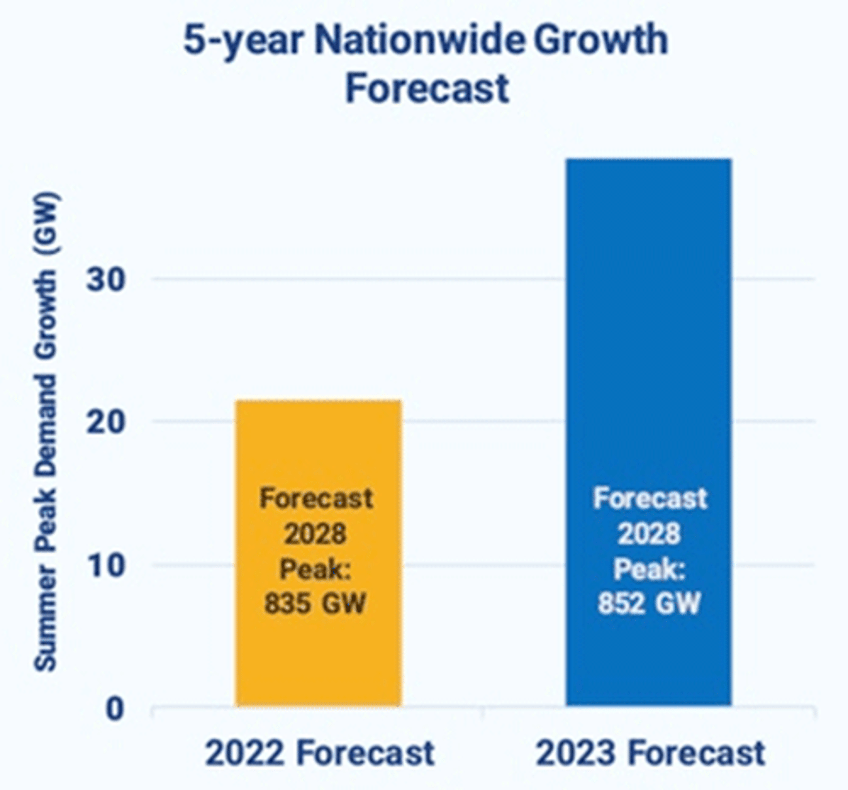

Since the start of the year, investors have been homing in on another round of the AI revolution, particularly focusing on the 'picks and shovels' of the sector, which are widely regarded as the winners of this new industrial revolution. However, an overlooked point by investors is the imminent surge in energy demand with the emergence of AI and later robotics. Within a year, the five-year growth forecast for US electricity demand has escalated from 2.6% to 4.7%, largely driven by the increased demand from artificial intelligence applications.

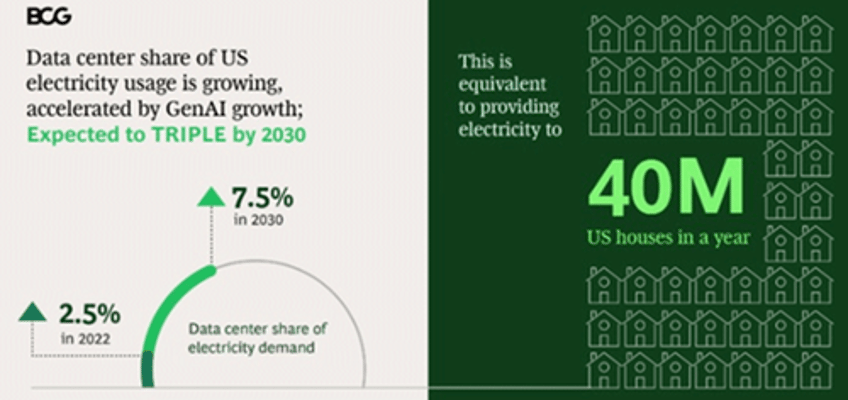

While AI is expected to enhance productivity in the long term, AI-driven technologies require substantial energy and energy infrastructure to support them. Schneider Electric, for example, projects that AI-driven power use will grow by 25%–33% annually through 2028. Much of this power consumption will occur at new data centers sprouting up around the world. The US data center construction market is anticipated to expand from $20.21 billion in 2022 to $28.56 billion by 2028. In the US, data centers’ share of electricity use is expected to triple to 7.5% by 2030, primarily due to the expansion of AI.

