Here is Tuesday's FindLeadingStocks.com Morning Report...

Good Morning Team,

- Up Day: Monday was a nice "up" day on Wall Street as the major indices bounced from deeply oversold levels. The window is now open to see if we get a Follow-Through Day (FTD) in the Nasdaq 100 (QQQ) and other popular indices. The Fed finishes its 2-day meeting tomorrow, then we have a slew of earnings, and the always fun jobs report, later in the week.

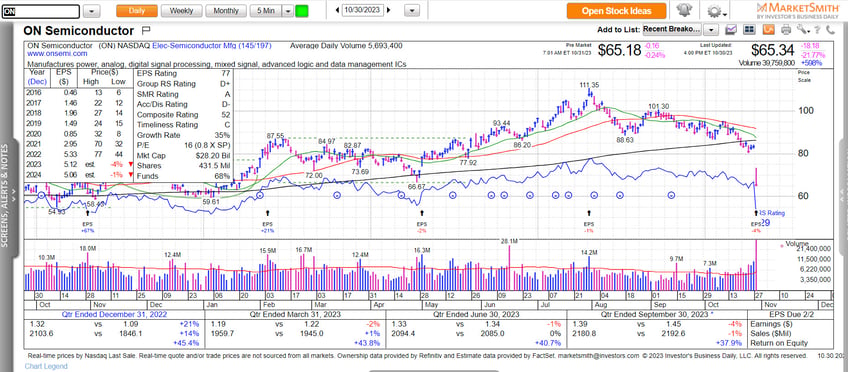

- EV Demand Waning: On Monday, EV stocks fell after Panasonic warned that demand is drying up for its EV batteries. Separately, shares of ON Semiconductor ($ON), which also makes EV related stuff, gapped down over 20% after reporting earnings.

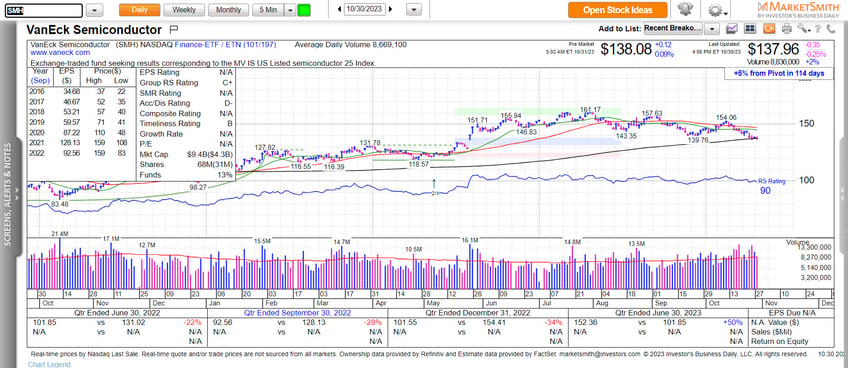

Charts & Data Courtesy MarketSmith Inc. Click here to Join MarketSmith - Watch The Semiconductors: The Semiconductor ETF $SMH, which tracks a basket of semiconductor stocks, is sitting on its 200 DMA line. The bulls want to see that level get defended. After Monday's close, LSCC, another semiconductor gapped down bigely.

Charts & Data Courtesy MarketSmith Inc. Click here to Join MarketSmith - Yellen, Powell, & Some Powerful Charts.

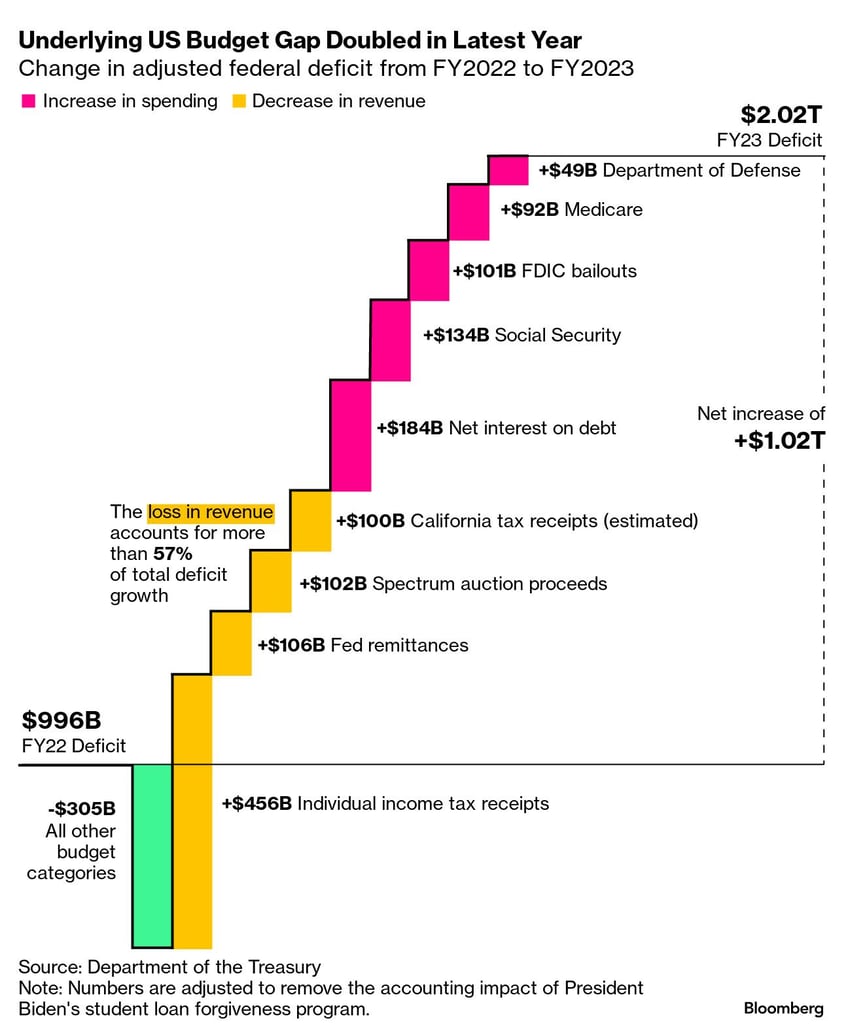

4A. The spending in Washington D.C. is out of control.

