Published at The Bitcoin Layer. Follow Joe and Nik on X.

Welcome to TBL Weekly #96—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

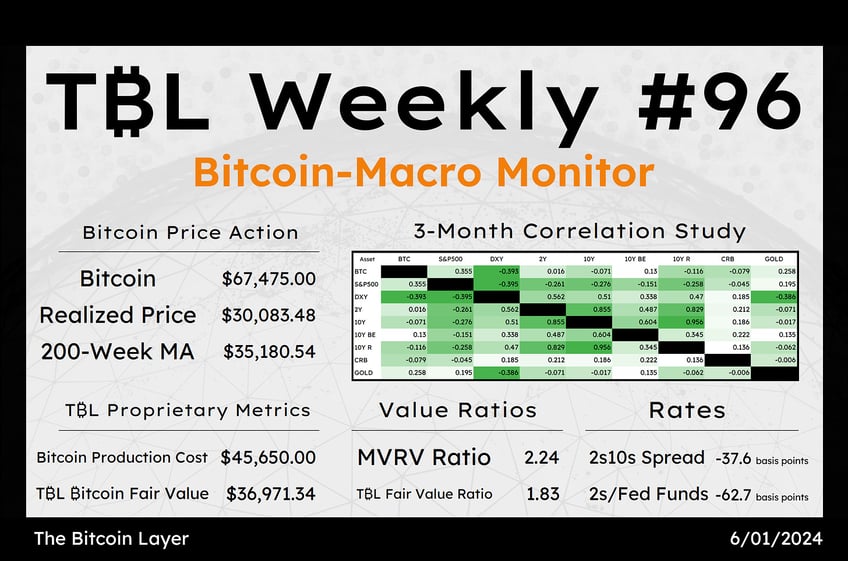

See our Bitcoin & Macro Glossary for term definitions

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning TBL Readers, happy Saturday ☕

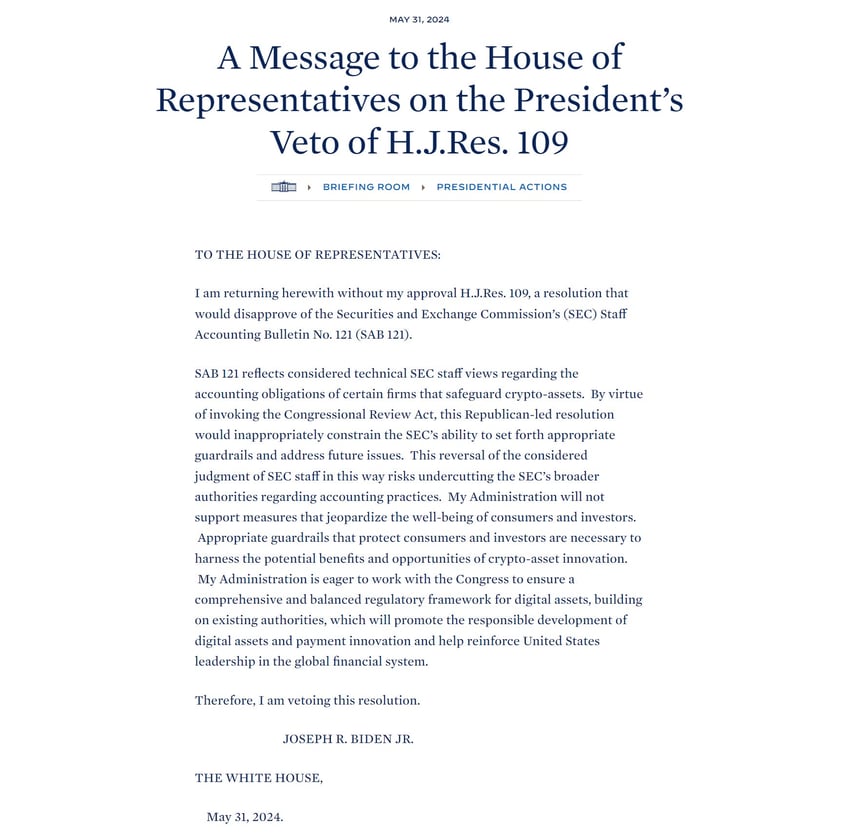

Biden vetoed the bill that would allow highly regulated financial institutions to custody bitcoin on behalf of their clients. This was a huge layup for Biden and the Democrats: with no effort at all, they could have wiped away years of bad press and become a pro-bitcoin, pro-innovation party. Instead, the President decided to veto the very first pro-crypto bill that came across his desk. American voters are voicing their support for pro-crypto policy given the 60 million or more who own and custody it. It is a losing battle to push restrictive bitcoin policy in 2024.

