Having topped $100,000 overnight ($peaking at $103,800)...

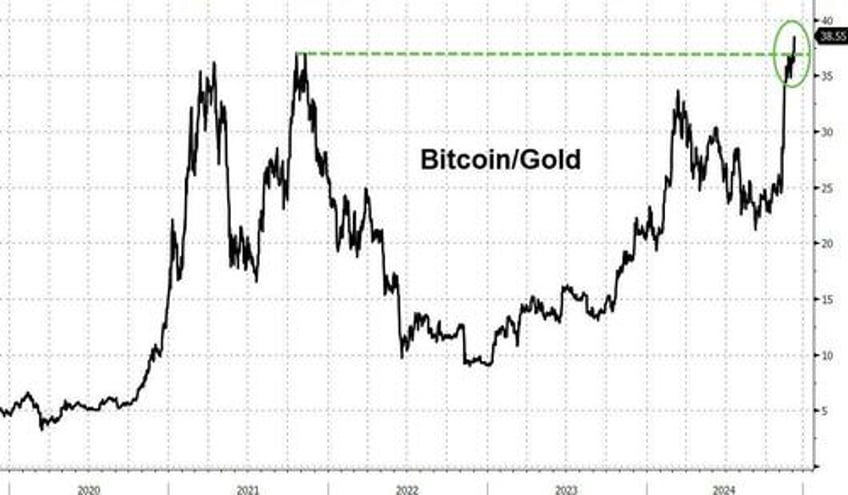

...bitcoin is not just at record highs vs the USDollar, but also relative to gold...

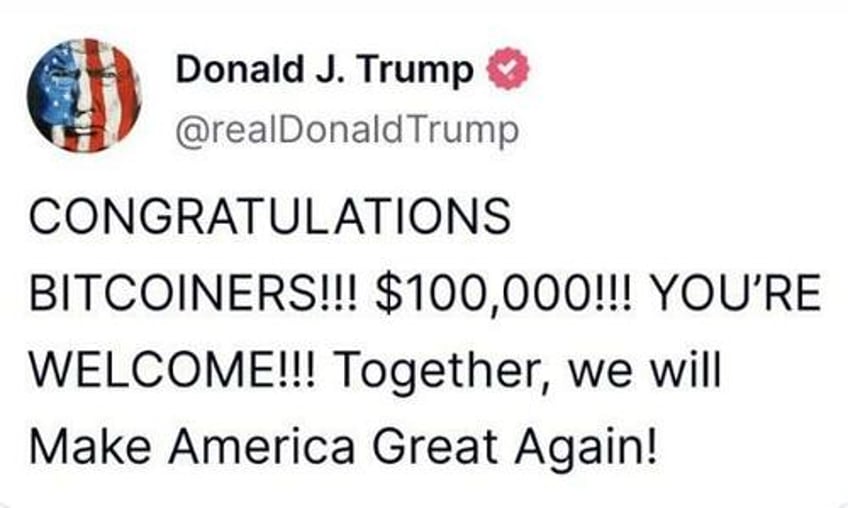

...and, arguably, the recent surge is down to one man (BTC is up 55% since the election), and - as always - he is not shy about mentioning it...

The rally has added $1.4 trillion to the crypto ecosystem's market cap and pushed bitcoin above Saudi Aramco as the 7th largest 'asset' in the world.

Not everyone is happy though...

The crypto market has jumped by roughly $1.4 trillion since Trump’s US election victory. Trump said 'you're welcome' after bitcoin hit $100,000 pic.twitter.com/P8ht09LWFN