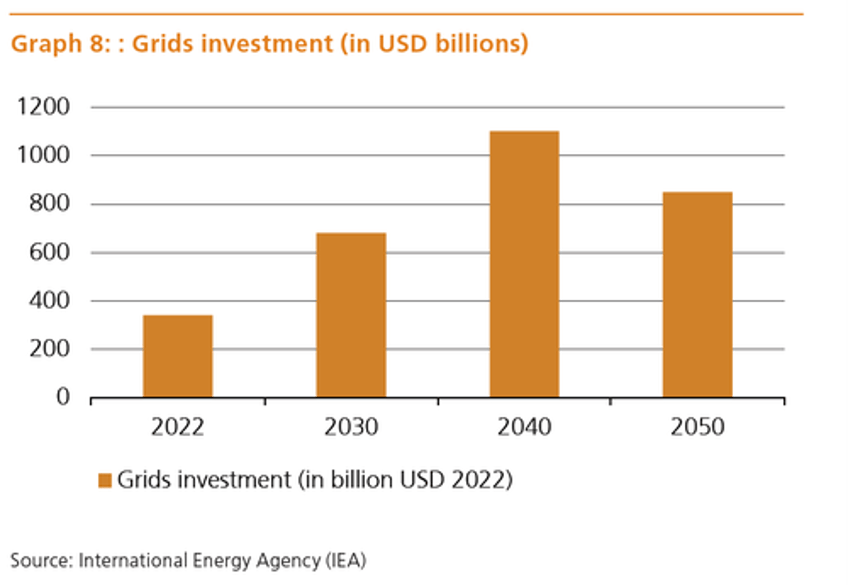

America's industrial and manufacturing revival, fuelled by over $900 billion in government incentives and investments, including the CHIPS Act and the Infrastructure Investment and Jobs Act, is another major driver of increased energy demand. To support this modernization, significant investment in grid infrastructure is necessary, with the IEA estimating around $680 billion per year needed by 2030 and over a trillion by 2040.

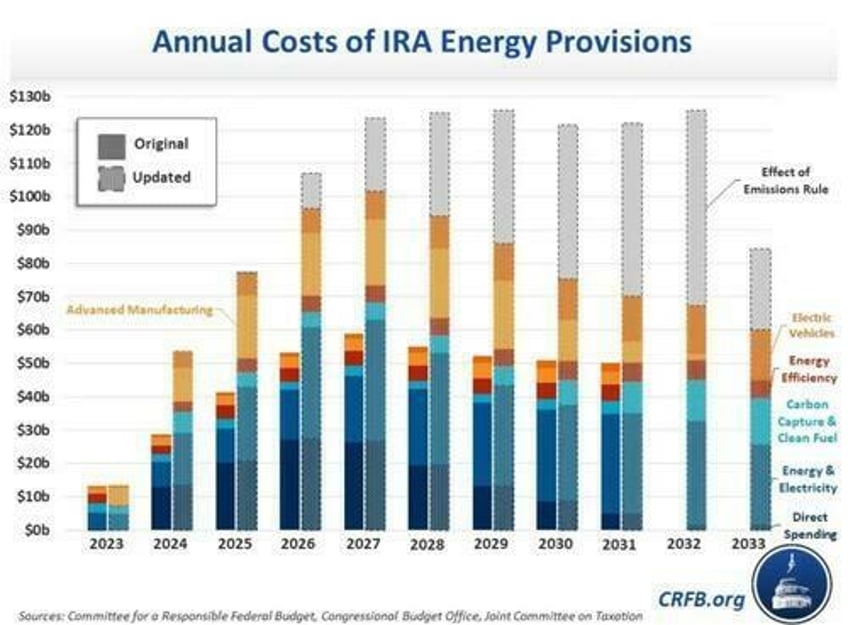

AI-driven energy and reshoring demand are not the only factor; additional regulations will also hike energy prices. Last April, the EPA proposed stricter vehicle emissions standards starting in 2027. If finalized, this rule would increase federal deficits by boosting electric vehicle tax credits and reducing gas tax revenue. The IRA's energy and climate spending and tax breaks were initially estimated at $400 billion through FY 2031 but are now projected to cost about $870 billion through 2031 due to various factors, including the emission rule, looser regulations, higher demand for green technologies, and economic changes.