The Republicans locked up a series of wins by getting several pro-BTC measures created and passed through the House and the Senate, with many Democrats crossing the aisle to support these measures too. The Biden administration, however, which has been floundering in the polls as the weeks and months go by, decided to dig its heels even further in the sand on a decidedly losing issue. He is avowedly anti-bitcoin, and he may be sealing his own fate in doing so.

Source: whitehouse.gov

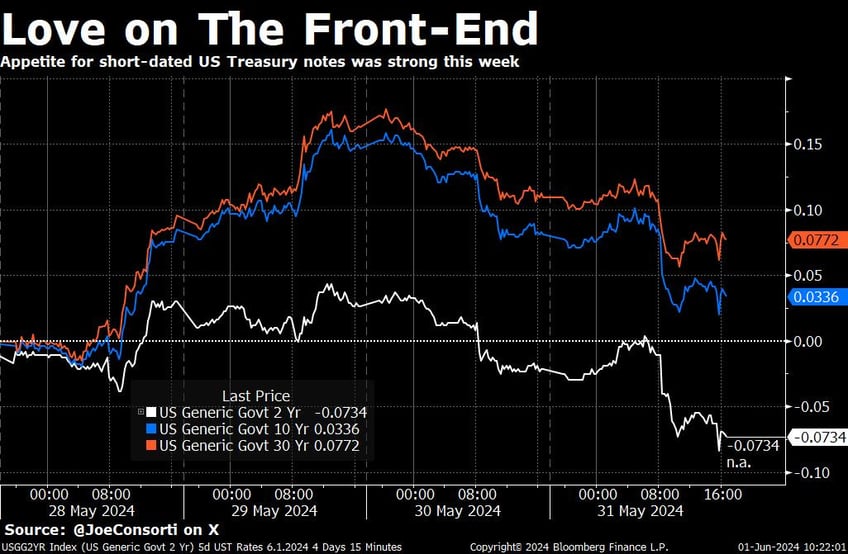

Rates were choppy this week, with several auctions tailing (weak demand) and sending yields marginally higher. Appetite for the front-end of the US Treasury curve is stronger than the long end, with 2s falling 7 bps over the last 5 trading days, while 10s and 30s rose 3 and 7 bps respectively.

The rise in growth and inflation expectations, seen in 10s and 30s (blue and orange) at the start of the week on Tuesday and Wednesday was due to economic releases coming in as expected or hot, and strong corporate earnings last week. The flip on Thursday into a decline in rate expectations and a reduction in growth expectations came due to sour economic data on Thursday and Friday. The Q1 revision for GDP fell by 0.3%, personal consumption missed expectations, and prices in both the GDP release and the Core PCE release showed slight deceleration. Personal income and spending both missed on Friday and the MNI Chicago PMI missed by more than 6 points and moved in the opposite direction of expectations. Strong start due to tailwind effect of corporate earnings, tepid finish due to mid-week reversal in economic fortune. Outcome, chop:

Take my explanation for rates’ behavior from above and apply it to the chart of the S&P 500’s trading week price action below, and you know why it behaved the same way, albeit in the inverse direction. Choppiness all around:

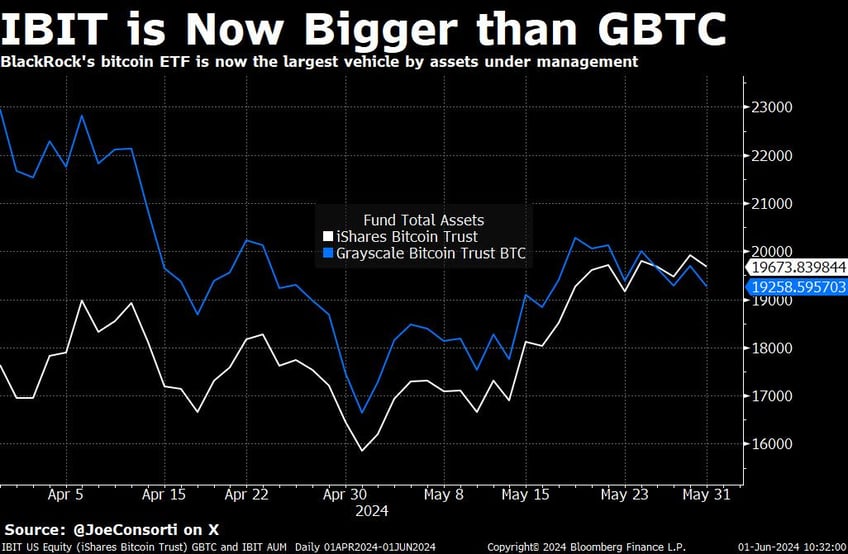

BlackRock's IBIT ETF has recently overtaken Grayscale's GBTC ETF to become the largest bitcoin fund globally, managing a staggering $19.67 billion in assets under management (AUM). Goodnight, Barry:

