Authored by GoldFix ZH Edit

Some form of this plan will succeed. They did their homework. The West should negotiate the peace if they want what is good for everyone

Good morning: A couple days ago Russia announced publicly their intention to use Gold as a payment solution in international commodity trade. They intend to start with Grains, a food mainstay.

Contents: (2200 words)

- BRICS Gold and the 3 Definitions of Money (Refresher)

- **Golden Specifics: Breaking out the details (Pros start here)

- Russian Proposal Analysis: The whole article summarized

1- BRICS Gold Satisfies All 3 Definitions of Money Now

There are 3 definitions of money. Money can be a

- Store of Value

- Medium of Exchange

- Unit of Accountancy

Money does not have to be all three at the same time to be considered money. The Russian solution however, ambitiously proposes Gold be *all* three. And to our eyes, while there are many vulnerabilities and many risks seen and hidden, they are at least approaching the problems/risks correctly. They want to succeed. Here is how Russia and the BRICS define Gold as money

Store of Value (SOV)

We all know that is what Gold has been forever. Despite being demoted officially in favor of the USD, it remains the store of value it has always been. This plan uses Gold as a reserve asset. Reserve Assets are Stores of Value.

Medium of Exchange (MOE)

The USD and Fiat in general along with their accompanying market structures put in place by the G7 made it extremely impracticable to use Gold as a medium of exchange (aka Settlement Medium). This is on top of the fact that Gold is bulky and has a physical presence not transferrable electronically with high degree of certainty the collaterol is actually there. Full explanation of MOE economics in Gold’s MOE Problem and this section of Pozsar’s Gold-mageddon writeup.

Blockchain enables Gold to compete as an MOE again. Gold is now both physically real, and a digital abstraction. The difference between trading gold electronically and Gold held on a blockchain is collateral verification. If it works, NFTs will serve as contracts and security measures for physical gold verification. IF IT WORKS.

There is considerable risk here. But it is extremely important to note: The risk is overcome by trust. The tech is merely a tool to make trust a little easier. There is centralization risk here. How they mitigate that is key.

Unit of Accountancy (UOA)

How much does your wheat cost sir?

When business is transacted it is accounted for in dollars. We price gold in dollars too. What if they begin pricing Wheat in Gold? How much does that cost again? 2 Grams! Lets look at why this will and will not work quickly.

Nations that trade these commodities with each other are existentially co-dependent. To break or discontinue even one of these transactions is almost an act of war. The trust is in the co-dependency and mutual destruction risk. Food Detente1. The UOA is actually second in importance in these type transactions.

Remember the adage… a good suit costs an ounce of Gold throughout modern history? Well, the BRICS are applying that rule. They are telling you: If gold is a commodity, and we are trading commodities for each other, then the price should be reflective of that.

2- Golden Specifics: Breaking out the details

Gold has historically been considered a reliable and stable asset, making it an ideal candidate to back the digital currency used in this system. Here are some specific aspects involving gold in the proposed system:

Gold as Reserve Asset (SOV) and Settlement Medium (NFT-MOE)

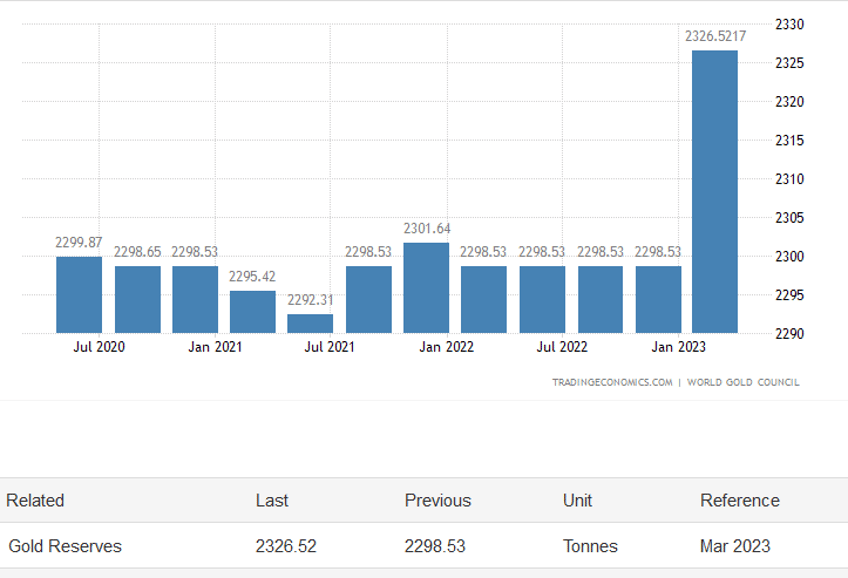

Participating countries will contribute physical gold and gold-backed non-fungible tokens (NFTs) to a reserve fund. This reserve fund will act as security for the full repayment of digital currency balances. The reserve fund's value will determine the debt limit set for each country, ensuring that it exceeds the amount of the contribution.

What do you think they are buying with that money?

Insuring Against G-7 Manipulation

To limit exchange rate risks, the value of the special payment unit (the digital currency) will not be based on the instant spot price of gold. Instead, it will be determined based on an average over a previous period, such as a rolling year. This approach reduces volatility against the currencies of developing countries, making it comparable to volatility against the US dollar.

EXCERPT

Continues here ...