— zerohedge (@zerohedge) December 5, 2024

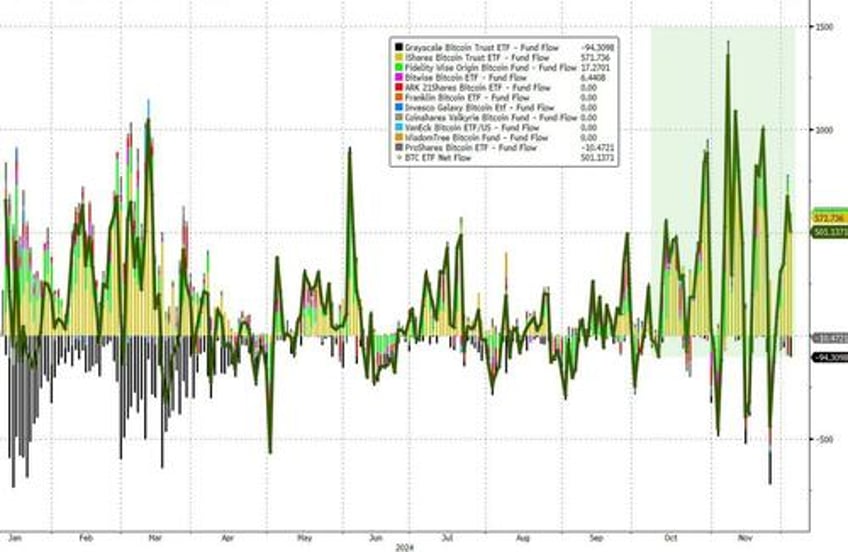

Lizzy will not love this either - flows into BTC ETFs have exploded since Trump was elected...

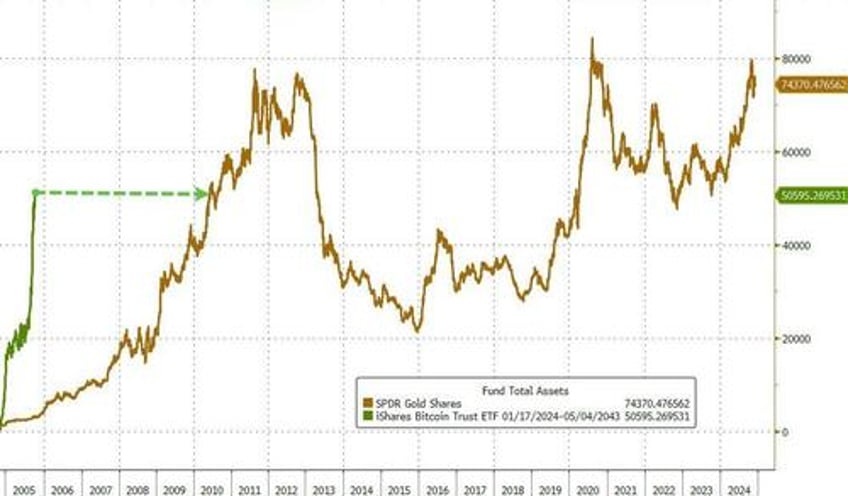

And one ETF in particular has benefited greatly.

BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed $50 billion in assets under management, achieving the milestone in just 228 days - more than five times faster than any other ETF in history.

For context, it took GLD five and a half years to reach that level of AUM...

Speaking to Decrypt, Bitfinex analysts noted that fresh demand from new investors has played a major role in Bitcoin’s record-breaking year.

“The ability of BTC to make new ATHs every week, despite profit-taking, is due to the fresh demand coming into the market from new investors,” the analysts said.

“Any selling has been absorbed and outpaced by strong ETF inflows and subsequent buying from institutions.”

With anti-crypto SEC chair Gary Gensler’s departure and the nomination of Paul Atkins, a former SEC commissioner known for advocating market-friendly policies, analysts expect a shift toward a more collaborative regulatory framework for the crypto market.

Rather than being viewed as speculative assets, Bitcoin and crypto-backed ETFs like IBIT are increasingly viewed as tools for diversification and stability, especially as regulatory headwinds are predicted to ease.

However, the establishment remains ambivalent as Fed Chair Powell said in an exclusive interview with CNBC that Bitcoin is in competition with gold, not the U.S. dollar.

“People use bitcoin as a speculative asset — it’s like gold,” Powell said.

“It’s just like gold, only it’s virtual, it’s digital. People are not using it as a form of payment or as a store of value. It’s highly volatile. It's not a competitor for the dollar, it's really a competitor for gold,” he added.

BREAKING: 🇺🇸 Fed Chair Jerome Powell says #Bitcoin is a competitor to gold, not the US dollar. pic.twitter.com/YQHFiThTBo

— Bitcoin Magazine (@BitcoinMagazine) December 4, 2024

Many would argue the opposite - preferring to spend their 'fiat' currency - a depreciating asset - and save in bitcoin - an appreciating asset.