bonds, those seven stocks each account for, on average, about the same share of overall portfolio risk as a 1-2% allocation to bitcoin.

We think that’s a reasonable range for a bitcoin exposure."

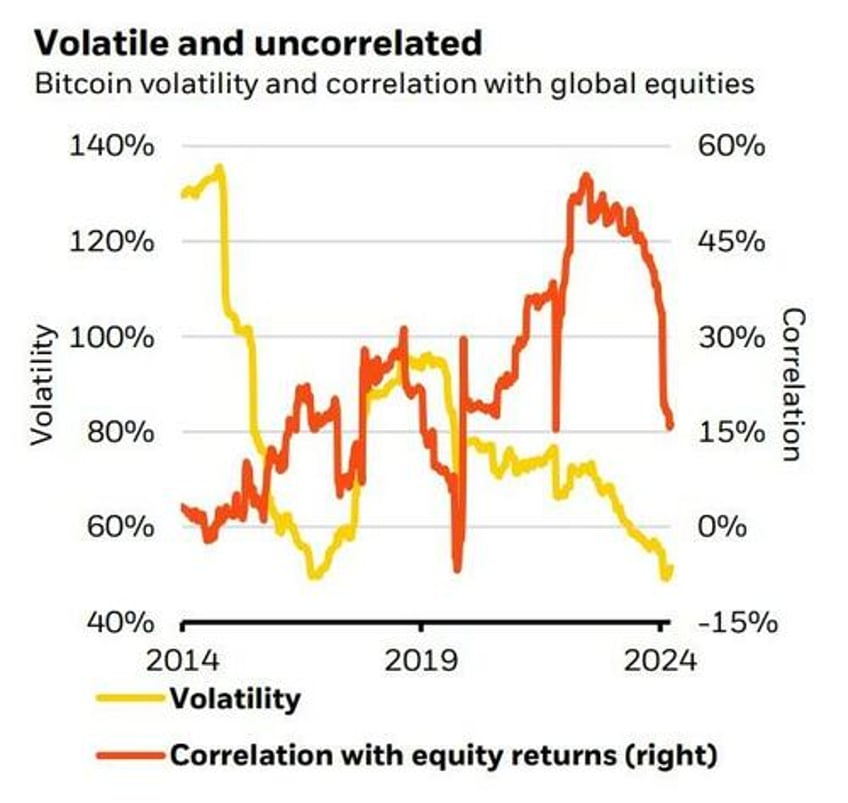

As with gold, bitcoin can be driven by sentiment, narratives and momentum – both up and down.

Why not more, they ask (and answer):

"Going beyond that would sharply increase bitcoin’s share of the overall portfolio risk."

With approximately $11.5 trillion in assets under management (and manager of the largest spot BTC ETF, iShares Bitcoin Trust (IBIT), which holds net assets of nearly $54 billion), they are worth listening to.

According to BlackRock, investors "need to think about Bitcoin’s expected returns in a different way: it has no underlying cash flows for estimating future returns. What matters: the extent of adoption."

"Bitcoin may also provide a more diversified source of return,” BlackRock said, adding:

"We see no intrinsic reason why Bitcoin should be correlated with major risk assets over the long term given its value is driven by such distinct drivers."

Longer term, BTC "could potentially also become less risky – but at that point it might no longer have a structural catalyst for further sizable price increases," the report said.

Instead, "investors may prefer to use it tactically to hedge against specific risks, similar to gold."

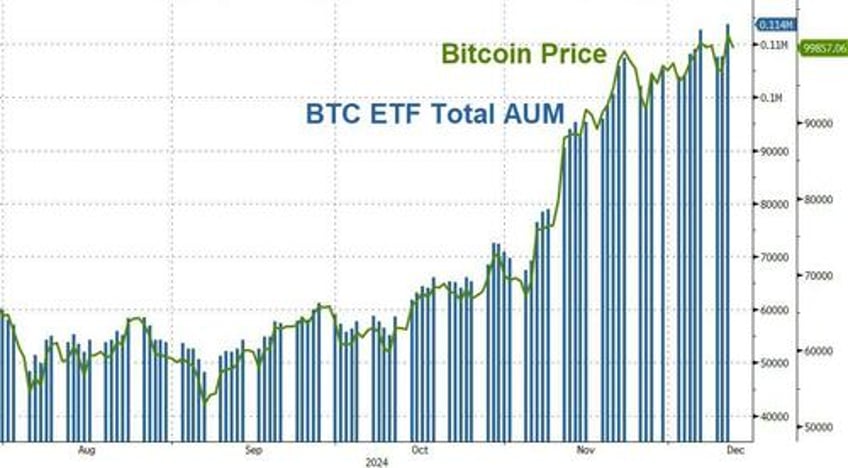

Launched in January, spot BTC ETFs emerged as 2024’s most popular investment vehicles, breaking $100 billion in net assets in November.

As CoinTelegraph reports, these surging inflows from institutional investors could cause “demand shocks” in 2025, driving up BTC’s spot price, according to a Dec. 12 report by Sygnum Bank.

“Our analysis shows how even relatively modest allocations from this segment can fundamentally alter the crypto asset ecosystem,” Sygnum said.

The report, dubbed 'Sizing Bitcoin in portfolios', was released by BlackRock Investment Institute on Dec. 12.