Unless you lived under a rock over the past month, you must already know that June 2024 will most likely be remembered in political history books as the month when European investors cast their votes for the usually uneventful European Parliament elections, which turned out to be consequential for European politics. Indeed, in France, this vote triggered Macron to call a snap election, as his wounded ego of the "golden boy" president has likely started to spread chaos.

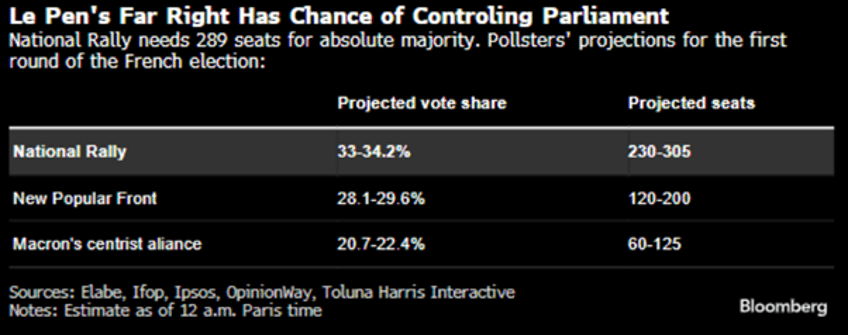

As the results of the first round French elections show, and as was widely expected, Ms. Le Pen's Rassemblement National (RN) was the main winner. The RN (and its dissenting LR allies) secured 33% of the votes and placed first in 298 out of 577 districts. The Nouveau Front Populaire (NFP) – comprising La France Insoumise (LFI) led by Mélenchon, the French Communist Party (PCF), Les Écologistes/EELV, and the Socialist Party of France (Parti Socialiste, PS) – won 28% of the votes. President Macron's centrist coalition, Ensemble (ENS) – Renaissance (RE), the Democratic Movement (MoDem), Horizons, En Commun, and the Progressive Federation – obtained 21%, and the center-right Republicans 10%.

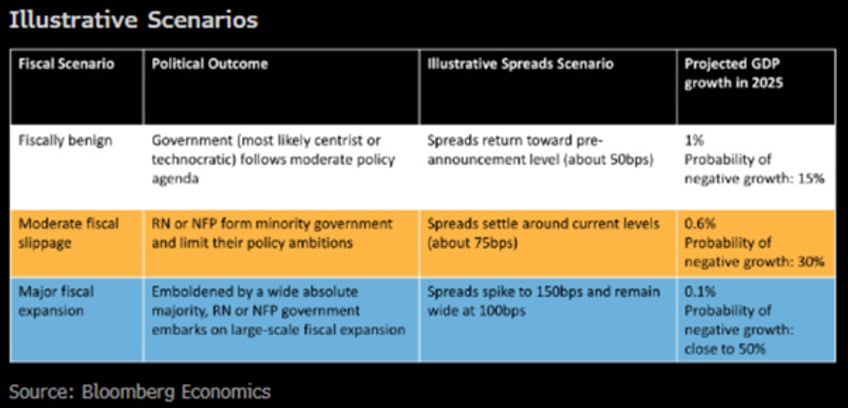

Ahead of the second round, the prospect of an outright majority (289 seats out of 577) for RN remains uncertain, as it also depends on whether any candidate from the left or the president’s coalition will drop out in three-way races and how an alliance between NFP and ENS will end up benefiting the opposition to RN.

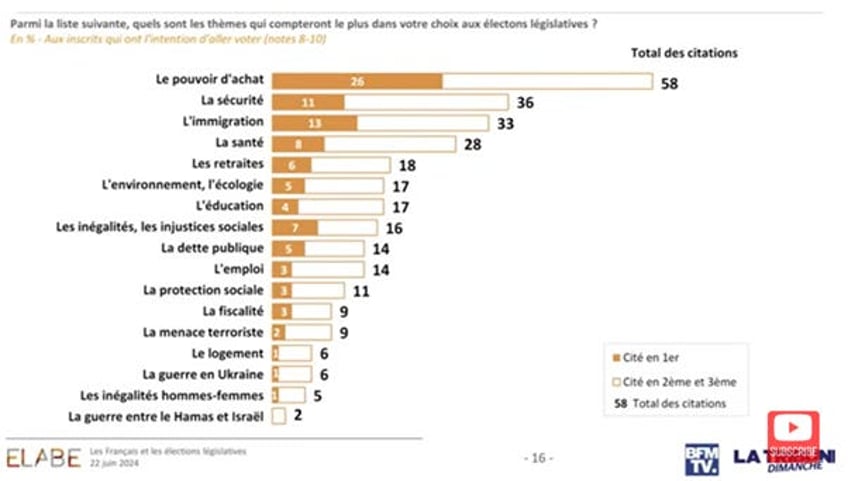

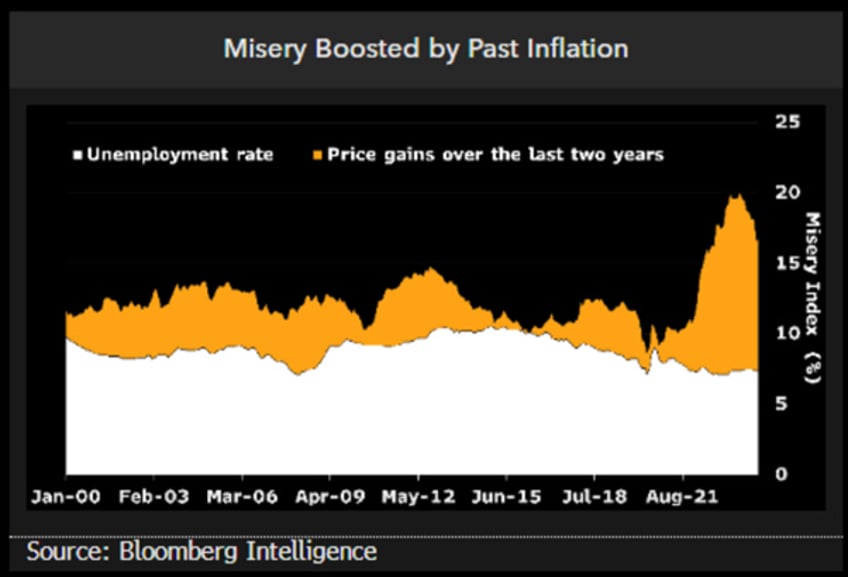

As the year of political hell unfolds, investors must understand that elections have consequences, with some elections having more significant impacts than others. Like everywhere in the world, the French banked their votes with their wallets in mind. Ahead of the first round of the election, the top three voter concerns were the economy, security, and immigration.

