Contents: (4 minute read)

- Chief Economist at Apollo proclaims ‘No cuts for 2024’

- Inflationary Surge: 1970s vs 1940s Paths

- Comment: They Need Us to Save

- Disinflation Cycle is Dead and Buried

- More

1- “Fed won't cut rates in 2024”

Chief Economist Torsten Sløk at Apollo via ZeroHedge

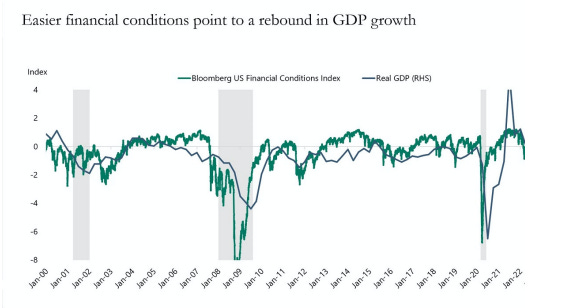

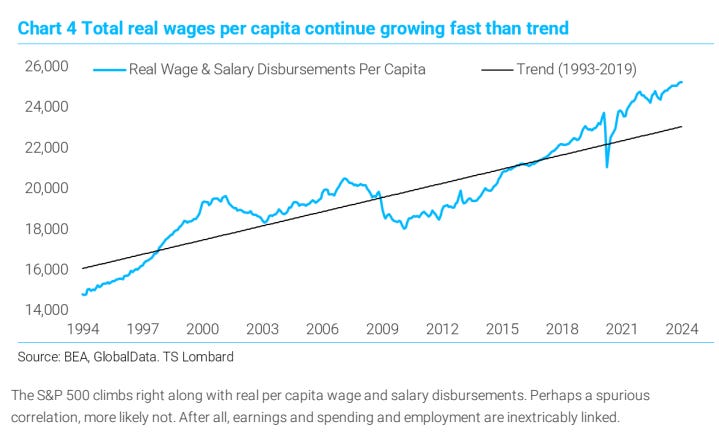

1) The economy is not slowing down, it is reaccelerating. Growth expectations for 2024 saw a big jump following the Fed pivot in December and the associated easing in financial conditions. Growth expectations for the US continue to be revised higher…

