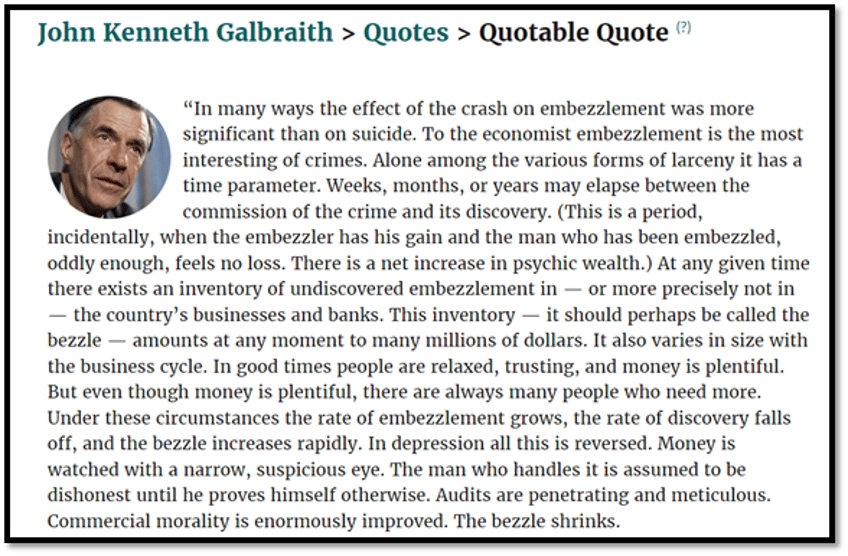

Those who have read some financial literatures are probably familiar with the concept of ‘bezzle,’ developed by John Kenneth Galbraith. To summarize, ‘bezzle’ refers to a long-term pattern of bad faith, where individuals or organizations create an ‘inventory of undiscovered embezzlements’ during periods of rising markets. This concept was coined by Galbraith, an American economist, in his book The Great Crash of 1929.

The characteristics of the bezzle can be summarized in three points:

Illusory Wealth Creation: The bezzle does not necessarily involve criminal acts; rather, it involves the creation of apparent wealth through fraudulent means, such as accounting tricks or misrepresentation.

Delayed Discovery: Weeks, months, or even years may pass between the commission of the fraud and its discovery, allowing the perpetrator to benefit while the victim remains unaware of the loss.

Net Increase in Psychic Wealth: During this period, the perpetrator enjoys the gains, while the victim feels no loss, resulting in a net increase in ‘psychic wealth.’

When the bezzle is eventually exposed, it can lead to significant losses for investors. Understanding the concept of the bezzle is crucial for investors and financial professionals, as it underscores the importance of rigorous risk management and due diligence to mitigate the impact of such schemes.

https://www.goodreads.com/quotes/543316-in-many-ways-the-effect-of-the-crash-on-embezzlement

Until recently, and until the Yen carry trade tantrum hit, most investors did not understand that the actions of a central bank managing an economy on the brink of a financial doom loop, can lead to high complacency. That phenomenon has attracted investors into the forward illusion spread by some financial alchemists promising miraculous returns not only from the AI hype but as well from an asset class that most investors do not understand and which is usually associated with opaque accounting and valuation practices : Private Assets. Indeed, as individuals seek higher rates of return than the market generates, Wall Street tends to bring new companies to market to meet the demand of the investing public. Private equity and Private debt have always been an attractive investment as it is depicted as the story of someone who bought a company’s shares when it was private and made a massive fortune when it went public.

Before delving behind the curtain of the black holes of private assets, investors must first understand that there are significant differences to consider between the vast majority of retail investors and high-net-worth individuals before investing in private assets. These differences are often defined by the underlying risks of private asset investments.

Liquidity Risk: Investors often underestimate that private asset investments cannot be easily liquidated if capital is needed elsewhere. While seeking high returns, they may find themselves vulnerable when their capital is locked in an illiquid investment, especially during a financial crisis.

Duration Risk: Private asset investments often take much longer to exit than initially projected. Optimistic projections, which include favourable exit assumptions, frequently fall short of reality. Market downturns, economic recessions, or changes in industry conditions can extend a supposed 3-year investment into a decade or more. This extended duration amplifies liquidity risk, potentially tying up capital for much longer than anticipated, often with minimal returns. High-net-worth individuals may manage both duration and liquidity risks, but most retail investors cannot.

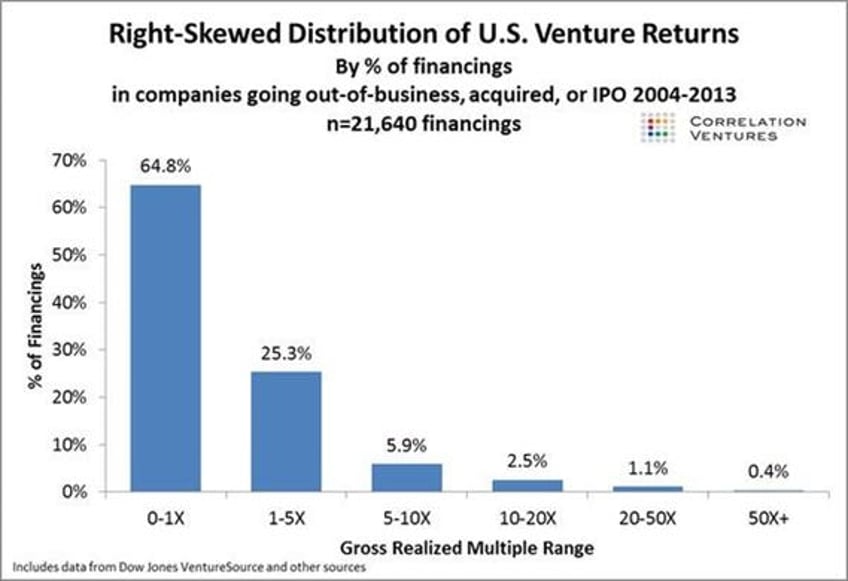

Loss Risk: High-net-worth individuals can absorb losses better than most retail investors. Many private equity deals fail, resulting in significant losses. While wealthy investors can diversify across multiple deals to offset failures, most individuals lack the capital for such diversification. Consequently, a loss in private equity can be highly detrimental.

To that point, investors should be aware that approximately 65% of private equity investments either fail or return only the initial investment at best.

