Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing the market since 2014. We specialize in predicting market direction by studying the economy and market signals. Join 8,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

The Bottom Is In

Throughout this week we observed 10 important technical and trading signals that suggest the bottom is in for the S&P500. These signals represent signs of selling exhaustion and capitulation. Our backtesting shows that they have predictive power in historical selloffs.

1. SPX entered a correction on March 13 (down -10% from peak). This was a measured move from the Feb highs and it also hit the 61% Fibonacci retracement level. There is strong confluence at the $5500 support.

2. The downtrend has been broken, with “higher lows” forming on hourly timeframes. SPX put in a hammer candle on Friday which is often a telltale sign of a bottom.

3. The 2022 analog is playing out as expected, and the next phase should be a bounce. We have identified and followed this analog for several weeks now.

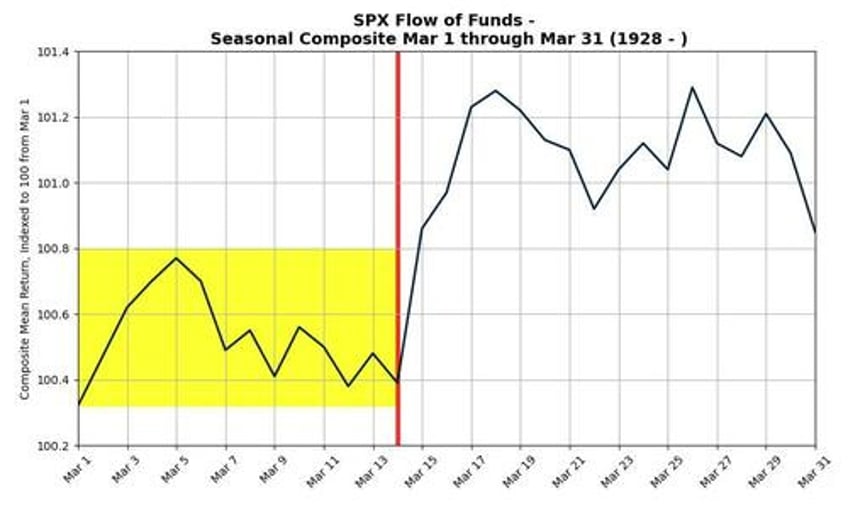

4. SPX seasonality starts to improve by the third week of March, and options expiry day (March 21 being the next) is often a reversal point for markets.

5. The mega cap stocks that led the selloff (NVDA, PLTR, TSLA) have already made capitulation lows a few days ago and are now making “higher lows” on falling volume.

6. Breadth is in oversold territory, and we had a positive breadth thrust on Friday with 91% of volume on the buy side (very important!)

7. Volatility is dropping, which should induce vol-targeting funds to resume buying.

8. Put/call ratios reached lows and investor positioning (as measured by AAII) is very negative.

9. The narrative pendulum has swung too far to “recession” and “stagflation”. The market has stopped reacting negatively to bad macro news (like Friday’s consumer sentiment) or tariff news.

10. Europe and China trades look overdone; if they stall, capital could flow back to US markets.

These signals set up the preconditions for a bounce but do not guarantee it. There is still the possibility that a recession takes over and SPX falls further, much like it did in 2022.

For more market timing content, head on over to MktContext.com and subscribe today!