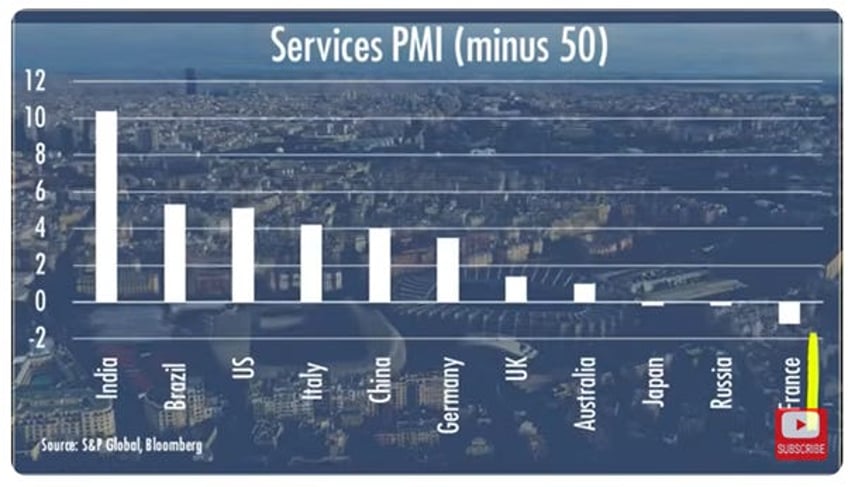

The French economy has barely grown over the past five years. This year, the IMF forecasts France to grow by a mere 0.7%. As a result, per capita GDP in real terms is barely above the pre-COVID level. In layman’s terms, this means no improvement in the standard of living. To illustrate the stagnation of the French economy, despite the expected tourism boom linked to the upcoming Summer Olympics in Paris, the service sector in France is performing worse than in Russia.

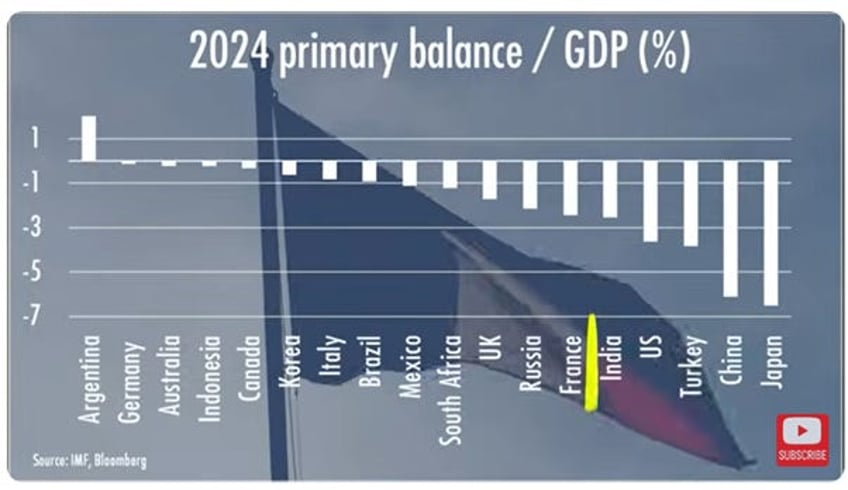

The French fiscal situation is in a bad shape with French Primary deficit (before interest payments) to GDP at 2.4%, again worse than supposed weakened by the war Russia.

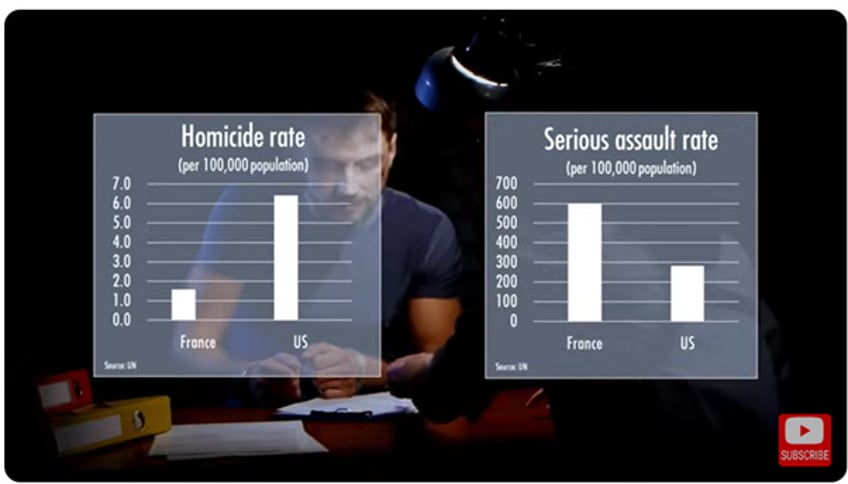

It is undeniable that the French are right to hold Macron responsible for the poor state of the economy. On top of that, looking at security, the second preoccupation of French voters, the serious assault rate is the highest among major European countries. Moreover, violent assaults have increased by 60% over the past 10 years. While the US still has a higher murder rate than France, there are many more violent assaults in France than in the US.

Immigration which has been stimulated by Macron’s globalist agenda has been cited as one of the reasons for the rising crime rate. While 10% of the total French population is Muslim, yet an estimated 70% of the French prison population is Muslim.

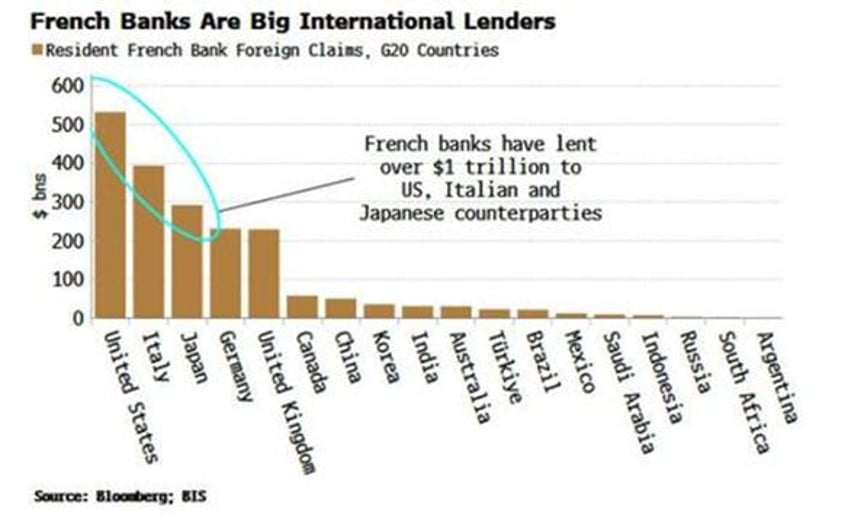

While many investors may think that what is happening in France is irrelevant for their portfolios, turmoil in France has the potential to spread globally through its banks, a key vector of financial contagion during crises. French banks are the fourth largest international lenders, with $2.4 trillion in foreign loans. The biggest borrowers from French banks are the US, Italy, and Japan, while UK, US, and Japanese banks have lent the most to France.

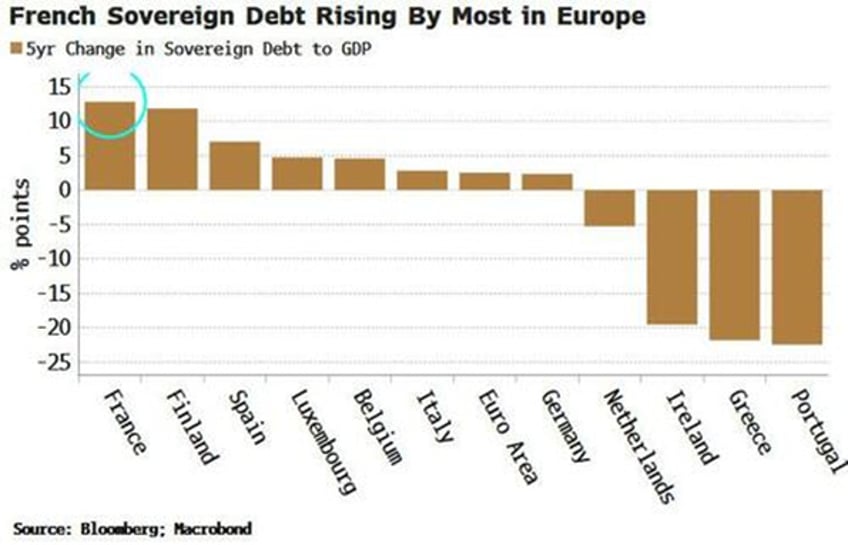

With France's political instability now in the spotlight, there is a risk of reappraisal of its assets relative to its deteriorating fundamentals. The risks are arguably greater for France than for the UK, given that 48% of French local and central government debt is owned by non-residents compared to 31% of UK gilts. France's public finances have worsened, with its debt-to-GDP ratio now at 111%, or approximately EUR3 trillion. While peripheral countries like Portugal and Greece have seen their debt ratios fall over the past five years, France's debt has risen more than that of any other major eurozone economy.

