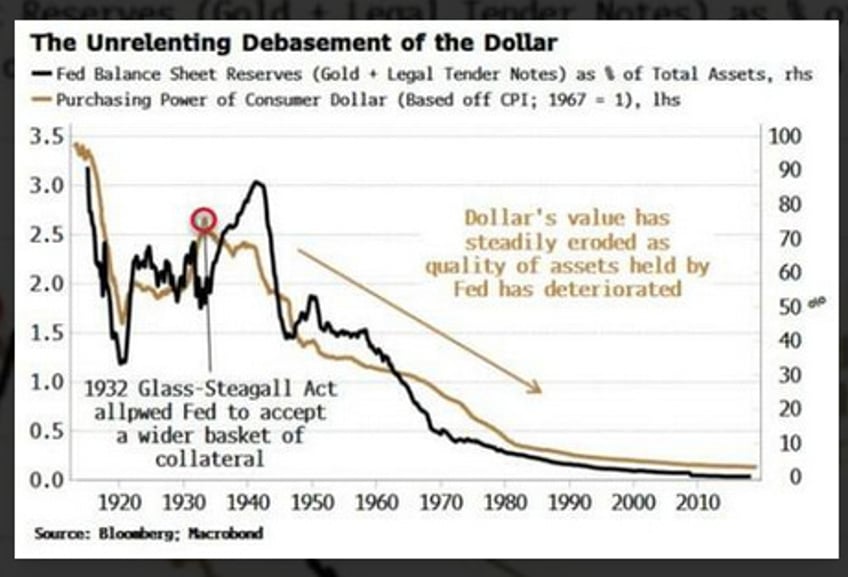

As the amount of safe assets held by the Federal Reserve — such as gold, tender notes, and government and commercial bills — has fallen in relation to the size of its balance sheet, the purchasing power of the dollar has been relentlessly diminished.

- Simon White, Bloomberg macro strategist

Contents: (1300 words)

- Background: The DEI Bond Model Will Kill Us Slowly

- Western Currencies on a Path to Permanent Debasement

- Why Central Bank Balance Sheets Matter:

- The BOE’s New Path: All Bonds Are Equal

- A Warning from History:

- The U.S. Outlook:

- Conclusion:

TL/DR:

- Central banks are normalizing the deterioration of their balance sheets.

- As they continue to accept lower-quality collateral, fiat currencies like the dollar and the pound will keep losing value.

- In the end, it’s the real value of these currencies and those who need to buy things with them that will bear the brunt of this ongoing debasement.

1- Background: The DEI Bond Model Will Kill Us Slowly

The analysis and commentary written below was provoked by reading Bloomberg Macro Analyst Simon White’s excellent piece on ZH titled Western Currencies Are On A Path Of Secular & Permanent Debasement covering Fiat debasement risk as it relates to Central Bank balance sheets.

On the way to doing so, it touches on a little talked about, and extremely important approach to how Central Banks maintain solvency when they are in a market crisis. This CB approach is worth elaborating on as it is a risky tool necessarily used in times of crisis now being implemented in “normal” times. It is also an end-around cause of currency debasement.

The crisis tool being normalized is: CBs are lowering collateral standards applied for loans to Commercial Banks that guarantee money those CBs give to them.

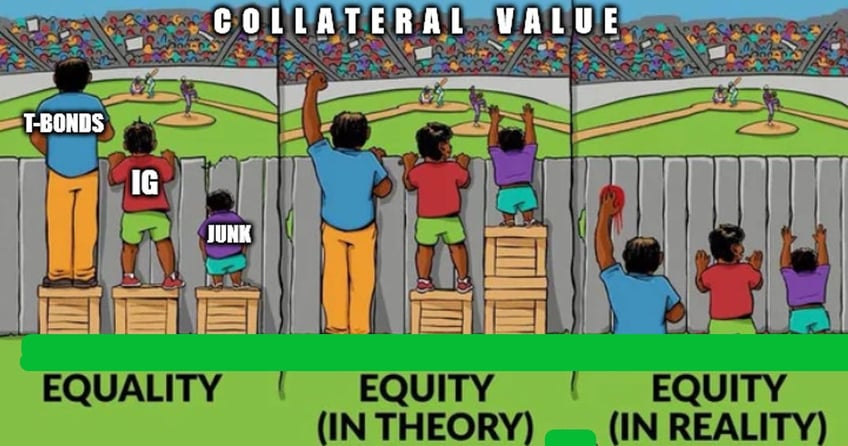

In English: CBs will treat bad collateral (your kid’s rusty bicycle) as equal to good collateral (your 2024 John Deer Tractor) in making loan rules justifying more money be given to you. Thus, you are incentivized to buy more rusty bicycles.

The Fed cannot cannot turn corporate banks (with rusty bicycles) away in need; And so, lacking QE or an ability to lower rates, they lower collateral standards. Specifically Central banks are moving to use a well-worn crisis tool as an every-day policy to keep commercial banks solvent and the economy afloat. That tool involves lowering their own standards of what good collateral is for Commercial Banks.

In an extreme example, Commercial Banks would be submitting junk quality bonds as 100% collateral, just like Greece was allowed to do with its government in the Grexit crisis.

