Where To Invest During A Lost Decade

Imagine you had an investment crystal ball – you could see the market’s future.

In 1969, you watched Warren Buffett shut down his investment partnership. He complained there were no attractive investments given his large (at the time) amount of capital ($100 million). But, because of your crystal ball, you knew he was completely wrong. You knew that the top 50 stocks in the S&P 500 – the so-called “Nifty Fifty” – were going to soar.

Total returns in these stocks during 1970, 1971, and 1972 were astounding. As a group they were up almost 30% annually. By the peak of the market (in 1972) their valuations had become “Tokyo-like” – McDonald’s (MCD) had a price-to-earnings (P/E) ratio of 86; Polaroid’s P/E was 91; and The Walt Disney Company’s (DIS) was 82. (Tokyo-like refers to the incredible Japanese stock mania of the 1980s, when the average P/E ratio on that market reached 70.)

When my children were younger, they’d do foolish things in the house. Like throw a football in the living room. Our family mantra is kindness always, no exceptions. So, rather than simply scold them, I’d ask them calmly: What happens next, boys? And they’d sheepishly answer, “Something is gonna get broken, and we will have to clean it up.” Sometimes they’d go outside with the ball. Sometimes something would get broken, and they had to clean it up.

When you participate in a market mania, I can tell you what happens next. Something will get broken, and you’ll have to clean it up. If you’d bought the Nifty Fifty in 1969, your portfolio was down almost 95% five years later – despite the incredible returns of the early ‘70s..

Today, we have the exact same scenario. Buffett has taken his chips off the table. If you look at the most recent Berkshire Hathaway quarterly report (3Q 2024) you can see that in his insurance subsidiaries, Buffett has increased his U.S. Treasury bill holdings (cash) by $150 billion in the last year. He now holds more T-bills than equities ($288 billion versus $271 billion). We know from press reports and other securities filings that he’s continued to sell stocks, and that his cash balances are now well over $300 billion.

But, meanwhile, the Nifty Fifty… whoops… I mean the Magnificent 7 (Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla) have continued to hit new highs. According to GAAP (Generally Accepted Accounting Principles), Tesla now trades at a P/E ratio of 197. We are well beyond Tokyo levels. As a group, the Magnificent 7 has been trading at around 50 times earnings.

These extreme valuations and the concentration of so much investment capital into so few stocks will lead to “a lost decade” for investors who hold the Nasdaq 100 or even the S&P 500. Equity valuations will revert to the mean and, even if these businesses do extremely well, their share prices won’t.

These unpleasant facts lead to an important question: What should investors do when facing a lost decade in future equity returns?

I’ve suggested a number of potential strategies in the past, including using a “permanent portfolio” strategy. We’ve recommended holding at least 25% of your portfolio in short-term fixed income (cash). It’s also wise to look for opportunities in distressed corporate bonds, where equity-like returns can be earned without any equity valuation risk. And, of course, there are special situations, like “Trump’s Secret Stocks,” and many others, like the small-cap biotech stocks – recommended by Erez Kalir in Biotech Frontiers – where you can avoid equity valuation risk.

Here's another strategy that I believe will work.

To succeed in a lost decade, look for “lost stocks.”

What are lost stocks? They are businesses that create incredible wealth, not through the expansion of their equity multiple (like Tesla) – but instead by their own internal cash generation plus excellent capital allocation.

These companies are run by excellent investors hiding inside businesses that everyone ignores.

Lost stocks use things like share buybacks and special dividends that don’t register as yield or total return on investment databases (such as Bloomberg). These strategies make their incredible performances harder for analysts to discover.

And these businesses are the absolute masters of capital allocation. They create enormous value by investing their cash flows in the best possible ways, whether that’s buying back their own shares or buying other businesses.

Here are five examples.

