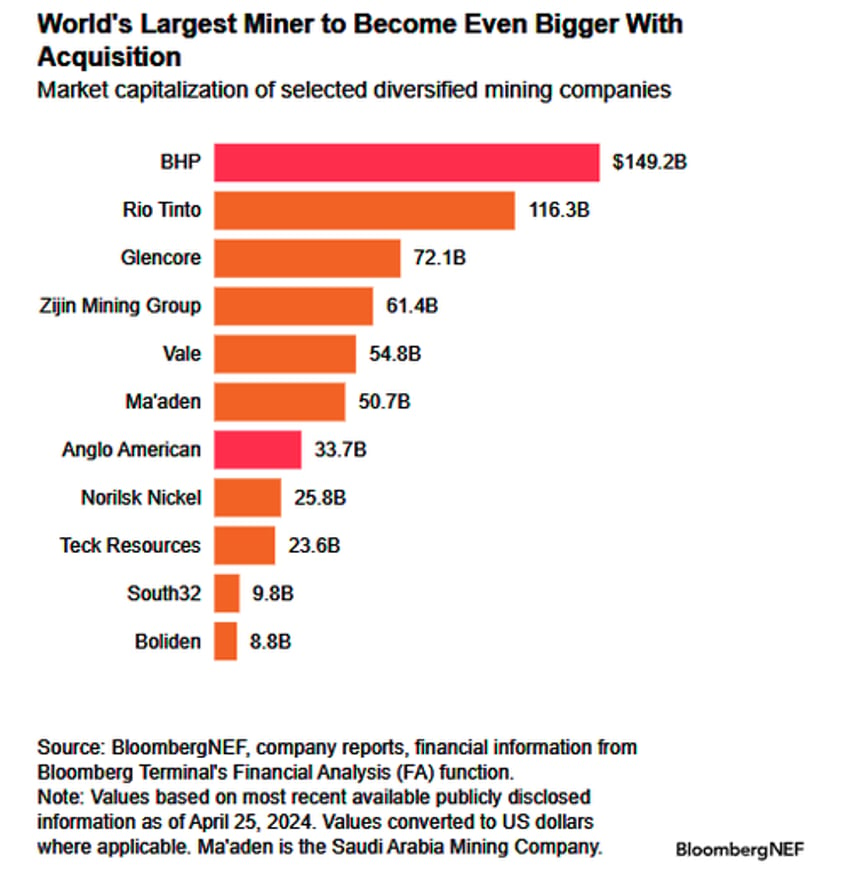

The world's largest global diversified miner, BHP Group, is making a monster bet on surging future copper demand with the proposed takeover of Anglo American Plc. The bet is based on the thesis that the world's power grids need a major overhaul and that the electrification of the economy will unleash new demand for base metals. This also comes as market observers have warned about an impending shortfall of global copper mining supply.

According to Bloomberg, BHP proposed an all-share deal valued at £31.1 billion ($38.9 billion). The transaction depends on Anglo spinning off its South African iron ore and platinum businesses to its shareholders. The offer is conditional and non-binding at £25.08 a share, or about a 14% premium to Anglo's closing share price on Wednesday.

Anglo shares in London jumped 13% to £24.89, giving the company a market capitalization of about £30.5 billion.

BHP's proposed acquisition of Anglo would dwarf its 2023 takeover of Australian copper producer OZ Minerals. The top miner believes copper demand will double over the next three decades.

Copper is a critical base metal for infrastructure and renewable energy. BHP bets that the world's power grids must be upgraded as fossil fuel demand slides and the global economy's electrification ramps up.

If the deal closes, BHP will become the world's biggest copper producer (controlling roughly 10% of the global copper mining supply), which comes as some market observers are warning about supply shortfalls.

About a year ago, billionaire mining investor Robert Friedland explained to Bloomberg TV in an interview that copper prices are set to soar because the mining industry is failing to increase supply ahead of 'accelerating demand.' He warned:

"We're heading for a train wreck here."

Friedland is the founder of Ivanhoe Mines Ltd. He continued, "My fear is that when push finally comes to shove," copper prices might explode ten times.

Jefferies' commodity desk recently warned, "Disruptions have significantly increased, and a market deficit is now increasingly likely. We could be at the foothills of the next copper cycle."

BofA recently warned, "The copper supply crisis is here."

Let's not forget about our note titled "The Next AI Trade," which explains the investment opportunities in upgrading the nation's grid as generative AI data centers increase power demand.

And Jefferies is on it: "Copper Demand in Data Centers."

Back to BHP, the company said in a statement to London Stock Exchange that the takeover would increase its "exposure to future-facing commodities through Anglo American's world-class copper assets" as well as "complementing BHP's iron ore and metallurgical coal portfolios."

Jefferies analysts commented on the proposed takeover, indicating BHP might face competition in its pursuit of Anglo.

"Our analysis suggests that Anglo consists of an undervalued portfolio of multiple tier 1 assets several of which are in low-risk jurisdictions (Australia, Chile, Peru and Brazil)," Jefferies said.

Jefferies Christopher LaFemina said:

"We would be surprised if this is BHP's final offer," adding, "We estimate that a price of at least £28/sh would be necessary for serious discussions to take place, and a takeout price of well above £30 per share would be the outcome if other bidders were to get involved."

A successful takeover would mark the first mega mining deal in more than a decade and signify the importance of critical metals and their use in upgrading the world's power grid.