What’s behind the numbers?

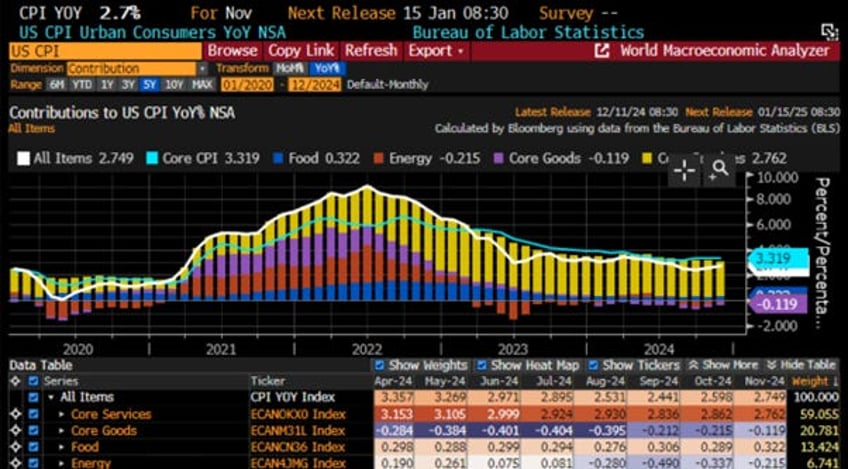

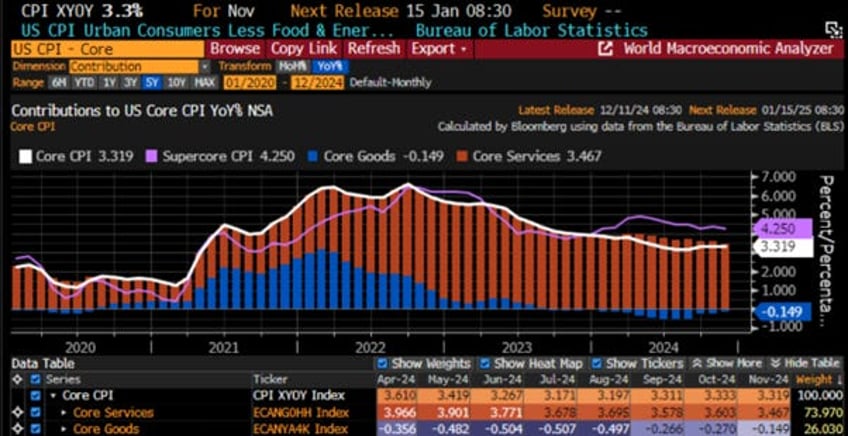

After an inline headline CPI to start the last quarter of the year, November's CPI rose by 0.3% MoM, meeting expectations and up from October's 0.2% MoM increase. With the disinflationary base effect fading further, the YoY increase reached 2.7%, aligning with expectations but higher than October's 2.6%. Energy and core goods remained deflationary YoY in November, while core services, which account for 58% of the headline CPI, grew by 2.76% YoY, up from October’s 2.6%. Food inflation reaccelerated to 0.32% YoY.

The core CPI rose by 0.3% MoM, meeting expectations and matching October's pace. On a YoY basis, with the disinflationary base effect having ended a few months earlier, it increased by 3.3%, aligning with expectations and matching October’s rate. Core services continued to rise at 3.56% YoY, contradicting claims that inflation has been defeated. Core goods deflation was less pronounced than in October, at -0.15%. Notably, this marks the 54th consecutive month of MoM core CPI increases.