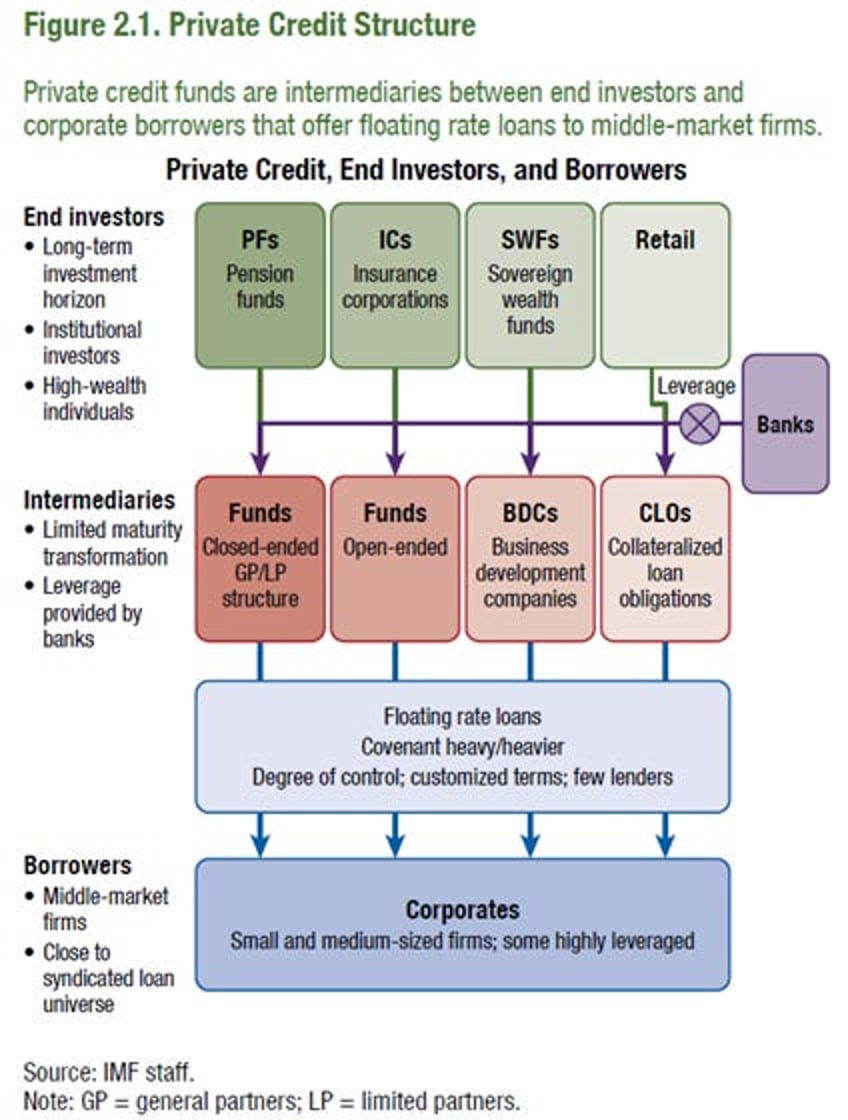

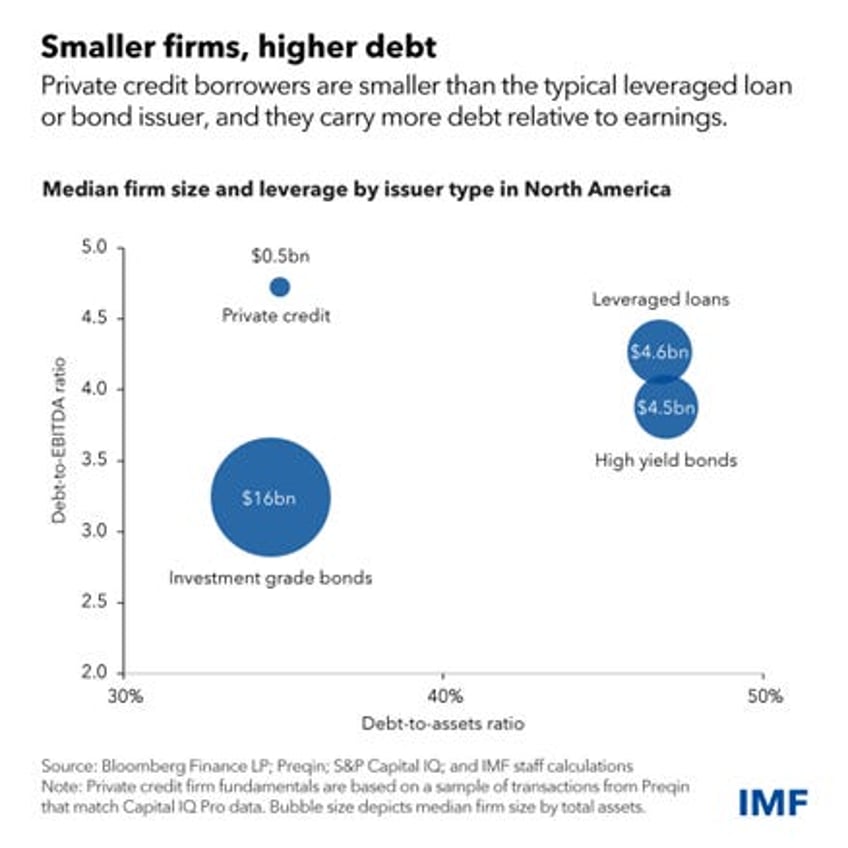

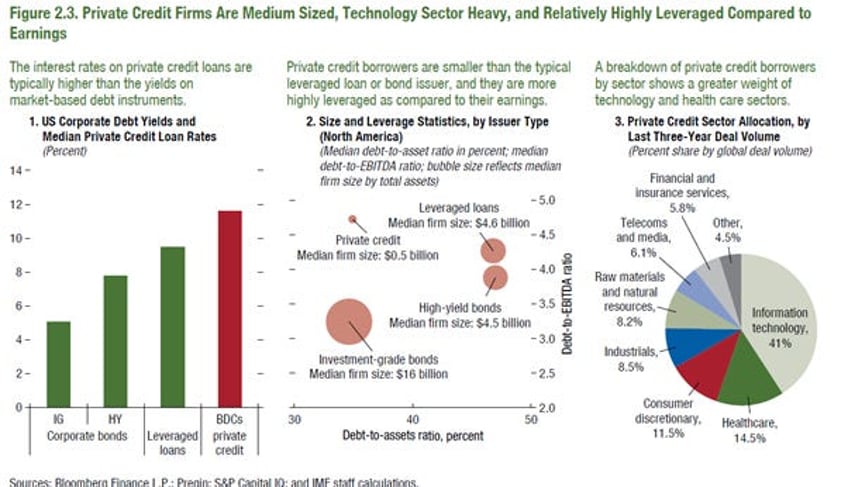

Private asset investing is mostly related to Private Credit and Private Equity investments. Private credit mainly involves alternative asset managers who raise capital from institutional investors through closed-end funds and lend directly to primarily middle-market firms.

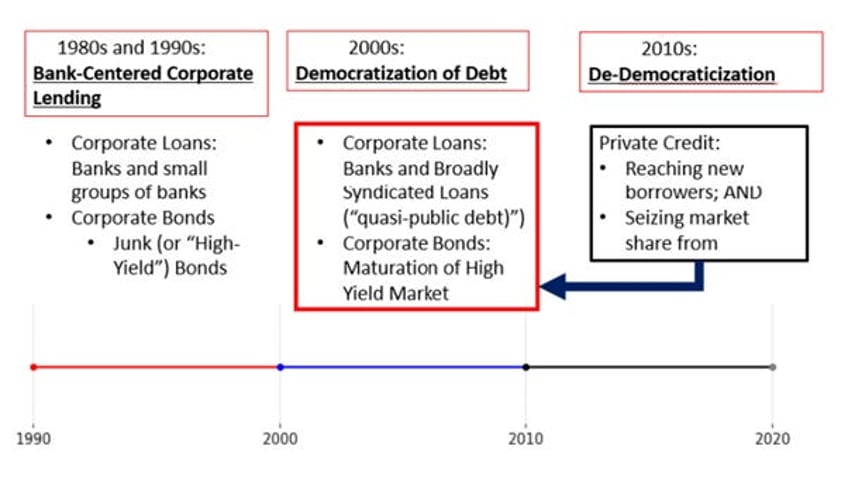

Proponents of private credit argue that it has delivered significant economic benefits over its roughly 30-year existence. It has emerged as a lending solution for middle-market companies that are too risky or large for commercial banks and too small for public markets. Loans are typically negotiated directly between borrowers and alternative asset managers. Although usually more expensive than bank loans, private credit offers value through strong relationships and customized terms designed for flexibility during stress. Unlike broadly syndicated loans, private credit often includes enhanced covenants for downside protection. Managers claim to have greater resources for managing problem loans, leading to fewer sudden defaults, smoother restructurings, and lower financial distress costs. Private credit deals are often idiosyncratic and difficult to value or trade, which means lenders rely on long-term pools of locked-up capital. The sector has grown rapidly since the global financial crisis, gaining market share from bank lending and public markets, partly due to a long period of low interest rates and heightened attention to alternative investments. Private credit has historically shown high returns and relatively low volatility. Regulatory reforms post-crisis, which raised capital requirements for banks and made regulations more risk-sensitive, encouraged banks to hold safer assets. Additionally, some end investors, notably insurance companies, have shifted to private credit due to lower capital charges compared to commercial banks.

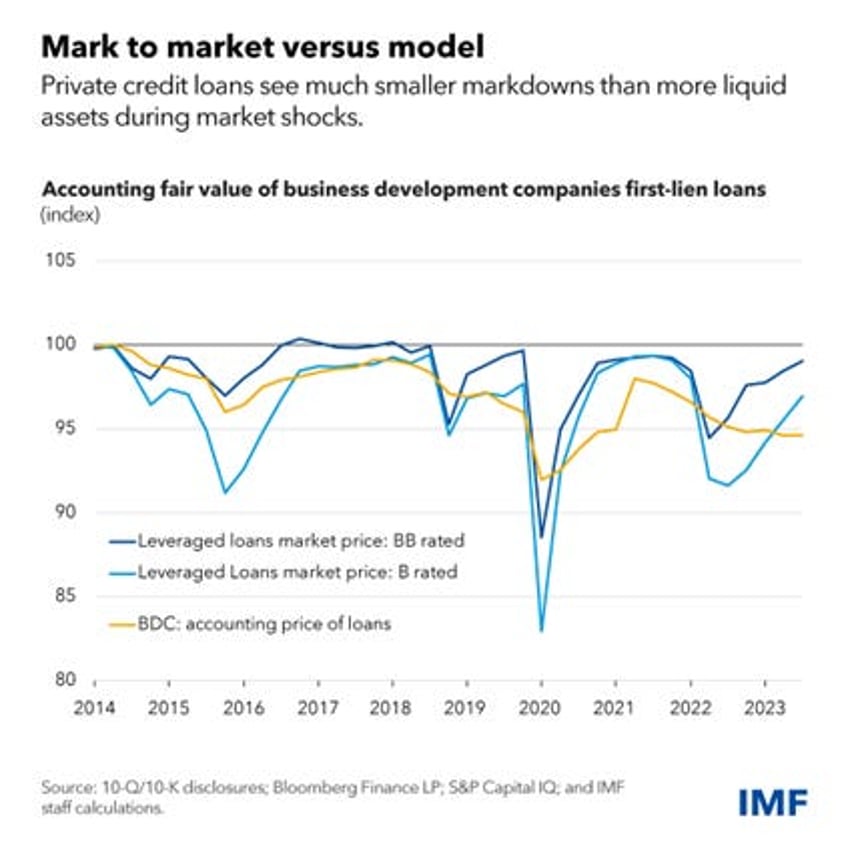

A major risk is that private market loans rarely trade, so they can’t be valued using market prices. Instead, they are often marked quarterly using risk models, leading to potentially stale and subjective valuations. An analysis comparing private credit to leveraged loans, traded regularly in a more liquid and transparent market, reveals that, despite lower credit quality, private credit assets generally experience smaller markdowns during times of stress. In a nutshell, models structurally overestimate the value of private market loans, increasing the risk of bezzle when market instability spreads.

While private credit fund leverage appears low, multiple layers of hidden leverage within the ecosystem raise concerns due to data limitations. Leverage is also employed by fund investors and borrowers, complicating the assessment of systemic vulnerabilities.

There is also significant interconnectedness within the private credit ecosystem. Although banks’ overall exposure to private credit is small (about $200 billion, less than 1% of US bank assets), some banks may have concentrated exposures. Additionally, certain pension funds and insurers, including private-equity-influenced life insurers, are increasing their investments in private credit, adding to the sector’s risk.

Finally, while liquidity risks seem limited now, a growing retail presence could change this. Private credit funds often use long-term capital lockups and impose redemption constraints, but new funds targeting individual investors might face higher redemption risks. Although liquidity management tools exist, they haven't been tested in severe downturns.