The Debt & Deficit Are OUT OF CONTROL and growing rapidly. The interest payments on that debt is out of control. Hopefully, someone in D.C. wakes up and does something.

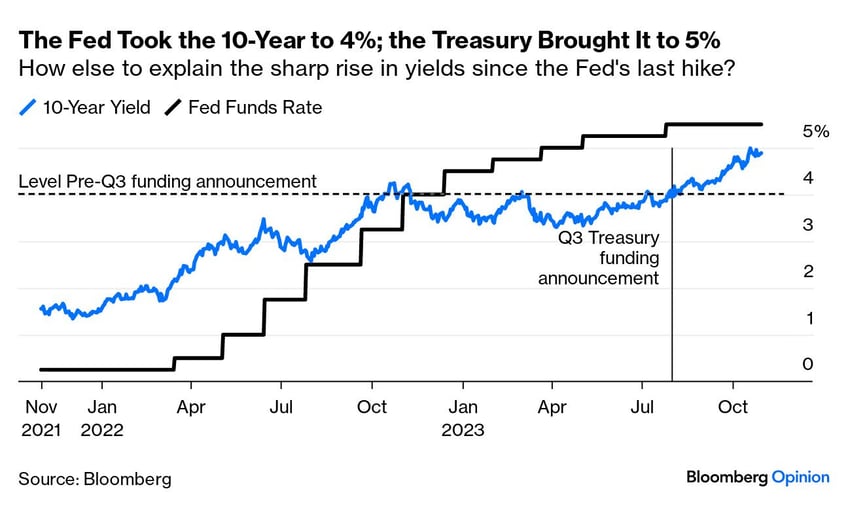

4B. Yesterday, legendary investor Stanley Druckenmiller said he is beginning to hear signs on the periphery that things are slowing down. Here is a good chart that illustrates that point.4C. Watch Yellen and Powell tomorrow.

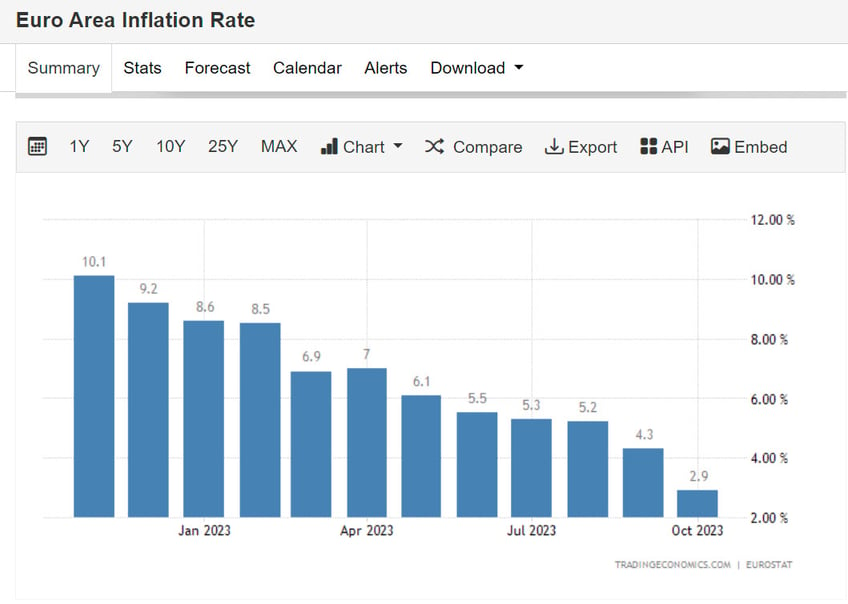

4D. Euro Area Inflation Declining: The inflation rate in the Euro Area declined to 2.9% year-on-year in October 2023, reaching its lowest level since July 2021 and falling slightly below the market consensus of 3.1%, as a preliminary estimate showed. Meanwhile, the core rate, which filters out volatile food and energy prices, also cooled to 4.2% in October, marking its lowest point since July 2022. However, both rates remained above the European Central Bank's target of 2%. The energy cost tumbled by 11.1% (compared to -4.6% in September), and the rates of inflation eased for both food, alcohol, and tobacco (7.5% compared to 8.8%) and non-energy industrial goods (3.5% compared to 4.1%). Services inflation remained relatively stable at 4.6%, compared to 4.7% in the previous month. On a monthly basis, consumer prices edged up 0.1% in October, after a 0.3% gain in September. source: EUROSTAT - Movers:

UP: PINS, WOLF, ANET, MPWR, RNAZ, HMST, CAT, BUD, STLA, ARGX

DOWN: LSCC, AMKR, VFC, WDC, ICU, TNXP, SKS, HLIT, BP,

Happy Halloween!

Have A Great Day!

Adam