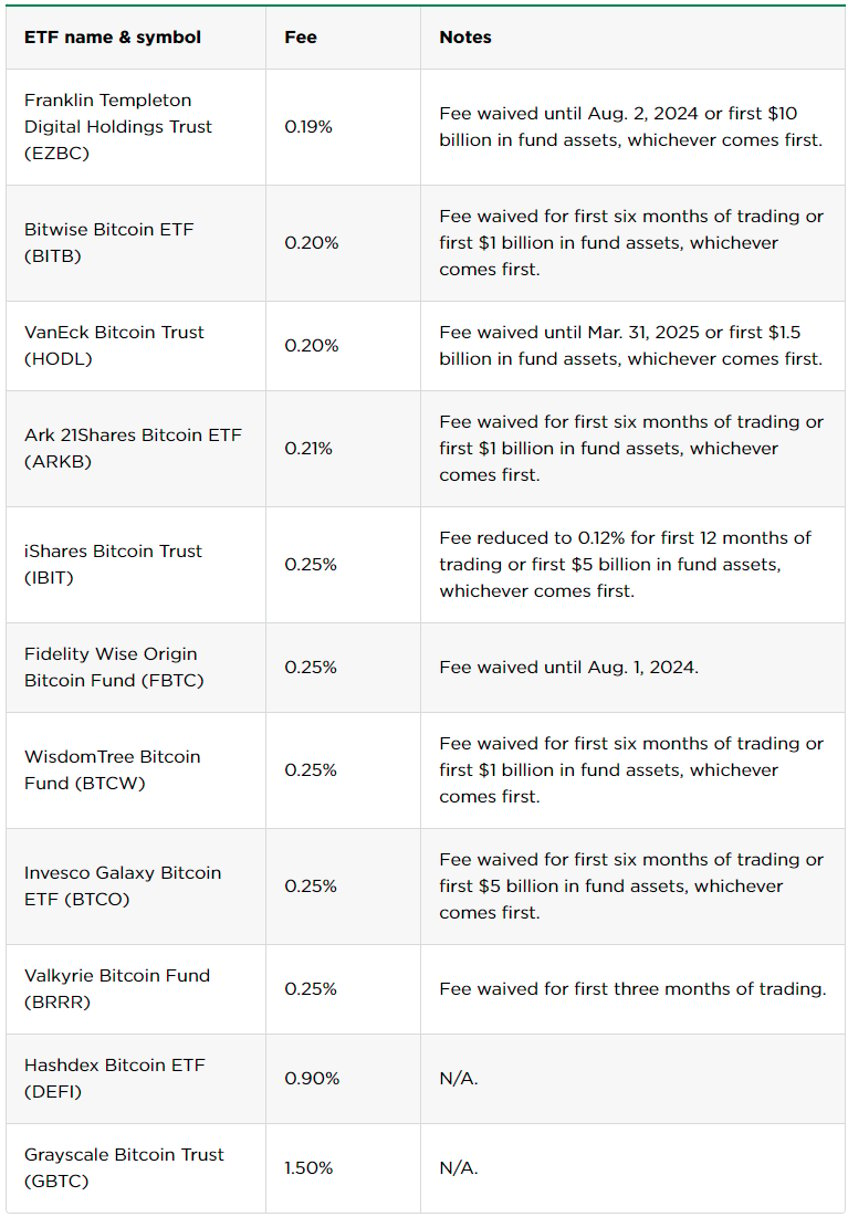

This milestone was driven by its more competitive fee structure of 0.25%, significantly lower than Grayscale's 1.5%. The reduced fees make BlackRock's offering more attractive to investors, particularly given its size as the world’s largest asset manager. Fees with other vehicles are the same 0.25%, or lower in one case, but it all boils down to BlackRock’s sheer size, name value, existing AUM, client base, and reputation.

