What is This?

This is the IGWT 2024 report in full. For our part, short summaries of each section were written, some subtopics were respectfully added. The summary is bare-bones and serves as a map to dig into what is in our opinion the best Gold-Focused publication out there annually.

Alternatively, if you know what you wish to read already, just open the PDF at bottom and use the links embedded in the content list to navigate the report. Enjoy.

Gold and IGWT Coverage

This past year Gold has exploded in coverage for various reasons. The currency of last resort is all of a sudden the center of attention for various global situations. Geopolitical risk, monetary and fiscal policy, monetary multipolarity are all tied to Gold in some way now. Frankly they always have been, but now people are noticing again. The BRICS have made sure of that.

The mainstream media, and even the banks in general, are not really sure how to cover Gold’s rebirth, if they admit it’s a good investment at all. None are really explaining it in context of the biggest picture as we have tried at GoldFix these past 2 years. None except the IGWT team.

The 2024 IGWT covers every one of these new and complex topics surrounding Gold’s present and future.

There are many sections of this report we also wish to go through in detail. However the first one, the must-watch one, will be the Brent Johnson and Louis-Vincent Gave debate on the dollar. There was a lot of talk on topic and we know both people by reputation as we knew Zoltan Pozsar when covering their interview of him in last year’s IGWT report, here and here. This Dollar debate should be equally fun.

- The Status Quo

- Mastering the New Playbook**

- The Geopolitical Dimension

- Gold's Historical Performance Amidst Market Volatility

- Gold’s Brothers in Arms

- Technological Fact and Fantasy**

- Not Your Father’s Gold, But it is Your Grandfather’s

1- The Status Quo

a. Introduction

In this year’s edition of the "In Gold We Trust" report, the IGWT team meticulously dissects the current status and future prospects of the gold market. This comprehensive analysis delves into the intricate dynamics shaping the gold market, highlighting emerging trends and structural shifts that reinforce gold’s position as a crucial asset in today’s volatile economic landscape.

b. Gold’s Status Quo

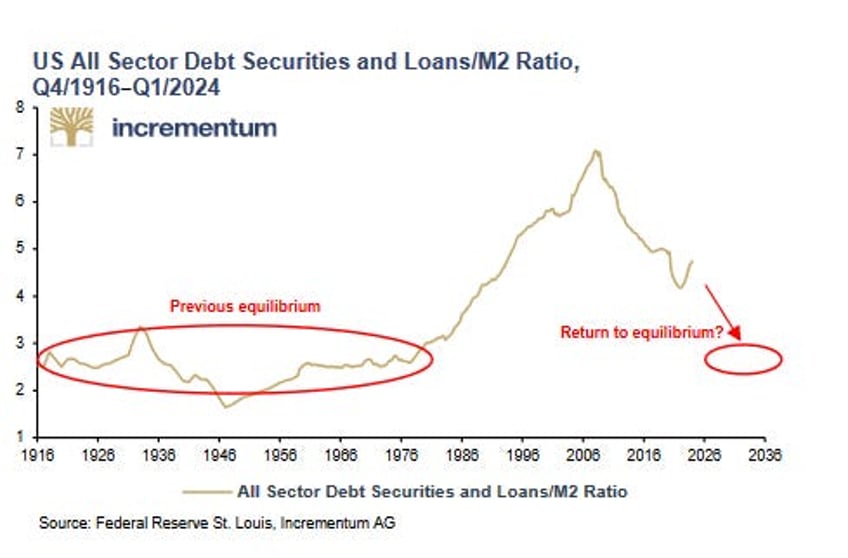

The gold market has entered a new era, emerging from a four-year consolidation phase. The “IPO of gold” on August 15, 1971, marked the beginning of a remarkable journey, with gold’s average annual increase reaching 10.0% in USD terms. Over the past 25 years, gold has appreciated by 772% in euros, demonstrating its robustness compared to fiat currencies. The historically inverse relationship between the US dollar and gold is evolving, signaling potential future shifts.

