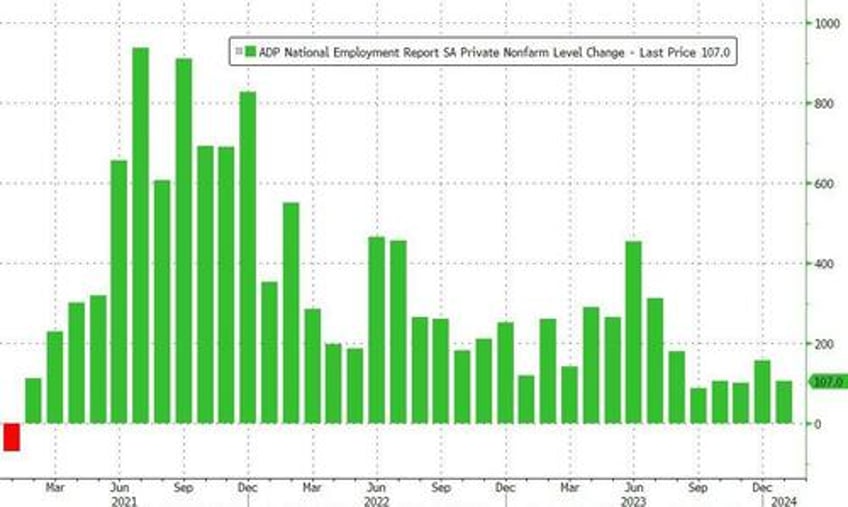

Analysts expected the ADP employment report to show a slowdown in job additions from last month's rebound (driven entirely by Services as Manufacturing jobs declined), and it did. ADP reported the addition of just 107k jobs (and the prior month was revised down to +158k from +164k). This is the second lowest monthly increase in jobs since Jan 2021's drop in jobs...

