Subscribe on our website www.gmgresearch.com

Market Update: Key Insights for the Week

Big rate cut decision on Wednesday the 18th. We are in the 25bps camp (see below).

Gold volatility up, Bitcoin and Silver rising.

We like: Interest rates, USD, Utilities, AMD, ARM, Coupang, Meta, Coffee, Home Builders, and Bitcoin.

Positive market drivers: reasonable valuations, rising earnings, and falling rates/

Unemployment rise is due to labor force participation, not a sign of broader economic distress—ignore fear-driven headlines…. for now.

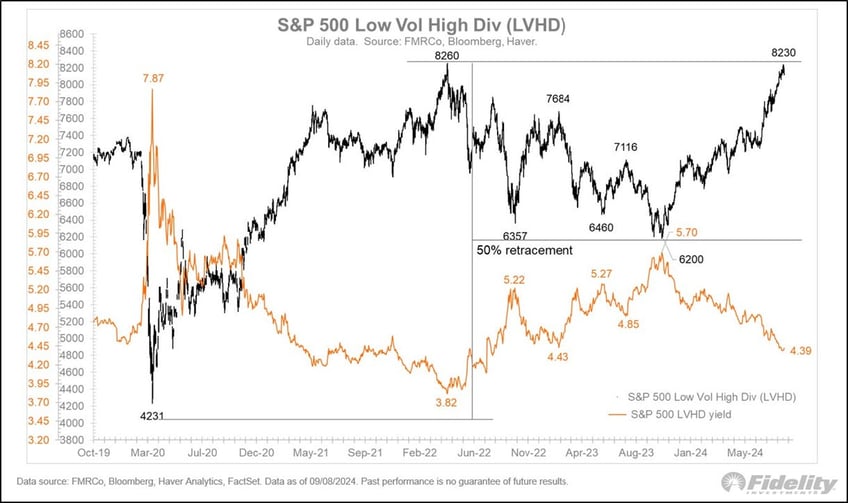

Watch the S&P 500 low vol/high div index and equal-weighted strategies. Also, keep an eye on corporate and CDS spreads for real signs of weakness.

S&P: Long Term Trend

Our NEW CALL: Utilities are in a new bull market. Data-center expansion will be constrained by energy output which will promote MASSIVE investment into utilities.

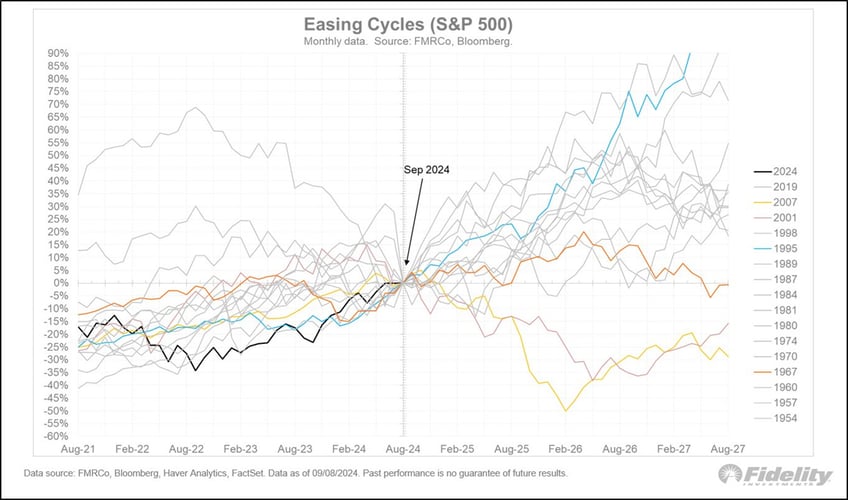

After Easing Cycles

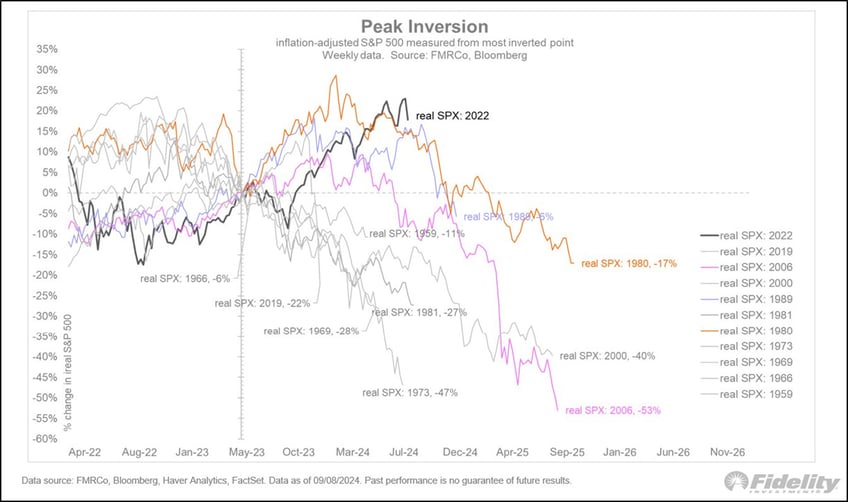

Longest steak of an uptrend after peak yield curve inversion.