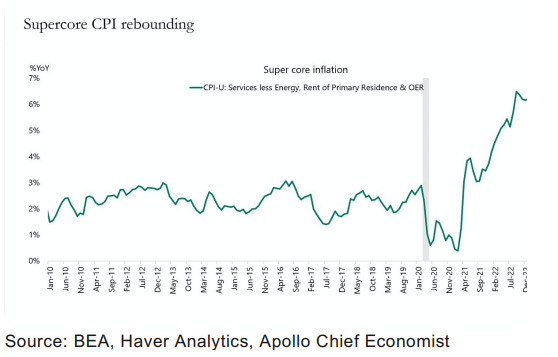

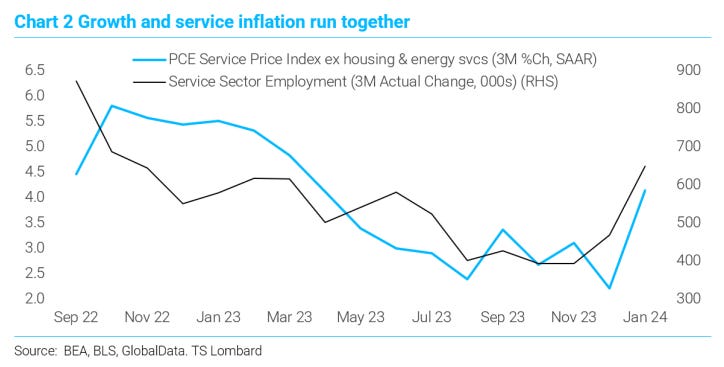

2) Underlying measures of trend inflation are moving higher…

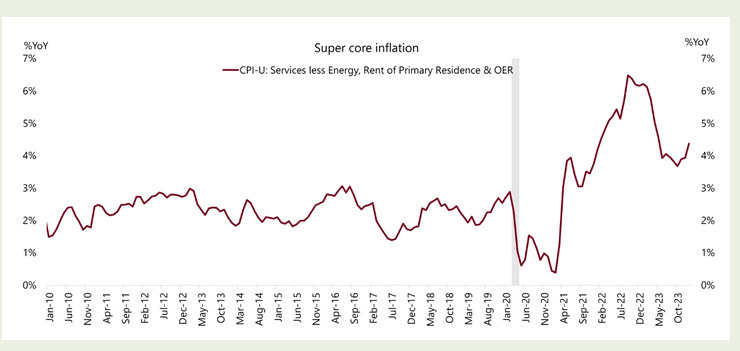

3) Supercore inflation, a measure of inflation preferred by Fed Chair Powell, is trending higher…

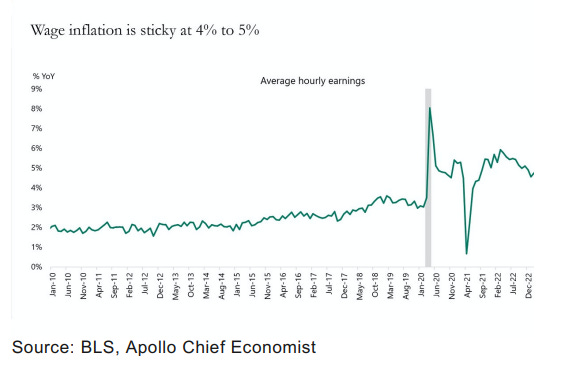

4) Following the Fed pivot in December, the labor market remains tight, jobless claims are very low, and wage inflation is sticky between 4% and 5%’…

5) Surveys of small businesses show that more small businesses are planning to raise selling prices…

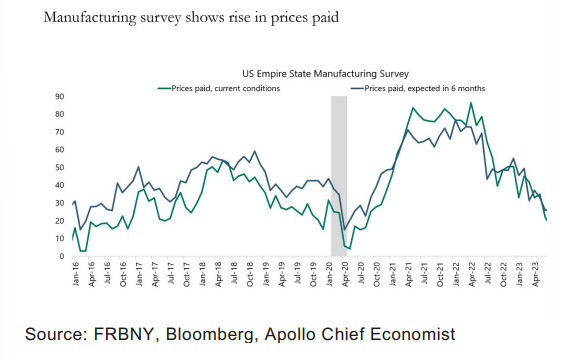

6) Manufacturing surveys show a higher trend in prices paid, another leading indicator of inflation….

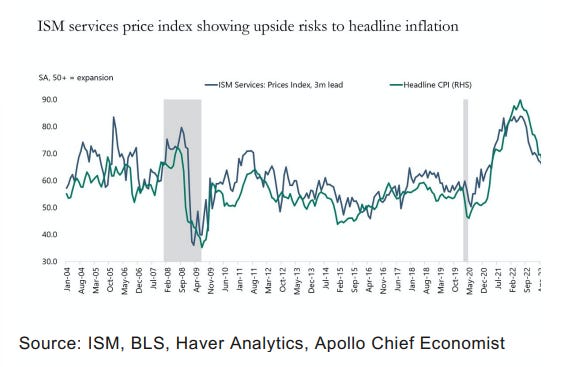

7) ISM services prices paid is also trending higher…

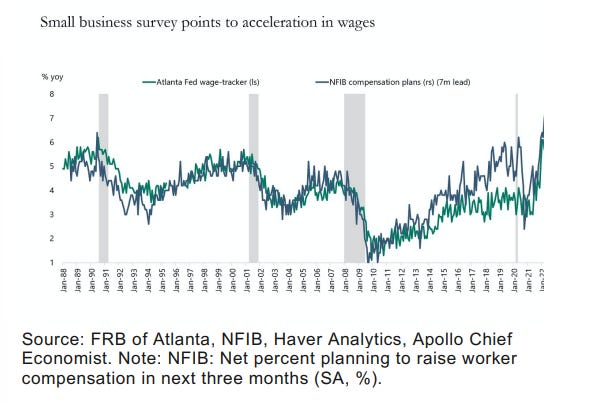

8) Surveys of small businesses show that more small businesses are planning to raise worker compensation…

