Just in case it wasn't obvious, The NY Fed's latest report on household debt confirms that the strong spending seen in Q3 was driven - drum roll please - by Americans tapping their credit cards by a record amount year-over-year.

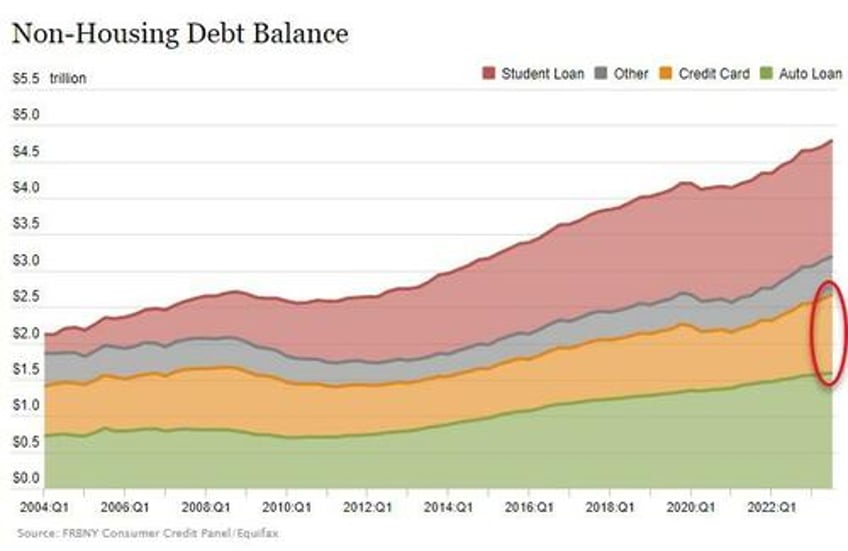

Overall, household debt increased by $228 billion last quarter, bringing the total to $17.3 trillion, which included a $48 billion rise in credit-card balances to $1.08 trillion, marking the eighth straight quarter of year-over-year increases, the report found.

Credit-card balances are now $154 billion higher than they were a year ago, the largest annual increase since the New York Fed began tracking the data in 1999, researchers said in a blog post.

No real surprise there - but certainly not the sustainable foundation of growth so many had pinned their hopes on.

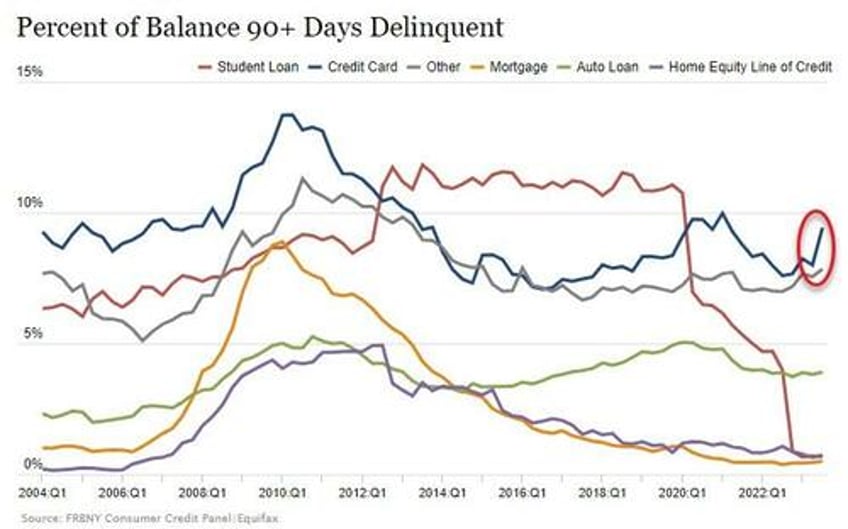

However, there is a problem - aggregate delinquency rates were increased in the third quarter of 2023.

“The increase in balances is consistent with strong nominal spending and real GDP growth over the same time frame,” they said in the post.

“But credit card delinquencies continue to rise from their historical lows seen during the pandemic and have now surpassed pre-pandemic levels.”

As of September, 3.0% of outstanding debt was in some stage of delinquency, with credit-card delinquencies' jump standing out...