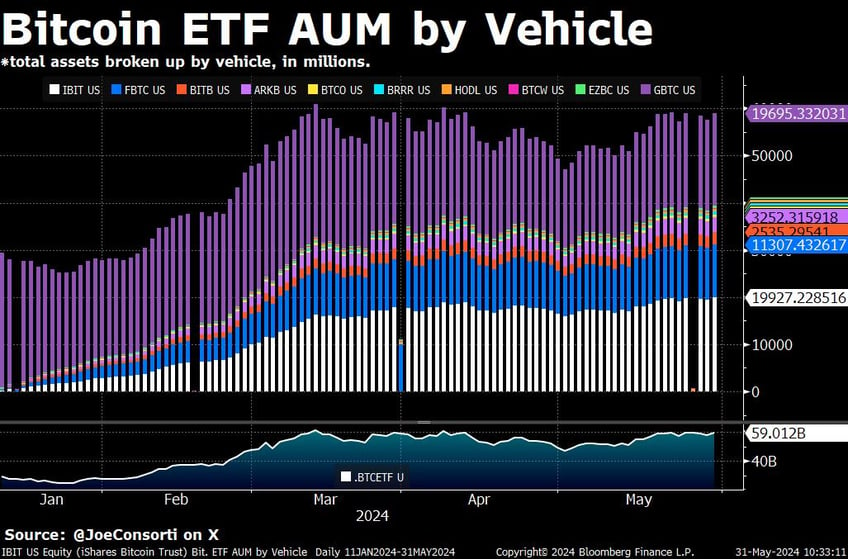

IBIT has been thrust to the forefront of the spot bitcoin ETF space, and we doubt that the crown will ever fall from its head:

Taking a look at every spot bitcoin ETF’s assets under management, BlackRock’s IBIT in white is now larger than the incumbent king GBTC in purple. Perhaps I should swap these colors now that there’s a new king in town.

With Grayscale shuffling its executive deck away from Michael Sonnenshein, the man we have to thank for these ETF approvals in the first place, to an industry veteran, it’s clearly trying to win back dominance and retain its relevance to institutional investors. So long as its fee remains arbitrarily high, its AUM will continue to wane and give up market share to its cheaper, more reputable competitors:

Next Week with Nik

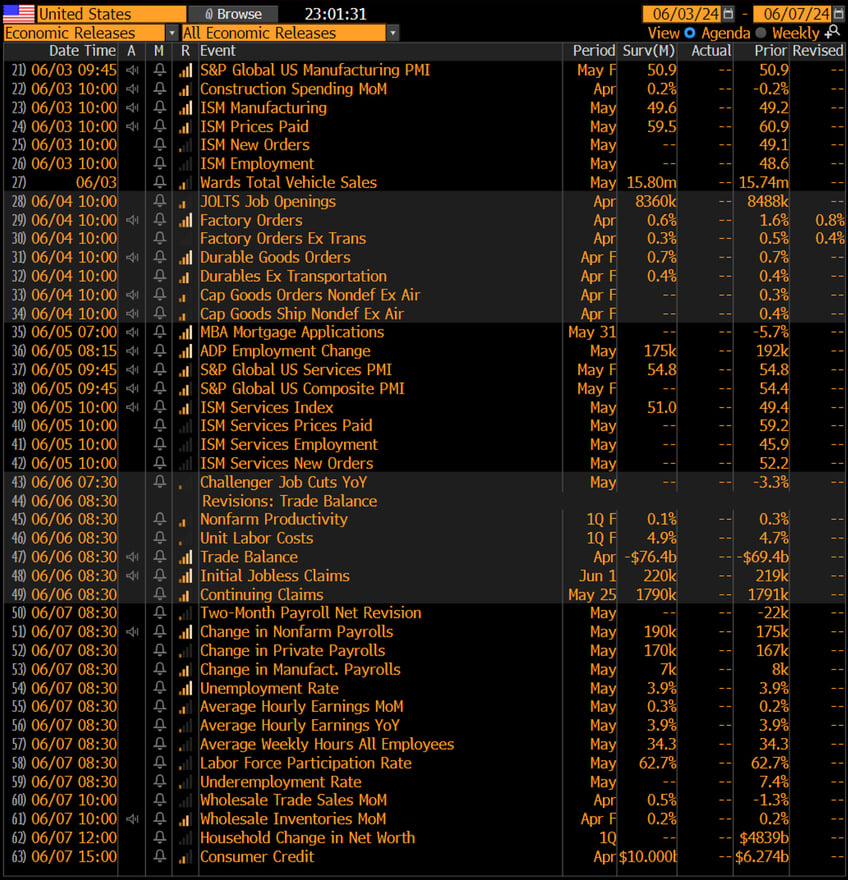

Finally, the return of fresh, tier-1 employment data! Next week, we will learn a lot about the health of the labor market, with JOLTS, nonfarm payrolls, and average hourly earnings all set to print. This is not to mention the employment subreadings within ISM services and manufacturing, also releasing next week. Needless to say, the market has plenty of economic information off which to trade, but our focus remains slightly divided.

