Following the series of mega-mergers in the oil exploration and production space, a potential US refining cartel—a 'mini OPEC on American soil'—could be taking shape with some of the first coordinated policies to reduce refining capacity this quarter as demand falters and concerns about a global glut of crude mount.

Bloomberg reports that four major refiners, including Marathon Petroleum, owner of the largest US refinery, plan to reduce refining capacity at 13 of its plants to an average of 90%, down 4% from the same quarter in 2023. Similarly, PBF Energy announced plans to refine the least amount of crude in three years. Phillips 66 will operate refineries near two-year lows, and Valero Energy expects to cut oil processing soon.

The four major refiners represent about 40% of the US capacity to refine oil into diesel, jet fuel, gasoline, and other essential crude products critical to the economy. Slowdown fears encompass not just the US economy (recession scare last Monday) but also China, thus reducing crude product demand and shrinking profit margins for refiners.

On Monday morning, commodity firm Argus' Bachar EL-Halabi wrote on X, "Opec blinks first, downgrading for the first time since July 2023 its global oil demand growth forecasts for 2024 and 2025."

Halabi continued:

Opec now sees demand growth projection for 2024 to be 2.11mn b/d down from 2.25mn b/d.

Opec has also cut its oil demand growth forecast for next year by 60,000 b/d to 1.78mn b/d.

Opec's latest oil demand growth projections narrow the gap with other forecasters such as the IEA and EIA, but Opec's figures are still comparatively bullish.

Reminder: The IEA projects oil demand to increase by 970,000 b/d this year, while the EIA sees demand rising by 1.1mn b/d.

#Opec blinks first, downgrading for the first time since July 2023 its global oil demand growth forecasts for 2024 and 2025.

— Bachar EL-Halabi | بشار الحلبي (@Bacharelhalabi) August 12, 2024

🛢️ Opec now sees demand growth projection for 2024 to be 2.11mn b/d down from 2.25mn b/d.

🛢️ Opec has also cut its oil demand growth forecast for next… https://t.co/BPPe0C95id pic.twitter.com/dUxAJDoMvk

Vikas Dwivedi, Macquarie's global oil and gas strategist, told Bloomberg recently in an interview in Houston, "Compressed refining margins are setting up the stage for another round of heavy refinery maintenance in the US during the fall season ... and that's going to weigh on balances and may add to crude builds in the US for the rest of the year."

He said the potential for supplies to exceed demand has reduced the premium geopolitical risks festering in the Middle East, explaining, "The market is no longer willing to pay a huge premium for that because the tensions haven't so far resulted in a loss of barrels."

Dwivedi expects Brent crude oil to average around $75/bbl in the fourth quarter and slide as low as $64/bbl in the second quarter of next year.

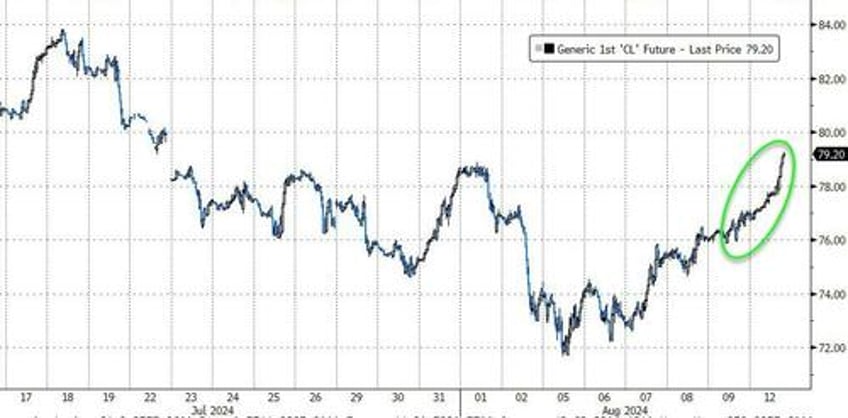

In the meantime, Crude is soaring today amid geopolitical tensions...

Chief Commercial Officer Rick Hessling said Marathon "will run economically at 90%" capacity in the third quarter, a multi-year low. He pointed out that the Chinese economic recovery remains a significant concern, and OPEC could stir volatility with policy in the short term.

The bigger story here is the possible rise of the US refining cartel after a series of mega-mergers in recent quarters.