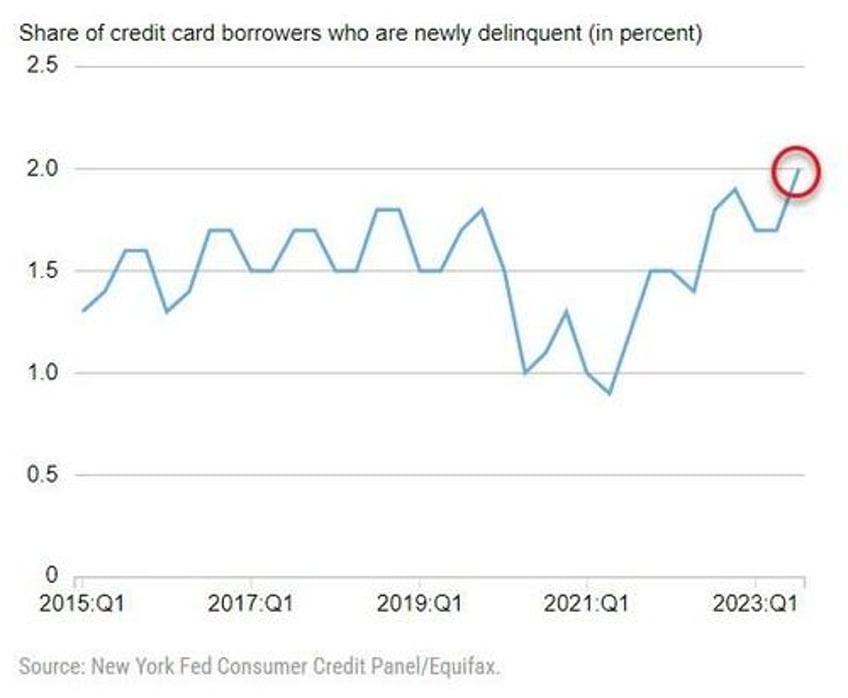

Most notably, the share of debt becoming newly delinquent is now rising for most types of debt, with the share of newly delinquent credit card users rising in Q3, and now exceeding pre-pandemic average levels...

So, who is behind this sudden surge in delinquencies?

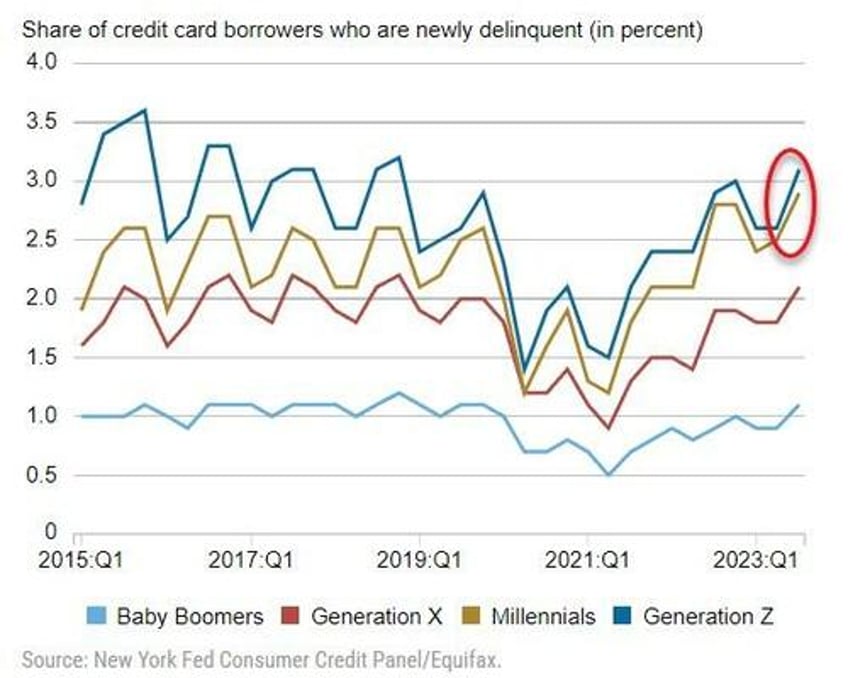

While Baby Boomers (born 1946-64), Generation X (born 1965-79), and Generation Z (born 1995-2011) credit card users have delinquency rates similar to their pre-pandemic levels and trends, Millennials (born 1980-94) credit card users began exceeding pre-pandemic delinquency levels in the middle of last year and now have transition rates 0.4 percentage point higher than in the third quarter of 2019.

