Contents:

- Full Circle

- BlackRock And Silver Eagle Production

- The March 2020 Pandemic Comex Squeeze and DoT Panic

- Comex Only Please

- Coin and Blank Makers Get Smart

- Enter BlackRock

1- Full Circle

Authored by GoldFix ZH Edit

This special piece is for our hardcore metals people.

We’re going to tell you a story that needs telling for: precious metals investors, those who do (and do not) believe markets are manipulated, and people like ourselves who know the Metals Market structure has been cooked since this ZeroHedge article in 2010 detailing Vincent Lanci's formative experience/training in manipulation. The CFTC also took note of that 2010 ZH post, which detailed the goings on when PhiBro was manipulating Silver for a short-squeeze higher magically “rescued” by Warren Buffet.

Here is that CFTC message from the Secretary of the CFTC.

The Fuse Shortens...

Now it has come full circle. This is a story we knew about for some time, but were never sure of details. Neither were folks ready to listen. Now, because of Michael Lynch filling in a couple important puzzle pieces.. we can tell you more.

First, Michael shows you what happened and why ASE prices likely skyrocketed. Then we tell you how and why it transpired going back to Covid. It is must read.

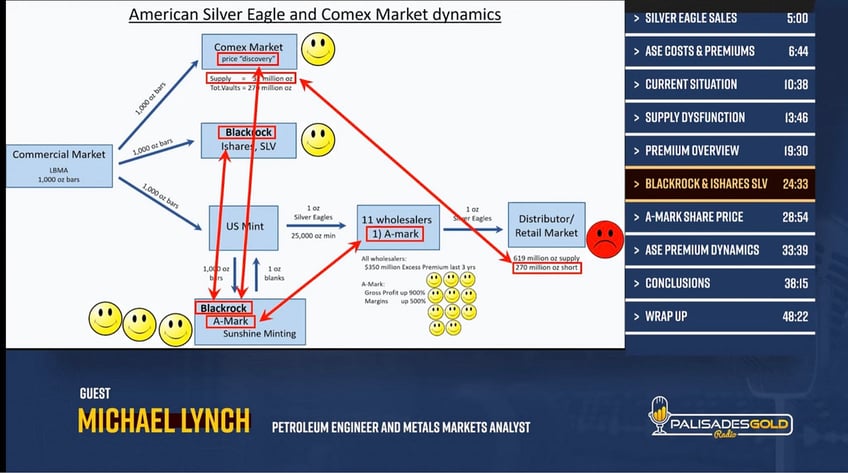

2- BlackRock And Silver Eagle Production

Michael Lynch, a member of the group Silver Degens—themselves the core behind Wall Street Silver— speaks under cover with Tom Bodrovics of Palisades Radio. You may remember Micheal from an excellent guest-post here: Why is The US Treasury's Silver Eagle Mandate Not Being Honored? : Analyst

Michael then did more research into the logistics of Silver coin production after this and found that the problem in part is the refinement of blanks. We had discussed that with industry professionals and GoldFix Founders a while ago only in cursory manner.

We opined back then it was part of why the March 2020 market moves occurred. That an exploited weakness in the PM supply chain lead to what has happened the past 3 years to coin premiums. Yet we did not drill down on the specifics, viewing it as trading risk.

But Michael did drill down. We fill in the rest after the video

Video Summary:

- The Mint has been unable to meet demand due to alleged production issues with blanks, but some suggest Blackrock is manipulating the market through Ishares SLV Trust.

- Silver stackers can avoid premiums by buying larger bars instead of Silver Eagles.

- A solution to the Mint’s shortage would be to bring production in-house, giving them more production flexibility.

Micheal Lynch

- Twitter: https://twitter.com/DtDS_WSS

- Substack: Michael Lynch: on Gold and Silver

Next: Here’s how this all started and why Michael’s analysis is largely correct.

3- The March 2020 Pandemic Comex Squeeze and DoT Panic

**The following is a product of proprietary research, extensive communication, and experience with principals in the Refinery and PM Financing industry in the US and EU. The corroborating sources were believed to be reliable***

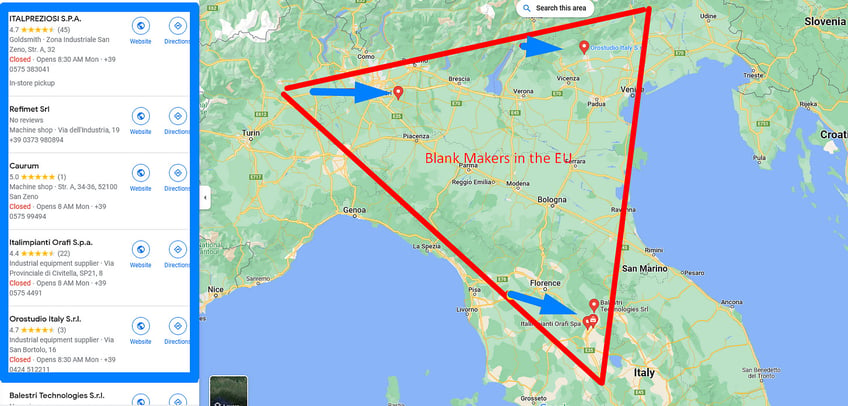

Back during Covid, metal refiners in the EU, many of which were in Northern Italy, had shut down due in part to the pandemic at the same time someone needed blanks for fabrication in the US.

