Analysis: How Crazy is $3,000 Gold From Here?

Turns Out, Not Crazy at all

Gold has broken above $2,500 for the first time ever as US Presidential elections grow closer and The Federal Reserve is expected to start rate cuts. This week’s MSA Weekly Report discusses the most recent rally in gold and its continued upside potential. GoldFix breaks that report down for readers while adding our own observations

The Unclenched Fist and a $3,000 Target

MSA had identified a critical breakout in the 36-month average momentum and the 100-week momentum charts, which occurred in late March. Friday’s price action confirmed the momentum indicator was correct. This breakout also significantly marks the conclusion of a three-year-wide pause in gold's upward movement, initiating a new phase characterized by accelerated price action.

Five years of channel trading broken...

The multi-year parallel uptrend channel, which faced resistance around the $2450 level, has now been decisively breached. The fist keeping Gold in place as Michael referred to it, seems to have loosened its grip.

Not How Gold Bull Markets End

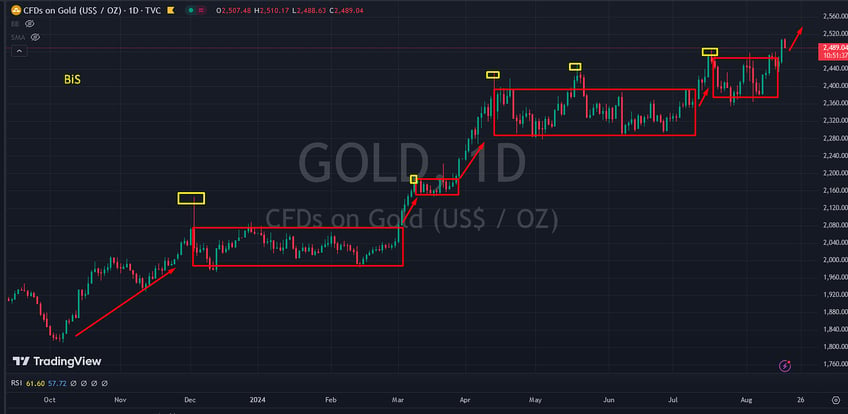

The price behavior since April of this year was a repeat of behavior we noted going back to December 4th 2023. Last week’s rally a repeat of action identified going back in December of 2023 when mystery Comex sellers (yellow rectangle below) were first seen keeping a lid on Gold while mystery buyers of the BRICS variety, relentlessly accumulated physical bullion (red rectangles) until the next price spike. The cycle then repeated itself another five or six times

Capped and Bought while banks try to get shorts back...

Michael notes this most recent range breakout occurs at the top of a cluster of levels going back years. More on that concept in SPECIAL: The Gold "Cap And Trade" Model

Beyond $3,000?

Utilizing traditional price chart analysis, Michael projects the next significant resistance level for gold to be above $3000. But adds significantly:

Bull trends in gold over the past fifty years have more often been at least eight-fold moves. This one began from a low at $1050. You do the math.

History Says We Ain't Seen Nothing Yet...

Chart GoldFix. Data Source MSA

While such projections are inherently speculative, this eight-fold target is supported by Gold’s previous Bull cycles

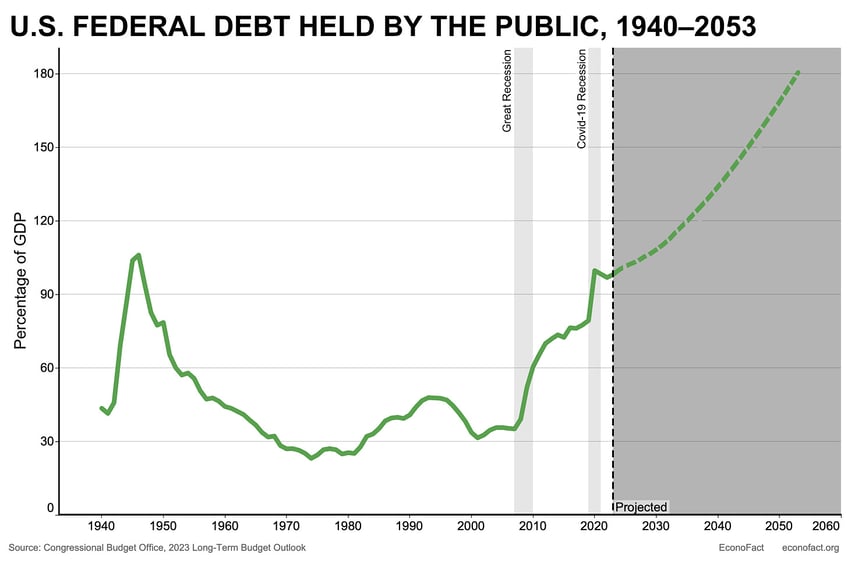

Global Debt Makes it Worse

The analysis further argues the current monetary environment, coupled with the dynamics in other asset classes, is more volatile and disruptive than at any time in the past five decades.

Recognize that the external monetary and other asset class factors that are in play and about to become more so, are far more dynamic and upending than at any prior time in the past fifty years.- Source: Michael Oliver for MSA

More specifically, Central banks,facing unprecedented economic challenges, are likely to engage in extensive monetary easing, which will further support gold's ascent. MSA and GoldFix anticipate that gold, along with silver, will outperform previous bull markets, driven by the intensifying global financial instability.

The real question is: what does 8 times $1050 equal?

Continues here

Free Posts To Your Mailbox