Overall, while these vulnerabilities may not currently pose a systemic risk for the time being, they could escalate, affecting the broader economy. In a severe downturn, deteriorating credit quality could lead to defaults and significant losses. The opacity of private credit could make these losses hard to assess, potentially leading to reduced bank lending, large retail fund redemptions, and liquidity strains for private credit funds and institutional investors. Significant interconnectedness could also impact public markets if insurers and pension funds are forced to sell liquid assets to cover losses in illiquid ones.

With an estimated $1.3 to $1.6 trillion worth of private loans outstanding (rivalling the $1.4 trillion in publicly rated junk debt), it seemed reasonable to assume that this booming market might be having a macro impact on the economy, even allowing it to withstand some of the pain of higher interest rates by creating new and competitive sources of funding. The problem with all of this is that it remains conjecture. Private credit is nothing if not opaque, and trying to figure out exactly what’s happening in the space remains challenging. Those preaching for private credit argue that private credit should be understood as heralding a sharp reversal in the democratization of debt, which will have transformative impacts on corporate governance and corporate finance. The rise in private credit according to these private credit evangelists marks a reversal of a recent multi-year trend in corporate finance. Unlike in equity markets, where companies have been shying away from public stock offerings in recent years, businesses absolutely flocked to the public bond market to issue debt for much of the early 2000s. But booming private credit means that trend has been changing.

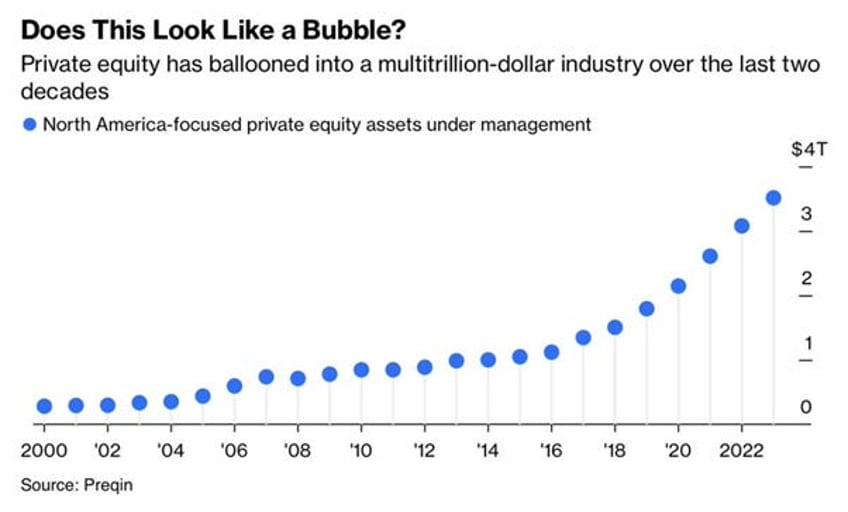

Let's look back to 1980, before Reagan: there were just 24 private equity funds. Today, there are over 17,000 in the US only. In 2000, PE firms managed around $579 billion in the US; now, it's nearly $8 trillion globally. KKR, for example, grew from $15 billion in 2005 to $575 billion today, a 3,733% increase. Private equity also employs about 11.7 million people, comparable to Ohio's population. So, is this explosive growth similar to the dot-com bubble of the late '90s or the rise of mortgage-backed securities in the mid-2000s?

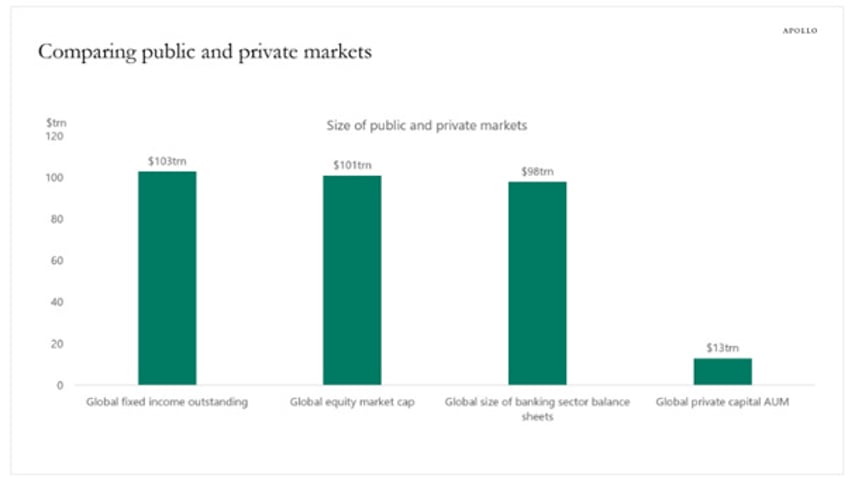

To assess whether private capital (private credit and private equity) could threaten financial stability, it’s helpful to compare its size with other asset classes. Global fixed income investments total around $130 trillion, while global equity markets have a market cap of about $101 trillion. The global banking sector's assets amount to $98 trillion. In contrast, total global private capital assets under management (AUM) are around $13 trillion. Thus, private capital represents less than 5% of global financing markets.

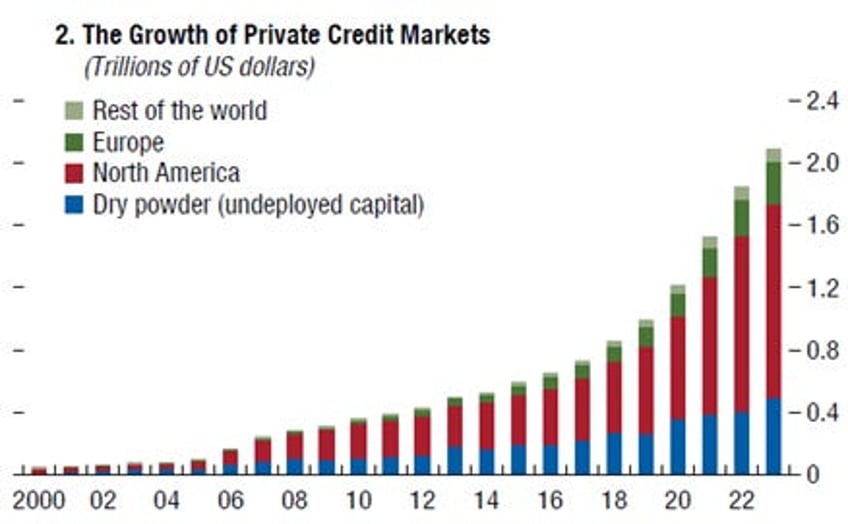

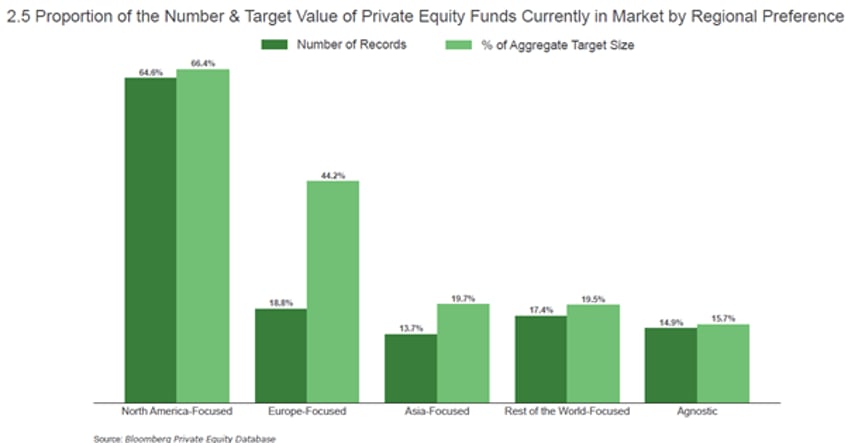

Although private capital is much smaller than global financing markets, it has gained popularity among institutional and high-net-worth investors seeking a supposedly antifragile asset class in an unstable monetary and fiscal environment. The private credit market, where non-bank financial institutions like investment funds lend to corporate borrowers, reached $2.1 trillion globally last year, with about 75% of this in the United States. Its market share is approaching that of syndicated loans and high-yield bonds. Looking at where private assets, and private equity in particular, are invested, the top regional focus by aggregate fund size is multi-regional. However, unsurprisingly, North America-focused funds hold the largest proportion of funds currently in the market by regional preference. Conversely, ‘agnostic’ funds maintain the lowest proportion.

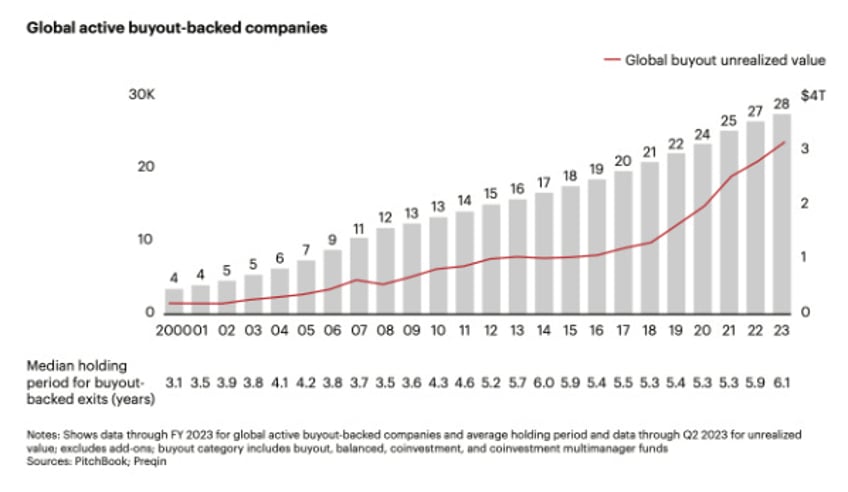

Globally, there are now 28,000 private equity firms managing over $3.0 trillion in ‘unexited deal value’. For those seeking the next big short, the private equity and debt markets might be a more promising target than the equity market. Since most of these companies have started their business around 2020 when interest rates were closed to 0% and given that they will have to refinance their debt sooner or later at 6+% interest rate, this will make things very hard for most of them.