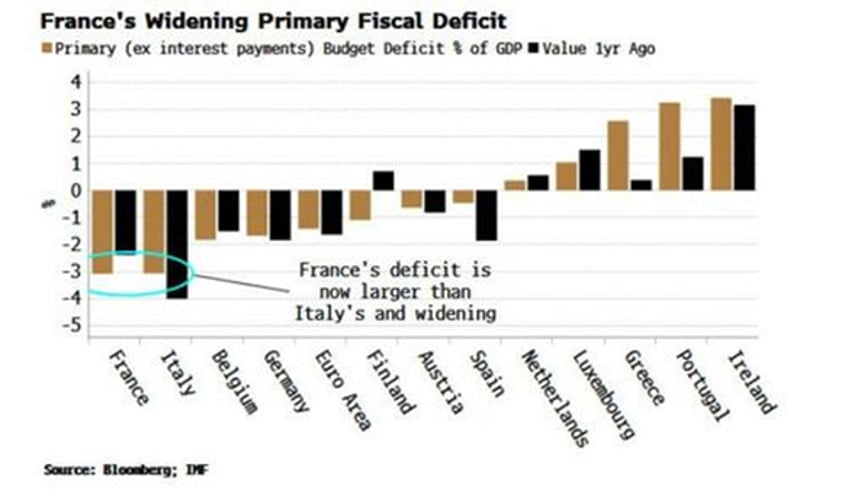

Debt is a stock problem, but it's less concerning if the flow is positive. In France, it isn't. The budget deficit stands at 5.5% of GDP, only worse than Italy's among major eurozone countries. However, Italy's deficit is burdened by legacy debt from the 1990s, and its primary budget balance (excluding interest payments) has been significantly better, indicating a more sustainable debt repayment path. In contrast, France's primary deficit is now worse than Italy's and rising. This highlights a structural issue affecting France's ability to repay its debt, while peripheral countries like Greece, Portugal, and Ireland are running significant primary budget surpluses.

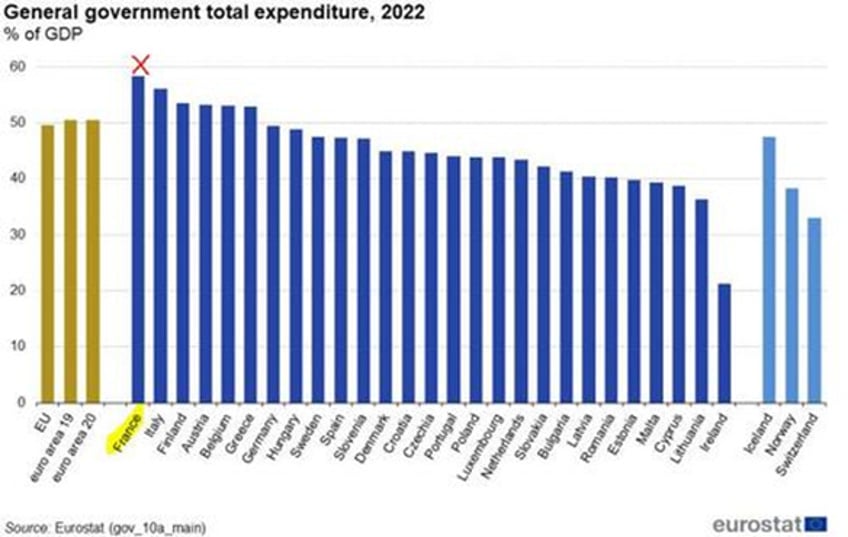

There is little sign of any structural change ahead. France continues to be one of the most dirigiste countries in the world, and the largest in Europe, with government expenditures totaling 58% of GDP. France’s state is so large that the public sector employs 5.3 million people (21.1% of the active population), a ratio of civil servants to inhabitants of 70.9/1,000, according to Eurostat.

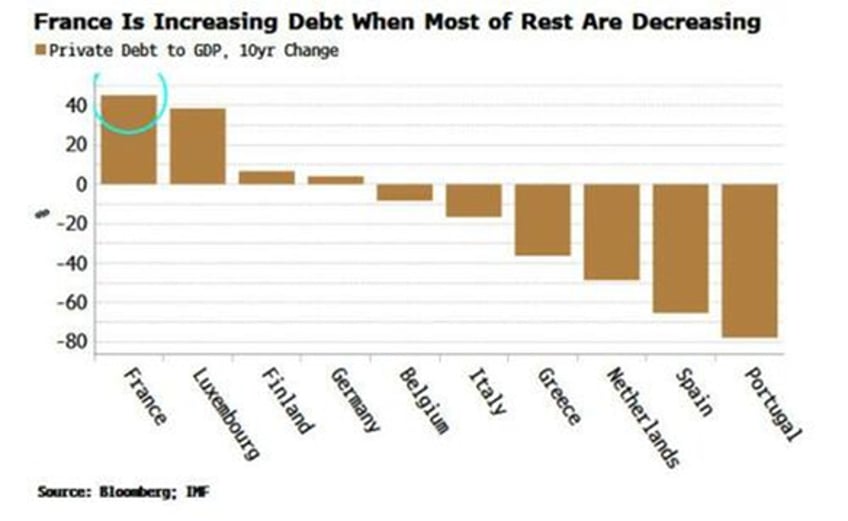

It’s not just public debt that’s rising in France; private debt is also on the rise. Among the main euro-zone countries, only Luxembourg and the Netherlands have higher private debt relative to GDP. Luxembourg's debt is primarily due to its status as an international finance centre, while in the Netherlands, it's largely driven by mortgage debt. Although the Dutch private debt-to-GDP ratio is declining, France's has increased more than any other country's over the last decade. At 228%, it ranks sixth highest among major emerging market and developed countries worldwide.

