Here's the FindLeadingStocks.com Morning Report:

Good Morning Team,

- Day 2 & Futures Up: As of this writing (6:45amET), futures are up. The Nasdaq 100 (QQQ) marked Day 1 of a new rally attempt on Friday which means, if we rally today without taking out Friday's low, then today will be Day 2 of a new rally attempt. The earliest a new follow-through day (FTD) can emerge will be on Tuesday which would be Day 3 of a new rally attempt. The other indices ended lower on Friday which means, if they rally today, than today will be day 1 of a new rally attempt for those indices and the window opens on Wednesday for a new FTD.

- This Week On Wall Street: Fed Meeting, Jobs Report, & Earnings: The three big data points I'm watching this week will be: The Fed Meeting on Wednesday, A slew of earnings this week, and the Jobs report on Friday.

Tuesday - Consumer Confidence Report.

Wednesday JOLTs Job data, Treasury New Borrowing Plan, Federal Reserve's Rate Decision, and Statement on Wednesday.

Thursday: Initial Jobless Claims.

Friday: October Jobs Report

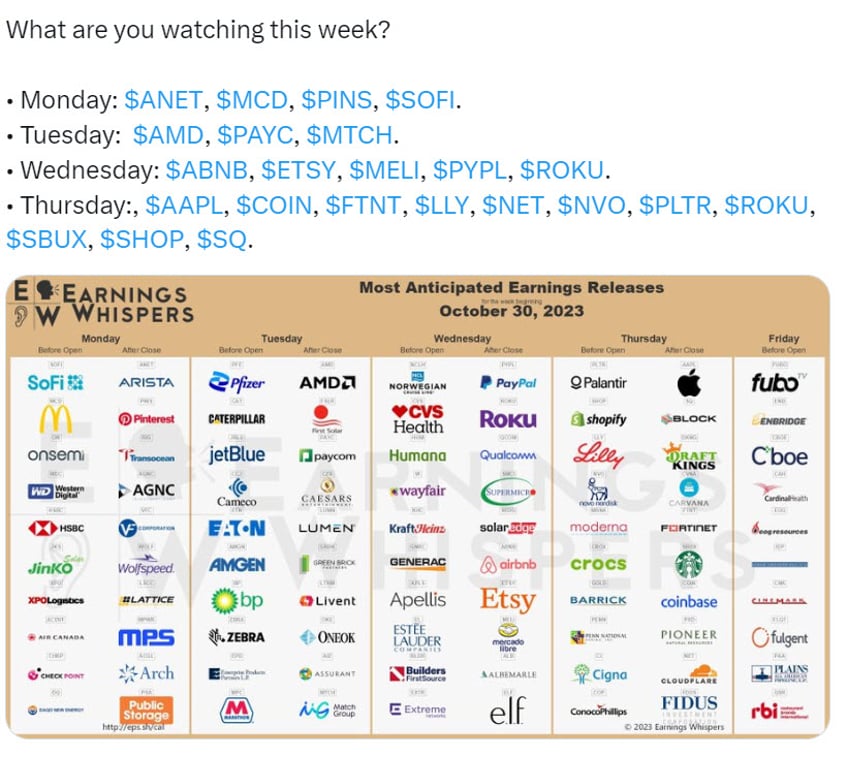

Earnings Party: Approximately 20% Of The S&P 500 will release earnings this week.

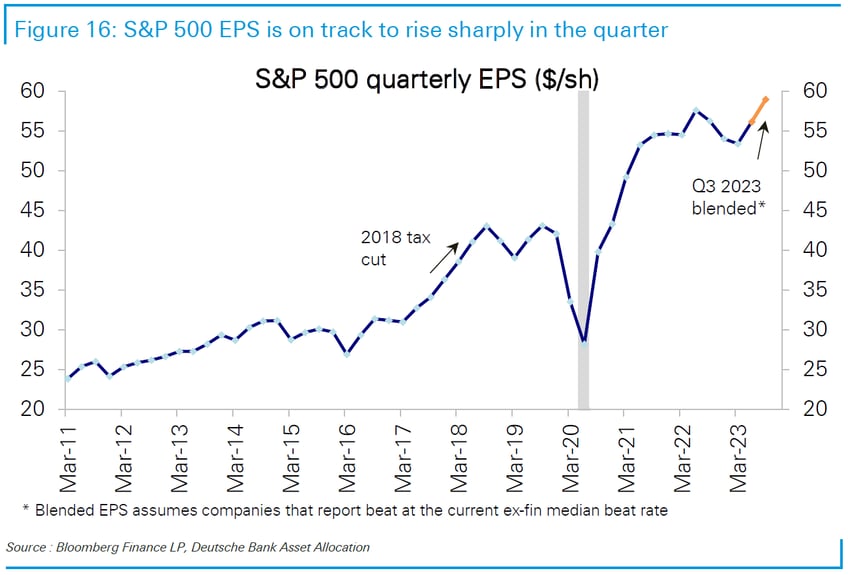

Here's the earnings calendar courtesy Earnings Whisper: - A Closer Look At Earnings: Based on the latest estimates, EPS is expected to grow. However, if you remove the magnificent 7 stocks, EPS will decline.

- Treasury Department's New Borrowing Plan: On Wednesday, the Treasury Department will announce its new borrowing plan., just before the Federal Reserve's policy statement. The announcement will show how much the Treasury plans to increase the sale of longer-term debt to cover a growing budget deficit. Many experts expect the Treasury to announce a refunding of $114 billion, following the same pattern as the $103 billion plan in August. However, some suggest a smaller increase in long-term debt and a greater reliance on short-term bills due to rising yields. Despite signals from the Fed that they are close to ending rate hikes, long-term securities have been falling for weeks. This will be important because the debt, deficit, and interest on all of that money is growing exponentially and is out of control.

- How The Market Reacts: The most important thing I'm looking for will be how the market and leading stocks react to everything mentioned above. If we rally this week, see new breakouts, big breakaway gaps on earnings, that will be a positive sign. Conversely, if we don't, and fall, that will be bearish. Remember, the market is very stretched to the downside, sentiment is very bearish, and over due to bounce.

Have a great day!

Adam