"We estimate that a 10% drop in the Shanghai gold price boosts physical China gold demand by 16%."

-Goldman

Contents: 1500 words

- Intro

- China’s Household Demand Drivers

- Physical Demand

- GS Gold Model

- Structural Drivers

- Still Bullish Gold

- Something to Think About

- About Goldman’s Demand Model

- Final Comment

- Slide Deck

1- Intro:

In a report put out by Goldman’s precious metals analysts Lina Thomas and Daan Struyven dated July 22 (the day after the $50+ selloff), the bank reaffirms its case for stronger gold prices reinforced by resilient Chinese demand. Their focus for this report is on physical demand in China, and within that cohort, China household demand.1

ZeroHedge summarizes much of this in their latest piece, Goldman Expects Gold To Surge On Relentless Chinese Demand:

China’s strong tradition of physical gold ownership and easy access to physical gold keep it as the dominant form of demand. China’s gold market, which accounts for about one-third of total global physical demand [and that] although cyclical gold demand is soft due to price sensitivity, structural changes leave China gold demand roughly intact on net.

Here is our own breakdown of that Goldman report echoing what ZH notes.

2- China’s Household Demand Drivers:

The report discusses three major points of interest noticed in their Household analysis in reaffirming a $2700 price target for 2025. Those are: Physical Demand, The GS Economic Model, and Structural Drivers. Here they are broken out and summarized with some additional observations.

Physical Demand: remains robust

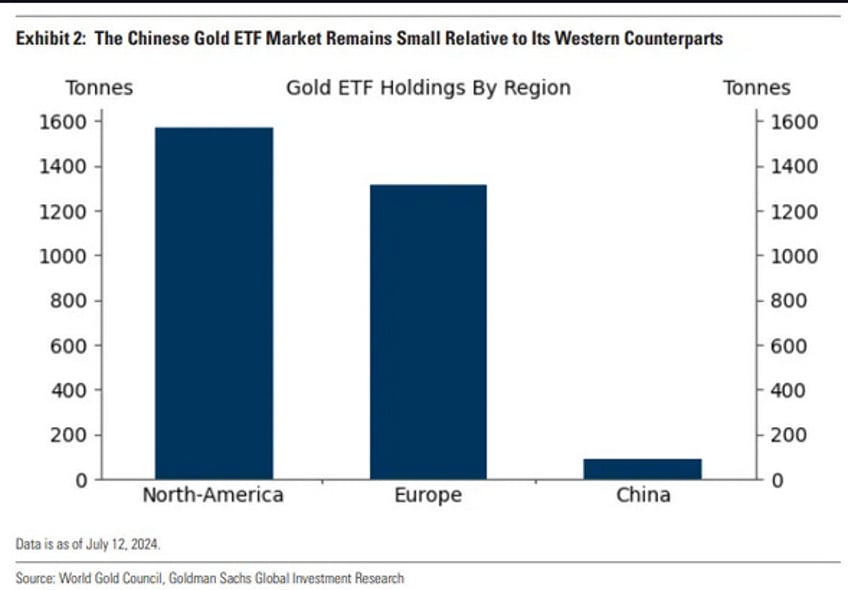

China’s financial market for Gold is growing, but physical demand still dominates.

Paradoxically, this is because in China, access to physical is easier than it is in other parts of the world2, and even easier than Financials. The current market structure and culture promote Gold as the marginal purchase over Stocks. Only a tiny fraction of Chinese have equity exposure, yet most have Gold.

ETF ownership

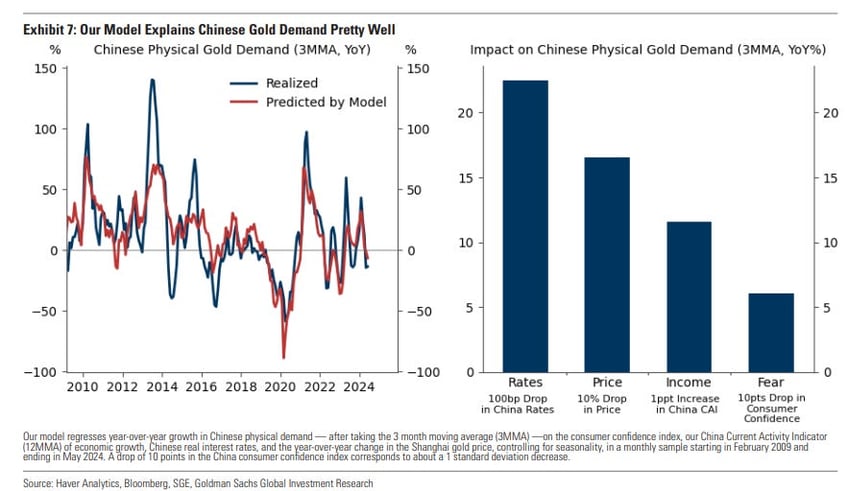

GS Gold Demand Model: very price sensitive

Everything cited in this category is directly related to the following parameter inputs into the GS Gold demand model (see chart), which has been very accurate in forecasting China household Gold demand. Here are those model inputs summarized.

- Interest Rates- lower means more buying3

- Economic Fear- fear means more buying

- Household Income- more means more buying

- Gold Price- elastic, higher means less buying

Covering these in reverse order: The report notes gold price sensitivity is greater than it has been before at current prices, Household income as interpreted by discretionary spending is recently lower, with economic fears and rates factors as seemingly stable. Taken together in the proper mix, these four inputs are a good proxy for China household Gold demand.

