By Benjamin Picton, Senior Macro Strategist

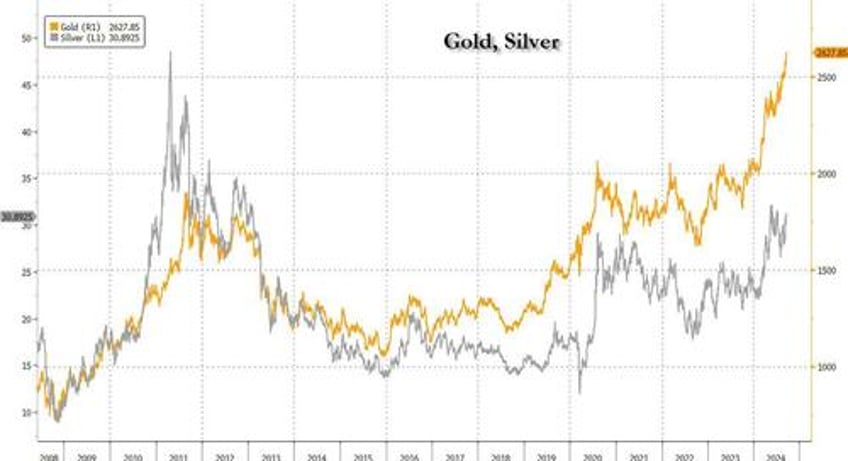

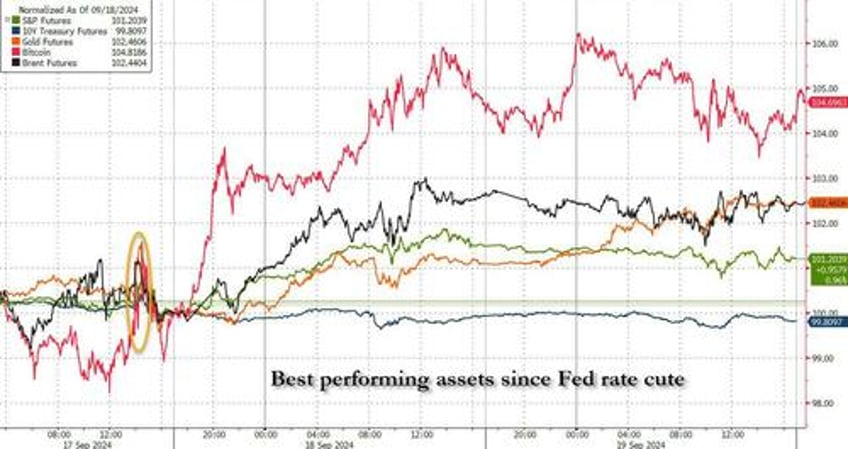

Gold prices traded at fresh all-time highs on Friday, closing well above the $2600/oz barrier. The rally in gold seems unstoppable at this point and resets on the all-time-high are becoming a frequent occurrence. This perhaps comes as no surprise given that the Fed wrong-footed many economists to start the easing cycle with a supersized rate cut even as growth has remained strong, inflation above target and the Federal deficit at eyewatering levels.

The contrast between the yellow metal and the bond market is worth exploring. While gold was resetting records, the 2s10s Treasury curve was busy bear-steepening. Usually we would expect a zero-yield asset that some disparagingly refer to as a “pet rock” to perform poorly when market yields are rising. Equity markets responded to the lift in long-end yields by closing the session flat in the case of the ‘money today’ Dow Jones, and down by 1/3rd of a percentage point in the case of the ‘money tomorrow’ (we hope!) NASDAQ. So why was gold insensitive to higher yields while equities were not?

Some have suggested that Fed dovishness was already ‘in the price’ for bonds, but that doesn’t fully explain the price action. The Dollar spot index was down by just 0.39% last week (the third consecutive weekly fall) as yields rose and spot gold lifted 1.71%. Is this an example of market inefficiency, or is this a least-dirty-shirt effect where the DXY (a relative price) doesn’t fully reflect a devaluation of all currencies being priced into gold as the market considers the potentially infinite supply nature of Treasury bonds?

Perhaps markets simply picked up on Christine Lagarde’s comments in Washington about the parallels between the 2020s and the 1920s? Particularly the bit where she cautioned that adherence to the gold standard in the 1920s induced deflation (true) and contributed to the rise of economic nationalism. Lagarde’s point seems to be that deflation is worse than the alternative of inflation; so perhaps it makes sense to get long pet rock while the world’s second most powerful central banker is openly hinting that she views the erosion of your salary and savings as the lesser of two evils. Bitcoin also had a pretty good week and is up more than 1% in early Monday trade.

Oil prices might offer further clues. Crude had fallen sharply in the fortnight prior to last week as markets started to get jittery about slowing demand in China and the USA and the prospect of a 180,000 bbl/day rebound in supply from OPEC+ later in the year. OPEC+ has now announced that production cuts will be extended and the Fed has delivered a supersized rate cut. Are those actions sufficient to justify last week’s 4% rally in crude prices, or might other commodity markets also be tentatively pricing in a secular inflation theme? The Bloomberg Commodity Index has closed higher in 9 of the last 10 sessions.

This week is a little less action packed in terms of market-sensitive data, but there are still a few points of interest on the calendar. Friday brings the August PCE price index for the USA, where a 0.1% M-o-M headline rate is anticipated, along with a 0.2% core rate. That would translate to a 1-tick lift in the Y-o-Y core rate to 2.7% (courtesy of base effects). Imagine the Fed’s discomfort if that figure comes in materially higher having just delivered a 50bps rate cut. Image the discomfort of traders pricing in 25bps of cuts in addition to the 50bps of additional cuts this year implied by the Fed’s latest dot plot!

Also, this week we will see the Reserve Bank of Australia’s September policy rate decision and the release of its semi-annual Financial Stability Review. The RBA has been talking tough on their willingness to raise rates again to tame inflation, but few expect them to ever make good on those threats. Consequently, the December OIS has an RBA rate cut 66% priced even after a strong(ish) August employment report released last week and repeated protestations from Bank speakers that the Board doesn’t expect that they will be able to cut rates in 2024.

The RBA’s credibility was dealt a severe blow by repeated assurances as late as November 2021 that the cash rate was unlikely to rise until “2024 at the earliest”. By November of 2023 the RBA had raised rates 13 times. So, now that the RBA is saying that they could hike again many analysts (including yours truly) seem to have concluded that the Aussie central bank is a sheep in wolf’s clothing and if they were really going to raise rates again, they would have done it by now.

Of course, the RBA has been under political pressure all year not to raise rates. Political interference in monetary policy re-emerged as a theme following the Fed’s decision to deliver a 50bps cut 48 days out from an election. The antipodean expression of this is found in Aussie Treasurer Jim Chalmers is trying to steer a bill through Parliament to reform the RBA to make it look more like the Bank of England (!), abolish its powers to direct the lending of commercial banks (which would be handy in a crisis) and abolish his own power to override RBA policy rate decisions (also handy in a crisis).

With the main opposition parties opposed to the bill the Treasurer must now rely on the left-wing Greens party to get it passed, but in one of the great ironies the Greens have demanded that the Treasurer retain his power to override the RBA and exercise that power immediately to cut interest rates! Clearly, there is nothing more political than the price of money, and the gold price knows it.