Here's the FindLeadingStocks.com Morning Report

Good Morning Team,

- Better Action, Still Want A FTD: The market action has improved (slightly) on Monday and Tuesday. It's still early in the week, let's see where we close today and then on Friday. The window is now open for a new follow-through day (FTD) which will confirm the latest rally attempt. Remember, we still want to see more breakouts and big breakaway gaps to earnings. Be ready for a big decline, because, until proven otherwise, the bears remain in control. On the other hand, if we race higher and get a FTD, we'll be ready and can begin slowly probing some of the strongest names. Look at the weekend report for the strongest names and strongest setups!

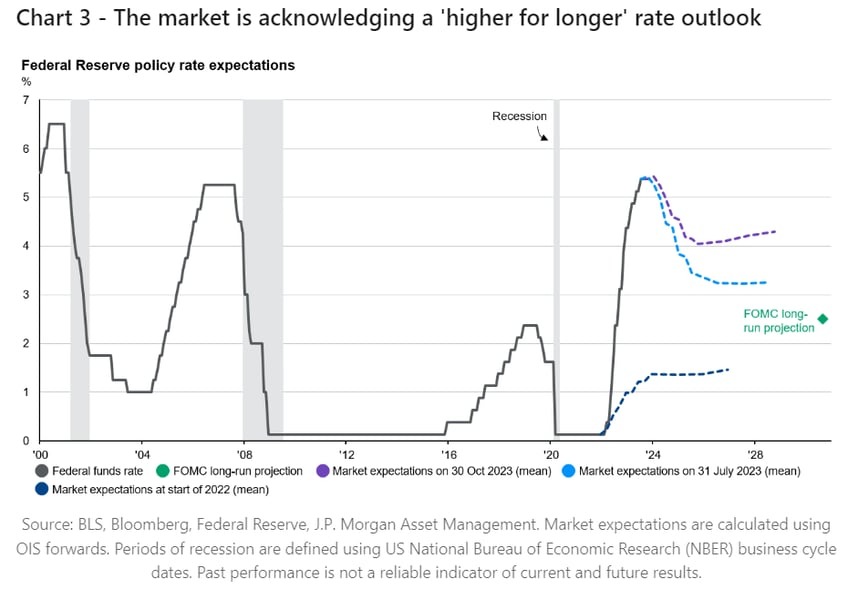

- Hawkish Pause & Big Day Today: The market will be watching the latest round of earnings, and specifically, what Yellen and Powell say today. I will be watching the market to see how it reacts to the news. The Federal Reserve is likely to keep interest rates the same today and leave the door open to increase them again in December, if needed (a.k.a. remain data dependent). Economists expect the rate will remain between 5.25% and 5.5%, a level set in July. Chair Jerome Powell, who will speak to the press after the decision, has indicated that the Fed wants to assess how previous rate hikes have affected the economy as they approach the end of their plan to increase rates. Plus the yield on the 10 year has soared and that has helped the Fed do its job with higher rates.

- Halloween 2007 & Some Interesting Charts: World markets changed bigely in 2008. The top was Oct 2007. Since then, US markets led the world higher while other markets lagged. Here are a few interesting charts courtesy of Bloomberg. The question going forward is, will this trend reverse? Meaning, while the US lag and international markets lead? Only time will tell.

Valuation:

Global Earnings

Higher For Longer: Even if the Fed does not raise rates today, the outlook remains 'higher for longer.' - Positive Earnings Reactions: It is encouraging to see some stocks begin to rally after reporting earnings. Hopefully, that continues and we end the year strong. ANET remains my favorite stock in the market right now. It gapped up nicely after reporting earnings and broke out of a bullish double bottom base, on monstrous volume. Charts & Data Courtesy MarketSmith. Click here to join MarketSmith

- Movers:

UP: FSLR, CZR, MCY, SATX, NVX, FLJ, GNRC, AXTA, TT, F, GM,

DOWN: PAYC, WE, BGFV, YUMC, MTCH, LTHM, AMD

Have a great day!

Adam