Structural Drivers are Fine: but cyclical are not

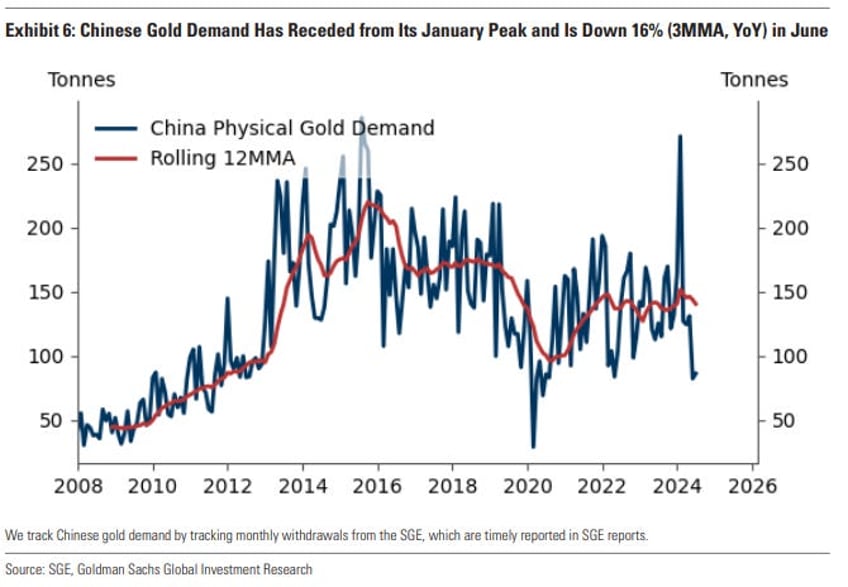

The report notes china physical demand is down 16% (3MMA, YoY) in June, due to higher gold prices and low economic growth, which have curtailed discretionary spending on jewelry.4

The bank deems this cyclical softness. On the other hand, they see almost no effect of this cyclical issue on their structural view.

China’s structural gold demand [is] roughly intact on net because the demand boost from lower confidence (fear) and lower interest rates roughly offsets the hit from lower trend GDP growth (income)

Goldman thus continues to point to low rates and economic fear as structurally intact for Gold to remain bid by households.

3- Still Bullish Gold

The bank’s reasons for being structurally bullish Gold are restated, and emphasized despite the torrid run and recent pullback. They seem to not be too concerned by the dip.

We still see very significant value in long gold positions, and maintain our bullish $2,700 forecast (+12% vs. spot) for 2025.

The analysts cite Geopolitical concerns driving CB purchases, Fed rate cuts, and domestic risks such as Tariffs, debt issues, and Fed Subordination risks as underpinning Gold for the 2025 year.5

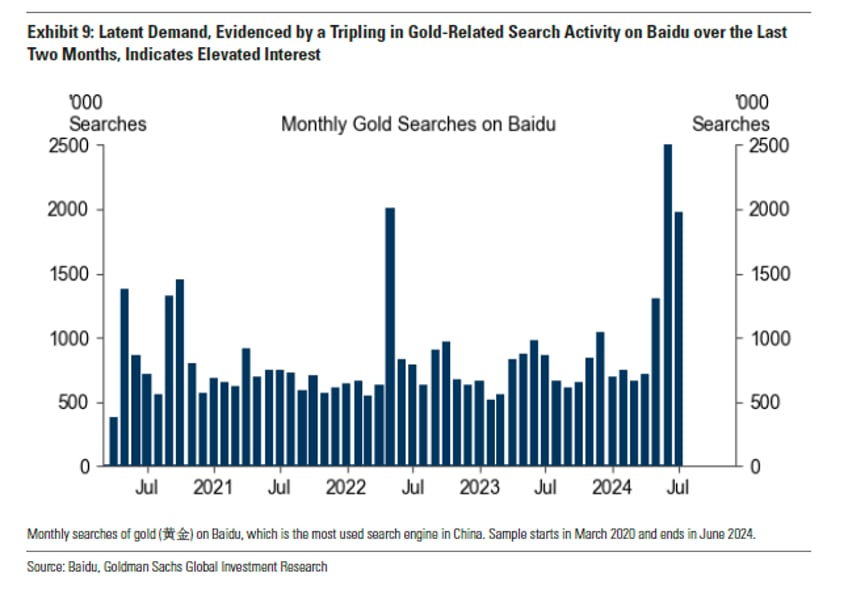

The takeaway is Goldman seems keen on dip-buying for a 2025 re-rally

That said, our finding that the particularly price sensitive Chinese6 market is digesting the price rally points to some risk that gold reaches our $2,700 target later than our 2024 year-end baseline. However, this same price sensitivity also insures against hypothetical large price declines, which would likely reinvigorate Chinese buying.7

Then there is this…..

4- Something to Think About

Note the report says two related and important things separately about China Gold price elasticity.

- “We estimate that a 10% drop in the Shanghai gold price boosts physical China gold demand by 16%”

- “China physical demand is down 16% (3MMA, YoY) in June, due to higher gold prices”

Taken together it is indicative of a gold price that has reached...

Continues here

Free Posts To Your Mailbox