October’s jobs report was a disaster… at least for anyone who wasn’t paying attention. Indeed, cracks began forming in the labor markets a few months ago.

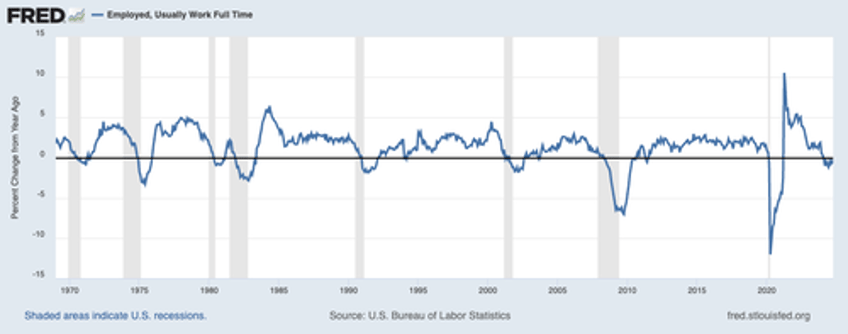

First and foremost, the number of people who are “Employed and Usually Work Full-Time” has gone negative on a year-over-year (YoY) basis. There have been a few false triggers in the past (1994, 2003, and 2011), but most of the time, this has signaled a recession is coming.

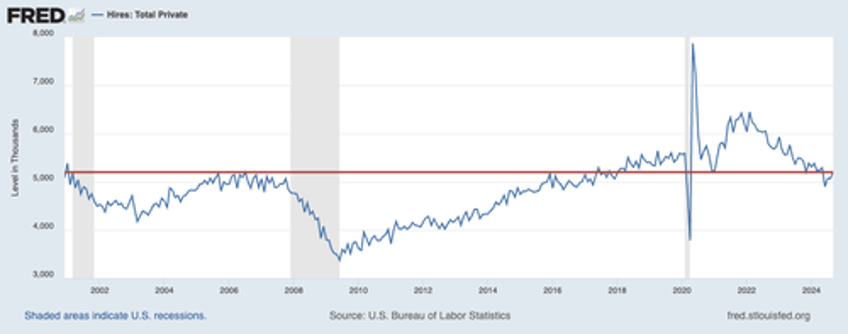

Secondly, total private sector hires have been declining, hitting levels that indicated things were getting “problematic” in the past.

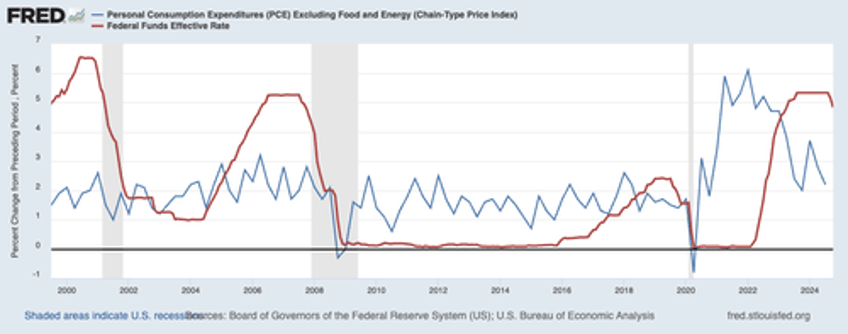

These issues alone are enough to warrant the Fed cutting rates if it has any hope of sticking a “soft landing.” The fact the Fed was acting “data dependent” by focusing on jobs data that is massaged to the point of being borderline fiction shows just how clueless they can be.

Remember, real- or inflation-adjusted rates have been positive 2.5% for most of the last year. Historically, this has been extremely restrictive. You’ll note that since 1999, any time rates were this positive, it wasn’t long before the economy rolled over into recession.

Put simply, the Fed is behind the curve already. It if wants to hit a soft landing it needs to cut rates faster and deeper than most realize. This combined with the fact Donald Trump will be the next President of the United States is opening the door to a stock market boom.

Smart investors are preparing for this now.

On that note, we just published a Special Investment Report detailing all of this, as well as the #1 investment to own during Trump’s 2nd Term.

We are selling this report as a standalone item for $499… but you can pick up a copy FREE simply by joining our daily market commentary, Gains Pains & Capital.

We are making only 99 copies available to the public.

To pick up yours…

https://phoenixcapitalresearch.com/trump2ndterm-leadgen/

Best Regards

Phoenix Capital Research

PS. for those of you who are interested in more details concerning what a Trump win would mean for the markets, our Chief Market Strategist, Graham Summers, MBA recently hosted a webinar addressing this situation, including his upside target for stocks during the next four years, which stock market sectors will outperform, which sectors will decline, and more.

This webinar will available to the general public for $49.99... However, readers of Zero Hedge can access it for just $19.99.

To do so... and take steps to prepare your portfolio for Trump's 2nd Term...