Submitted by QTR's Fringe Finance

For as bearish as I am on the economy and the country as a whole, given our massive growing debt problem, there are a couple of hidden names in tech, of all places, that I wouldn’t mind dabbling in. I’m done trying to pick “great stocks” and “winners”. How about I just keep it real and try to identify stuff that doesn’t suck ass?

Most people who read me consistently know that right now I’m focused on a rotation out of technology and into staple names, utilities, “boring” stocks, miners, and equities tied to commodities. But that doesn’t mean I can’t still recognize what I believe to be decent opportunities in the technology space.

If I had to pick 3 names today and hold them for five years, here’s what they would be.

The first would be Intel (INTC). As frustrated as I am as a long-term shareholder of Intel, it finally is starting to feel as though things possibly can’t get any worse.

I know that isn’t much of a long thesis, especially when you’re trying to defend a semiconductor company that has done jack shit in the middle of an artificial intelligence boom. But the reaction to this past quarter of worse-than-expected news—yet again, for what seems like the millionth time under Pat Gelsinger—really did, to some degree, feel as though the market has given up on Intel. And when the market gives up on a company that isn’t going to go bankrupt, it’s time to start looking.

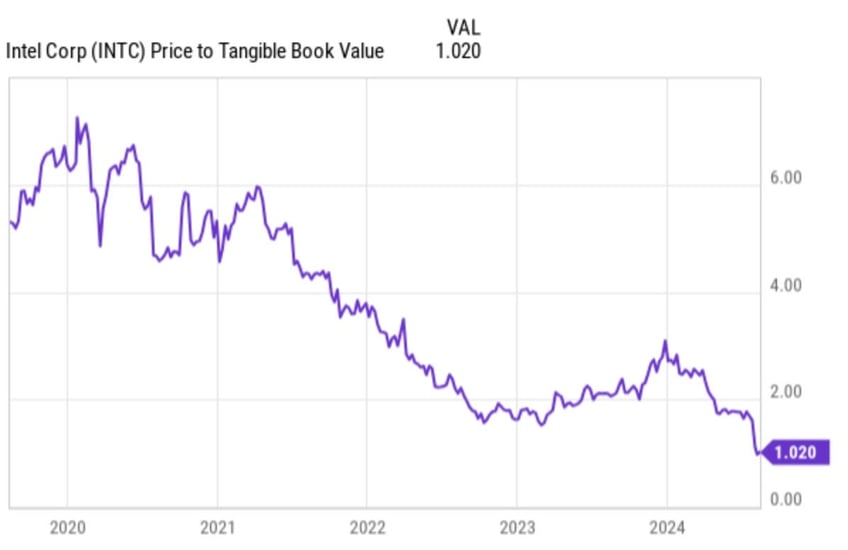

As numerous outlets have already noted, the company is now trading right at, or barely under its tangible book value, or its liquidation value.

For a company in the semiconductor space that has a multiple-decades-long track record of being a staple stock, tons of brand equity, and a growing total addressable market, I can’t help but believe somebody is going to see its value.

If it hasn’t yet, the company may wind up bottoming in both sentiment and stock price sometime soon — but even priced the way it is now, with arguably the worst news of more job cuts and underperformance behind it, it seems prime for an activist investor or a potential strategic transaction.

I know it won’t likely happen, but I can’t think of a better situation for Warren Buffett to use some of the brand-new cash he raised selling Apple stock. He can essentially invest back into the same industry at a far more distressed valuation with an American-based company that is extraordinarily well-known and has a long history. This would seem to place it right up Buffett's alley, though it’s a long shot. When Buffett took his stake in Apple, they were still using Intel processors — it has to be on his radar.

Even if Warren Buffett doesn’t notice, I’m sure other investors already have. I threw my hands up in the air and exclaimed, “You’ve got to be f*cking kidding me!” after this last quarter decimated the position I had. Then, knowing my own track record as a contra-indicator, I smiled and thought to myself: “Wow, this might be the point where everybody else feels like this. And if so, it may actually be a good time to add to my position.”

So, that’s what I did. If Intel beefs it from here, blame Pat Gelsinger. That’s my bagholder plan. In fact, blame him for anything about my blog you don’t like.

The second and third names I really like here are...(READ THIS FULL REPORT HERE).

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.