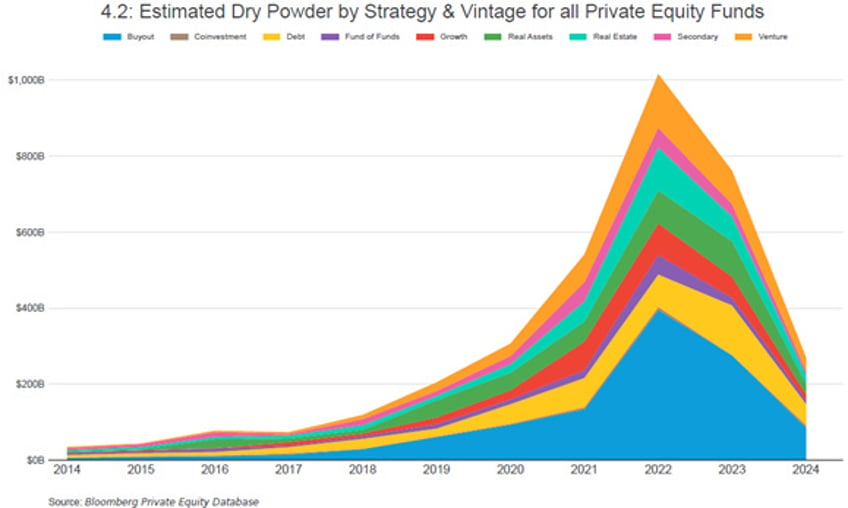

For high-net-worth and retail investors attracted to private equity's high returns, the common-sense question should be why they’re given such an opportunity if it’s expected to generate significant profits. A major issue for private equity (PE) firms is managing ‘dry powder’, capital raised but not yet invested. PE firms must either deploy this capital or return it to investors, which can lead to funding less-than-ideal deals due to high demand. In 2023, global PE dry powder surged to a record $2.59 trillion, marking an 8% increase from 2022, as firms faced a slow year in dealmaking with limited investment opportunities. As this capital gets deployed in 2024, its performance in a slowing economy and amid the challenging monetization of AI hype remains uncertain.

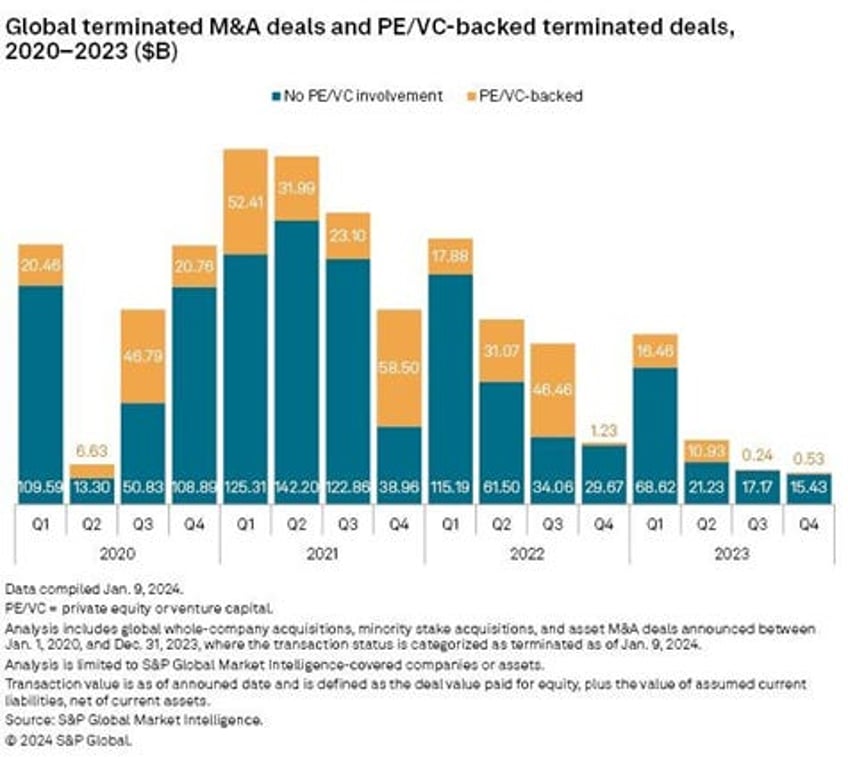

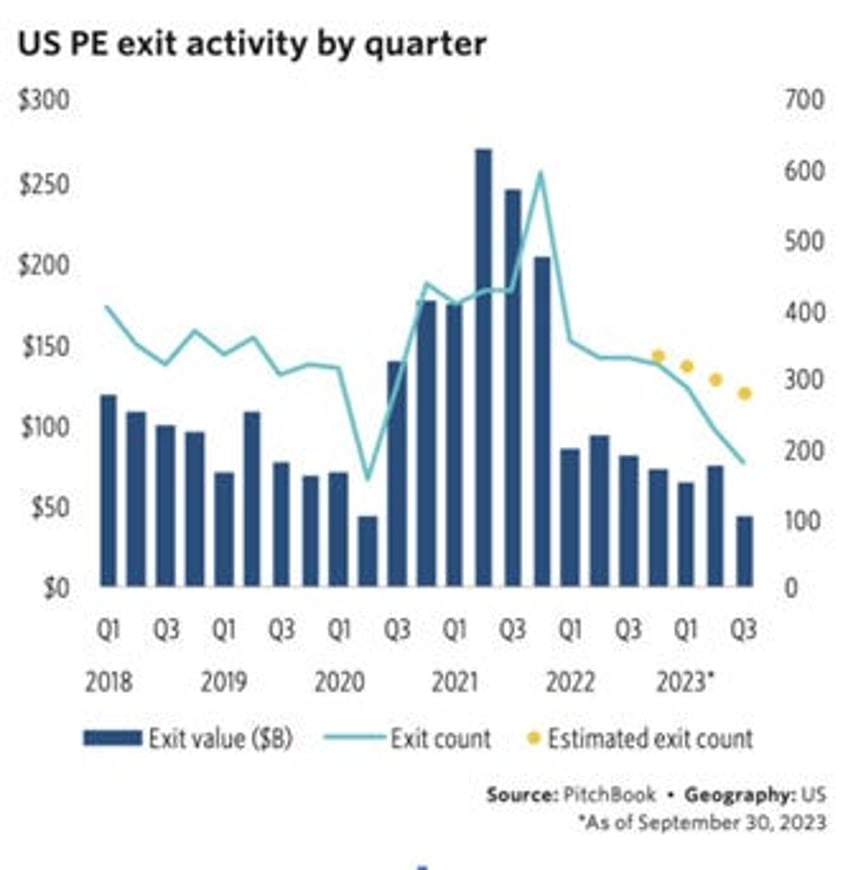

More worrying for those invested in the asset class, deal value has declined by 37% year-over-year, exit value by 44%, and the number of fund closings by 38%. Overall, these indicators are not very bullish for the private equity sector.

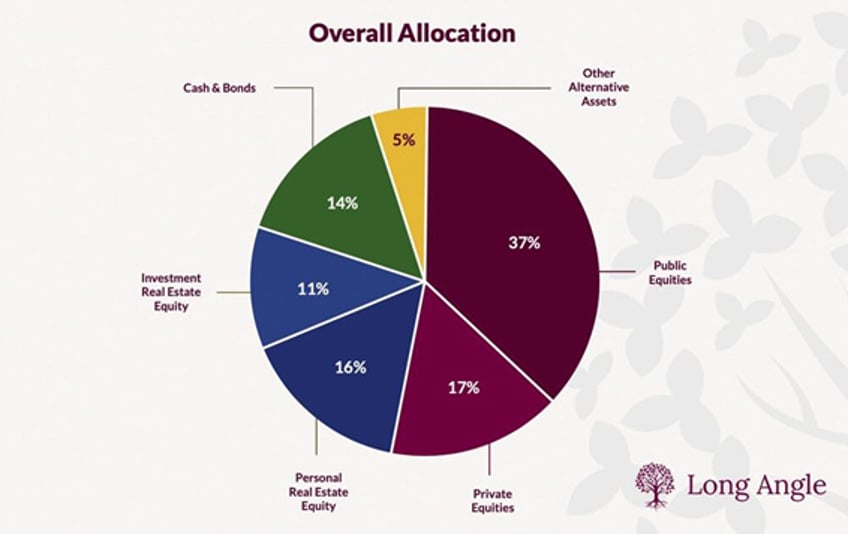

The next question is who owns private assets today. According to data from Long Angle, high-net-worth individuals allocate roughly 17% of their investments to private equity. However, these reports often include personal businesses as part of this allocation.

As John Galbraith mentioned in his book The Great Crash of 1929, the risk of bezzles is primarily related to the danger of developing hype, which, combined with financial opacity, can lead to irrational expectations. It is undeniable that the past few years have been marked by an overly financialized economy, fuelling a surge in investments in private assets. This narrative is based on the theory that, despite a 2.5% annual economic growth and interest rates at 5.5%, some financial alchemists have created an industry capable of growing to $15 trillion, two-thirds of US GDP, at a 15% annualized return. Even a primary school student can see that this math doesn’t add up. This occurs at a time when everyone, from university endowment funds to high-net-worth individuals lured by private bankers, has heavily invested in this asset class.

