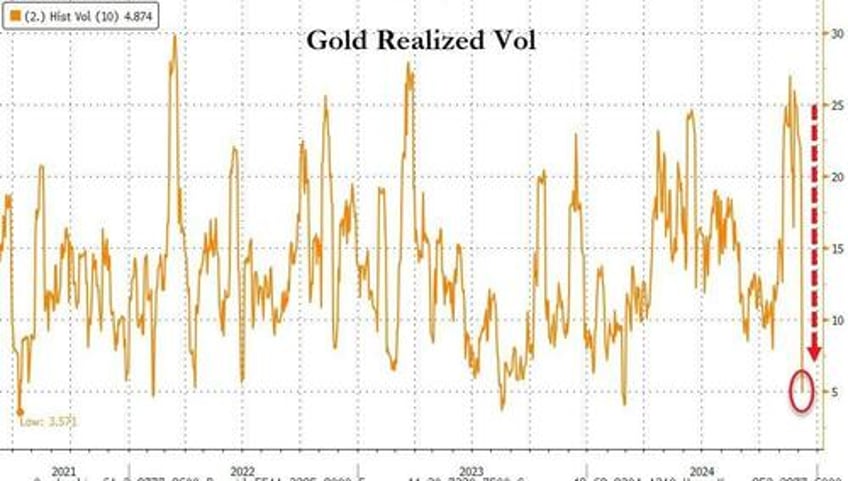

The last ten days or so have seen an almost unprecedented collapse in gold's realized volatility...

Source: Bloomberg

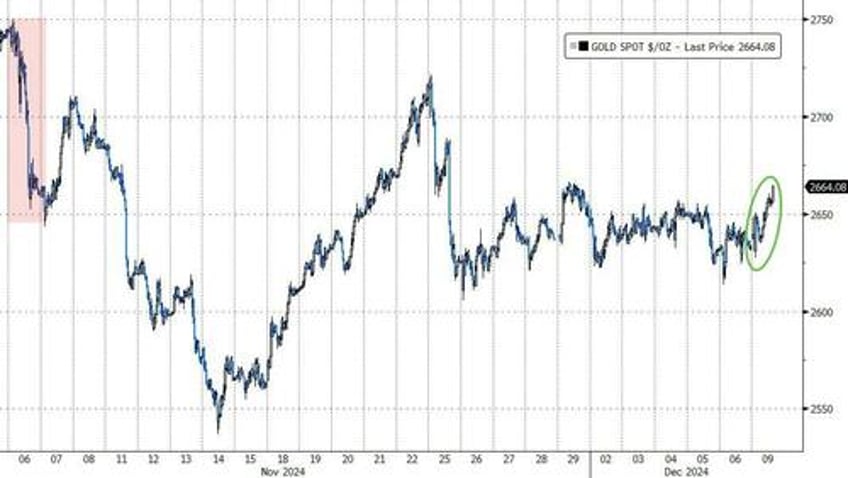

...as the price of the precious metal hovered just below its crucial technical 50-day moving-average level...

Source: Bloomberg

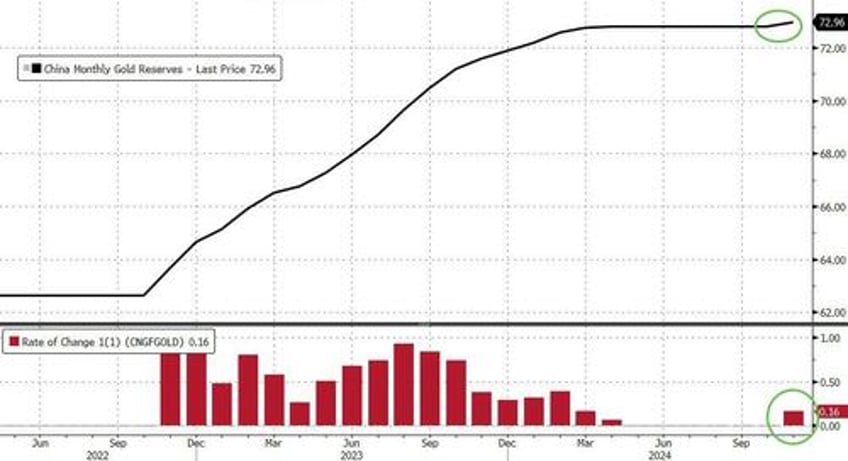

As we posted on X, this created a coiled spring like tension in the markets, that may have just been broken by news from Beijing as Reuters reports that China resumed gold purchases in November after a six-month pause (which ended an 18-mnth buying streak) and also launched (another) major stimulus effort.

"Falling U.S. interest rates and ongoing solid demand from central banks are supporting the gold price. (It) Was definitely good to see again purchases by the Chinese central bank last month, but other central banks have been also buying large quantities," said UBS analyst Giovanni Staunovo.

That prompted a jump in the barbarous relic this morning...

Source: Bloomberg

Robust central bank buying, monetary policy easing and geopolitical tensions have driven gold to multiple record highs this year, setting the metal on track for its best year since 2010 with a over 28% increase so far.

"The decision to increase gold holdings, particularly following Trump's recent election victory, reflects the PBOC's proactive approach to safeguarding economic stability amid evolving global conditions," OCBC analysts said in a note.

Zero-yielding bullion thrives in a low interest rate environment and is considered a hedge against political and economic uncertainty.

Adding to political uncertainty in the Middle East, Syrian rebels seized Damascus, forcing President Bashar al-Assad to flee to Russia, ending 13 years of civil war and over 50 years of Assad family rule.