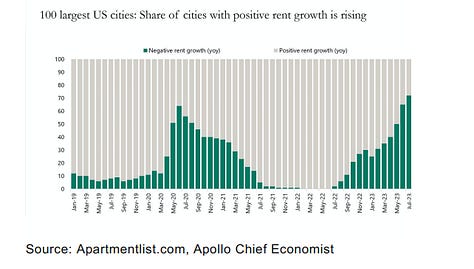

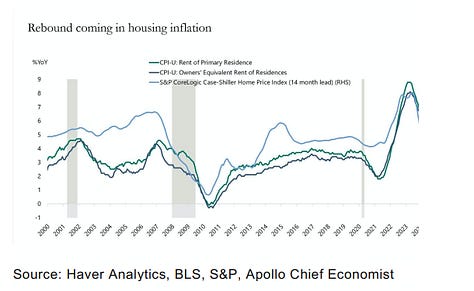

9) Asking rents are rising, and more cities are seeing rising rents, and home prices are rising, 3 charts…

10) Financial conditions continue to ease following the Fed pivot in December with record-high IG issuance, high HY issuance, IPO activity rising, M&A activity rising, and tight credit spreads and the stock market reaching new all-time highs. With financial conditions easing significantly, it is not surprising that we saw strong nonfarm payrolls and inflation in January, and we should expect the strength to continue…

The bottom line is that the Fed will spend most of 2024 fighting inflation. As a result, yield levels in fixed income will stay high.

2- Inflationary Surge: 1970s vs 1940s Paths

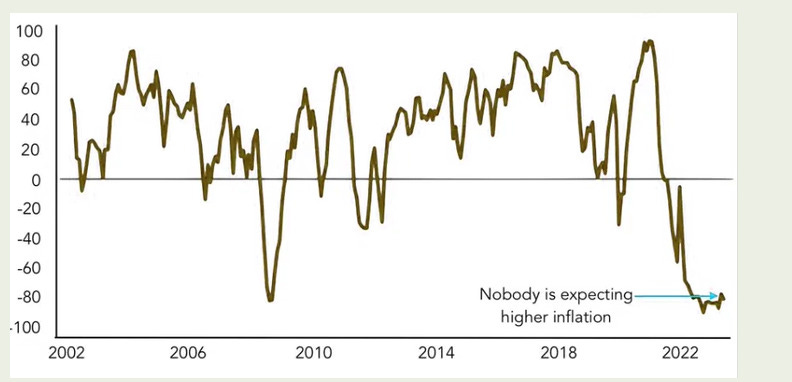

Most of the population believes inflation is dying or dead again…

They [The FOMC] understand that they have no control over goods prices unless they curb demand through a recession – which given their updated mandate isn’t an option. But they also know that they have a lot of control over services inflation…

Services inflation is almost entirely a function of domestic economic activity. The Fed has to get that lower. But they can't