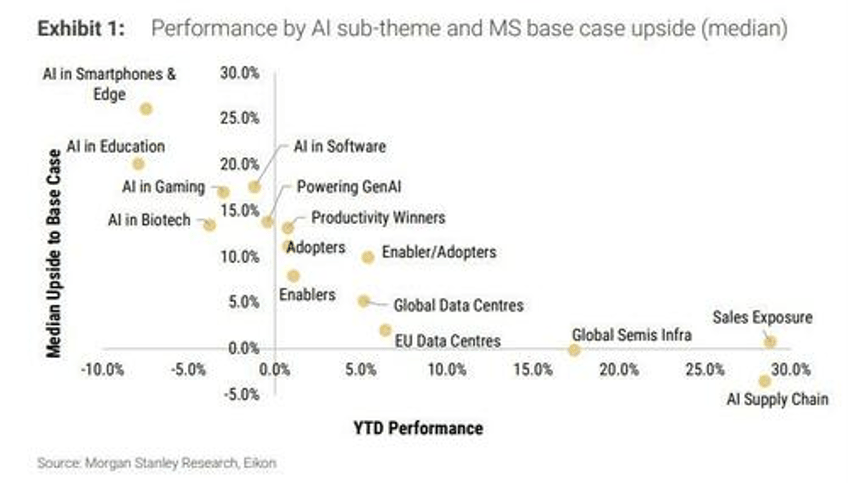

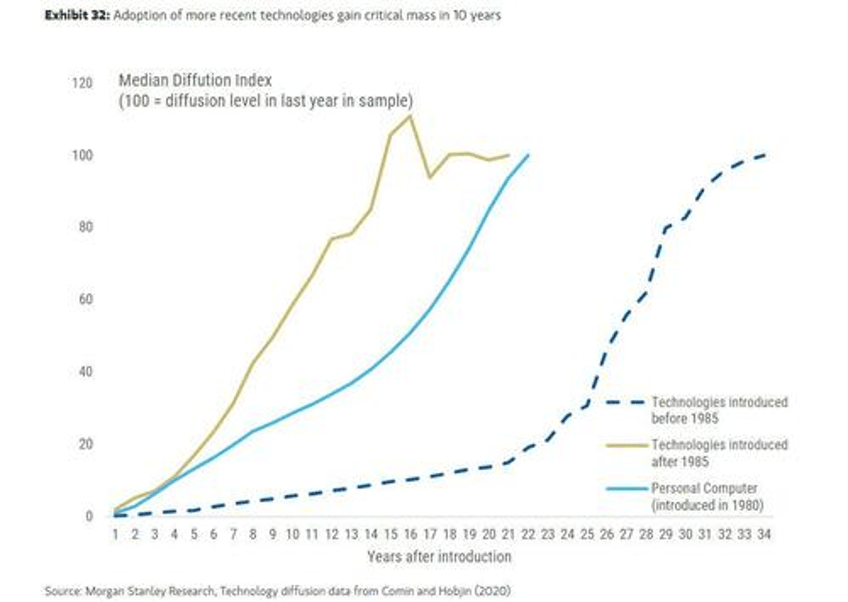

The other key question is in which sectors private equity funds are investing. As seasoned investors know, Wall Street bankers are skilled storytellers. Recently, the focus has been on the transformative potential of Artificial Intelligence, with claims that it will revolutionize all aspects of our lives, including how to build an army. However, just like previous overhyped narratives, the real challenge lies in the massive infrastructure capital required for AI to become profitable. As the focus shifts from early innovators to AI adopters, the demand for efficient capital will grow significantly. In this context, various forms of credit unsecured, secured, securitized, and asset-backed is supposed to play a major role. The diffusion of AI technology, particularly through generative AI and large language models, is poised to drive significant economic change.

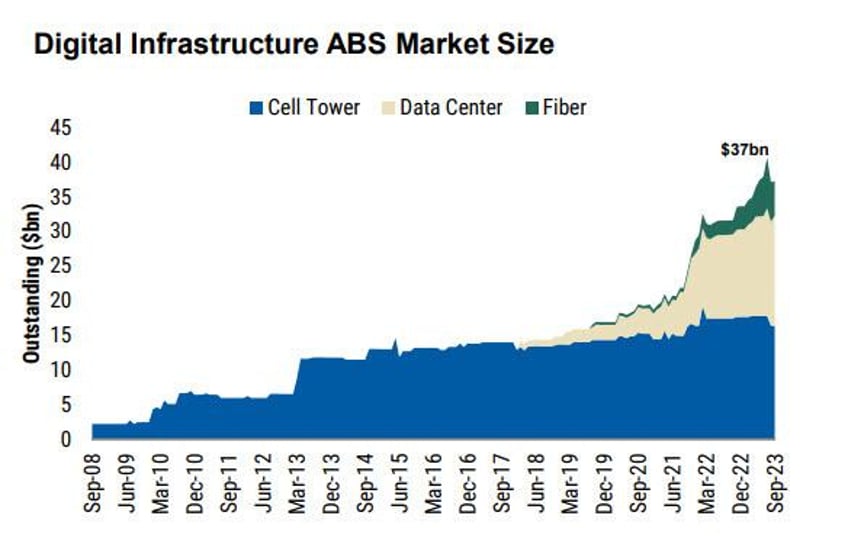

As the capital expenditure (capex) cycle shifts from AI enablers to adopters, it's important to note that most sectors are not as cash rich as technology. While the median cash-to-debt ratio in tech is over 50%, it's about 15% for other sectors. As AI infrastructure needs rise, reliance on credit markets will increase. Financing for AI infrastructure, particularly data centers, will extend beyond corporate credit markets. Data centers can be owned by their users or by operators leasing space, and their lease payments or the centers themselves can serve as collateral for securitization. This market, which began with the issuance of the first data center asset-backed securities (ABS) in 2018, has grown to over $20 billion and is set for rapid expansion.

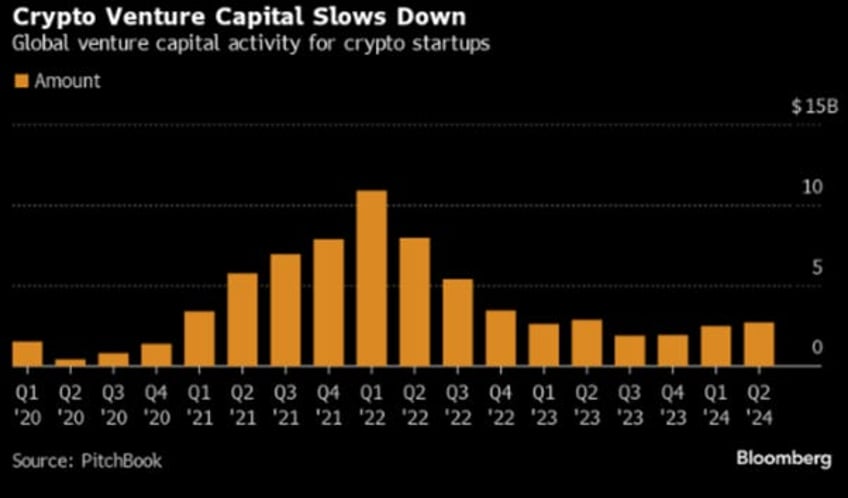

Outside of AI-related investments, venture capital, which is even riskier than private debt and private equity investments, has succumbed to the seductive charms of the crypto mermaids spreading the ‘Bitcoin scam’. Indeed, while still well below the levels reached in 2021 and 2022, VC investment in crypto has seen a resurgence over the past quarter, with more than $2.7 billion raised by this industry in the past three months. This marks the third consecutive quarterly increase in total investment in the sector. While investments are mostly focused on infrastructure projects such as new blockchains, venture capitalists remain wary of consumer-focused applications.

In summary, according to the ‘private asset alchemists’, as AI technology advances, credit markets are expected to play a growing role. Blackstone recently claimed, probably talking its own book, that the private-lending industry is still in its early stages and could expand to $25 trillion. This growth will be driven by financing needs for energy transition and data centers, despite growing scepticism about the real value of generative AI and increasing revelations about the 'climate change scam.' Blackstone recently highlighted that private credit is increasingly focused on real economy financing, including data centers and energy projects. They noted that higher base rates and the shift from banks to private lenders are fuelling this growth. Blackstone, also a major player in commercial and residential real estate, is aggressively pursuing data center investments and private debt to fund them. This strategy connects directly to firms like CoreWeave, which drives ‘artificial’ demand for Nvidia's AI chips, contributing to rising market valuations and the AI hype in general which we know is built on artificial accounting. With tight spreads in public markets, Blackstone is promoting private credit for its illiquidity premium, capitalizing on strong demand driven by AI and massive infrastructure investments.

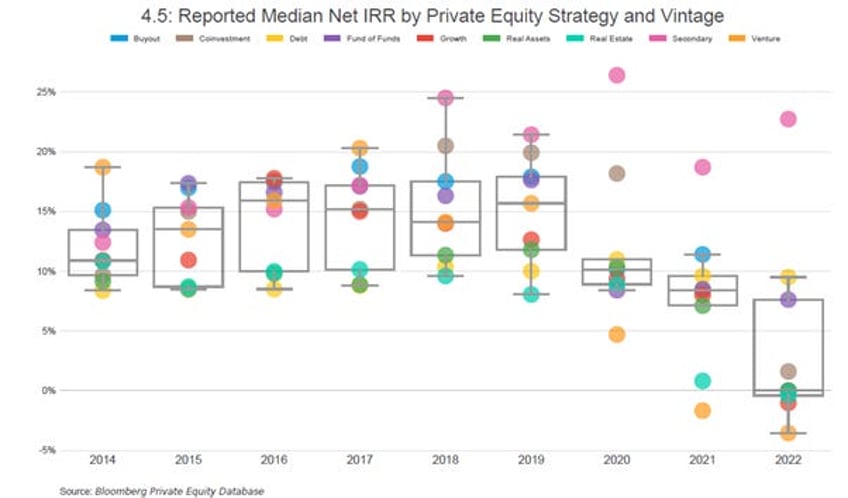

However, the recent sell-off in AI-related Magnificent 7 stocks may prompt investors to realize that the money they committed to financial alchemists promising 15% annualized returns over a minimum holding period of 5 years might not only fail to deliver these miraculous returns but could also result in significant capital losses. So, the next question is whether these financial alchemists have delivered on their promised returns. Analysing the net IRR of private equity strategies over the years, we see that despite all the promises, returns have significantly declined since the start of the COVID pandemic. This decline indicates that, in general, these funds may not justify the risks investors take by being locked into illiquid assets with often opaque investment structures.