Over the past 2 decades, the US shale oil industry has been the driving force behind America's economic success, transitioning the country from a net oil importer to a net exporter.

In its annual newsletter, Warren Buffet highlighted that not long ago, the US was heavily dependent on foreign oil. Pessimism prevailed for a considerable period until the US shale revolution had a transformational impact on the US economy.

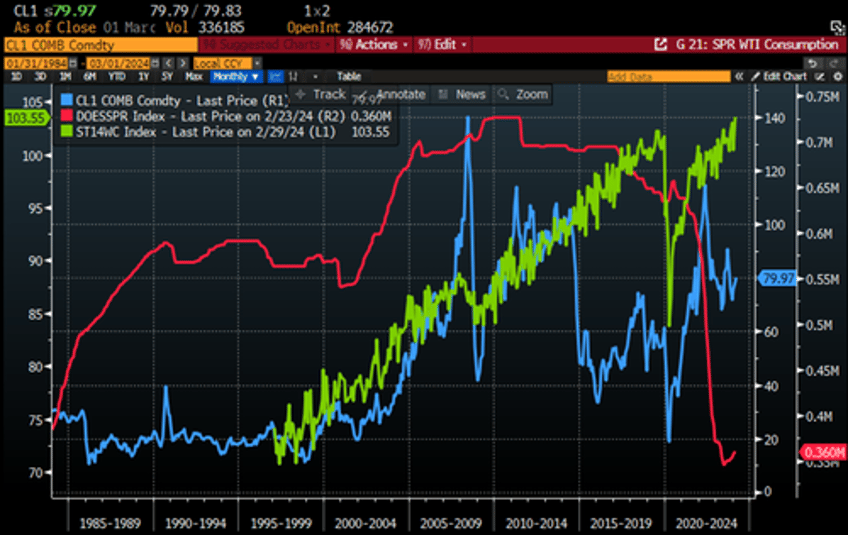

The US Shale industry has enabled the US to reduce its Strategic Petroleum Reserve as an additional supply source over the last decade, even as demand continued to rise amid a more challenging macroeconomic landscape.

WTI price (blue line); US Strategic Petroleum Reserve (red line); Global Oil Demand (green line).

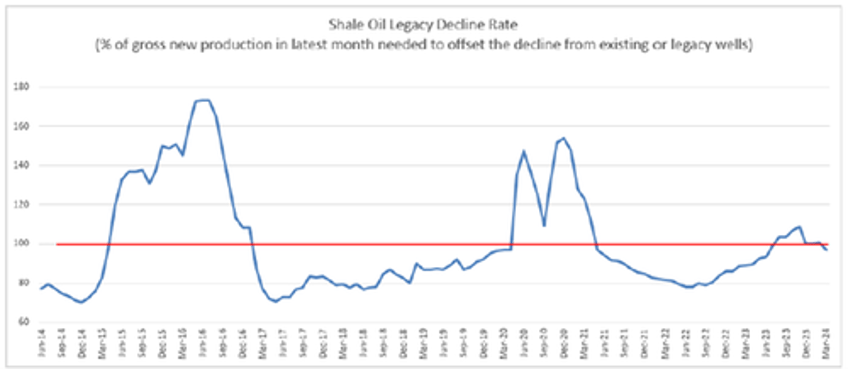

However, shale producers are encountering hurdles in expanding their operations after reducing drilling rigs last year. Oil production growth from the lower 48 states is projected to rise by 270,000 bpd this year and 330,000 bpd next year. Therefore, offsetting base declines becomes more challenging as production levels increase, requiring more production to merely maintain flat levels. This outlook coincides with shale explorers exercising greater restraint in spending.

