Tens of millions of Americans are having trouble paying their power bills as residential electricity inflation continues to run rampant. The latest data from the US Bureau of Labor Statistics (February's print) shows that three out of every four major cities in the US had power prices rise for residential customers.

"Food has been a worry, but now electricity is the worry," 75yo Alfredo De Avila told Bloomberg, adding, "Unless you want to go to candles and firewood, we have no other choice but to bite the bullet and pay."

For the Oakland, California, resident, already battered by high taxes, food inflation, elevated fuel pump prices, and out-of-control violent crime, the latest price increase from the state's largest electricity utlity, PG&E Corp, of a 13% jump in power bills in January, plus more expected rises this year, could put the retiree under more financial pressure.

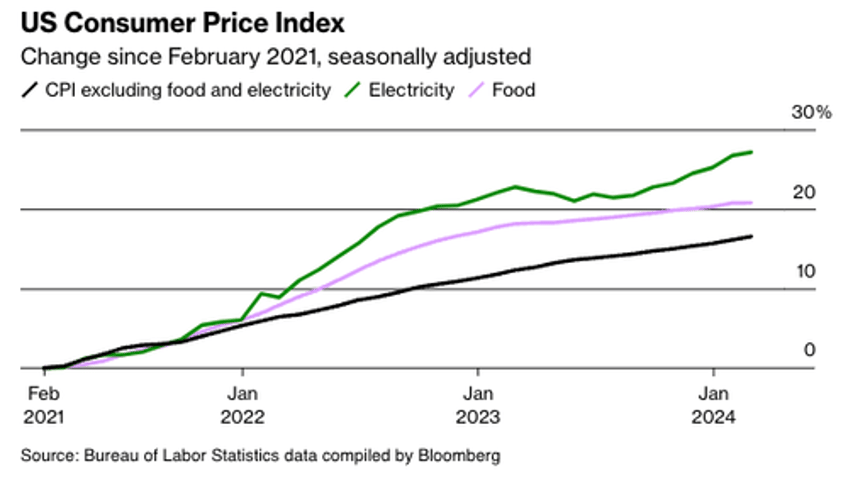

BLS data (from February's print) shows that power prices nationwide have jumped 27% since early 2021.

The National Energy Assistance Directors Association, representing state directors of the Low Income Home Energy Assistance Program, recently reported that the average US household heating bill was $836. This decreased from $978 the previous year and slightly down from $849 in 2020. Nonetheless, the Household Pulse Survey data in March indicated that 19.2% of families could not pay at least one energy bill in the past 12 months, an increase from 16.5% in the same period the year before. And power bill debt in the nation has just hit a record high.

Soaring power costs are happening during a major upgrade of the nation's power grid. Bloomberg said utilities are "undergoing multibillion-dollar overhauls to replace aging fossil fuel plants with greener alternatives and to make existing systems more resilient to wildfires, hurricanes, and flooding."

The CPI for electricity is zooming.

— Jeff Weniger (@JeffWeniger) April 10, 2024

The first time we saw anything like this was in the wake of the 1973 oil embargo, with electricity prices running higher for the rest of the 1970s. Then we saw it when the "Commodities Super Cycle" busted the middle class into 2008. pic.twitter.com/VM9ARYDJqo

In a note last week titled "The Next AI Trade," we outlined how power grids are racing to increase generation capacity to accommodate new demand, fueled by onshoring trends, electrification of transportation of buildings, extreme weather, and artificial intelligence data centers.

"A lot of people's eyes just popped out in the past six months," Rob Gramlich, president of Grid Strategies LLC in Washington, DC, said, adding, "It's been 20 to 25 years of flat power demand, but now we're in a new mode."

Emily Fisher, executive vice president for clean energy at the Edison Electric Institute, a trade group for the utility industry, said these costs can no longer be avoided, noting, "We have to make these investments to have a reliable and affordable system."

Add rampant electricity inflation to the long list of soaring costs, such as the recent surge in gasoline prices at the pump as they inch closer to the politically sensitive level of $4 a gallon, elevated food prices, and the worst housing affordability in a generation. No wonder the vast majority of Americans are fed up with the failure of Bidenomics, as the president's polling numbers have been going down the drain.

America is unaffordable.