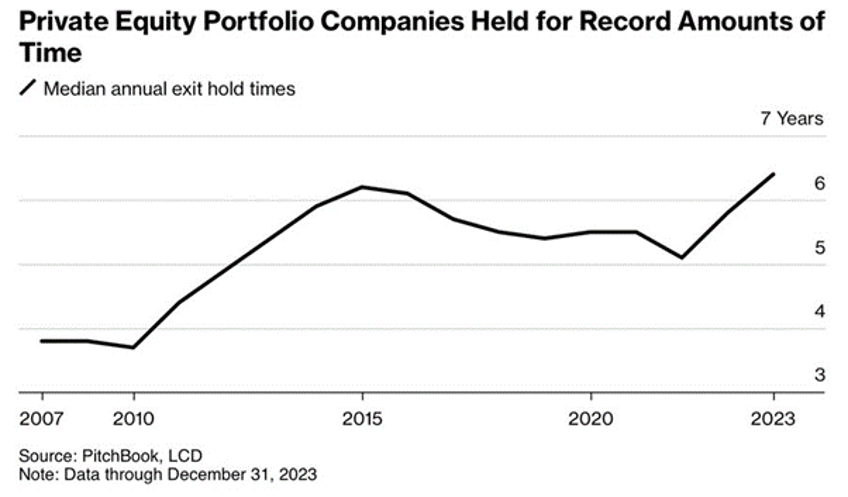

To generate returns, private equity firms often rely on exit strategies, with Initial Public Offerings (IPOs) being a common choice. This reliance is why investment bankers are eager to push high-net-worth investors into private equity. Experienced investors understand that IPOs typically occur only in a bull market. Notably, as of the end of 2023, the median annual exit hold times for private equity investments have reached a 15-year high.

Investors must understand that as the US moves deeper into inflation-driven misery and recession, low exit rates will likely turn into no exits at all. Those who believe that private equity offers a safety net against rising volatility in equity markets are in for a rude awakening.

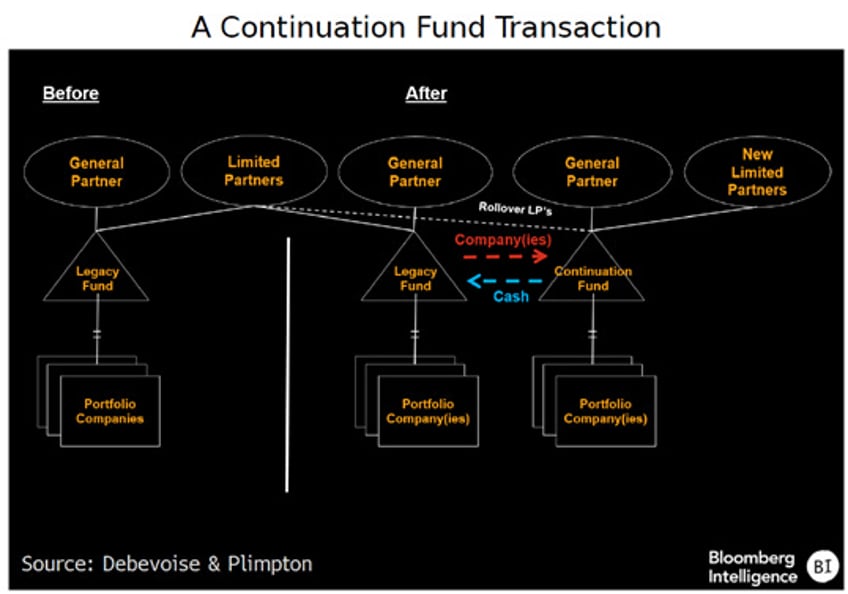

Without doubts, the growing ease of accessing secondary markets has given private equity funds greater flexibility and led to the rise of numerous "unicorns," such as SpaceX, OpenAI, and Stripe. Despite concerns from the SEC about reduced transparency, there have been no moves toward increased disclosure, and Congressional action may be needed if more high-profile failures occur. To manage liquidity or retain assets, private equity funds can engage in ‘secondary transactions’ rather than traditional exits. This includes selling parts of their portfolios, creating continuation funds, or starting new funds with the same assets but different investors. Investment managers like Ardian, which have invested in over 1,600 funds and 10,000 companies, capitalize on these transactions for the arbitrage opportunities, as secondaries are often sold at discounts compared to their final exit value.

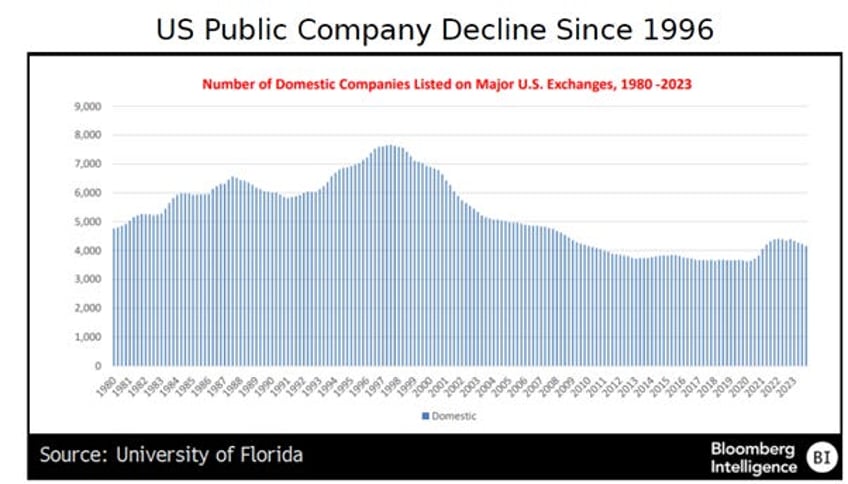

Ultimately, the decision for private companies to go public is increasingly driven by factors beyond capital access, such as creating acquisition currency, establishing a market price for their stock, or enhancing their reputation. A recent survey highlights that private companies can now raise comparable amounts from private markets as from public markets. Thus, companies often go public primarily for M&A opportunities, with newly public firms being more likely to engage in acquisitions than their established public peers. However, the significant compliance burdens of being a public company can be a major hurdle. While public company compliance has become more stringent, private company regulations have eased. The decline in US public companies since 1996, coupled with stringent regulations like Sarbanes-Oxley (2002) and Dodd-Frank (2010), contrasts with the liberalization of Regulation D for private companies in 2012. This has reduced the number of IPO as the incentive to go public is diminishing over times, especially for those companies which are not cast trapped.

Private equity and private debt funds are also known as being inherently opaque, allowing them significant latitude to delay the inevitable reckoning. Since these funds are not marked to market regularly, they often use artificial accounting techniques to avoid alarming investors until it's too late or they have no choice but to pull the plug.

