Homebuilder sentiment crashed in September, the second consecutive monthly decline, as higher mortgage rates scared off prospective buyers.

The National Association of Home Builders/Wells Fargo index of home builder sentiment fell five points to 45. The figure was below even the most pessimistic estimates in a survey of analysts by Econoday.

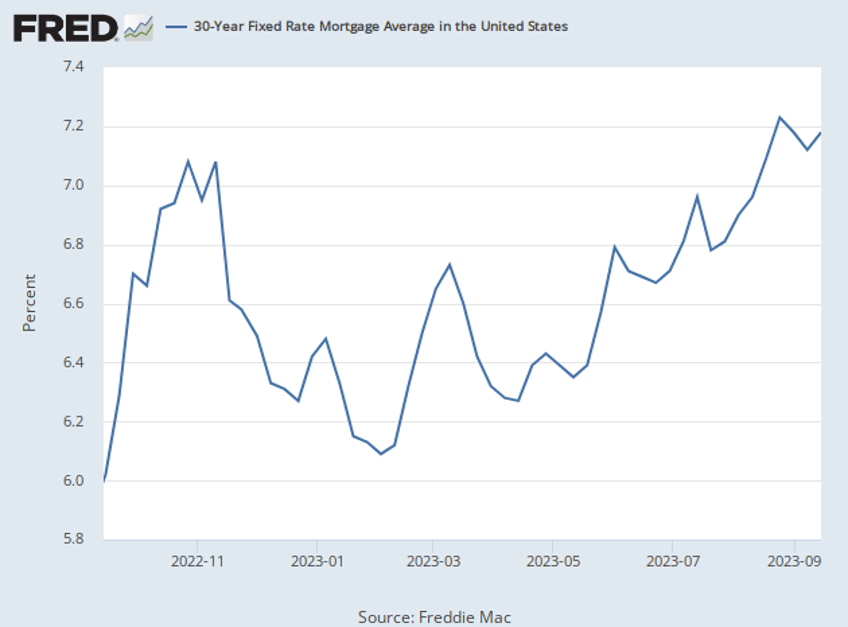

“The two-month decline in builder sentiment coincides with when mortgage rates jumped above 7% and significantly eroded buyer purchasing power,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “And on the supply-side front, builders continue to grapple with shortages of construction workers, buildable lots and distribution transformers, which is further adding to housing affordability woes. Insurance cost and availability is also a growing concern for the housing sector.”

The gauge retreated to 50 in August from a 13-month high of 56 in July. That was the first decline of the year and largely reflected a decline in prospective buyer foot traffic to model homes. Readings below 50 indicate that homebuilders view market conditions are bad.

“High mortgage rates are clearly taking a toll on builder confidence and consumer demand, as a growing number of buyers are electing to defer a home purchase until long-term rates move lower,” said NAHB Chief Economist Robert Dietz.

A lack of supply of previously owned homes on the market has been sending buyers into the new home market and encouraging builders this year despite rates climbing higher. In August, however, rates jumped above seven percent and that seems to have been a tipping point for would be home buyers.

The NAHB commented:

As mortgage rates stayed above 7% over the last month, more builders are reducing home prices again to bolster sales. In September, 32% of builders reported cutting home prices, compared to 25% in August. That’s the largest share of builders cutting prices since December 2022 (35%). The average price discount remains at 6%. Meanwhile, 59% of builders provided sales incentives of all forms in September, more than any month since April 2023.

While more pricing-out is now occurring, the lack of resale inventory at the start of 2023 has shifted the new construction buyer mix. A special question in the September HMI survey revealed that 42% of new single-family home buyers were first-time buyers on a year-to-date basis in 2023. This is significantly higher than the 27% reading from a more normalized market in 2018.

Mortgage rates have been pushed sharply higher by the Federal Reserve’s campaign to fight inflation by tightening monetary policy. The Fed has lifted its benchmark rate from nearly zero to over five percent and it has been reducing its bond holdings, allowing tens of billions of dollars of mortgage-backed securities and Treasuries to roll off as they mature.

Inflation climbed to forty-year highs after President Joe Biden pushed through an expansive fiscal policy in the form of the American Rescue Plan Act. That legislation poured deficit spending into an economy already recovering from the pandemic and lockdowns, causing prices to shoot upward at a pace not seen since the Carter and Reagan administrations. Although the deficit declined last year, this year it is expected to skyrocket again.