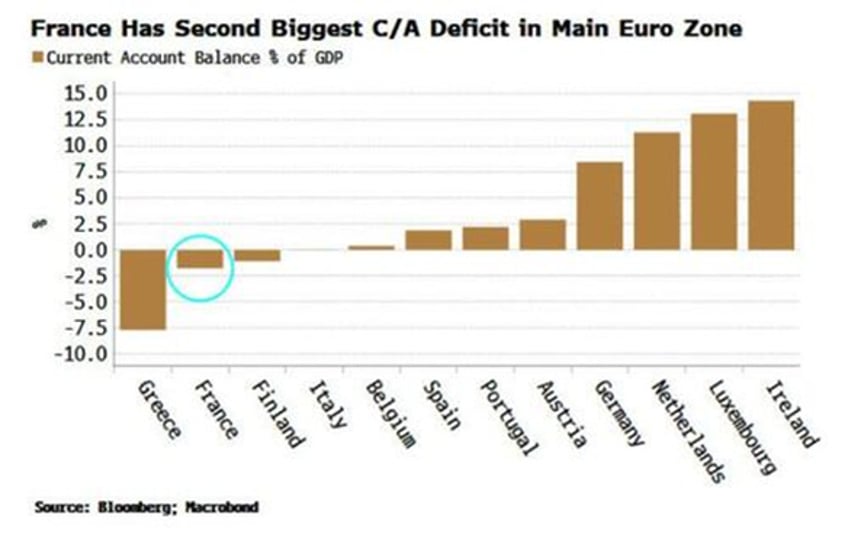

Furthermore, France’s debt service ratio, which measures the ratio of servicing private, non-financial debt repayments to disposable income, is approaching the critical 20% threshold observed in other countries before financial crises. To sustain the rapid increase in both public and private debt, France requires domestic capital. However, its current account deficit is among the highest of the major euro-zone countries, surpassed only by Greece. Similar to the periphery countries during the euro-zone crisis, which faced significant current-account deficits, there is no quick solution for France. It cannot devalue the euro to enhance export competitiveness or boost domestic savings, leaving asset adjustment as the primary mechanism for rebalancing.

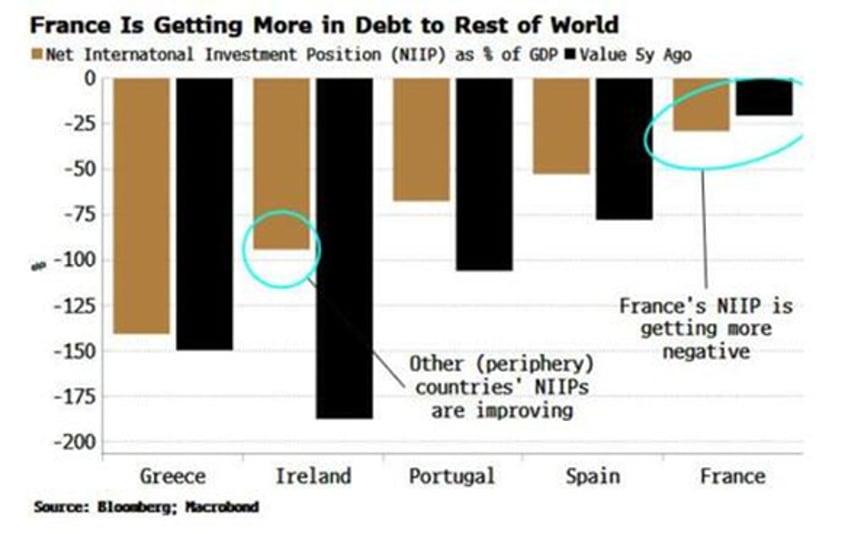

Once again, things are heading in the wrong direction for France. The sum of its public deficits equals its public debt, while its current account deficit mirrors its negative net international investment position (NIIP). France's NIIP, already negative, ranks among the lowest compared to other euro-zone countries. Unlike peripheral countries improving their NIIPs, France's continues to deteriorate.

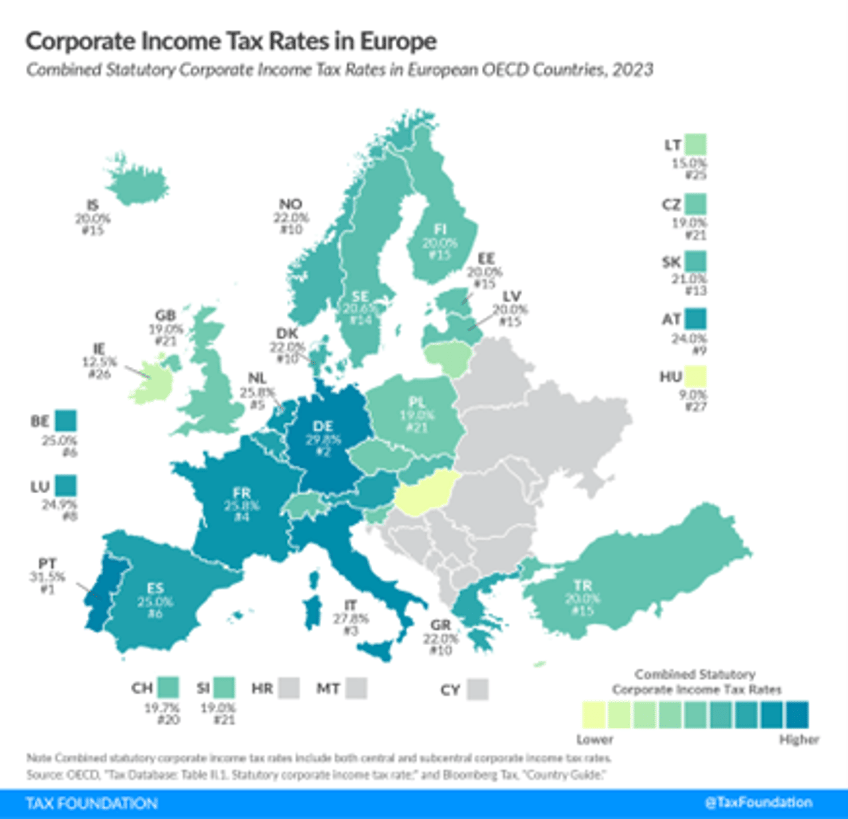

France has one of the highest tax systems in the OECD. Income tax and employer social security contributions account for 82% of the total tax wedge. Corporate tax rates are also high at 26.5%, and companies with profits over EUR500,000 pay 27.5%. Labor market regulations are so restrictive that the number of companies with 49 employees is 2.4 times higher than those with 50, due to significant burdens at the fifty-employee threshold. A 50-employee company must create three worker councils, introduce profit sharing, and submit restructuring plans to these councils if they fire workers for economic reasons.

These characteristics highlight a society with a large state, high progressive taxes, and an extensive social network. In essence, France exemplifies how communist Keynesian policies can lead to stagnation and ultimately stagflation, making everyone poorer as they have to spend more to get less to finance a plutocratic government.

Investors will have to wait until the night of July 7th to learn who will lead France's new government. The two main political groups, Rassemblement National (RN) and Nouveau Front Populaire (NFP) are on opposite sides of the spectrum. RN, mislabelled as far-right by mainstream media, may implement more progressive economic policies that clash with the EU's globalist agenda. NFP, a socialist-communist party venerating Simon Bolivar and Pol Pot, will push for increased social benefits, rising taxes as France would easily become the ‘Peronist Argentina’ under such an additional round of Keynesian regulations. Ultimately, similar to the US, both parties are looking to increase government deficits, which could endanger French banks and all holders of French government debt.

