Subscribe on our website www.gmgresearch.com

Breadth in the S&P is terrible. S&P is up 10% YTD but 45% of its constituents are negative.

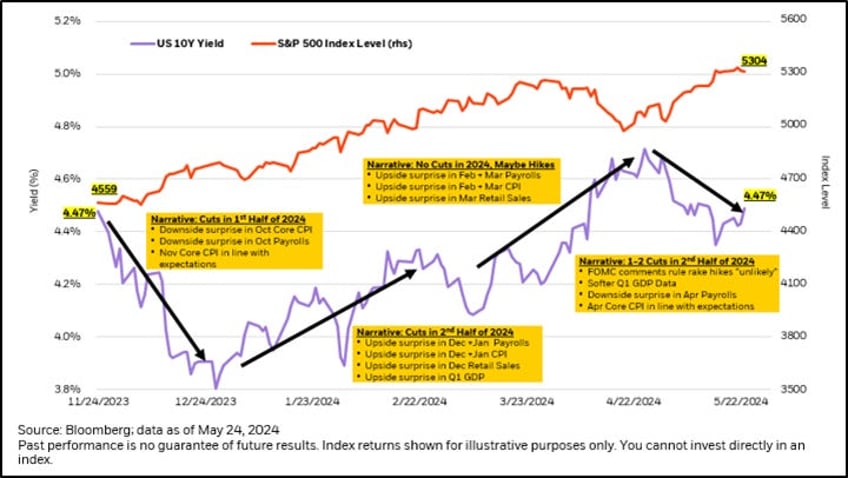

US and international yields are moving higher. 4.80% is something to watch on the 10yr

Going higher: Oil, wheat, commodities, AUDUSD, AMD, Japanese rates, Coherent, Meta, Platinum

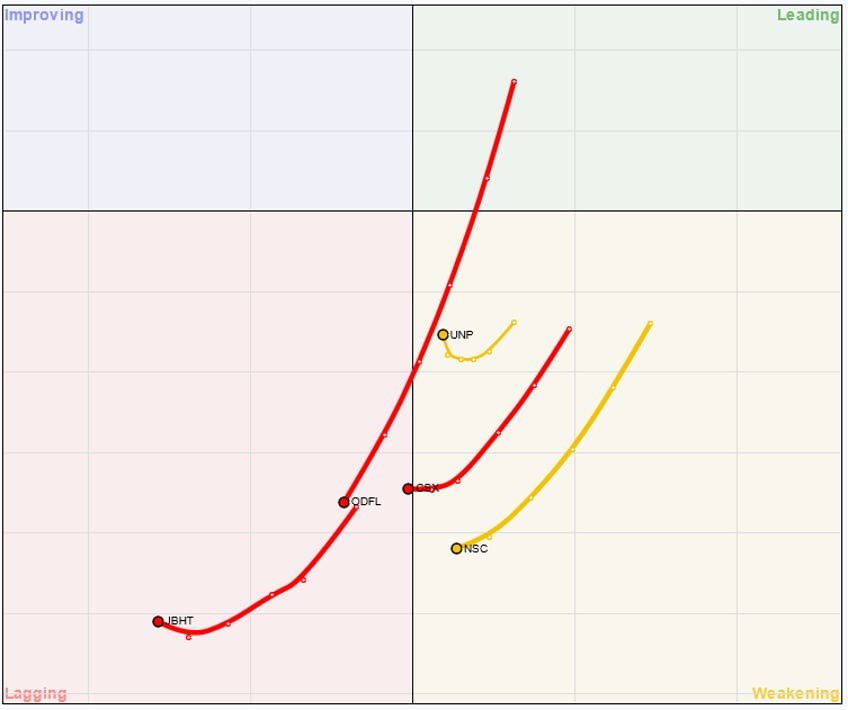

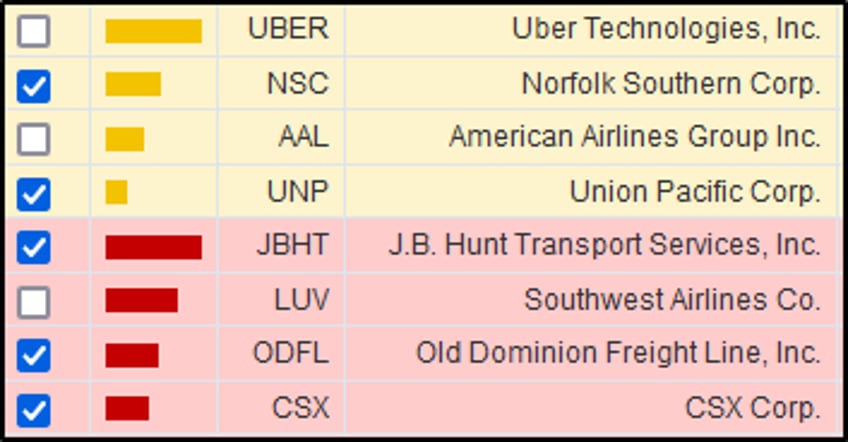

Stay away from: homebuilders, smallc-caps, “value”, Blackstone, CSX, shipping, rails, LVMH

% of stocks above the 200ma is continuing to deteriorate.

Same data just a different visual.

