Submitted by QTR's Fringe Finance

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week.

I believe Larry to truly be one of the muted voices that the investing community would be better off considering. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Lawrence Lepard (Photo: Kitco)

Larry was kind enough to allow me to share his thoughts heading into Q3 2023. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 2 of this letter, Part 1 can be found here.

SOUND MONEY ALTERNATIVES

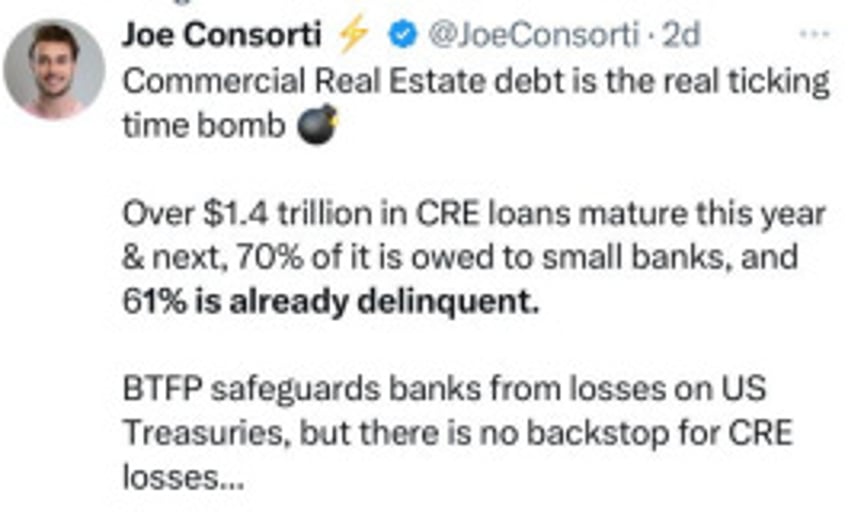

We have to admit that even we have been surprised by how far the Fed has been willing to go to try to restore the stability of the purchasing power of the dollar. After growing M2 by 42% in under two years, and watching inflation run wild, their extreme tightening in the opposite direction is a signal to us of weakness on their part, not strength. They are losing control of the monetary system and something is certain to break. In fact, something did break with Silicon Valley Bank and several other banks rapidly failing. But, for now their newly created Bank Term Funding Program (BTFP) band aid was able to control the damage. They are unlikely to be so lucky with the next item to break as the bond markets are bigger than the Fed and the banks are not yet out of the woods – particularly with Commercial Real Estate Loan issues still ahead for the non-GSIB banks as Joe Consorti recently pointed out:

Steve Czech pointed out a study by economists with “mark to reality” numbers vs. the FDIC’s “mark to myth”. That study made the following points:

The FDIC estimates unrealized/unrecorded losses on US bank balance sheets of $500 Billion at March 31, 2023.

A study by leading academics at Stanford, USC, Northwestern and Columbia estimates that same number to be $2 Trillion.

There are ~ 4,100 banks in the US. The study above concluded that 2,315 of those banks (or 56.5% of all US Banks) have assets worth less than their liabilities.

As more pain plays out in the economy over the next year and when the bond markets break, the amount of money that will need to be printed to contain the damage will possibly, once and for all, destroy the credibility of the Fed and sound money assets will perform very well.

In fact, it is notable that in a year when interest rates have been increased at one of the most rapid rates in history that the two premier sound money alternatives have performed admirably and well. Gold in calendar 2023 is up 8%, and Bitcoin is up 83% in 2023. All of this under the most hawkish Fed regime in 40 years. Dare we imagine what will happen when the Fed is forced to ease?

BRICS CURRENCY WATCH

There has been a lot of discussion regarding the possibility of a new BRICS1 Currency and so we want to offer our views on the matter. Since the US seized over $600 million of Russia's foreign reserve assets in response to the outbreak of the war in the Ukraine in Q1 2022, there has been a lot of talk by all nations around the world concerning payment systems, the SWIFT network and the issue of neutral reserve assets. The world has awoken to the risks associated with having nearly all world trade denominated in dollars and relying upon a network (SWIFT) that can be weaponized by the US to punish or sanction country behavior. Also, many nations have publicly stated that they are tired of selling their valuable commodities for paper assets which are continually depreciating in value. As a starting point, we have seen these complaints lead to many countries starting to trade among themselves directly, accepting each other's currencies without using a dollar exchange rate cross. For example, the Gulf Council states now accept Chinese yuan in payment for oil. Also, Russia and India now trade amongst themselves using rupees and rubles. These markets are not large and deep, but the important point is the direction.

More recently there have been multiple public comments by officials of the BRICS countries suggesting they are working on this issue and that, in the upcoming BRICS Summit on August 22-24 to be held in South Africa, they will be making announcements regarding their progress.

Some of the comments suggest that they are working to establish a new BRICS currency which will be backed by gold. In our view this could work, and if implemented correctly it would be earth shattering. The way they would need to implement it is to set a fixed rate between the new currency and gold and to make the two completely exchangeable, one for the other. Say 1 BRIC unit equals 1/10th of an ounce of gold. They would need to establish a BRICS Bank that issues and keeps track of the new currency and that bank would need to be 100% reserved by the underlying gold. Countries could obtain the new currency by sending gold to the bank or there would be an exchange rate for each currency submitted into gold. Thus, if Russia or China wanted to obtain a certain number of BRICS units, they would submit rubles or yuan and the bank would immediately use them to buy and hold gold. In turn, they would be issued BRICS currency units. In this way all trade would now be conducted in a fully reserved "neutral reserve currency" which would...(READ THIS FULL ARTICLE HERE).