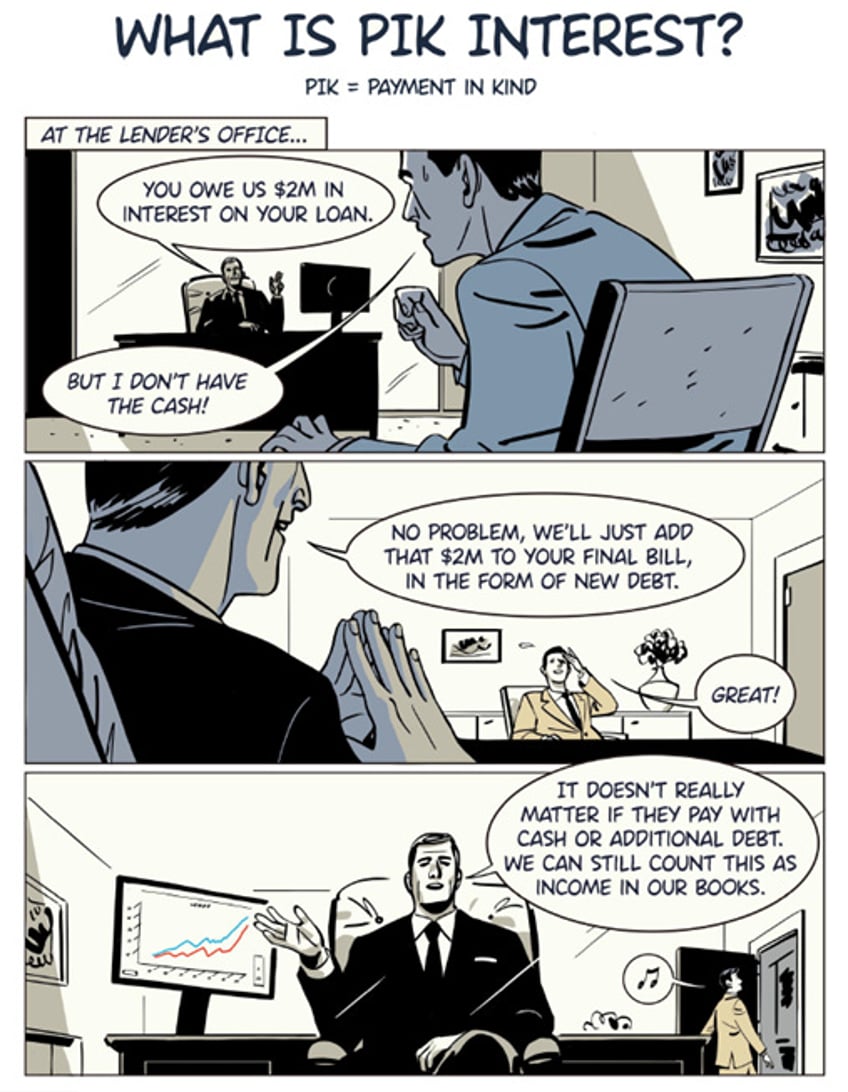

For example, Prospect Capital, a New York firm that helped pioneer the private credit boom, uses an unusual strategy to maintain dividends from its $8 billion fund: it sells financial instruments to retail investors and uses the proceeds for payouts. While this has everything of a Ponzi scheme, this has allowed the fund to distribute hefty dividends despite deteriorating investment performance, primarily in corporate loans and real estate. Last year, Prospect’s cash flows fell $200 million short of its dividend payouts, the largest gap in at least seven years. The fund’s market value has dropped over 40% below its underlying asset value, exacerbated by the FED’s rate hikes impacting floating-rate loans. Many borrowers have either defaulted, restructured out of court, or paid with additional debt (Payment-In-Kind, or PIK). PIK loans now make up a third of Prospect’s net investment income, twice the industry average. To cover the shortfall, Prospect CEO John F. Barry III has turned to selling bonds and preferred equity to individual investors. Funds like Prospect’s, regulated as business development companies (BDCs), must distribute at least 90% of taxable income, including PIK income, as dividends. Analysts warn that without significant changes in income generation, costly structural adjustments may be needed. Despite claiming strong loan performance and innovative financing, Prospect's high management fees and concentrated real estate investments have raised red flags. The recent increase in PIK loans and complex financing arrangements have drawn particular scrutiny.

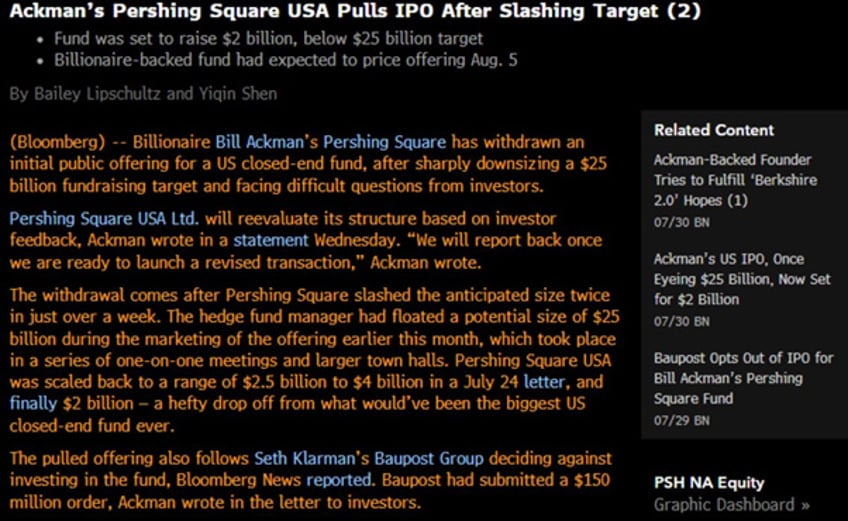

However, more prominent players in the industry have been in the news recently, confirming that times are tough as even attracting YOLO high net worth investors becomes challenging. This is especially the case when a high-profile venture capitalist withdraws an IPO. Bill Ackman, the outspoken asset manager, recently pulled the proposed listing of his closed-end fund, Pershing Square USA. This move represents a significant reversal for Ackman, who just months ago predicted it would be among the largest initial public offerings ever. The offering was initially set at $25 billion, then reduced to $10 billion, then to $2 billion, and now it's been cancelled altogether.

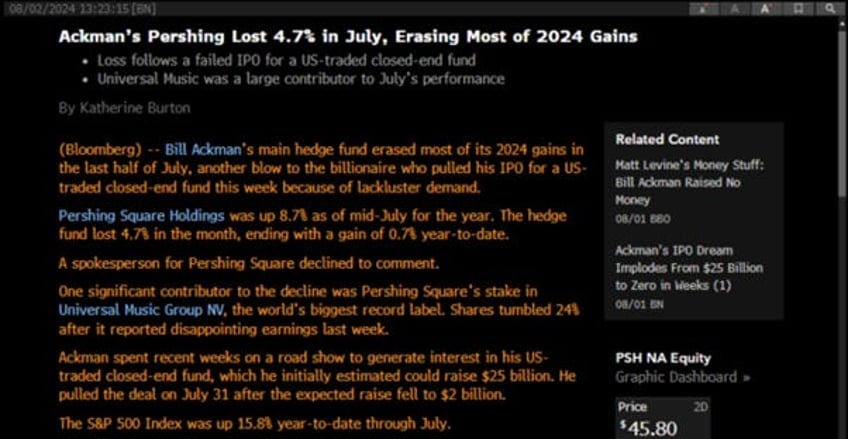

The cancellation of the Pershing Square USA IPO made all senses when investors discovered a few days later that Bill Ackman's hedge fund had erased most of its 2024 gains by July, even before the market downturn in early August.

Bill Ackman isn't the only high-profile manager in private equity and private debt currently facing difficulties. Investors may recall that the $69 billion Blackstone Real Estate Income Trust (BREIT) has had a rough ride over the past two years. In December 2022, the fund shocked the markets by gating redemptions. Although Blackstone announced in early April this year that it will no longer limit redemptions, it’s important to note that the fund can only accommodate a maximum of 2% of its NAV in monthly redemptions. Private equity and private debt funds are inherently illiquid. In times of rising volatility and potential crisis, investors may find themselves gated or forced to sell assets at significant discounts. The notion of a ‘semi-liquid’ vehicle in private assets is an illusion that investors should be wary of.

Another notable private fund recently in the news is the Blackstone Mortgage Trust, which provides financing for commercial real estate. On July 27, 2024, BMXT announced a 24% cut in its dividend due to increasing defaults and difficulties borrowers are facing in making payments or refinancing their loans. A significant portion of the troubled loans are tied to U.S. office buildings, which constitute about a quarter of the fund’s outstanding loans. According to the Green Street Commercial Property Price Index, U.S. office values have dropped 37% from their early 2022 peak, compared to a 20% decline for all commercial property.

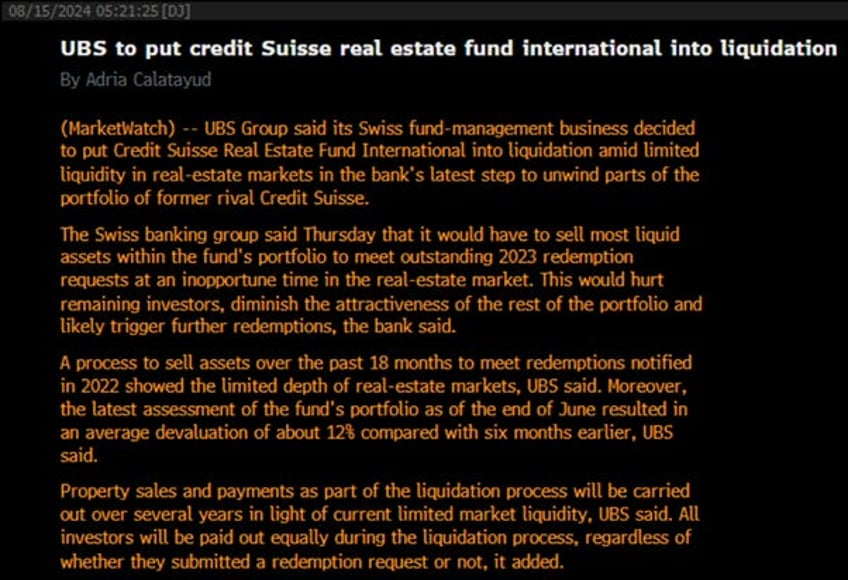

With the ongoing crisis hitting the commercial real estate market globally, Blackstone is not the only company struggling to monetize its investments in the sector. UBS, which reported Q2 2024 results largely driven by its highly volatile investment banking division while its wealth management unit continued to suffer from the costly integration of the struggling Credit Suisse, has also decided to liquidate the Credit Suisse Real Estate Fund International. UBS is taking steps to unwind parts of its former rival Credit Suisse's portfolio. This liquidation will involve selling the most liquid assets to meet outstanding 2023 redemption requests. UBS noted in its press release that the liquidation process will extend over several years due to limited market liquidity and a lack of buyers for this asset class.

Many well-known brands, including Payless Shoes, Toys R Us, Claire's, and more recently Red Lobster, have also fallen victim to the early stages of the 'Private Equity bubble' burst. The problem with private equity isn't just the higher bankruptcy rates; it's the reliance on excessive leverage to buy companies, which has become a serious issue.

https://www.thestreet.com/restaurants/red-lobster-shares-much-worse-chapter-11-bankruptcy-news

This brings us to the final question: Should investors invest in private equity, and can private equity replace gold and silver as the antifragile asset? Answering this question is challenging due to the various strategies within the private equity sector. However, investors can gauge returns by looking at the Bloomberg Private Equity Index, which represents the average NAV-based return of private equity funds as defined by the Bloomberg Private Equity Classification. Over the past 15 years, the Bloomberg Private Equity Index has outperformed the S&P 500 and gold. However, investors seeking diversification should note the high correlation between the index and the S&P 500, which diminishes the diversification benefit of holding private equity in a portfolio. Although $100 invested in private equity has generally outperformed the same amount invested in the gold over the period, the underperformance of gold has been delivered with a lower correlation to the S&P 500, demonstrating gold's role as an antifragile asset in a diversified portfolio.