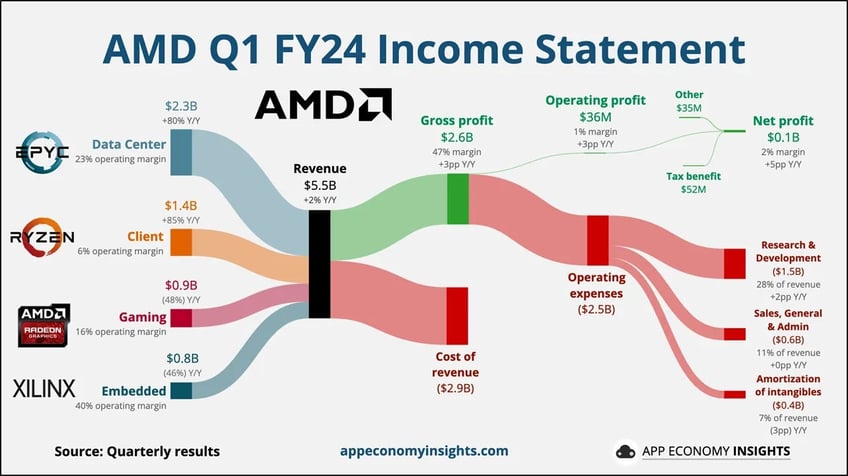

AMD and NVDA are the Pepsi and Coke of the semi industry. Bullish.

Follow Druckenmiller on Coherent: “Upside for Optical Suppliers: Nvidia didn’t order enough transceivers at least in the April quarter so the set up feels good for both Optical suppliers (e.g., Fabrinet, Coherent, Innolight). - JPM TMT Conference

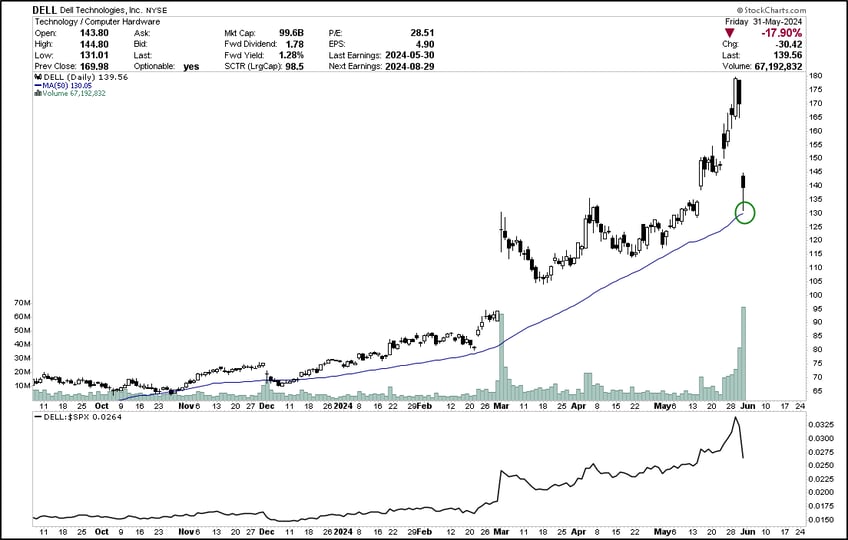

Dell is bouncing nicely off the 50ma.

Platinum is consolidating before moving higher.

$4.50 is a good risk/reward on Copper.

Avoid these companies.

CSX continues to be weak.

BlackRock - “A balanced portfolio today revolves around simply clipping coupon in fixed income and owning high-growth tech stocks.”

Illiquid assets

Reserve list MTG: Illiquid “non-security” that hasn’t gotten the attention it deserves recently. Higher in the next 3 years.

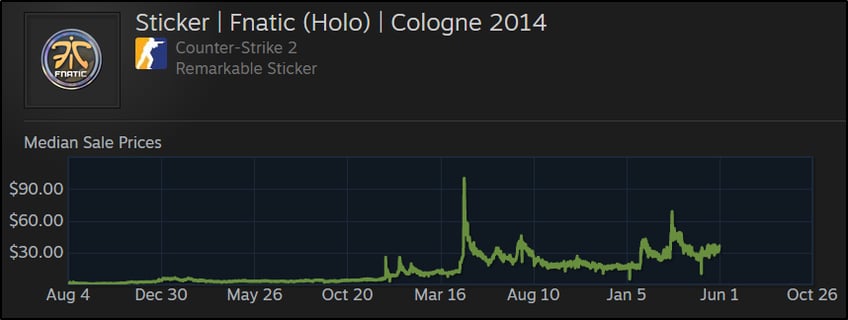

Counterstrike skins/stickers are going UP.

Learn Something

Why Systematic Rebalancing Doesn't Work

Systematic rebalancing, which involves adjusting a portfolio back to its original asset allocation, has inherent flaws that can increase risk and drawdown. Negative convexity occurs when the value of a portfolio decreases at an accelerating rate as the market moves against it. For instance, in a traditional 60/40 portfolio, if equity markets decline and the portfolio shifts to a 50/50 allocation, rebalancing would require buying equities to return to the 60/40 split. This process effectively creates a short straddle with negative convexity, which can exacerbate losses during market downturns. Mechanical rebalancing fails to account for market momentum and often ignores the true skewness of portfolio strategies. Instead of mitigating risk, it can inadvertently increase it. A more effective strategy involves allocating to a positive convexity approach, such as trend following.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.