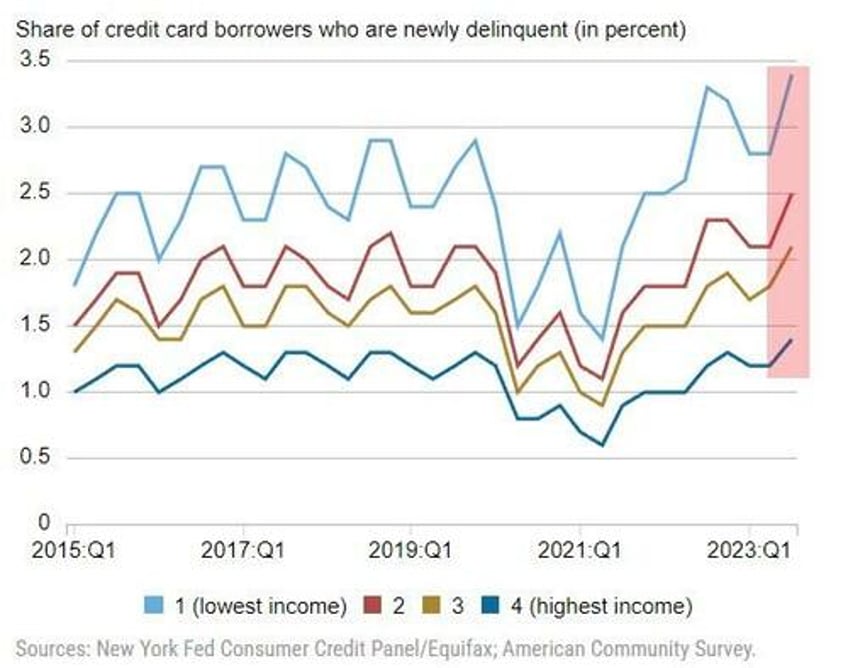

Additionally, as one might expect, the lowest-income areas persistently have the highest delinquency rates, but all four quartiles are now above their pre-pandemic levels.

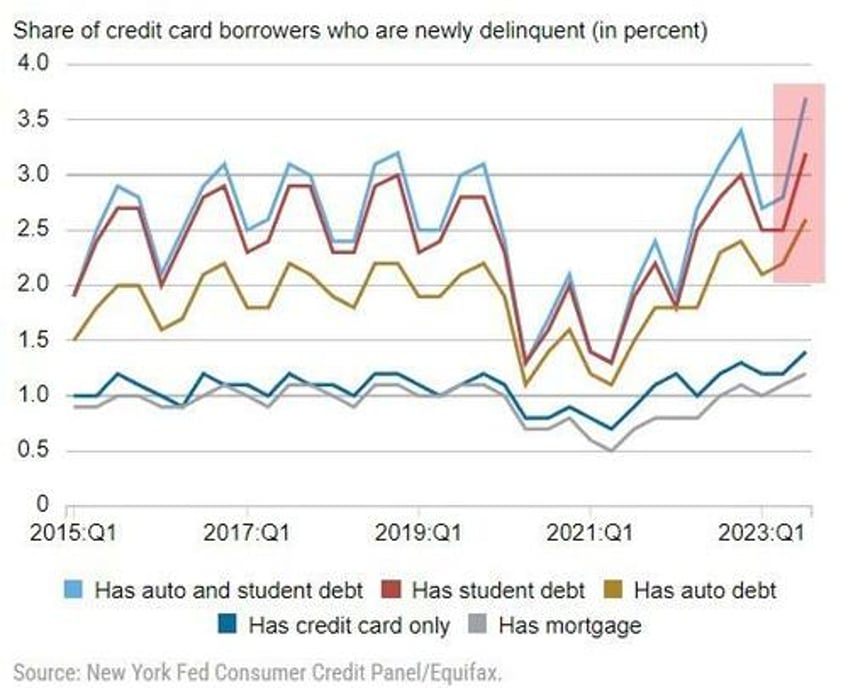

And finally, NYFed notes that borrowers with auto loans (gold line) or student loans (red line) were more likely to fall behind on their loans than before the pandemic. This was especially the case for those with student loans and auto loans (shown in light blue). This group’s transition rate into a credit card delinquency is 0.6 percentage point higher than it was prior to the pandemic. These repayment difficulties will likely continue to mount for student loan borrowers now that student loan payments have resumed.

Whether consumers can keep up with their debt payments and continue spending in the face of higher rates, growing obligations and shrinking savings, is something policymakers and economists are watching closely but given the acceleration in balances and delinquencies, we think the answer is clear.