Overbought Oil

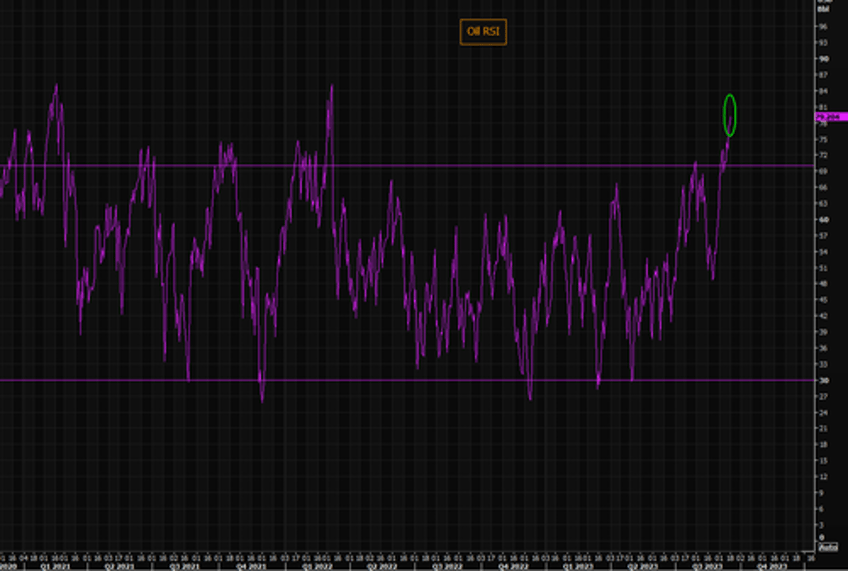

In yesterday's post ("10 Things You Need To Know About The Oil Rally"), The Market Ear pointed out that oil's RSI (Relative Strength Index) indicated the commodity was a bit overbought:

Let's start with a simplistic price momentum observation. Oil RSI is getting rather extreme, but as regular readers of TME know, overbought can stay overbought for longer than most think possible...

TME included the chart below, which showed that oil's RSI was just over 79. Recall that RSI (Relative Strength Index) is a technical measure of whether a security or commodity is overbought or oversold, and values above 70 are often considered overbought, while values below 30 are often considered oversold.

The upshot of the chart above is that oil prices may stay higher for longer, but this probably isn't the best entry point to buy oil itself. But what if you could get a better entry point now for a bet on oil? That may be the case with the oil company below, Evolution Petroleum (EPM).

An Oversold Oil Company

Here's a recent chart of EPM, showing its RSI was under 30 yesterday, well into oversold territory.

Aside from the oversold RSI, the most notable feature of that chart is big gap down in price last week. That was a result of the company's earnings miss (about which, more below). Before we get to why the stock dropped last week, let's look at what was attractive about the stock before last week's earnings. Here's what I wrote about Evolution Petroleum over the summer:

The COVID lockdown of 2020 was a real-life stress test for the oil industry. With much of the economy shut down and most office workers working from home, road traffic plummeted, and oil prices crashed.

The company we’re betting on today passed that test with flying colors: not only did it generate positive earnings in 2020, but it kept paying dividends (albeit, at a reduced amount) throughout the crash.

Today, its fundamentals are excellent.

It has a Piotroski F-Score of 8 (on a scale of 1-9, where 9 is best), and Chartmill gives it an aggregate fundamental rating of 8. It also has a strong chart: Chartmill gives it a technical rating of 8 as well.

With all of its production in the U.S., this company avoids the political risk associated with global oil companies, and its small size lets it target fields that wouldn’t move the needle for oil majors.

What Changed?

EPM's chart and technical rating are no longer strong, but its fundamentals are. The company ended last quarter with plenty of cash on its balance sheet and zero debt. But it missed on top and bottom lines due to downtime and maintenance issues in some of its fields and lower oil ($69.51 per barrel on average) and natural gas prices ($2.44 per MCF, or thousand cubic feet) in the quarter.

The good news though is that maintenance issues are temporary, and oil and natural gas prices are significantly higher in the current quarter, with WTI (West Texas Intermediate) oil trading at about $90 per barrel now, and natural gas trading at about $2.77 now. That ought to be reflected in this quarter's earnings, which are scheduled to be reported in early November.

How To Play This

The simplest way would be to just buy the stock and reinvest its dividends. At yesterday's closing price of $6.80, EPM was yielding nearly 7% annually.

Another approach is to sell puts on it. I'm currently short the $7.50 strike puts on EPM expiring on October 20th. As of yesterday, you could sell those puts for about $1.00. If EPM is trading over $7.50 on October 20th, those puts will expire worthless and you'll keep that $1.00 credit; if it's trading below $7.50, those puts will be exercised, and you'll buy the stock for $7.50, but your net cost will be $6.50 ($7.50 minus the $1 you got when you sold the puts).

Something to consider if you'd like to add some domestic oil and gas exposure without overpaying for it.

If You Want To Stay In Touch

You follow Portfolio Armor on Twitter here, or become a free subscriber to our Substack using the link below (we're using that for our occasional emails now). You can also contact us via our website. If you want to hedge, consider using our website (our iPhone app is currently closed to new users).