The World Bank has issued a grim warning to developing countries: Sort out your debts or risk a “lost decade” of economic and financial ruin.

According to the Washington-based lending institution, developing countries spent a record $443 billion servicing their debt in 2022. That’s a 5% increase from the previous year.

That money is going toward principal and interest payments on debt from the past two decades. Over that period, developing countries borrowed lavishly, assuming that steady economic growth and low interest rates would allow them to repay their debts comfortably.

Then Covid, war in Ukraine, and rising interest rates threw a wrench in their plans.

Developing countries—which account for roughly 60% of global GDP—have seen interest payments on their debt increase sharply over the past two years.

“Record debt levels and high interest rates have set many countries on a path to crisis,” said Indermit Gill, the World Bank’s chief economist.

“Every quarter that interest rates stay high results in more developing countries becoming distressed.”

If that wasn’t bad enough, the U.S. dollar has strengthened since 2020, contributing to spiraling inflation across many developing countries and causing their foreign exchange reserves to dwindle.

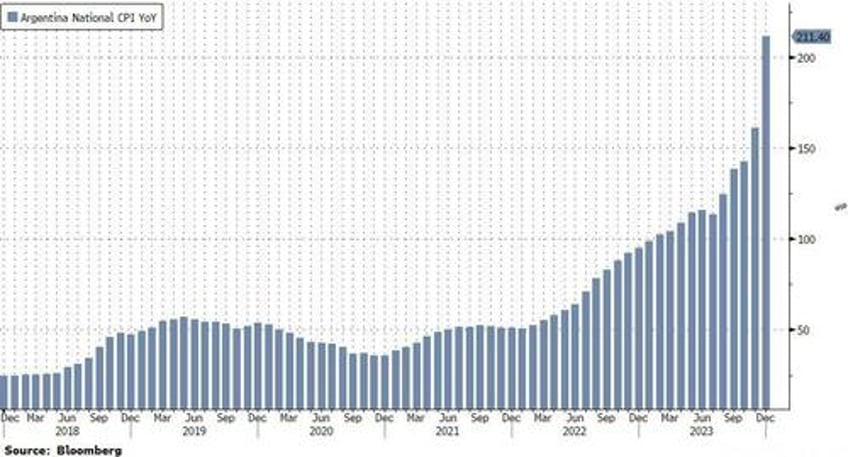

Americans think 9% inflation was bad. In Argentina, inflation spiked above 70%, while Chile, Brazil, and parts of Africa saw double-digit inflation rates.

[ZH: Actually late last night, Economists tracking Argentina see inflation at 213% at year-end, up 21.2 ppts from previous forecasts, according to the central bank’s monthly survey.]

In a September report, the World Bank acknowledged that low-income developing countries face the biggest challenge in paying down their debt. These countries account for one-fifth of the global population.

“Facing the increased financing needs in the aftermath of the pandemic and under pressure to respond to the cost-of-living crisis, reducing debt has become more challenging,” the Bank wrote.

What does a lost decade even mean?

In economics, a lost decade generally refers to an extended period of slow or negative economic growth, lasting roughly ten years or more. The term was originally coined to refer to Japan’s sluggish growth beginning in the 1990s.

Unlike Japan, however, developing countries probably can’t afford ten years of stagnation. A shrinking economy means less revenue to spend on underdeveloped infrastructure, healthcare, education, and debt payments.

The International Monetary Fund describes this as a vicious cycle that only contributes to more poverty and indebtedness.

“Revenue shortages keep them from paying down debt, which forces them to borrow even more to meet basic needs,” wrote Fanwell Bokosi, an economic affairs officer with an IMF-affiliated organization.

“Budget cuts only make matters worse by slowing economic growth, thereby reducing tax revenue,” he explained.

Growth outlook downgraded

Earlier this month, the World Bank warned that developing countries would grow just 3.9% this year—more than one percentage point lower than the average from the previous decade.

By the end of 2024, the Bank estimates that roughly a quarter of people in developing countries will be poorer than they were before the start of Covid. This figure is as high as 40% for the lowest-income countries.

It’s not just developing nations facing a grim outlook. The IMF and World Bank have downgraded their outlooks on advanced nations, too. In fact, the global economy is on track to complete the worst half-decade of growth in 30 years, World Bank economists said.

Per the IMF’s projections, advanced economies like the U.S., Eurozone, Japan, and the U.K. are on track to grow a dismal 1.4% this year. That’s lower than 2023’s mediocre 1.5% growth rate.