French history and literature abound with memorable statements that have endured through time. Louis XV, sensing the signs of the approaching Revolution, is famously remembered for saying ‘Après moi, le déluge’ ('After me, the flood'). In 2024, this statement could easily be rephrased as ‘Après Macron, le déluge’, (‘After Macron, the flood’) as whoever secures the majority of seats in the National Assembly on June 7th, the repercussions for financial markets and the French economy are likely to resemble a flood.

https://en.wikipedia.org/wiki/Apr%C3%A8s_moi,_le_d%C3%A9luge

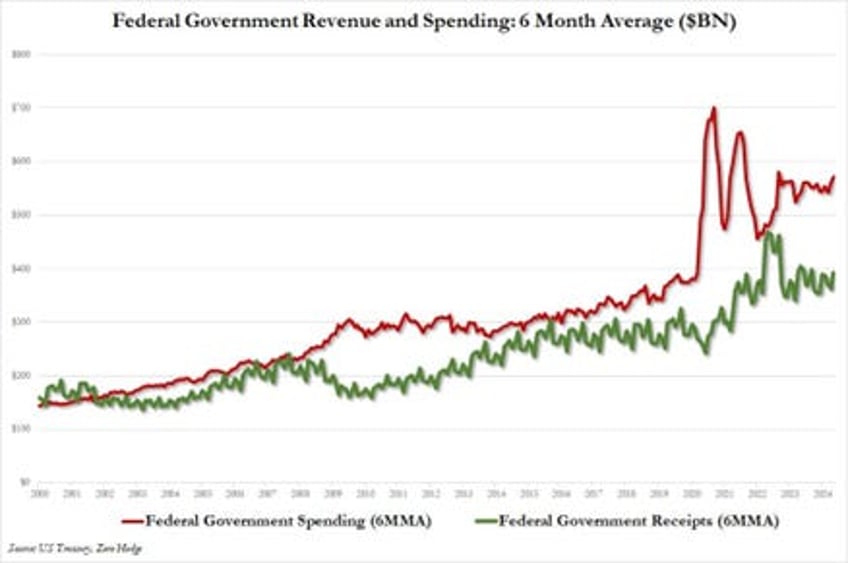

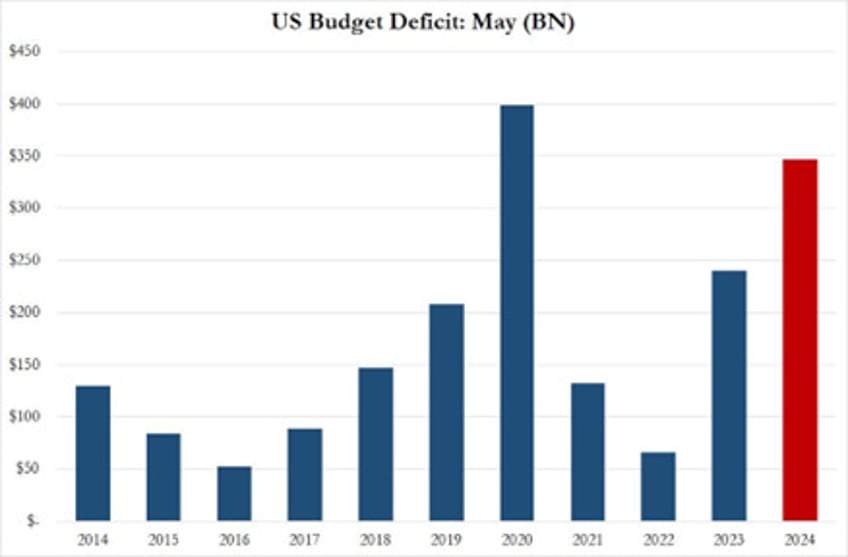

Back in the US, while investors were focused on ‘Jensanity’ at the end of last month, the US Treasury reported that in May, the US government collected $323.6 billion in tax receipts but spent more than double that amount, totalling around $670 billion.

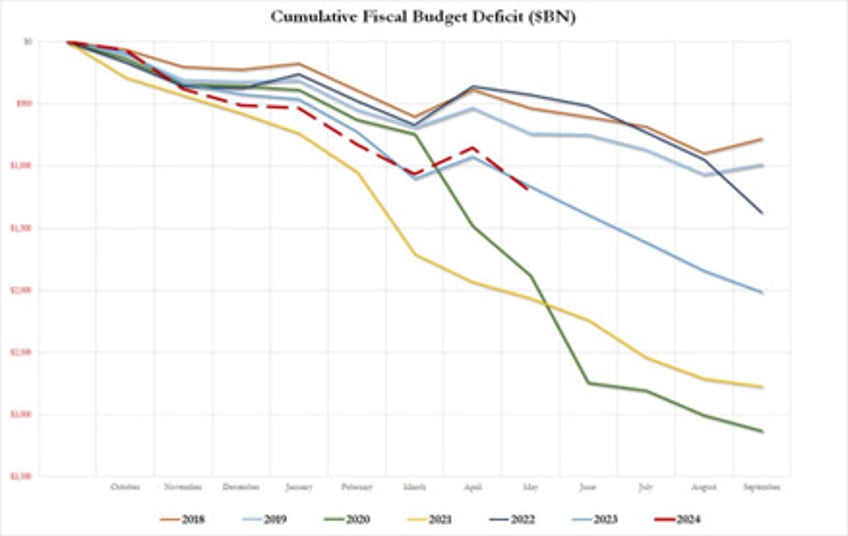

This resulted in a May budget deficit of $347 billion, which was about $100 billion more than consensus expected. It marks the second biggest May deficit on record, with only the peak during the Covid crisis in May 2020 being higher.

As a result of the blowout May deficit, the cumulative fiscal 2024 shortfall once again surpassed the total for 2023, bringing the year-to-date deficit to just over $1.2 trillion. This amount exceeds the $1.16 trillion cumulative deficit through May 2023, with four more months left in the fiscal year.