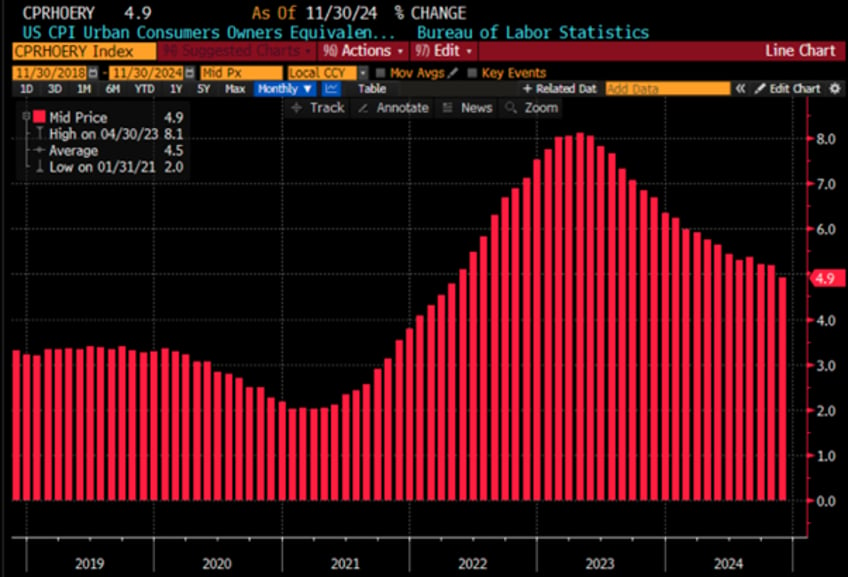

As a sign likely to be celebrated by those who believe inflation has been defeated, the Owners' Equivalent Rent (OER), a key indicator of inflation stickiness, grew by 4.9% YoY, down from the +5.2% YoY increase in October. However, it remains well above the level that any central banker genuinely committed to fighting inflation would consider indicative of easing inflation across the US economy.

Finally, another data point highlighting that while inflation is easing, it remains well above a level a truly committed Federal Reserve chair focused on fighting inflation for the good of the American people would deem satisfactory. The SuperCore YoY change eased from 4.6% in October to 4.3% in November, the lowest level since December 2023, yet still far from signalling that the fight against inflation can be considered mission accomplished.

Thoughts.

The November CPI, the second inflation data release since the US presidential election, shows further signs that, even before tariffs are implemented, the US is taking another step toward reflation.

Indeed, the November data continue to show that core and super-core CPI remain significantly stickier than what a central banker genuinely committed to fighting inflation would find acceptable. This indicates that with higher import tariffs and stricter immigration policies expected to take effect in the new year, investors should prepare for the road of reflation to steepen sooner rather than later. Higher tariffs on imported goods will inevitably push up goods inflation in the coming months, while tighter immigration policies will exacerbate services inflation, which remains above 3% year-over-year and is likely to persist at elevated levels for an extended period.

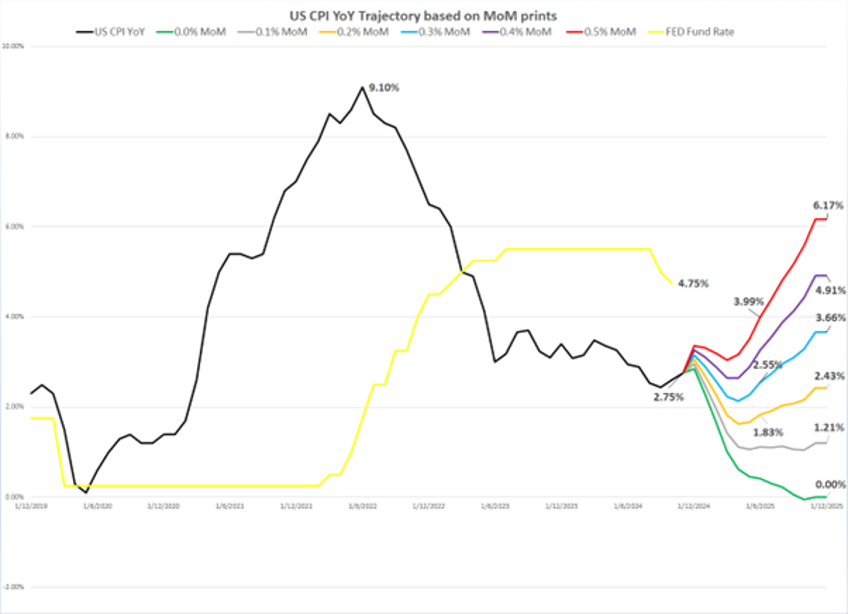

Instead of perpetuating the political illusion that the 2% inflation target is within reach in the near term and declaring "mission accomplished," investors, likely savvier than the thousands of PhDs at the FED and Wall Street firms, understand that hitting 2% by mid-2025 is mathematically impossible. Achieving such a target would require a miraculous disinflation in the first six months under the 47th U.S. president, who considers ‘tariffs’ the most beautiful word in the English dictionary. Anyone familiar with the base effect can draw the following conclusions:

Returning to 2% inflation by mid-2025 is mathematically unfeasible. CPI would need to print less than 0.3% month-over-month for the first six months of 2025.

For year-over-year CPI to return to 2% or lower by the end of 2025, monthly inflation would need to consistently remain below 0.2% over the next 13 months.

If month-over-month inflation reaches 0.2% or higher in the next 13 months, the year-over-year CPI change will likely range between 3.6% and 6.2%. This scenario could force the Fed to admit it erred by easing policy amid an inflationary boom in the U.S. economy.

