Submitted by QTR's Fringe Finance

For all the huffing and puffing I do about politics, you’d think that both candidates would have substantially different ideas for monetary policy, should they be elected. After all, this is supposed to be a finance blog.

But the truth is, they don’t.

While I do think the Republican Party is more inclined to decrease the size of government and cut some spending—both things that we desperately need to do in order to fight inflation and streamline our economy—President Trump has also promised to cut interest rates when he’s in office, a move that would normally add fuel to an inflation fire that the Fed has not yet put out.

Despite my whining, it’s a certainty that the national debt is going to go up, no matter who is elected president. With President Kamala Harris, it likely rises much quicker, and spending spirals even further out of control than it has been under the Biden administration (for a primer on just how screwed our nation’s finances are, listen to this podcast and then read this Zero Hedge article).

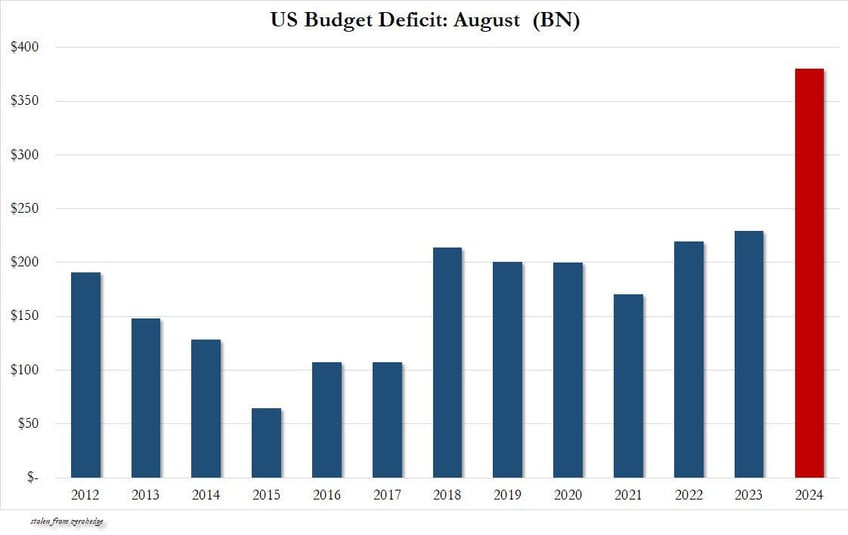

Chart: Zero Hedge

With President Trump, at least there would likely be some deregulation, lower taxes, and modest spending cuts that could slow our descent into monetary and fiscal Armageddon.

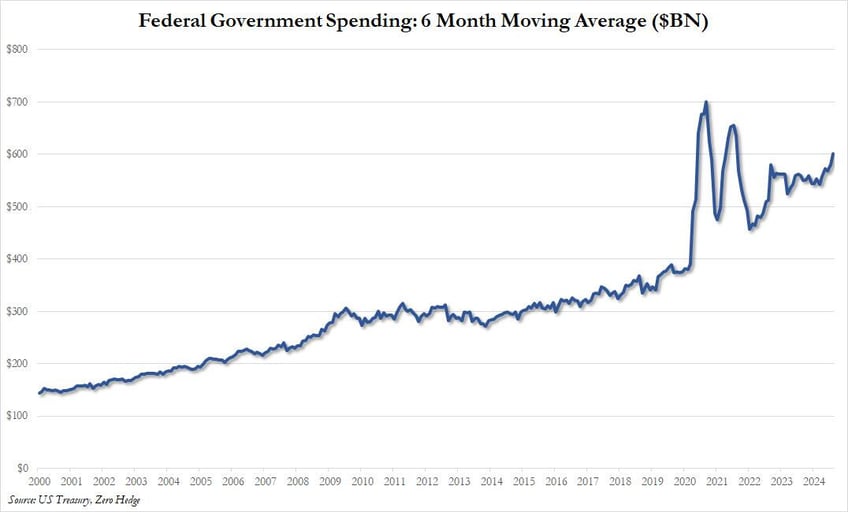

Chart: Zero Hedge

This morning I find myself looking back at the week, trying to make sense of the stock market moves over the last 3 sessions. With the NASDAQ at about 37x earnings and interest rates at 5.5%, combined with both CPI and PPI numbers that came in hot this week and the fact that we just made a massive negative revision to the country’s labor statistics, you don’t necessarily expect the stock market to be raging higher.

But the things that are supposed to happen with 5.5% interest rates after the largest debt bubble in history—namely...(READ THIS FULL ARTICLE FREE HERE).