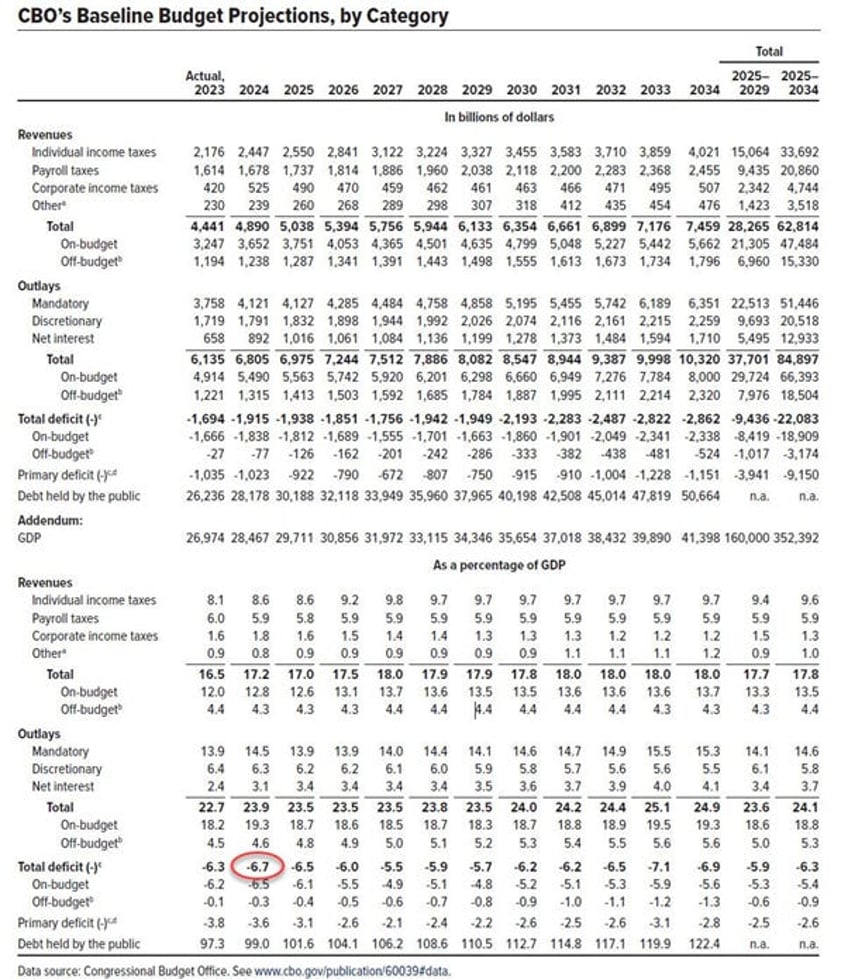

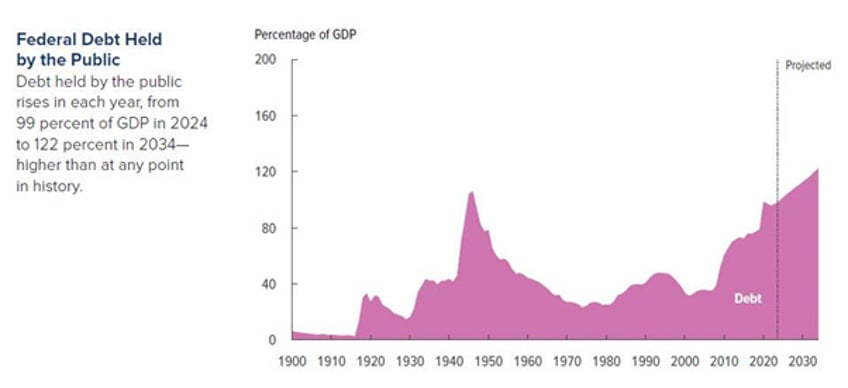

Now, at this point, someone at the CBO with a functioning brain looked at the numbers and realized that their current forecast of ‘only’ $1.5 trillion for the 2024 deficit seemed at best unrealistic and at worst, like total propaganda adding to the Forward Confusion narrative. Indeed, with just 4 months left in fiscal 2024, the CBO revised its forecast, raising the 2024 budget deficit projection from $1.5 trillion to $1.9 trillion. This revision confirms that there will be effectively no improvement in the fiscal picture between 2023 and 2024. In its latest projections, the Congressional Budget Office (CBO) predicted that government spending would continue to rise as there is a bipartisan agreement on that point.

The office attributed the 27% spike in the deficit to several key drivers. These include foreign military aid (allegedly related to ongoing support in Ukraine), actions by the Biden administration on student loans, slower recovery of payments by the Federal Deposit Insurance Corporation following bank failures, higher Medicaid outlays, and increases in government discretionary spending. Additionally, the $1.2 trillion in interest expense on federal debt exacerbates the situation, leading the CBO to revise its 2024 deficit-to-GDP ratio forecast from a previous prediction of 5.3% to 6.7%.

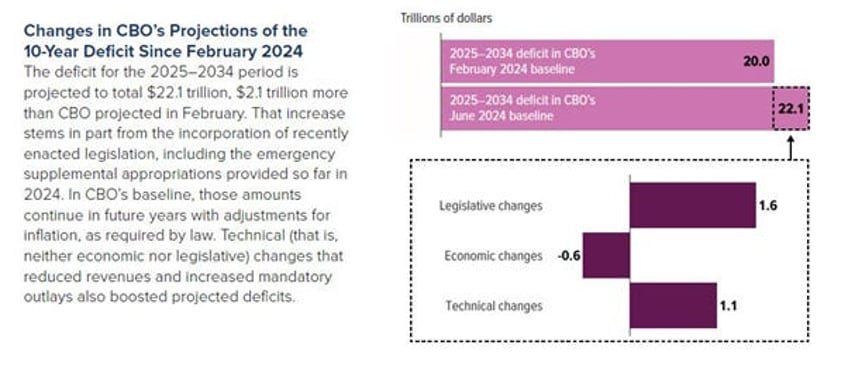

Meanwhile, the cumulative deficit from 2025 to 2034 is projected to reach $22.1 trillion, which is 10% higher than the office previously projected in February, marking a $2.1 trillion increase.

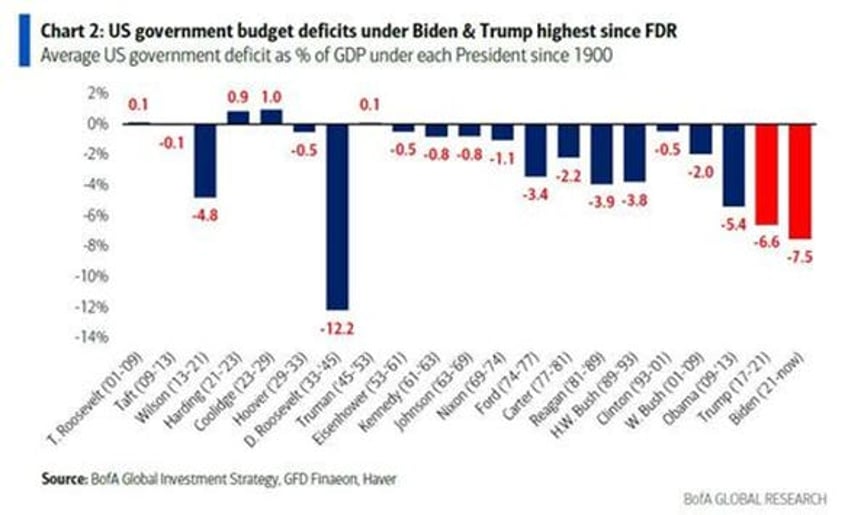

Of course, by the time 2034 rolls around, not only none of the current president candidates will still be around but the actual deficit will likely be significantly higher, meaning that for both of them, these financial metrics may seem inconsequential. Investors and voters should note that under both Trump and Biden, U.S. government deficits have been the highest since Franklin Delano Roosevelt's presidency during World War II. This suggests that the ultimate goal of the plutocrats in power, regardless of party affiliation, is to push the world into another war to divert attention from the inevitable default of the US government on its sovereign debt.

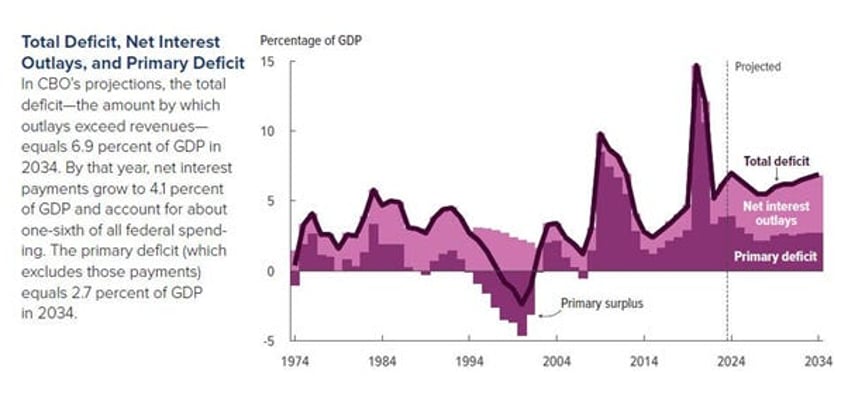

According to the CBO, the largest factor behind the increased cumulative deficit was recent legislation adding $1.6 trillion to projected deficits. This included $95 billion in emergency appropriations for aid to Ukraine, Israel, and Indo-Pacific countries, with ongoing funding adjusted for inflation expected to increase discretionary outlays by $0.9 trillion through 2034. Additionally, the CBO highlighted that deficits over the next decade are about 70% higher than their historical average relative to economic output. This suggests the US has passed the ‘Minsky Moment,’ facing potential consequences when the USD loses its reserve currency status. With rising interest costs and expenditures on programs like Medicare and Social Security, federal outlays are projected to peak at 24.9% of GDP in 2034, up from 24.2% in 2024. The CBO admits there's no scenario where future deficits will decline to zero, indicating a tough fiscal road ahead.