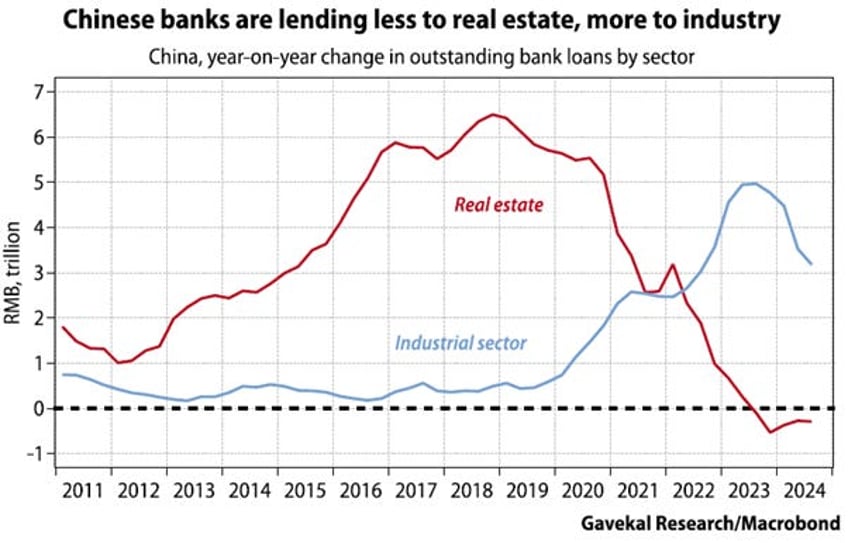

In 2018, Trump banned high-end semiconductor sales to China, jolting its leadership to address dependency on imports. This prompted China to fast-track semiconductor development and pursue self-sufficiency in key industrial inputs, fearing future US bans. Chinese banks were also directed to shift lending from real estate to industry.

The US's 2018 semiconductor ban spurred China's rapid rise as a leader in autos, solar panels, and industrial robots, prompting Western nations to adopt protectionism and abandon free trade ideals. While emerging markets benefit from China's deflationary impact, the West, not only doesn’t but also faces structural service inflation despite an influx of illegal immigration that should have lowered unskilled labour costs, compounded by missing out on China's high-tech deflationary benefits.

US Core CPI YoY Change (blue line); US Core Services CPI YoY Change (red line); US Core Goods CPI YoY Change (green line).

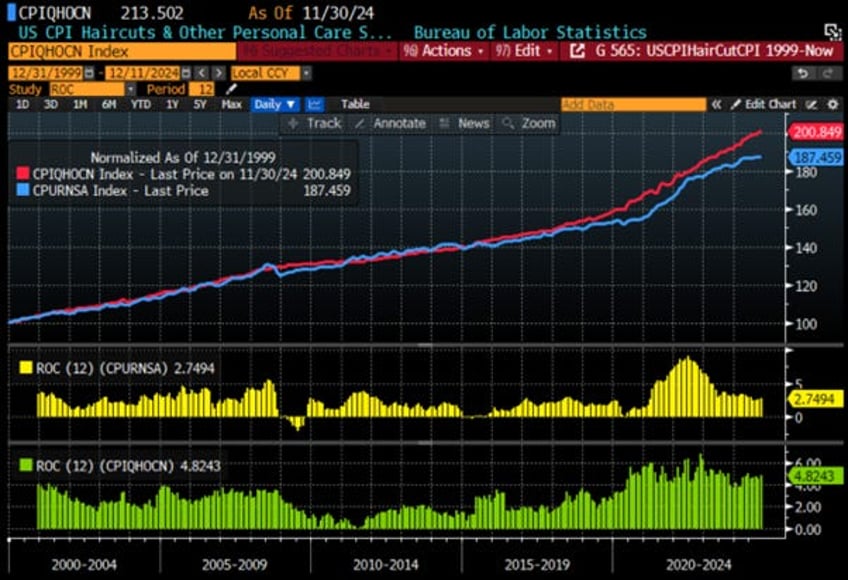

What else better than looking at the evolution of ‘haircut inflation’ to understand how sticky service inflation has been in the US. Indeed, a closer look at US CPI data reveals three distinct trends in haircut inflation over the past 25 years have mirrored the evolution of the US headline CPI:

2000–2008: Haircut inflation hovered between 2–3%, mirroring headline CPI, with occasional energy-driven spikes but generally anchored near the Fed's 2% target.

2008–2019: Post-financial crisis, both haircut and headline CPI inflation dipped to 1–2%, reflecting subdued economic growth.

2019–Present: Rising protectionism, fiscal laxity, and tariffs pushed haircut inflation to 4–6%, despite increased immigration and vacant retail spaces that should have tempered service costs.

This sustained rise in haircut inflation highlights structural shifts in service pricing which will add to re-inflationary pressures which will develop once tariffs are widely implemented under the 47th US president.

US Headline CPI (blue line); US Haircut CPI (red line) rebased at 100 on December 31st 1999; US Headline CPI 12 months rate of change (yellow histogram); US Haircut CPI 12 months rate of change (green histogram).