These businesses are like Wall Street’s mobile-home parks. They are some of the best businesses in the world, but few investors know where they are or how much cash they produce. They’re always out of sight. For example…

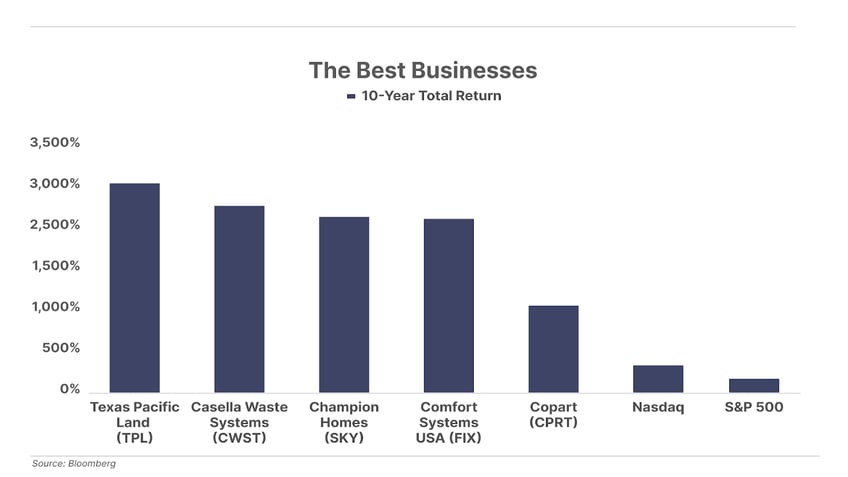

- Texas Pacific Land (TPL) - up 2,900% last 10 years, 66x earnings

- Casella Waste Systems (CWST) - up 2,632% last 10 years, 926x earnings

- Champion Homes (SKY) - up 2,434% last 10 years, 35x earnings

- Comfort Systems USA (FIX) - up 2,406% last 10 years, 33x earnings

- Copart (CPRT) - 1,141% last 10 years, 40x earnings

We’ve written a lot about Texas Pacific Land over many years (I first recommended it to investors in 2012) – so you’ve probably heard of it, but most investors haven’t. It operated, for decades, as a secret investment partnership. Incredibly simple business: huge land bank, producing leasing revenue, mineral royalties, and, lately, revenue from a rapidly growing water business. It was virtually impossible to get any information about the business. And all while, it kept buying back massive amounts of stock. From 1994 through 2013, Texas Pacific reduced its share count by 44%.

Casella Waste Systems is a serial acquirer in the garbage business. Nobody goes to Aspen or Davos and talks up their trash company. And that’s why it’s been able to buy $2 billion worth of high-margin waste-management businesses over the last decade at cheap prices, creating massive value for shareholders.

And… my favorite… Champion Homes, which builds mobile homes. Talk about the opposite of a glamour stock! How has it driven such incredible returns? Simple: it has great gross margins for a homebuilder (24%) and uses its cash profits to make great investments, both in its shares via buybacks, and in other mobile-home manufacturers. Again, nobody at Davos is bragging about the latest developments in trailer homes. Over the last decade, total shares outstanding have declined from 135 million to 57 million.

Why is this company my favorite? There’s nothing better than making money off the poor. Why? Because, like Ayn Rand taught, they have always been with us. People who make terrible life decisions still need a place to live. And that’s a market that’s never going away.

Comfort Systems USA makes it very easy to understand heating, ventilation, and air conditioning (“HVAC”). They buy HVAC businesses – having done over $1 billion in acquisitions over the last decade.

And the last example, Copart, is, like Texas Pacific Land, an incredible story of hiding in plain sight for decades. They own more than 200 junk yards in 11 different countries. Junk yards? Yep, that’s right. And guess what? Gross margins are close to 50%! Copart produces $1.5 billion in cash each year. This capital flows back into its own operations for growth (and more junk yards) and into its own shares ($1.4 billion in buybacks last decade).

As you can tell by their valuations, these “lost” stocks aren’t lost anymore. And just to be clear… I’m not suggesting you buy these stocks. They are, though, the kinds of unglamorous, underappreciated businesses operated by managers who are brilliant allocators of capital that can be astonishingly good investments.

And… when the correction comes… these are exactly the kind of businesses that you should keep in mind. Lost stocks can save you from a lost decade

Good investing,

Porter Stansberry

Stevenson, MD

Get Porter in your inbox… Every Monday, Wednesday, and Friday, Porter Stansberry will deliver his Porter & Co. Daily Journal directly to your inbox. He puts his 25+ years of investment knowledge into every punchy, fresh, and insightful issue… that’s free, with no strings attached. Everything is uncensored, and nothing is off limits. To get the Daily Journal, click here