US Existing Home Sales rose for the third straight month in December (longest streak since late 2021), rising 2.2% MoM and up 9.3% YoY - the best annual shift since June 2021...

Source: Bloomberg

Contract closings increased in three of four US regions, led by a nearly 4% rise in the Northeast

“Home sales in the final months of the year showed solid recovery despite elevated mortgage rates,” NAR Chief Economist Lawrence Yun said in a prepared statement.

However, despite the last rebound, for all of 2024, sales reached the lowest since 1995, when the US had about 70 million fewer people.

Source: Bloomberg

It marked the third straight annual decline, stretches only ever seen in the 2006 housing crisis as well as the recessions around the early 1980s and 1990s.

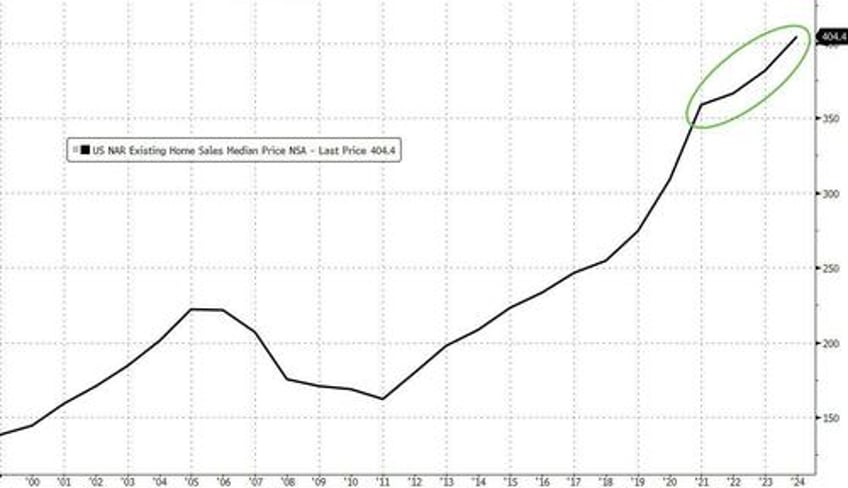

While sales volume declined, the median sale price, climbed 6% over the past 12 months to $404,400, reflecting more sales activity in the upper end of the market. That helped propel prices for the entire year to a record.

Source: Bloomberg

First-time buyers made up 31% of purchases in December, but NAR said the annual share was 24%, the lowest on record.

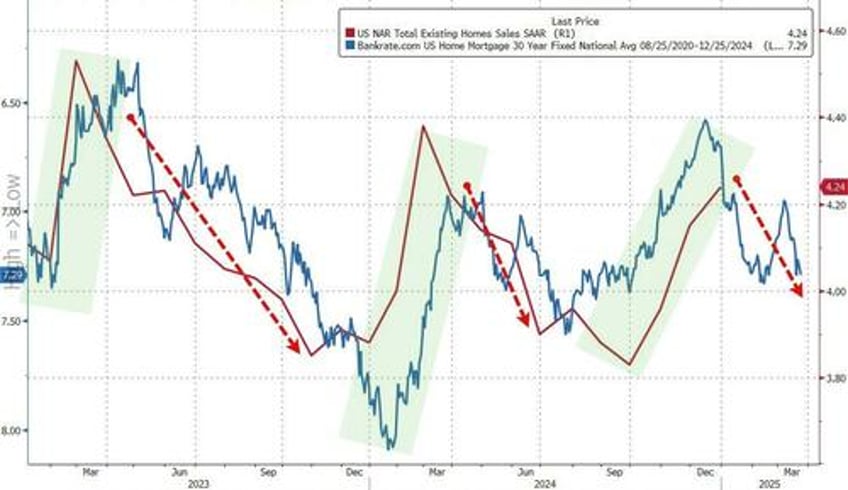

But, with a 3mo lag, mortgage rates have risen dramatically since, suggesting the euphoric renaissance of the US housing market will be short-lived once again...

Source: Bloomberg

...and Powell is in no mood to be cutting rates anytime soon (except for the pressure Trump will put on him).

Treasury yields are still elevated as investors brace for the cost of President Donald Trump’s policies and price pressures are cooling only somewhat. That’s projected to keep mortgage rates on average above 6% through at least 2027, according to some estimates.

Are homebuyers pulling for a recession to drag long-end yields lower and rescue affordability? Be careful what you wish for...