As the year of political hell will culminate on November 5th when American citizens go to the polls to elect their president and renew half of the Congress and Senate, everyone will agree that it takes a lot of gumption to go on television and repeatedly lie to over 300 million Americans, who undoubtedly have higher cognitive capabilities than the first among them. Investors and consumers will remember that while the current president can cherry-pick a few numbers to try to present himself favourably, these are facts that he doesn’t want US citizens to know:

In this context, the Western world is about to understand the meaning of the old saying ‘Weak men create hard times’…

In the meantime, nearly every aspect of American life is influenced by unelected government agencies that can implement regulations without consistent adherence to a uniform rule of law. This is how the ‘Deep State’ exerts control in what the Western mass media portrays as an exemplary democracy, but which resembles more of a plutocratic gerontocracy.

Politics have never been as divided as they are today. While politics has always been divisive, America has never been less united. Even during Barack Obama's presidential campaigns, despite the left vs. right divide, there was still a sense of shared identity as Americans first and foremost.

@trump_v_bidenThe difference is halarious yet serious #obama#trump#biden#debate#2012##2024c#compare

Enable 3rd party cookies or use another browser

Today’s political debates have devolved into outright battles, with each side believing the other doesn't deserve to share the same land. This echoes the sentiment from the movie ‘Civil War,’ where a separatist soldier asked, ‘What kind of American are you?’ This mindset is prevalent today, reflecting the deep divisions in society. This will ultimately lead to a massive rise in civil unrest that will explode by the beginning of September. The 2024 US Presidential Election features two fundamentally different visions for America's future, not just a typical Republicans vs. Democrats contest. Widespread economic dissatisfaction, fuelled by years of strain, a pandemic, mass migration, and woke politics, has created deep animosity. Many fear a civil war is inevitable as both sides seek to reclaim their version of America. By 2028, there may not be a US Presidential election at all.

Once the majority realizes that their vote will not make much difference, as the fiscal deficit will continue to rise regardless of who is the next tenant of the White House, the US empire is likely to implode from within rather than being defeated on the battlefield despite the Washington warmongers attempting to spread conflict globally to divert attention from the harsh realities faced by average Americans.

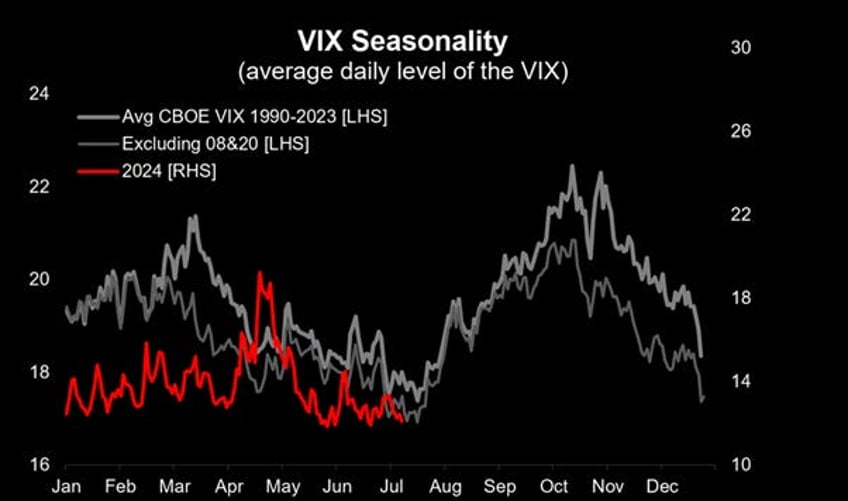

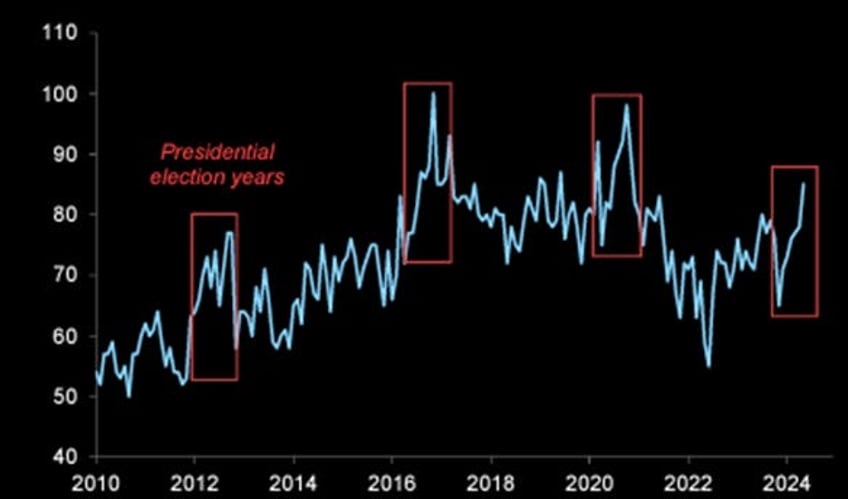

Coming back to financial markets, historically, option markets begin pricing in the US elections around 3 months before the event. While we are not there yet, volatilities are expected to start reflecting anticipation of the elections soon.

As a reminder, over the past 20 years, the VIX has typically bottomed out later in July due to seasonality.

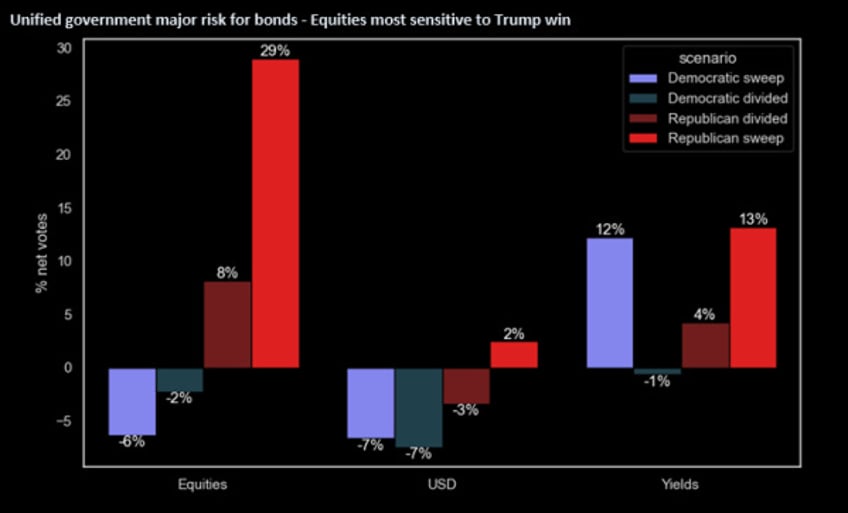

Goldman Sachs recently surveyed 800 global investors, summarizing their views as follows: Investors fear a unified government that gives the executive branch more spending power, which is seen as even more negative for bonds (yields up).

In election years, there is historically uncertainty among small business owners, who are reluctant to proceed with significant decisions ahead of potential changes in fiscal regulations following the inauguration of a new president and administration.