2- Mastering the New Playbook

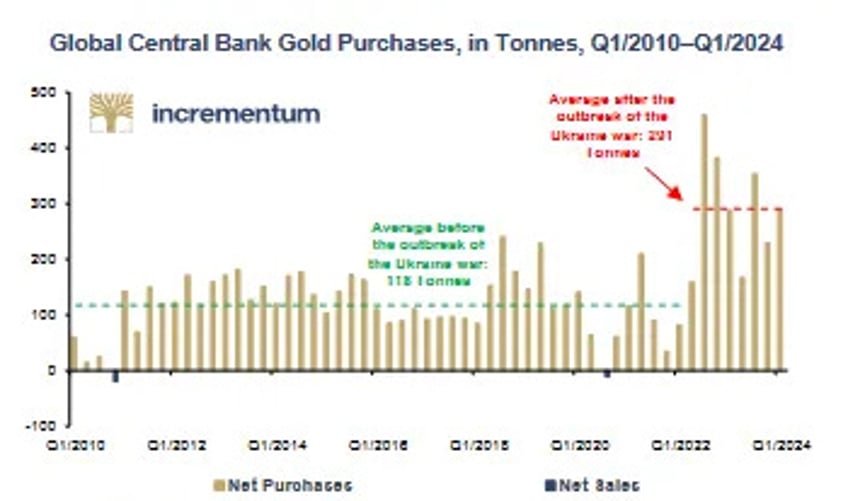

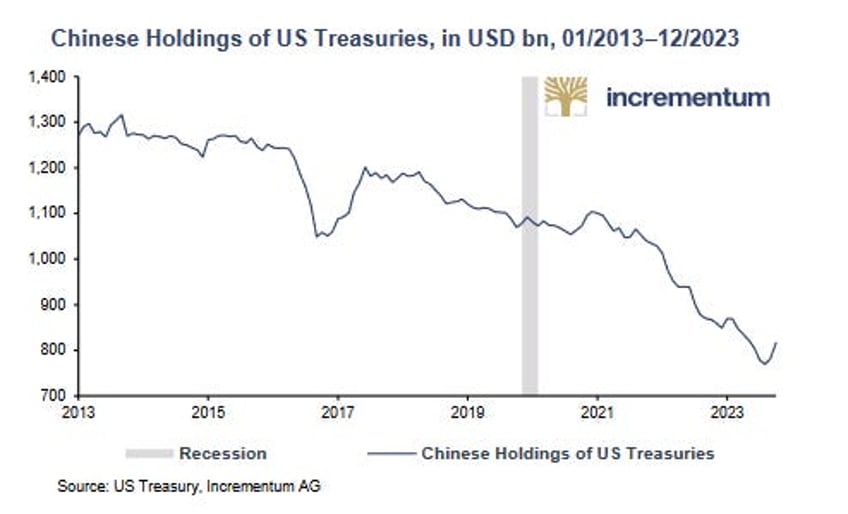

The old gold playbook, which dictated a falling gold price amidst rising real interest rates, is being rewritten. Western financial investors are no longer the marginal buyers; central banks and emerging markets, especially China, are now the key players. This shift is rooted in significant macroeconomic and geopolitical changes. The IGWT team suggests that investors consider increasing their allocation to gold, both as a safe haven and for performance.