Savvy investors understand that, rather than relying on the CPI, manipulated by politicians to spread propaganda, to assess an inflationary environment, they should consider whether government bonds can effectively hedge their wealth against debasement relative to the only asset with no counterparty risk: gold. Indeed, everyone knows that gold serves as the ultimate hedge against reckless government policies that create inflation and currency debasement to default on obligations. With the gold-to-U.S. Treasury ratio above its 7-year moving average since July 2019, regardless of political or economic rhetoric, the US remains in an inflationary environment.

Gold to US Treasury ratio (blue line); 84-month Moving Average of Gold to US Treasury ratio (red line).

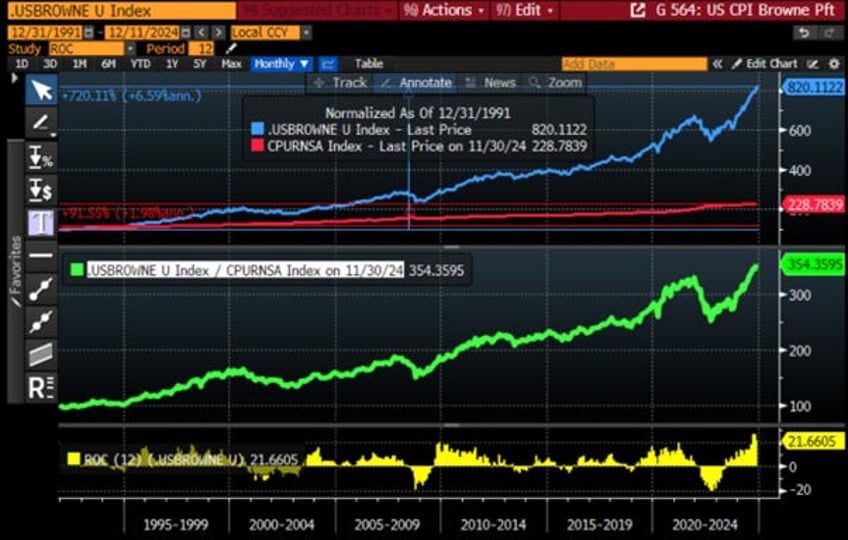

Passive investors should have recognized by now that the best way to achieve positive CPI-adjusted returns over the long term is through the Permanent Browne Portfolio, consisting of 25% cash, 25% bonds, 25% equities, and 25% gold. An initial $100 invested in this portfolio at the end of December 1991 would have grown to $815 in nominal USD and $346.20 in real USD (adjusted for CPI), representing an annualized nominal return of 6.6% over 32 years. During the same period, the US CPI rose at an annualized rate of 1.99%, meaning the Browne Portfolio delivered a 4.5% real return (above CPI), despite periodic drawdowns.

US Browne Portfolio (blue line); US Headline CPI Index (red line) (rebased at 100 as of 31st December 1991); Relative performance of the US Browne Portfolio to US Headline CPI Index (green line) (rebased at 100 as of 31st December 1991); 12 months Rate of Change of the US Browne Portfolio adjusted to US CPI (yellow histogram).

People with a modicum of curiosity may have noticed that the CPI-adjusted 12-month return of the Browne Portfolio was particularly low during three periods: November 2000 to May 2003, July 2008 to July 2009, and April 2022 to May 2023. An analysis of the business cycle during these times reveals that the US economy was experiencing either a deflationary bust or an inflationary bust, which explains the portfolio's poor annualized returns on an inflation-adjusted basis.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Middle Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Lower Panel: 12 months rate of change of the US Browne Portfolio adjusted to US CPI (yellow histogram)

With the S&P 500-to-gold ratio struggling above its 7-year moving average, investors should remain aware that, while the US economy is currently in an inflationary boom, it may be only 6 to 9 months away from shifting into an inflationary bust (i.e., stagflation). STAGFLATION will be painful for investors who haven't prepared their portfolios for this scenario. In this environment, people will buy even less for even more, and it will be challenging for those still blindly following Wall Street's ‘Forward Confusion’ narrative of seeking refuge in long dated fixed income papers and government bonds. Physical GOLD remains the only antifragile asset to thrive during an inflationary bust.

Bottom line: Any savvy investor should have understood that hose advising president elect Trump are idiots. They do not understand how the global economy functions. The US cannot experience a boom domestically while the rest of the world is contracting under the weight of tariffs. The world economy and peace depend on ‘mercantilist free trade’. Just as wars and civil unrests drive inflation like during the 1930s and 1970s, actively trading equities and holding a significant portion of a portfolio in hard assets like physical gold, rather than in long-dated bonds, will be the best strategy to preserve wealth amid structural inflation caused by war-driven shortages and other imperialistic economic rhetoric.

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/another-step-on-the-path-to-refla…

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.