"Government, wherever it asserts power, distorts commerce to the market’s detriment and the parasitic bureaucrat’s delight."

Today:

- Silver and Government distortions

- Market Rundown

- Zen moment- We’re here to help

- Other stuff

Manipulation is only one type of government distortion. Government’s mere existence is another.

1- Silver Selling and Government Distortions

Authored by GoldFix ZH Edit

This is a 3 month outlook. Continue to expect pressure on metals that defies economic expectations right now for several reasons, not the least of which is Sell Season is here.

Facts and Observations

The very big funds are just beginning the process of unwinding their futures positions slowly.- Fact

Many of them end their fiscal year in November, in order to prep for the new investing rounds that come in December.- Fact

This usually means a mechanical downdraft begins between now until October. This can be offset by real events like war, credit problems etc. But absent meaningful news.. the markets are held hostage by Fund mechanics this time of year.- Observation

The Silver lining is: not just the buy season that comes in November.. but sometimes in metals like Silver, we get an opposite effect during “Sell Season”.- Empirical Observation

While the bigger funds are selling their Gold and Silver longs, sometimes the CTA crowd is also initiating positions by selling Silver and Copper. Why are they initiating? Because their fiscal year ends on Dec 31. They also react to economic data like inflation and recession more aggressively since they are long a load of stocks.- Observation

For example, last year Silver was in a particularly nasty downdraft this time of year. It started in April when the Fed began rate hikes which were presumed to slow the economy. in August it got a boost from those very same CTAs who, late to the party, decided to hedge their long stocks by shorting Silver, Copper, and Gold.- Empirical Observation

Putting it all together it goes like this:

- Between August and October, Open interest tends to unwind.

- Larger players close (losing trades first, winners second) while smaller players sometimes add to positions.

- Then, smaller lesser capitalized players, especially ones making money (silver shorts last year), close last minute.

- These types start to cover when the Big boys are coincidentally buying back in ahead of Buy season

- Fireworks can ensue

When that is CTAs closing shorts, we can get counter-moves in Silver during Sell season.

Bottom line:

We could, although we are not predicting, have a repeat of that this year. Why?

- CTAs are again selling Silver, this time due to Recessionary fears

- Other funds are selling Silver and Copper due to China fears

- This is sell season, but the Long funds are almost already out of their longs.. look at the O.I. in both metals!!

This is most of the recipe for a short covering rally in September/ October before buy season. But not all of it.

Last year:

We had a proper catalyst— Large physical demand from China skewed the EFP positive giving us a sign the market was underpinned and due to rally.

**This year:

We have allegedly more Silver Eagles hitting the market by November, and a potential slow down in China Silver buying based on their economic worries.

We also do not know if “Buy season” will be as robust for metals as last year. This due to the Fed and China behavior and renewed Bitcoin competition. This is a big unknown.. the data does not look good for allocations so far.

Thank the IRS

If this sounds unnecessarily complicated.. it is.

All of it.. I mean all of it is because of End of Year tax allocations. If there were no IRS, there would be no reason to Buy or Sell before the End of the year. So do we hate the IRS or like them because of that? The point is— government intervention always creates opportunity— finding that opportunity is the hard part. Hate them if you must.. but profit from their ineptitude wherever you can.

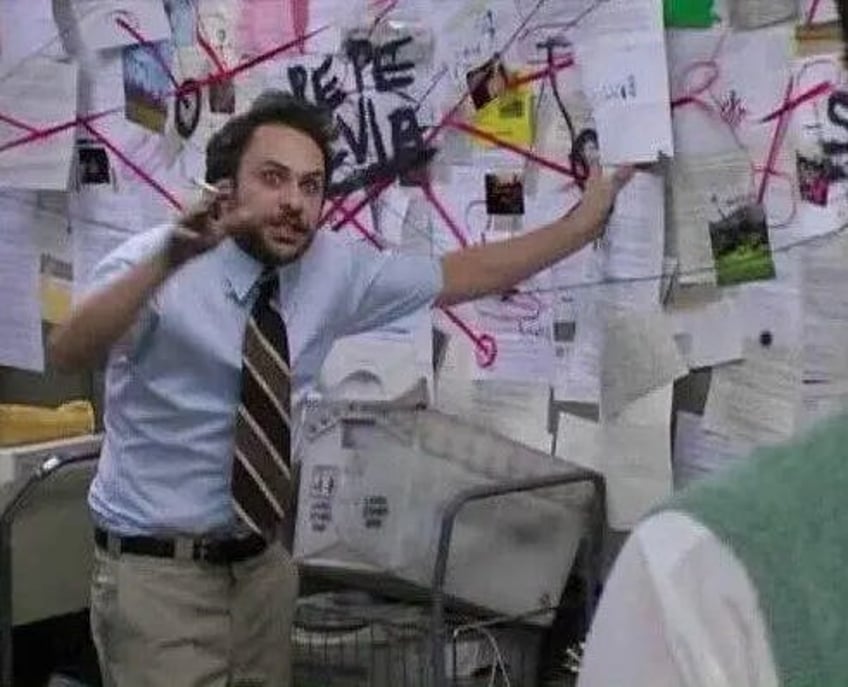

3- Zen Moment

What feels like being long Silver lately pic.twitter.com/Q57LwoawfM

— VBL’s Ghost (@Sorenthek) August 18, 2023

*RIP James Caan

Continues here ...