3- The Geopolitical Dimension

a. Enter the Dragon and De-dollarization

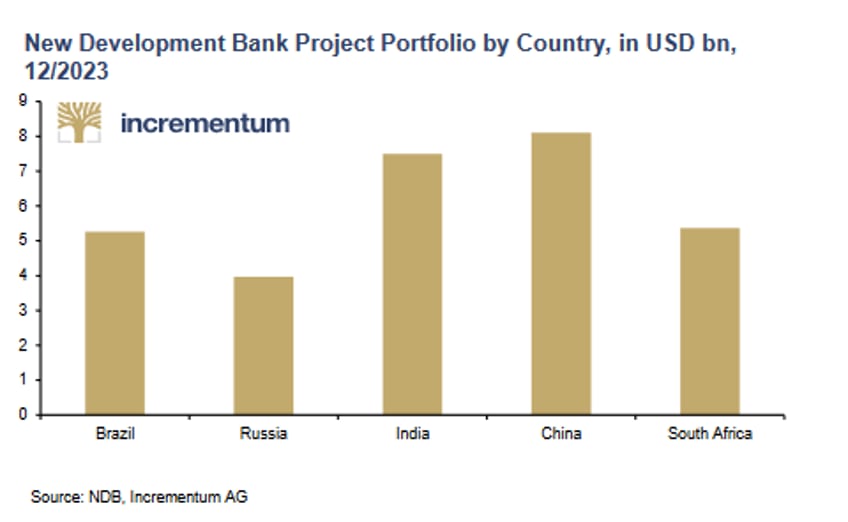

The de-dollarization trend is gaining momentum, driven by the increasing economic and political clout of emerging markets. Central banks, particularly in the BRICS nations, are accelerating their gold purchases.

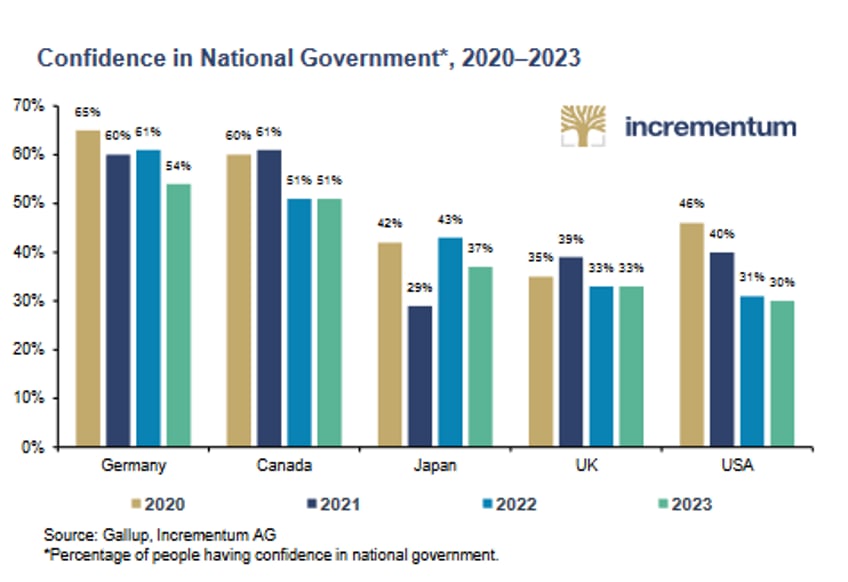

This movement reflects a growing distrust in debt-based currency reserves, exemplified by the West’s sanctioning of Russian reserves. Gold's role as a neutral, counterparty-risk-free reserve asset is being rediscovered, placing a structural floor under its price.

b. The East-West Divorce

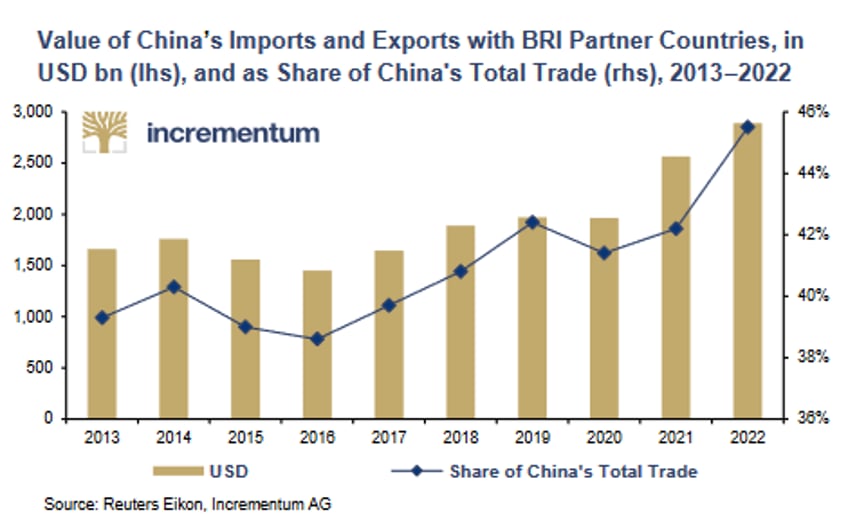

The geopolitical landscape is undergoing a profound transformation, with emerging markets asserting their influence. The BRICS+ countries, including new members like Egypt and the UAE, are challenging the Western-dominated international order. This shift is reminiscent of post-World War II Europe, where high current account surpluses led to increased gold reserves. The IGWT team draws parallels, suggesting a similar gold accumulation trend in emerging markets today.