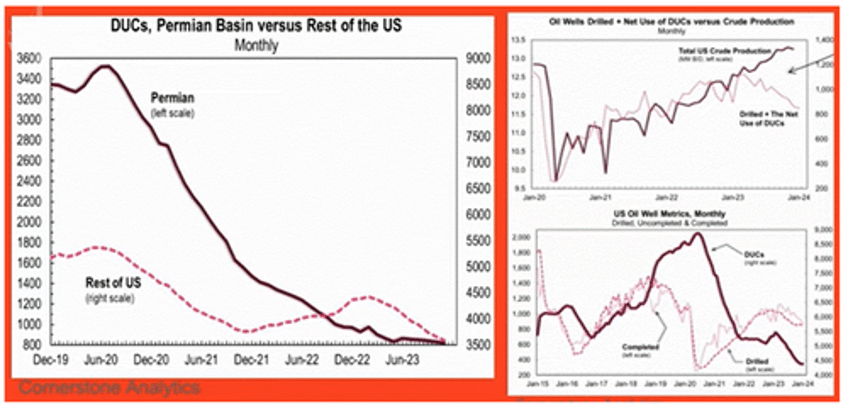

Examining Drilled but Uncompleted Wells (DUCs), it appears evident that the outlook for shale oil supply in the coming quarters is expected to be constrained.

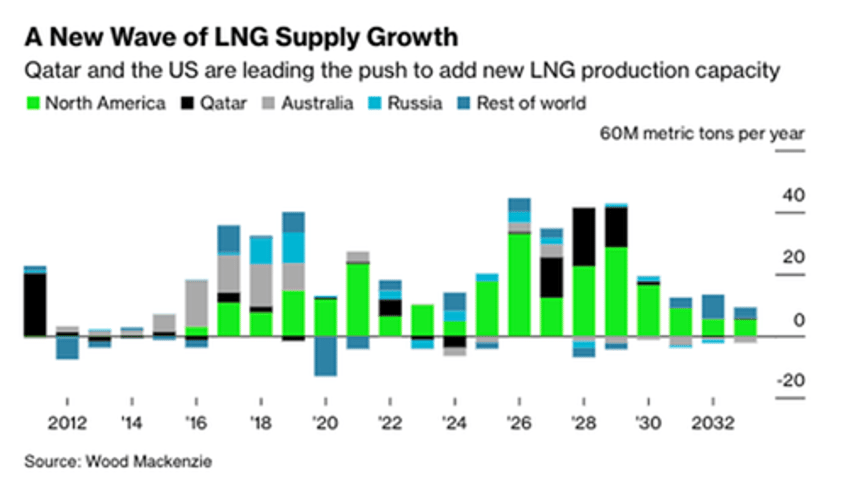

Despite the decision from the White House to halt new LNG export licenses in Texas, the third-largest LNG exporter globally, the LNG market is poised for significant growth in the coming decade.

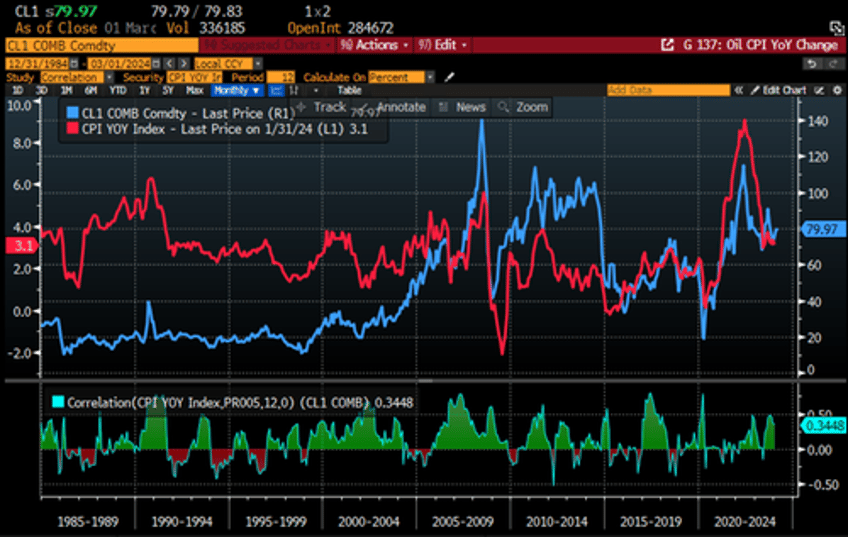

For macro investors, instead of delving into complex theories about what drives inflation and the US 10-year yield, a simple way to understand it is by observing the correlation between the oil price the US CPI YoY change.