Source: Bloomberg

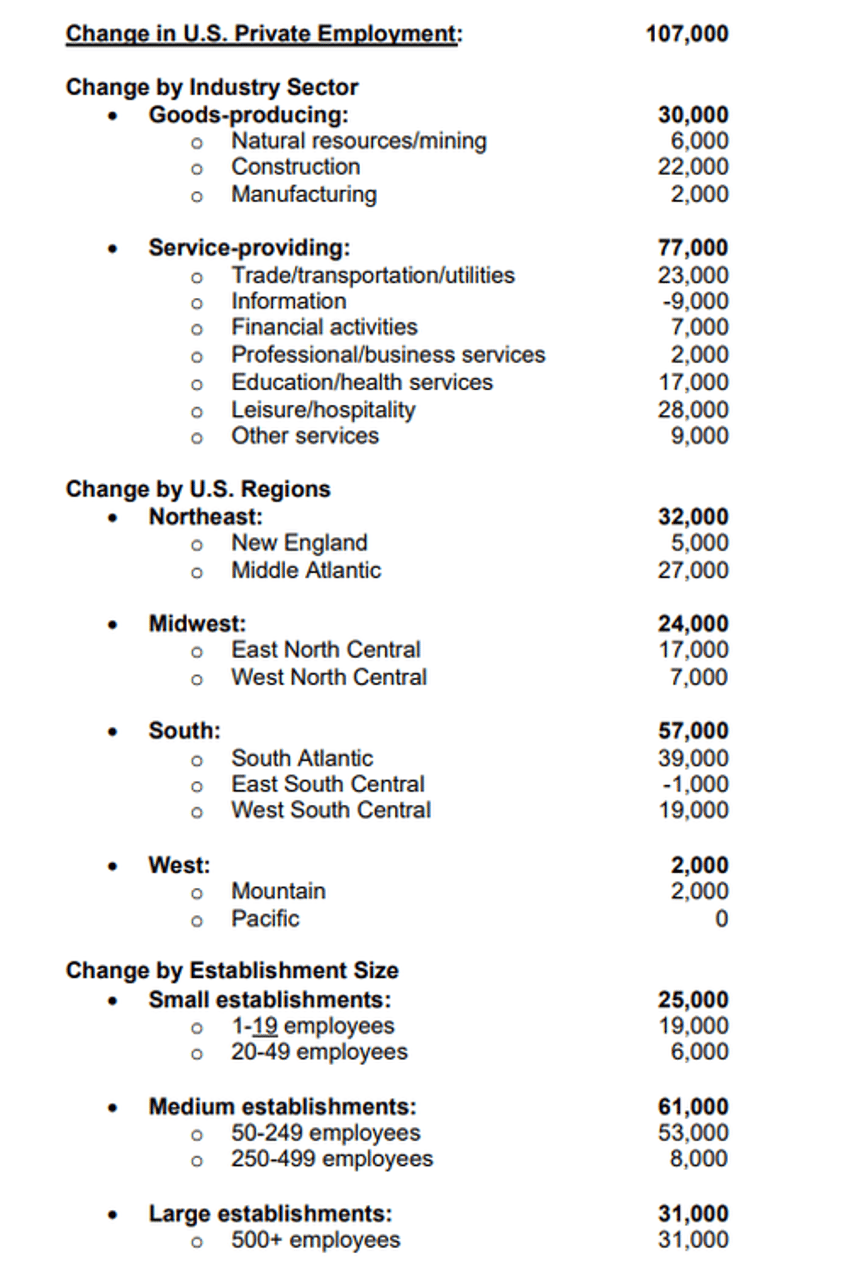

Information Services was the only group to see job losses last month...

On a non-seasonally-adjusted basis, manufacturing employment continues to trend lower...

ADP seems optimistic though...

"Progress on inflation has brightened the economic picture despite a slowdown in hiring and pay," said Nela Richardson Chief Economist, ADP.

"Wages adjusted for inflation have improved over the past six months, and the economy looks like it's headed toward a soft landing in the U.S. and globally."

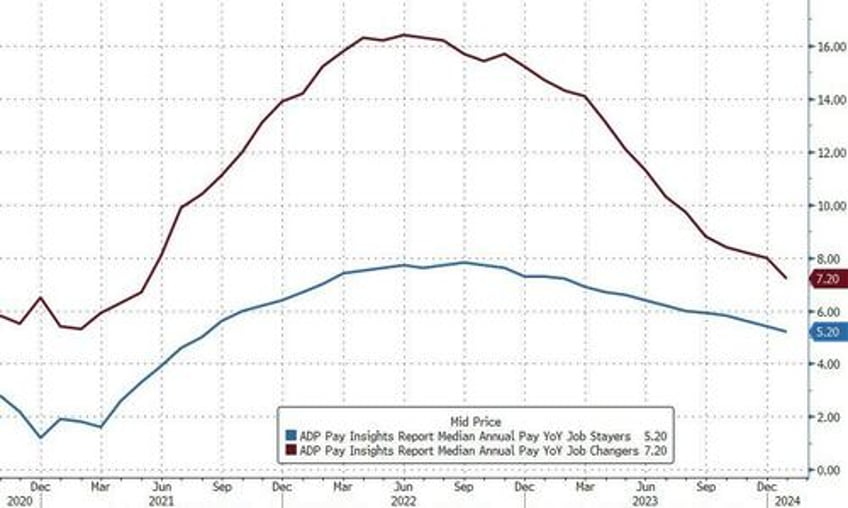

Wage growth is slowing, especially for job-changers... with the differential to job-stayers at its lowest on record...

Source: Bloomberg

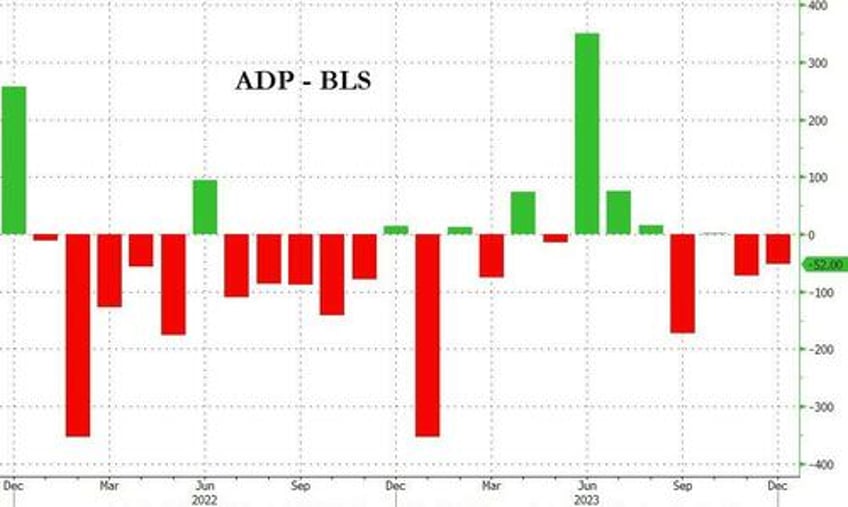

Finally, we note that ADP's data has under-estimated BLS's for 3 of the past 4 months...

Source: Bloomberg

So - can The Fed really cut rates (or even hint at imminent rate-cuts) with this kind of labor market?