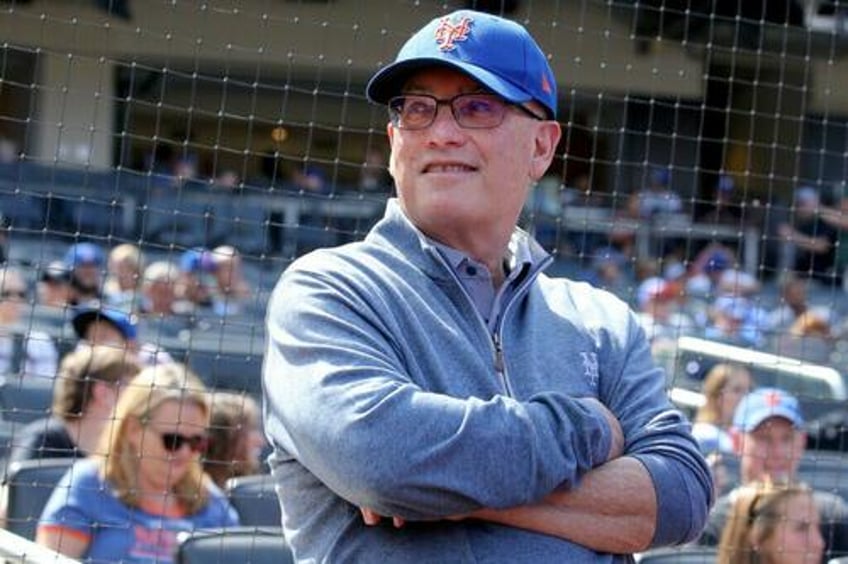

In one of his rare public appearances, billionaire hedge fund manager (and New York Mets owner) Steve Cohen told CNBC's Andrew Ross Sorkin this morning that he expects more and more businesses to move to a four-day work-week in the coming years.

“My belief is that a four-day work week is coming,” Cohen, the founder of Point72 Asset Management said in his first-ever interview on CNBC.

“That fits into a theme of more leisure for people.”

Steve Cohen: "My belief is that a four-day work week is coming. That fits into a theme of more leisure for people."

— zerohedge (@zerohedge) April 3, 2024

Correction: "...more leisure for people in my tax bracket"

Cohen points to a number of factors driving this shift, including the advent of artificial intelligence, and the fact that - post-COVID - more companies allowing hybrid working means “that people are not as productive on Fridays.”

And this thesis supports his major investments in the golf industry.

Specifically, Bloomberg reports that Cohen is part of a consortium that recently invested up to $3 billion in an entity being formed by the PGA Tour and Saudi Arabia’s Public Investment Fund.

The deal, with fellow billionaires including Marc Lasry and Milwaukee Brewers owner Mark Attanasio, is in a new commercial entity that is set to boost prize money for players.

Cohen is also a team owner in a new simulator-based golf league funded by Tiger Woods and Rory McIlroy.

Ironically, Cohen said he’d keep his own traders and portfolio managers working five days a week.

“Taking off Friday when you have a portfolio - that would be a problem,” he said.

So no golf for the PMs.

Cohen may well be right - as all the social narratives are shifting this way - and as Goldman Sachs assuredly explained:

Applying our estimated global labor productivity boost to countries in our coverage implies that widespread AI adoption could eventually drive a 7% or almost $7tn increase in annual global GDP over a 10-year period. Although the size of AI’s impact will ultimately depend on its capability and adoption timeline—and uncertainty around both of these factors is sufficiently high that we are not incorporating our findings into our baseline economic forecasts at this time—our estimates highlight the enormous economic potential of generative AI if it delivers on its promise.

True: there is "enormous economic potential" ... as long as the world survives the revolution that will follow the layoffs of 300 million people.

But the consequences of such a seismic shift in America's way of life would have serious consequences.

Not the least of which is a need for UBI (Universal Basic Income) handouts to fill the pockets of those 'less productive' (read soon to be unemployed) people so they can buy their iPhones (and play golf?) and not burn-the-system down in a revolution.

UBI, of course, is playing right into the hands of the Cloward-Pivens chaos-creators, forcing more and more of the population to become entirely dependent on a benevolent government (as long as you vote the 'right' way)... and to fund that spiraling government debt, The Fed will need to 'enable' trillions in QE every year.

More debt >> More QE >> more inflation >> weaker dollar >> lower standard of living >> higher UBI >> more debt...

Buy gold and bitcoin.