Another Oversold Company Pops

In a post last week, we mentioned out RSI (Relative Strength Index) kept us out of a losing trade (a bearish bet against Stitch Fix SFIX 0.00%↑), and helped us time an entry into another bet (on an oversold materials stock). Yesterday offered another example of RSI in action.

A technical indicator to keep in mind for earnings trades. https://t.co/g6zISKkVmc$BIG $SFIX

— Portfolio Armor (@PortfolioArmor) September 25, 2023

Heading into earnings on Thursday, Nike (NKE 0.00%↑) had an RSI of less than 20, indicating it was oversold.

News for the company recently hadn’t been great; as retail maven Jeff Macke noted, the company’s shoes selling for discount prices at Costco wasn’t a good look.

Spotted at $COST : $NKE shoes. The Zoom Winflow 8 Shield running shoe. $59.99 at CostCo, $77.97 from the Nike app and $86-$89 from the $AMZN FleaMarket.

— Jeff Macke (@JeffMacke) September 25, 2023

Entry-level shoe, limited quantities. But this isn't a good look for a brand as anal as Nike. Good for Cost

cc @hmeisler pic.twitter.com/EvKfV4SYek

As it happened, the company reported mixed earnings on Thursday, beating on earnings, but missing on revenue. But since the stock was so oversold, that mixed report was enough to spike the stock nearly 8% after hours. That leads us to today’s trade, which is another oversold company, albeit one that’s a bit more upscale than Nike.

One Of A Top Trader’s Three Macro Trends

One of the top traders I follow on X (the site formerly known as Twitter) believes there are three obvious trends to watch, one of which is the persistent demand for luxury goods across the upper 3 quintiles of earners (his other two top trends are AI and the growth of GLP-1 agonist drugs like Ozempic). The company we’re betting on today is positioned to benefit from that trend. It’s down about 30% since this summer after a slight earnings miss and concerns about a recent acquisition. But it also has solid fundamentals. To put it them in perspective, let’s compare it to Nike.

Stronger Fundamentals Than Nike

Recall that the Piotroski F-Score is measure of financial strength on a scale from 0-9, with 9 being best. Nike had an F-Score of 6 heading into earnings; the stock we’re betting on today has an F-Score of 8.

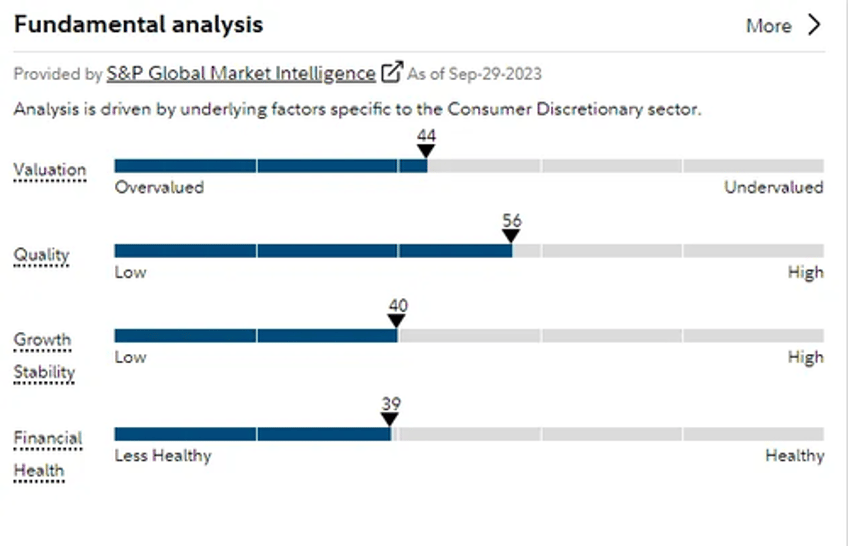

Here’s what Nike’s fundamentals looked like on S&P’s histogram ahead of earnings:

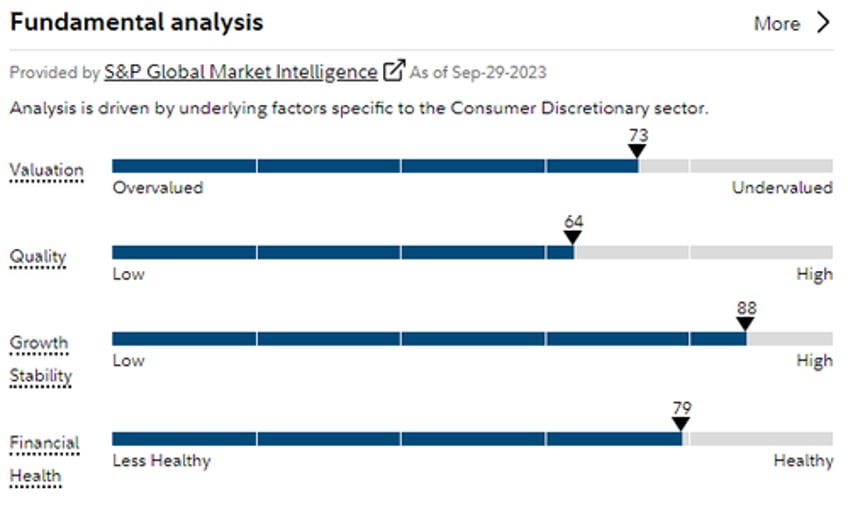

Here’s what our luxury company’s fundamentals look like now:

Our bet here is that if oversold companies with weaker fundamentals have bounced on mixed earnings recently, than an oversold company with stronger fundamentals is likely to get a similar bounce on slightly-better-than-expected earnings. And with that kind of bounce (5% to 10%), the options trade we have teed up for it today can generate a return of more than 150%.

If you'd like a heads up when we place that trade, feel free to subscribe to our trading Substack/occasional email list below.

If You Want To Stay In Touch

You can follow Portfolio Armor on Twitter here, or become a free subscriber to our Substack using the link below (we're using that for our occasional emails now). You can also contact us via our website. If you want to hedge or see our current top ten names, consider using our website (our iPhone app is currently closed to new users).