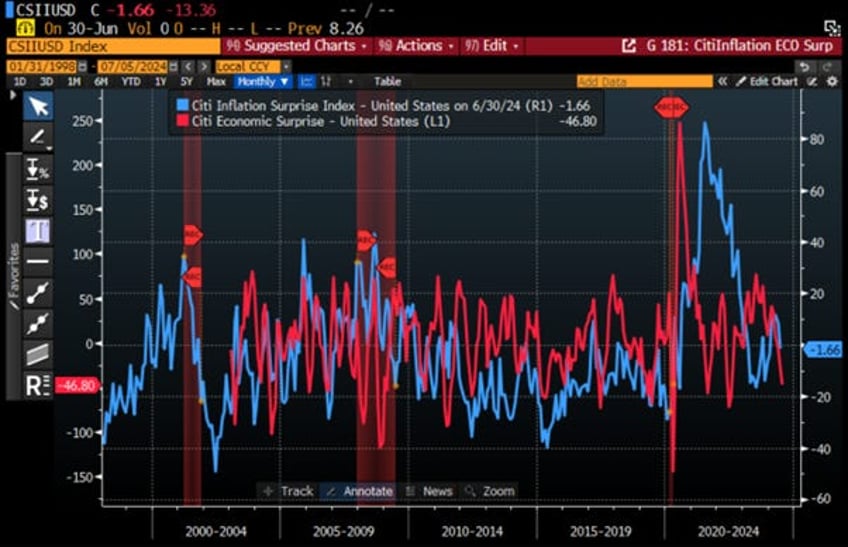

In this context, economic surprises are expected to deteriorate further, while the return of inflation is likely to accelerate as the base effect becomes less favourable. This challenges the narrative of a "Goldilocks" scenario for the US economy. Instead, rising uncertainties domestically and internationally suggest a scenario of consumer-driven stagflation, where people buy less for more.

Citi US Inflation Surprise Index (blue line); Citi US Economic Surprise Index (red line) & US Recessions.

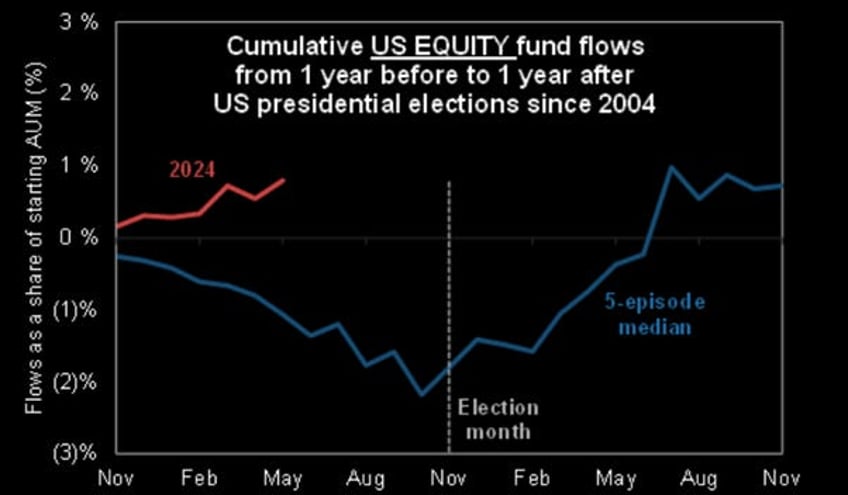

Based on historical seasonality over the past 20 years, US equity markets typically experience outflows as we approach Election Day.

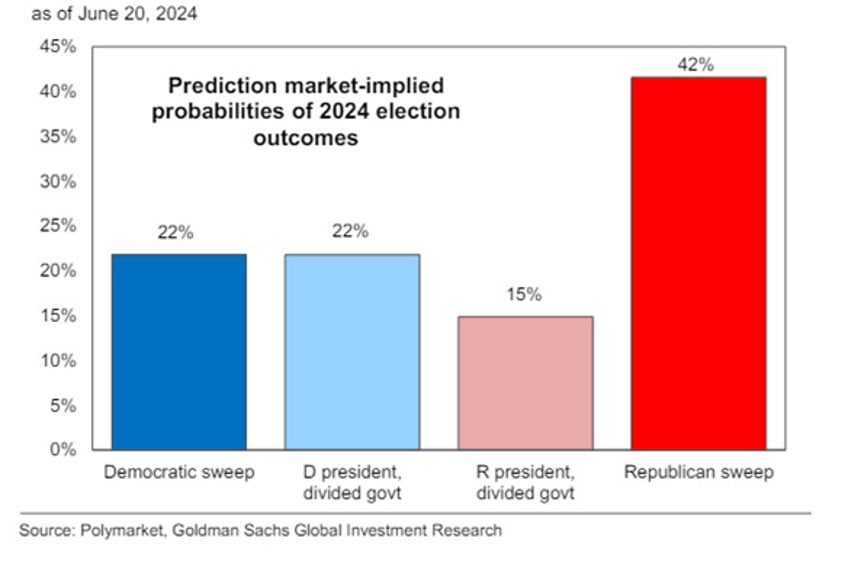

For the equity market, the consensus has increasingly priced in a scenario where Trump wins the election and Republicans control both Congress and the Senate (i.e., a Republican sweep), seen as the most likely outcome if the election proceeds without irregularities given the disastrous state of the US economy which has been managed over the past 4 years for the Democrat’ plutocrats.

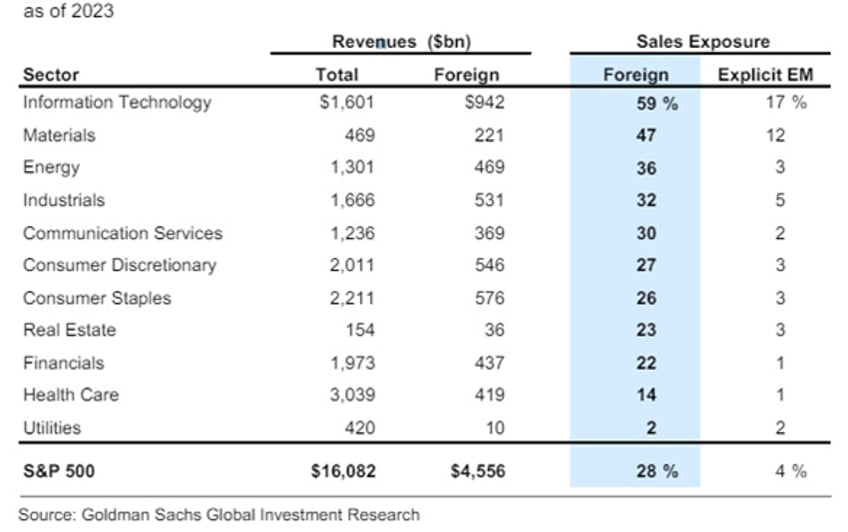

The impact on asset classes is expected to result in a strengthening of the US Dollar regardless of who wins the White House, given the developing political and geopolitical challenges globally. Trump's potential tariff policies, such as a proposed 10% across-the-board tariff on imports and a 60% tariff on imports from China, could significantly increase inflation. These tariffs would likely pose a challenge to stocks with high international revenue exposure due to the risk of retaliatory tariffs and heightened geopolitical tensions. It may surprise some that the tech sector has the highest international sales exposure with 59% of total revenues (including 17% from emerging markets), while cyclicals follow closely behind.

If this report has inspired you to invest in gold, consider Hard Assets Alliance to buy your physical gold: https://www.hardassetsalliance.com/?aff=TMB

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/apres-macron-le-deluge

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.