Driven by soaring demand associated with artificial intelligence, electric vehicles, power infrastructure and automation, copper prices are up around 50% in four years. Now, telecom giants are poised to cash in -- by pulling their old copper lines back out from from the ground and down from poles and recycling them, according to a new report from Bloomberg.

“We’ve got all of this material, sitting redundant,” David Evans asset recovery head at UK-based TXO tells Bloomberg. The firm, which provides engineering services to telecom companies, estimates that the industry has the potential to harvest 800,000 metric tons of copper in the next 10 years. At today's values, that would represent about $7 billion.

Still-higher copper prices may lie ahead. "You know, it is the most compelling trade I have ever seen in my 30 plus years of doing this," Jeff Curie, chief strategy officer of the energy pathways team at Carlyle Group, recently said in an appearance on Bloomberg's Odd Lots. "You look at the demand story, it's got green CapEx, it's got AI, remember AI can't happen without the energy demand and the constraint on the electricity grid is going to be copper."

With four US reclamation centers, AT&T's recovery efforts are already underway, but ramping up rapidly. “With copper prices where they are, we are scaling quite significantly,” Susan Johnson, an executive vice-president at AT&T leading its copper recovery and resale efforts, tells Bloomberg.

Aside from selling the copper, telecom utilities also benefit by making more room for fiber cables and reducing the cost of ongoing maintenance. Also, as the Wall Street Journal first reported in a July 2023 exposé, when left to deteriorate, some old copper cables present a health hazard, as they're sheathed with lead insulation, and are leaching the dangerous element into soil and water. Removing these cables -- some of which go back to the late 1800s -- can help mitigate liabilities.

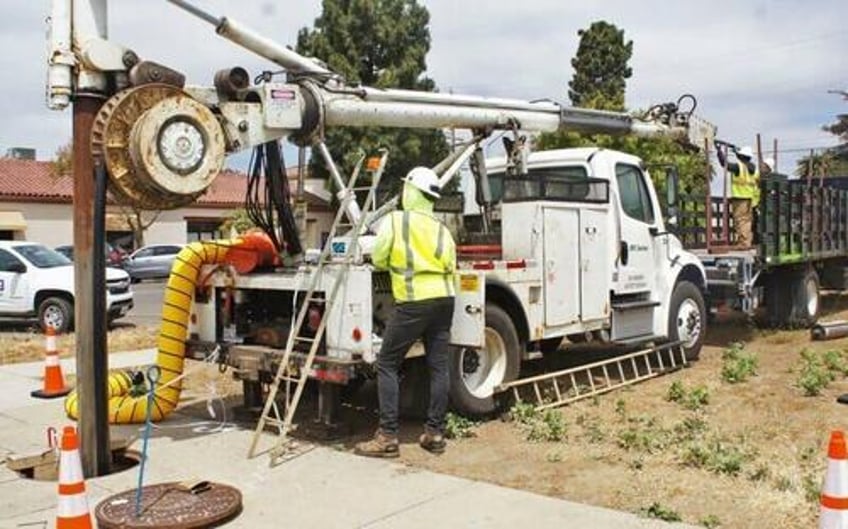

Workers split thick cables to extract copper.pic.twitter.com/oLHDI6NKzh

— Tech Burrito (@TechBurritoUno) September 20, 2022

After the cables are pulled out of the ground, they have to be stripped and cleaned to obtain the copper, which can then be sold to domestic and international buyers. At prices between $6,000 to $9,000 per ton, profit can top 30% after extraction, recovery and processing costs, said TXO’s Evans. -- Bloomberg

Meanwhile, in a dog-chasing-its-tail dynamic, some premature recycling efforts are targeting the same green-energy infrastructure that's helping to push copper prices higher:

Tesla Supercharger station in Bay Area hit by thieves with every charging cable cut pic.twitter.com/ro38DkJKqQ

— Clown World ™ 🤡 (@ClownWorld_) May 13, 2024