Over the past few months, it's clear that the Fed is just as confused as we are. Simply put, I can make an extremely strong case for 5% 10s, as well as one for 4% 10s. And with such a balanced outlook, economic releases bring intrigue on how the market interprets the data, in addition to the data itself. The case for higher yields is sticky inflation and a Fed refusing to finish the job out of fear of financial calamities. The case for lower yields is a recession on the horizon that brings inflation back down. Hiding in the background is the AI revolution, set to be disinflationary for labor costs. And lastly, towering over everybody else, is a forward looking $50 trillion in public debt at well over 100% of GDP, mandating inflationary policies to diminish bonds' real value. Lastly, Treasury auctions take a respite next week:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Subscribe to The Bitcoin Layer

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

In this video, Joe walks through bombshell developments last week in the political sphere surrounding bitcoin. He discusses the announcement that Donald Trump is reportedly considering bitcoin to address the U.S.' $35-trillion debt problem. He also breaks down the U.S. debt problem and why it has become so unsustainable, showing the trajectory of our debt growth and providing an analogy for viewers to better understand it. He discusses how this would be the first instance of a G20 nation purchasing bitcoin for its reserves, and why it would pave the way for a tidal wave of other nations to follow suit.

Check out—Could The United States BUY BITCOIN?

Wednesday

We’re not a political outlet—we’re a bitcoin and global macro research firm. This development has sweeping implications for how bitcoin as an asset and network is treated here in the United States and therefore how capital allocators will position themselves. In today’s post, we cover:

Trump’s bitcoin strategy as an aid for the US’ $35-trillion national debt problem

Why the US debt problem is so bad that the only way out is to print money

A tsunami of companies are buying bitcoin for their treasuries

Check out—Bitcoin treasury holdings are going mainstream

In this episode, Nik is joined by TBL's correspondent in Africa, Noelyne Sumba. Recorded just before Marathon's huge announcement on mining bitcoin in Kenya, Noelyne explains recent positive developments in North and East Africa around bitcoin mining. As policymakers continue to enact pro-mining ordinances and approve investment in Africa, Noelyne discusses why she thinks lives will be positively affected as energy infrastructure and consumption can bring people hope and better access to the global economy.

Check out—Bitcoin Is Changing Lives In Africa

Thursday

Welcome back to another week of TBL Thinks. This week we give you the breakdown on the US housing and commercial real estate markets. Then, we make our way to China for a brief peek into the country’s real estate woes.

Check out—TBL Thinks Real Estate Edition: Retail, ARMs, & China bailouts

In this episode, Nik brings us a global macro update focused on the US government's grand manipulation of the dollar. Nik argues that although the dollar index oscillates, the major theme of introducing dollar liquidity/supply to suppress its value continues to drive asset prices, including Treasuries, stocks, gold, and of course, bitcoin. Join us for an in-depth discussion of the US fiscal picture, tax receipts, interest expense, debt-to-GDP, asset returns, and a global monetary reset.

Check out—Global Macro Update: Bitcoin Thrives When US Manipulates Dollar

Friday

You all are a highly educated, avid reading bunch. Whenever I pose questions on theoretical macro topics, you always have a name ready to submit as a relied-upon expert. For that, thank you—it has made my job as a researcher more enjoyable and challenging, and the analysis is better for it. It also reminds me that I’m still a rookie. Now with a little over decade of fixed income experience, I’m constantly reminded at the gaps in history I must fill into my own arsenal to conjure up today’s full macro picture. There is no substitute for experience.

With that, I spent the past several days on the framework of Luke Gromen, one of your favorite analysts. In today’s letter, I’ll drill down into some of his core arguments, represent my own, and discuss why his historical context inspired me. This one is heavy on the bullish implications for bitcoin, and it begins with a timely update on bitcoin capital flows.

Check out—The dollar endgame

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Subscribe to The Bitcoin Layer

That’s all for our markets recap—have a great weekend, everyone!