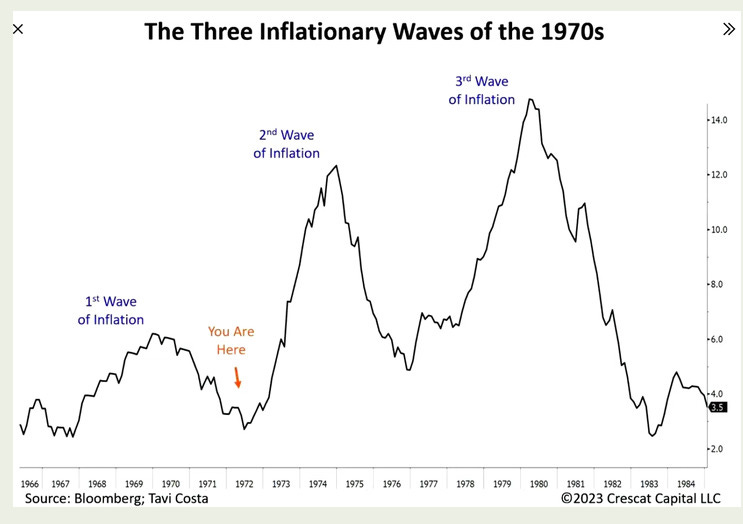

This is what a 1970s repeat can look like…

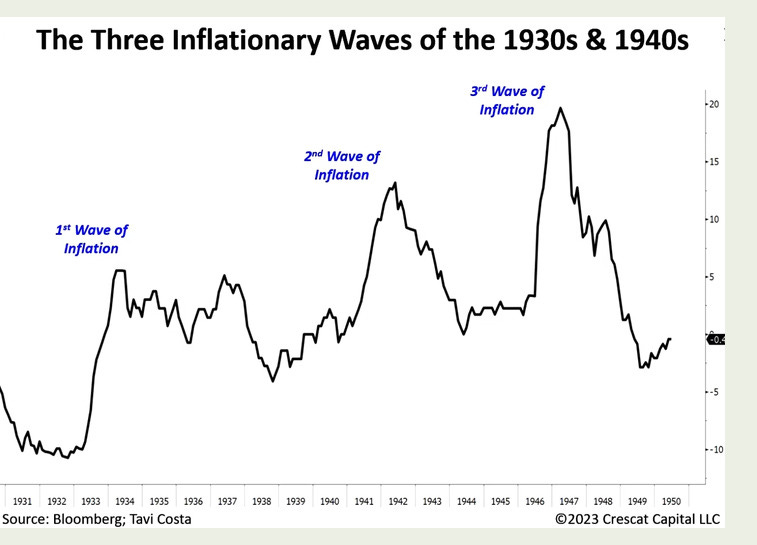

Here is the "good inflation” of the 1940s. This inflation was necessitated by the great depression, war, and a need to grow manufacturing, all things we are experiencing to varying degrees again now…

If this is the”good inflation” then it is like the 1940s where increasing services inflation ( wages) are accompanied people working to rebuild the country..

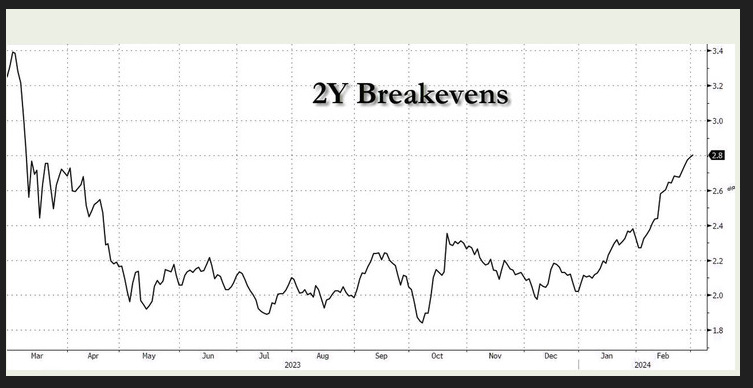

But 2 Year Break Evens are ramping again, implying this may be the 1970s type of inflation if the manufacturing industry does not get cooking. And, judging from the most recent ISM numbers, the fiscal money being spent is not helping much in that way at all yet…

3- Comment:THEY NEED US TO SAVE MONEY

In the end. If the government is paying you more, but they don’t want you to buy more stuff.. then they want you to save that money. They just cant say that outloud

Why? One possible benefit will be to have those funds available for necessary future Bond purchases. The USA is forced to self finance its deficit now that the BRICS are liquidating their holdings of UST.. The population will be mobilized to do just that.

This Bond self-financing is going to happen. It already is.

And that is why, Gold is a buy now and America is a buy in a few years. If we're wrong about America being a buy in a few years, it’s a stagflationary situation at best and a bad inflationary 1970s style cycle at almost worst. We don’t want to think about the actual worst..

More here

Free Posts To Your Mailbox