IN THE EU MUCH GOLD/ SILVER REFINING IS DONE IN THIS TRIANGLE...

Coin blank demand was simultaneously seasonally higher due to US government production needs while the world was also waking up to Precious metals for safety in a crisis.

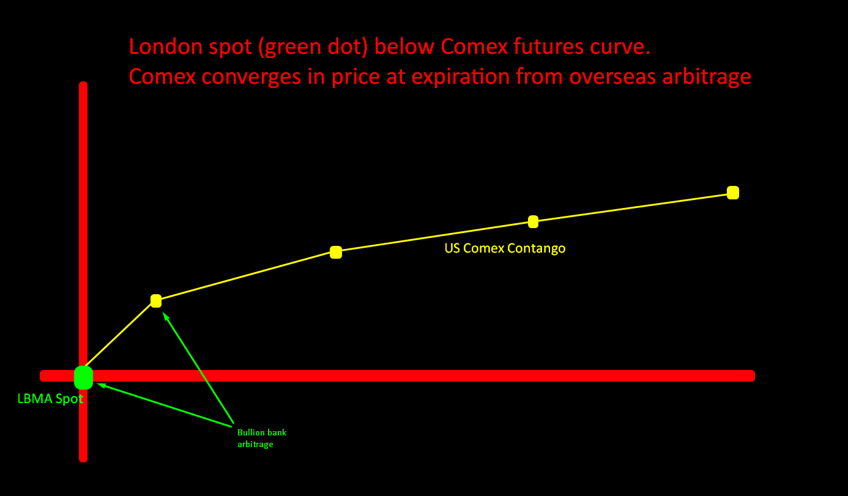

Context on DoT demand: The US Treasury takes Comex metal as part of its mandate to make coins. Typically many Bullion banks satisfy their Comex deals with physical on the LBMA and then have that metal refined locally and shipped to the US in blank /bar form. Nobody used Comex for physical then unless desperate, but they did drain it for London delivery on occasion. Why? Because that's where the buyers from Asia hit up and that is where the refineries are.

Normal EFP Arbitrage between LBMA and COMEX by Bullion Banks….

But.. during the pandemic, the Lombardy region was on complete lockdown and refineries were closed. Therefore the refinement had to be done elsewhere, if at all. But due to the logistics hiccup, that meant LBMA bars in current form had to be directly delivered against COMEX longs.

That’s when the problem started. Comex and LBMA bar sizes are different and therefore technically not directly deliverable against each other. You could not satisfy a delivery request on Comex with an LBMA bar not then without repouring it

4- Comex Only Please

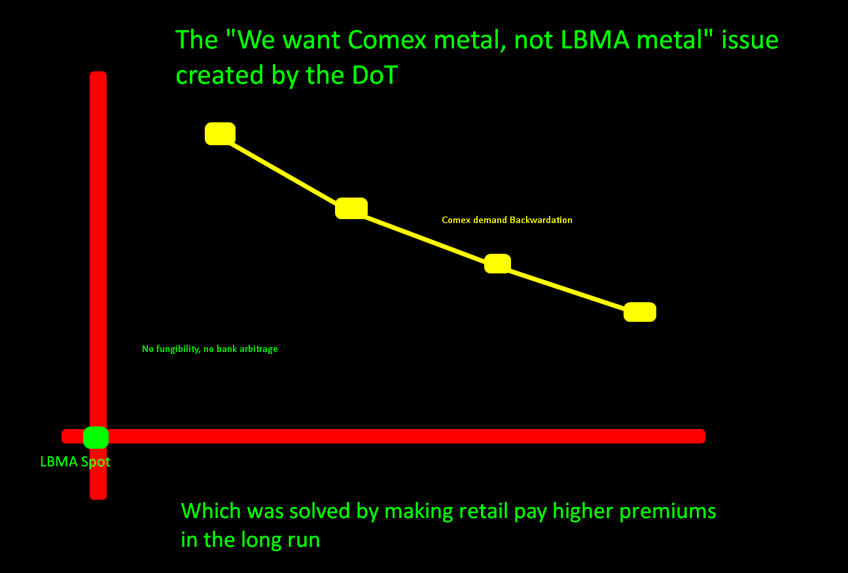

London spot remained below Comex futures. Nobody “wanted London”. But Comex futures went into a very steep backwardation. The Buyer was apparently the US DOT, and they needed US metal. This all while refiners were closed and London bars were not substitutable for Comex for a period of time. Whatwe call a "venue" short squeeze ensued owing to the inability to make proper delivery. Comex form bars went ballistic. (There is one source we can reveal. George Gero, friend and mentor who passed away December 12th 2020. His twitter account has some of our chats from around this time.)

Long story short: This created a short squeeze in Comex vs LBMA venue due to DOT needing US metal and refining capacity in retreat.

The Comex Pandemic Squeeze of 2020…

There is only one immediate reason for all of the above: Comex and London bars were not fungible. Comex was being bought, but London was not able to be transferred over to Comex in bar form.

That is when the opportunity presented itself not just for an arbitrage trade, but for a complete future throttling of the whole complex which could result in massive trading edge if you had deep pockets and physical infrastructure.

First, well-run (or bailed out?) Bullion Bank profits exploded during this time for good reason. They cannot be blamed for this. Had they not done their thing, the market would have seized.

The arbitrage between Comex and LBMA regulatory rules made it easy for them. It also revealed a major supply chain weakness focusing on the coin-blank makers and refineries...

Continues here ...