Performance of $100 invested in Bloomberg Private Equity Index (blue line); S&P 500 Index (red line); Gold USD price (green line) as of 31st December 2007 and correlations.

Readers who have scrutinized the chart above should have noticed that the Private Equity Index has been mostly flat since the end of 2022. Seasoned investors are familiar with the magazine cover curse. In December 2023, Blackstone’s CEO was featured on the cover of Forbes, which coincided with the onset of problems for the asset class.

That was also around the time Blackstone made its ‘woke coming out’ with its 2023 holiday video.

Another sign that the private equity hype has peaked can be observed with celebrities like Kim Kardashian and Jay-Z launching their own PE firms. As history showed, celebrities are a good sentiment signal that a bubble is about to burst as it was the case with the FTX collapse which signalled the top of the Crypto bubble that has not yet finished to deflate.

While the ‘Go Woke Go Broke’ narrative alone may not be enough to build an investment case, the real issue for investors who have trusted these financial alchemists will be discovering that they are paying exorbitant fees for returns that barely outperform those of a passive S&P 500 index ETF over the long-term. When it comes time to exit, the crowded redemption requests will likely lead to gates being imposed, and the promised high returns in any economic environment will turn into a financial nightmare. Investors' money will not only be locked up by the managers but will also face significant drawdowns that have been obscured so far using phantasmagorical mark-to-model rather than mark-to-market accounting rules.

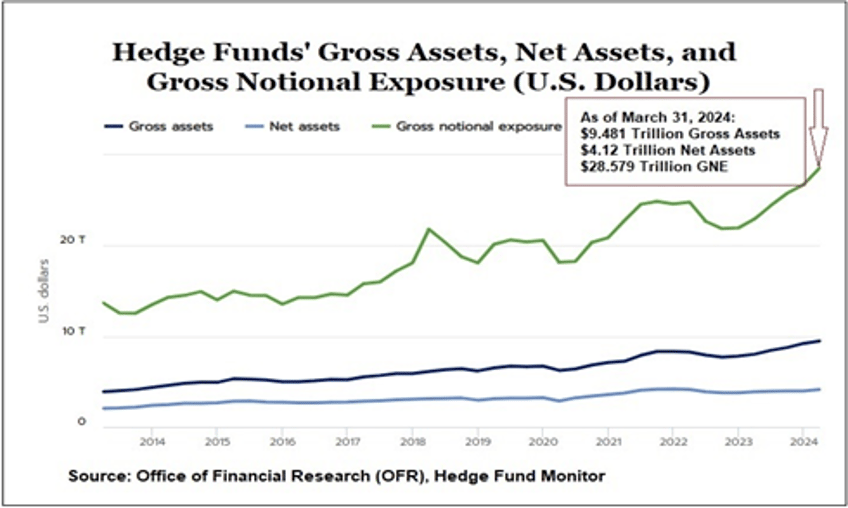

While not being part of the ‘private assets’ the hedge fund industry seems to be an even bigger risk for the financial sector. According to a report from the US Treasury's Office of Financial Research (OFR), hedge fund Gross Notional Exposure (GNE) surged by 24.5% over the past year, reaching $28.579 trillion by March 31, 2024, up from $22.946 trillion. GNE reflects the total of long and short exposures, both on and off-balance sheets. Despite the banking crisis of spring 2023, hedge fund exposure has dramatically increased. The OFR, established by the Dodd-Frank Act to monitor financial risks, is facing significant challenges due to Wall Street's influence.

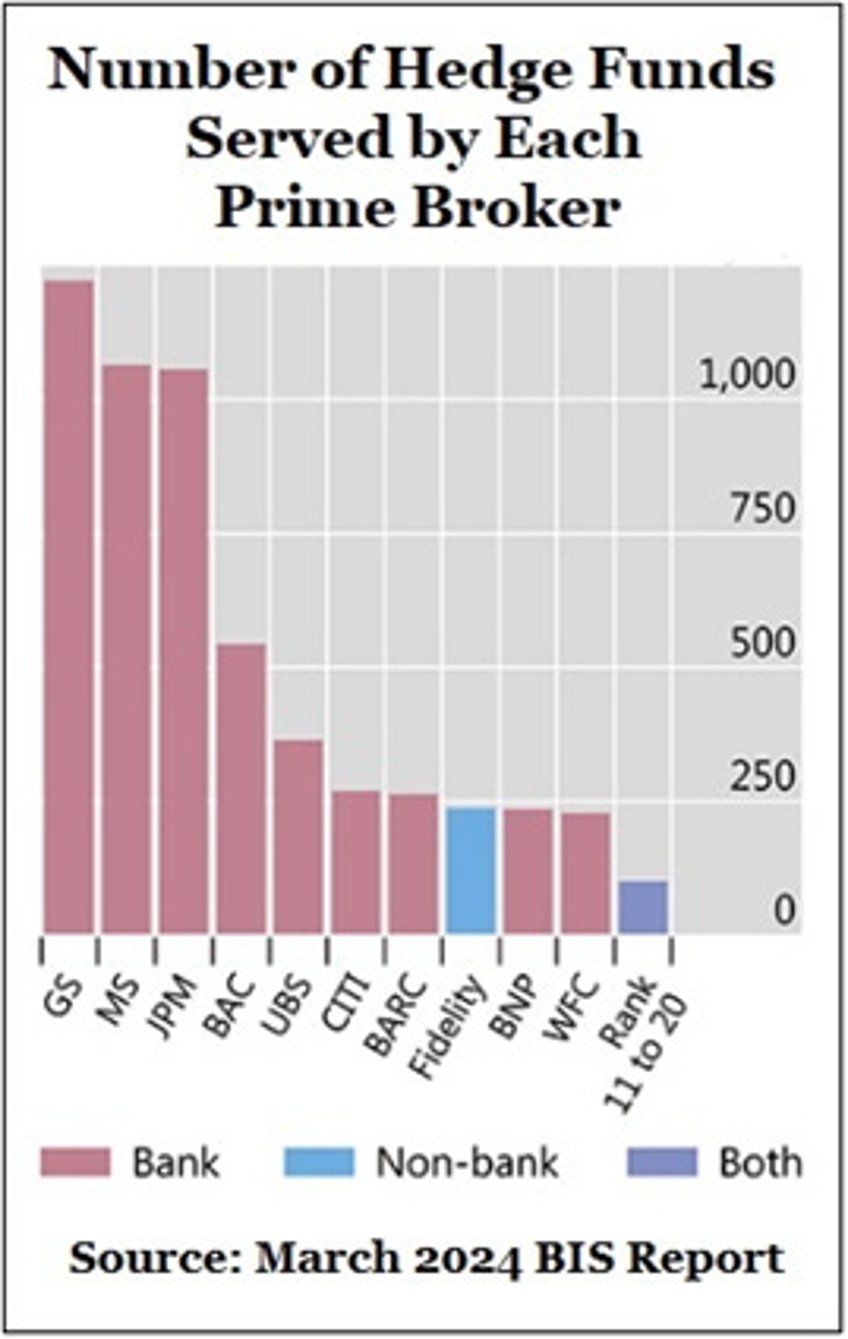

The OFR warns that over-leveraged hedge funds depend on continued lending and face risks from declines in asset values, which can lead to margin calls and liquidity issues. Major Wall Street banks, which can own federally insured banks, provide this leverage through their ‘Prime Broker’ services. A March 4th report from the Bank for International Settlements revealed that Goldman Sachs, Morgan Stanley, and JPMorgan Chase each serviced over 1,000 hedge funds. These megabanks, known for their risk management issues, have histories of questionable practices. For instance, during the 2008 crisis, Morgan Stanley's hedge fund FrontPoint bet against subprime mortgages while receiving substantial FED emergency loans. Goldman Sachs faced SEC charges over the ABACUS deal, where it allowed a hedge fund to profit from dodgy investments. JPMorgan Chase, despite criminal convictions, retained stakes in hedge funds. These examples highlight significant concerns about risk management and regulatory oversight on Wall Street. As everyone knows, there are little to no guardrails or moral compass on Wall Street in its pursuit of profits. History shows that bankers often play the unfair game of ‘Tail I Win, Toss I Win,’ as they have a history of privatizing profits and socializing losses by seeking taxpayer-funded bailouts when their unconsidered risky behaviour pushes them to the brink of bankruptcy.

As everyone knows, the market has been turbulent with a big drawdown in the S&P since the start of August, a spike in volatility, and a rebound that has some believing the worst is over. While, in times of extreme equity market pain, it may seem comforting to know that Private Equity & Credit funds valuations are largely unchanged, investors will sooner or later discover that what is supposed to be a winning investment proposal is just as fake as the photos generated by generative AI of politicians on their campaign trails. With Wall Street complicit in the falsehood, as it makes bankers' lives easier, investors will find that bezzling black stone and rock will impede their goal of focusing on RETURN OF CAPITAL as RETURN ON CAPITAL fizzles. Liquidity dislocations have historically had unexpected consequences, and this time, it could be private assets, being the dolphins and whales falling victim to liquidity-driven dynamite fishing. This market dislocation could transform the current consumer recession into a full-blown economic downturn. Bottom line, investors must understand that private valuations should mirror public ones, so if public valuations drop 20%, private valuations should follow. If private equity firms don't mark their portfolios down, it could lead to redemption demands, triggering an unwinding. As risks are rising and complacency disappears, the private asset class may ultimately turn investors into ostriches, who refuse to face the reality of higher risks and volatility in an ever-evolving financial world.

However, this is NOT a time to get pessimistic; it is a time to observe, study, and understand what lies ahead for us as investors and citizens. We, The People, need to be prepared for the future to come as the challenges we endured in the past become our tools to reshape the future!

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/bezzling-black-stone-ahead

If this report has inspired you to invest in gold, consider Hard Assets Alliance to buy your physical gold: https://www.hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.