c. Dubai Gold Trading Grows

Dubai’s role in the global gold market is expanding. The UAE’s strategic location and favorable trade policies have made Dubai a key player in gold trading. The city’s robust infrastructure and regulatory environment attract significant gold flows, reinforcing its status as a global gold hub.

d. China’s Economic Situation

China’s demand for gold is surging, driven by both state and private investors. The financial turbulence in the Chinese real estate market, coupled with declining interest rates, is prompting a shift towards gold as a stable investment.

The cultural significance of gold in China, amplified by the Year of the Dragon, further fuels this demand. High domestic liquidity and restricted gold imports are keeping Chinese gold prices elevated.

e. Japanification of the West?

Next, the report explores the concept of "Japanification" in the West, characterized by prolonged low-interest rates and sluggish economic growth. This environment could lead to increased gold demand as a hedge against economic stagnation and deflationary pressures.

4- Gold's Historical Performance Amidst Market Volatility

a. Roy Jastram’s Golden Constant

Roy Jastram’s work, "The Golden Constant," is revisited to understand gold’s role in preserving wealth during inflationary and deflationary periods. The IGWT team underscores gold’s enduring value and its ability to provide stability in volatile economic environments.

b. The West Forgets

Despite gold’s historical significance, it faces an image problem in the West. There is a subtle stigmatization of gold, where it is often viewed as a relic of the past. The IGWT team argues that this perception is misguided, emphasizing gold’s relevance in modern investment portfolios.

c. Gold Seasonality

The report delves into calendar anomalies in the gold market, identifying seasonal patterns that influence gold prices. Understanding these anomalies can provide investors with strategic insights for optimizing their gold investments.

d. Fundamentals When They Want the Gold

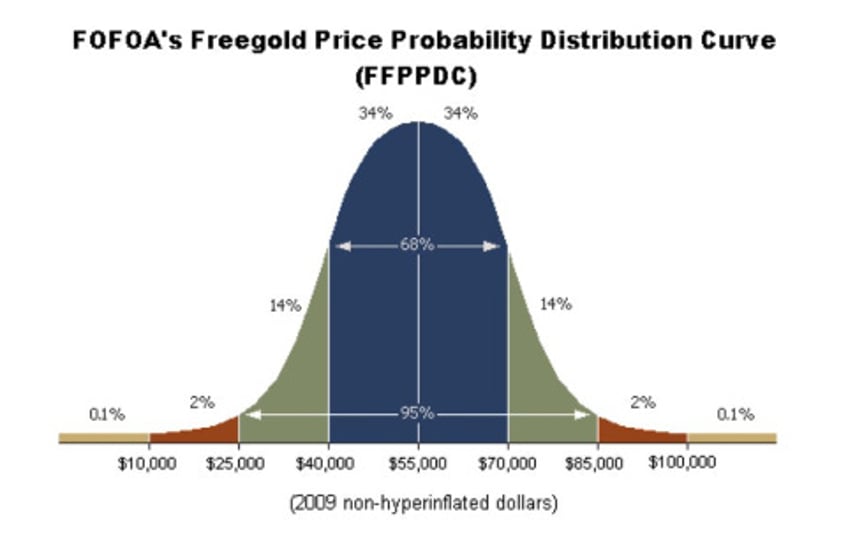

The IGWT team presents an alternative framework for assessing gold prices, focusing on fundamental factors such as supply-demand dynamics, geopolitical risks, and macroeconomic trends. This perspective offers a more comprehensive understanding of gold’s valuation.

Continues including full report here

Free Posts To Your Mailbox