Low Vol High Dividend is basically the opposite of the mega cap stocks.

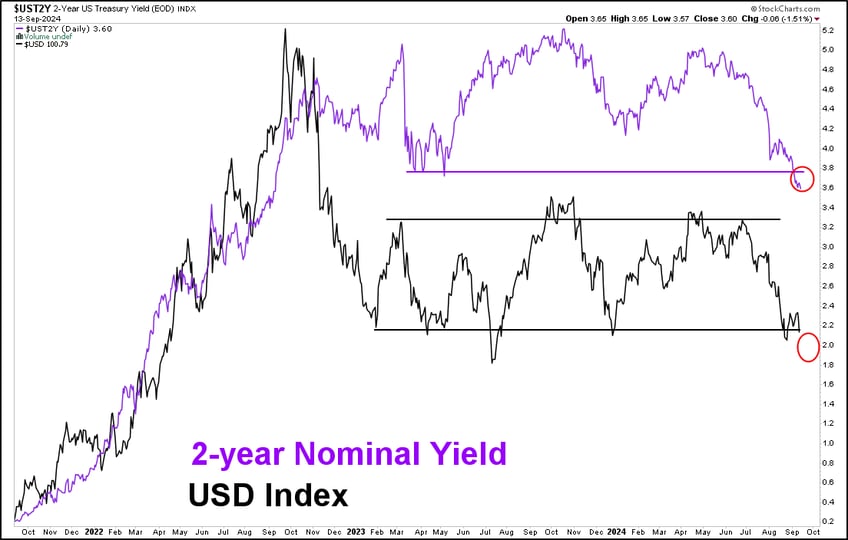

USD is following interest rates lower.

Coffee continues higher. We started covering at $1.78

Home-builders continue to new highs.

Meta: We are staying bullish, all time highs approaching.

ARM outperforming most semis.

Coupang! Look at the accumulation volume. Wants to go higher.

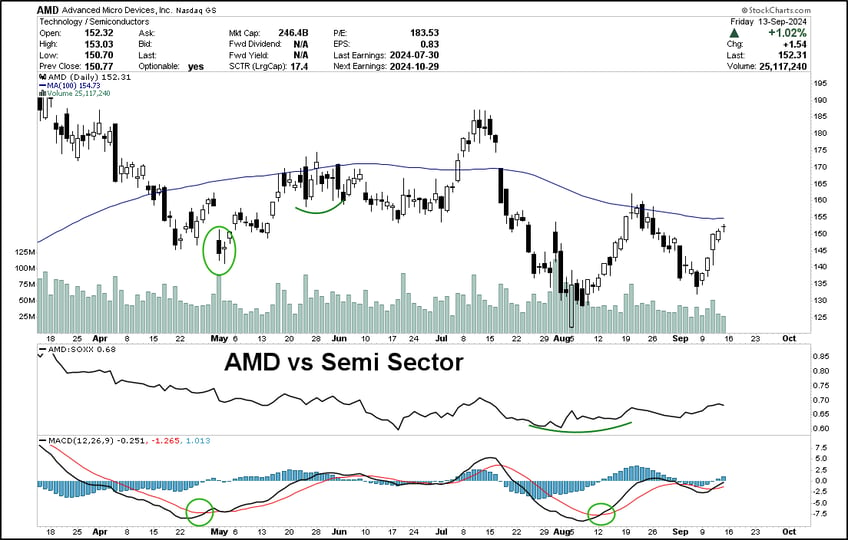

AMD is poaching Nvidia executives now.

Bitcoin is clearly the winner. That Ethereum ETF approval was a sham.

Interest Rate Situation Explained

Dovish View:

Real rates are at their highest since hikes began.

With inflation at 2% and unemployment above “normal”, restrictive policy seems excessive.

Economic growth is driven by borrowing, with savings at a low 2.9%—unsustainable.

Housing market and businesses serving low-income consumers show signs of weakness.

Hawkish View:

A 0.25-point cut allows the Fed to gauge impact and avoid panic.

A larger cut risks signaling aggressive future cuts, complicating inflation control.

The Fed favors consensus and clarity ahead of elections—starting small is the least disruptive.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.