Here is Simon White describing it:

It will inevitably lead to Central Banks holding collateral of poorer quality. This will normalize these types of assets being held on the CB’s balance sheet

In the end, Commercial banks will effectively tell the Central Banks what is good collateral. Central Banks will go from lender of last resort in emergencies to lender of first resort in daily operations. Emergencies will be normal.

Here again is Simon quoting the BOE on this very concept

The bank says in another recent speech whose title says its all, Let’s Get Ready to Repo!, it needs to accept a “broader range of assets” as collateral to make the system “usable for the widest range of firm business models.”

ECB New Scheme: The wrong question is “How much do you need?” The right question is “How much do you want, we’ve got infinite amounts…

"The single punchline is that both we the Bank and you, the market, need to prepare ourselves for increased usage of both our short term and long term repo operations. Or in short , let’s get ready to repo!"

The BOE seeks to accept as many forms of Bond collateral and monetize them to the max to unlock their economic value leaving very little margin for error in a crisis. Effectively, if they can no longer utilize a NIRP rate policy, they can make all assets as good as cash. Gold may be Tier1 now, but so will everything else be soon if this keeps up.

Put another way, they seek to diversify the asset mix given high collateral value, to give those bonds worth less a more equitable, inclusive experience. The problem with making all bonds more or less equal in stature while those Bonds remain unequal in economic potential and risk of default translates to an "equitable" solution that will lower valuations for all or lower the currency in which they are denominated. It transfers the economic risk of default ( since the ECB is potentially backstopping every bond now) from the bonds themselves into the currency they are denominated. The result of such behavior is debasement.

Sounds like Bond socialism to us2. When this finally fails, the EU CBs will publicly3 revalue Gold to help their balance sheets. By then it will be too late we fear.

2- Western Currencies on a Path to Permanent Debasement

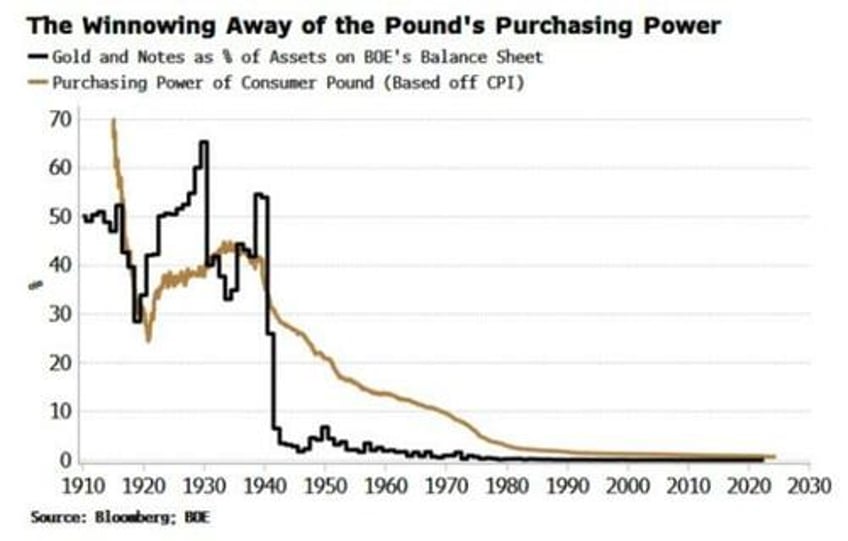

The Bank of England (BOE) is introducing a new approach to monetary policy that shines a light on a critical issue: the dollar, the pound, and other western fiat currencies are on a trajectory of long-term, possibly irreversible debasement.

Central banking doesn’t usually grab headlines, but every now and then, something big happens. The BOE’s latest move is one of those moments. They’re implementing a new system for managing reserves, one that could accelerate the deterioration of their balance sheet and, by extension, the currency’s value. In the U.S., the system looks different, but the outcome might be the same: a dollar that continues to lose its purchasing power.

3- Why Central Bank Balance Sheets Matter:

The balance sheet of a central bank is critical because the currency we use—whether it’s dollars, pounds, or yen—is essentially a liability backed by the bank’s assets. The lower the quality of those assets, the less our money can buy. In times of financial stress, central banks act as the backstop, absorbing the real losses from crises and inflation. This process leads to a gradual erosion of the currency's value.

Take the Federal Reserve, for instance. Over time, as the share of high-quality assets like gold and government bonds on its balance sheet has dwindled, the dollar's buying power has steadily dropped. Today, the dollar buys just a fraction of what it could in 1932, when the Glass-Steagall Act first allowed the Fed to own long-term government debt—a move that set the stage for the ongoing degradation of its balance sheet.

4- The BOE’s New Path:

The BOE’s latest strategy, a "demand-led" system for reserves, signals a shift in how central banks operate post-2008 financial crisis and post-COVID. In the UK, this shift is driven by the need for more central bank reserves to meet regulatory demands and avoid funding crises like the one the U.S. experienced in 2019.

The BOE’s new approach shifts from creating excess reserves based on government debt to meeting banks' demand for reserves through repos. The catch? This shift means the BOE will end up holding lower-quality collateral, not just government debt, even outside of crisis situations.

Simon White again:

[ in a "demand-led" system for reserves] what banks use to settle balances each day *must* be “shiftable” on to the central bank’s balance sheet in a crisis. If they are not, liquidity is at risk of seizing up altogether.

Thus, in a crisis, potentially no asset under this scheme will be turned away.

Continues here

Free Posts To Your Mailbox