WTI oil price (blue line); US CPI YoY change (red line) & Correlation.

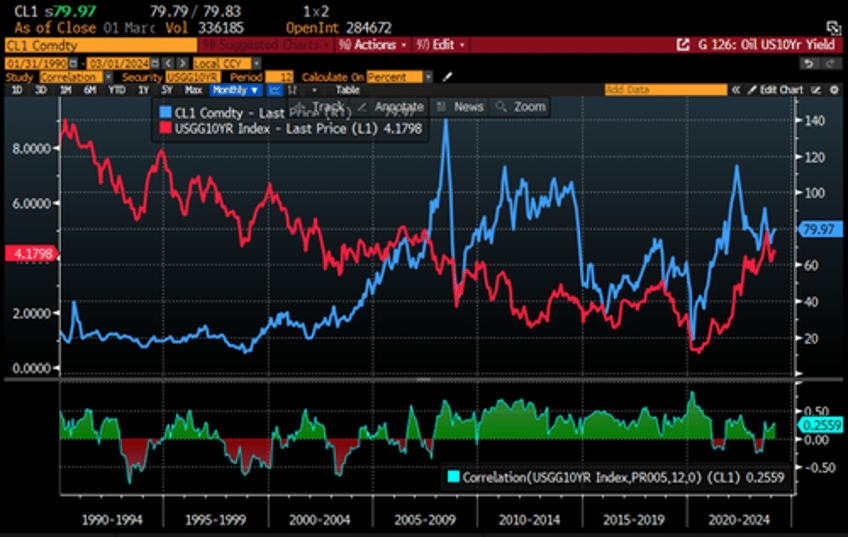

The movement of oil prices in the coming months will also significantly influence the rise of the US 10-year yield and contribute to the return of the Bear Steepener.

WTI oil price (blue line); US 10-Year Yield (red line) & Correlation.

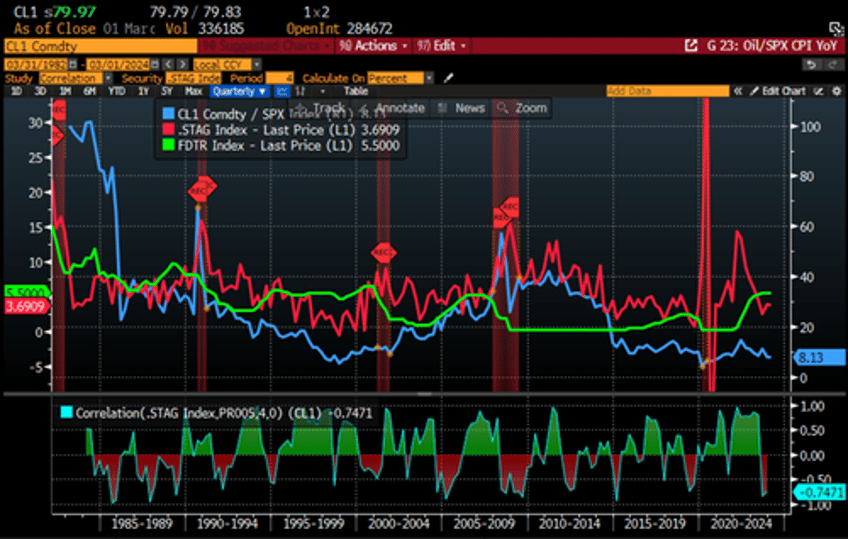

Ultimately, readers will remember that what really matters is the relative performance of the oil price to the S&P 500 index, as the outperformance of the oil price to the S&P 500 index has been one of the best indicators of an incoming recession and rising inflation pressures. This has also been a trigger in the past for the FED to raise rates. With the recent bottoming of the WTI to S&P 500 ratio, investors should be even more convinced that not only will the FED not be able to cut rates in 2024, but the next move is more likely to be a raise than a cut.

Relative performance of WTI oil price to S&P 500 index (blue line); US Stagflation Index (red line); FED Fund Rates (green line) & Correlations.

Read more and discover how to position your portfolio to benefit from the next energy wave on : https://themacrobutler.substack.com/p/aligning-stars-of-the-stellar-ene…

t The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.