Published at The Bitcoin Layer. Follow Joe on X. Follow Nik on X.

Welcome to TBL Weekly #92—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning everyone! Happy Saturday.

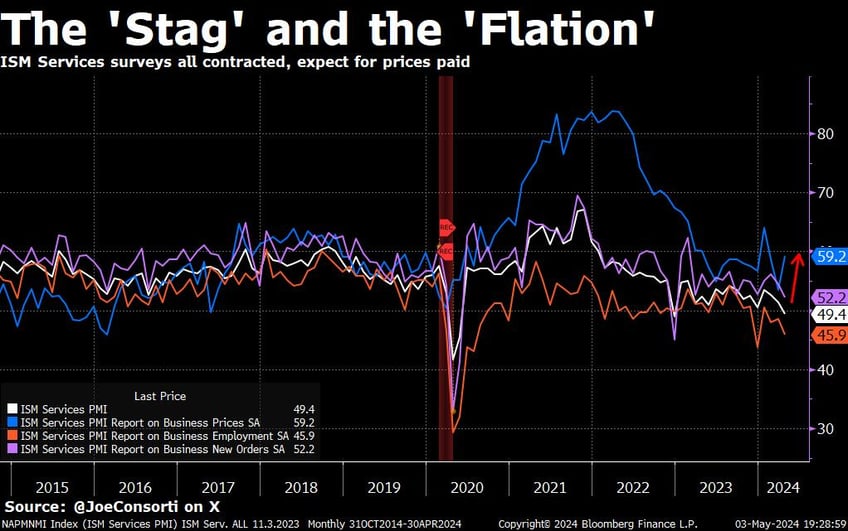

The frequency of high-inflation/low-growth data is on the rise. Nik wrote about this in his exceptional post on Thursday, I’d recommend you take some time to read it if you haven’t yet. Friday’s release of the April ISM Services data added to this trend. Stagflation means the price level in the economy is rising or accelerating, even as economic activity slows and contracts.

The employment component fell deeper into contraction at 45.9, new orders decelerated but are still in expansion at 52.2, while prices paid were the sole outlier that soared all the way up to 59.2. Again, this is adding more fuel to the stagflation narrative. GDP growth has already slowed from 3.4% to 1.6% quarterly, while core PCE inflation has accelerated from 2% to 3.7%. Opposite directions.

Affordability is the #1 issue for young people, with “inflation/the economy” ranking foremost and “jobs that pay a living wage” a close second. Should stagflation materialize, it could be the death knell for the incumbent. The last time the US experienced stagflation in the 70s, Jimmy Carter lost by a 46-state landslide in his election bid.

All that’s left to truly be in stagflation is negative quarterly GDP with positive CPI inflation. We’re not quite there yet, but if the trend of rising unemployment claims winds up driving the unemployment rate to 4% or higher, we will be. Not ideal for the Fed, or for your wallet:

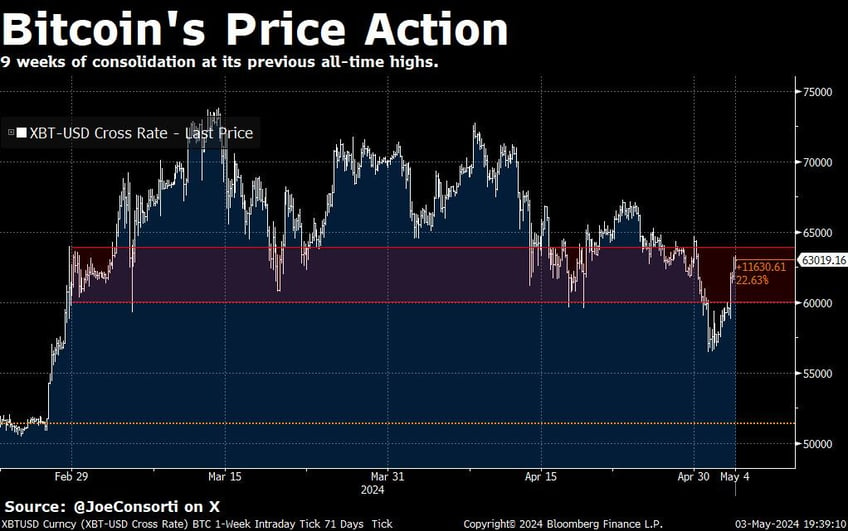

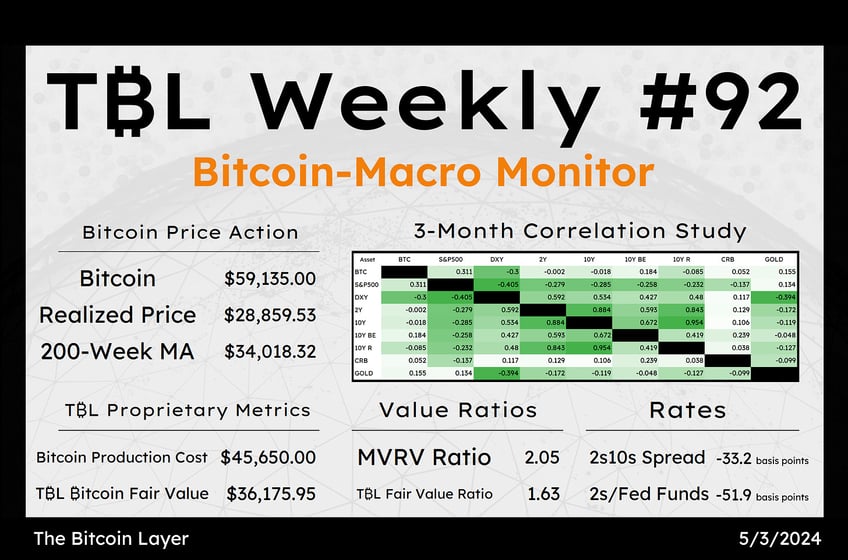

Bitcoin has bounced 11% off of its lows and we’re officially back into the honeymoon range here between $60k and $65k. Just as I called in Tuesday’s dedicated bitcoin piece, any break below this level would be nothing other than an inevitable breather after 7 consecutive months of up only. Profit-takers have done their thing, and we’re heading back up. Bitcoin is officially up 50% year-to-date. Doomsayers in shambles:

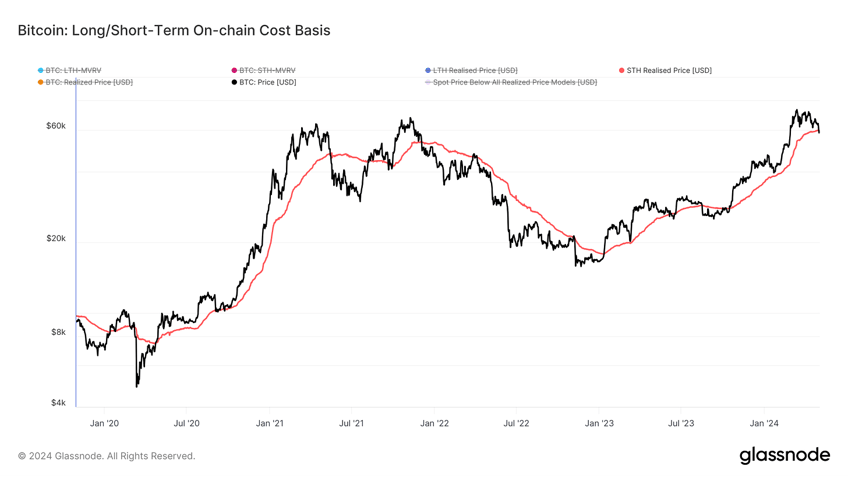

Bitcoin’s price bounced right off the STH cost-basis of $59,414, only wicking below it briefly before rocketing 11% in one day on Friday. A clear rejection, if I’ve ever seen one. This is the first time since October that bitcoin has come into contact with this key level.

This is the average price at which short-term holders bought their coins—think of it as a trader’s realized price (as opposed to a long-term investor’s). Short-term holders, being the most fickle group of bitcoin holders, can get very flighty if the price moves below their average buying price, an extended period below could initiate a feedback loop of selling.

Short-term holders clearly took this opportunity to lift the market’s offer hard instead of getting flighty, signaling that momentum is very much still on the side of the bulls. This bounce right off the level rather than a break underneath is typical of bull markets, and continuation from here is further confirmation that the market has not topped:

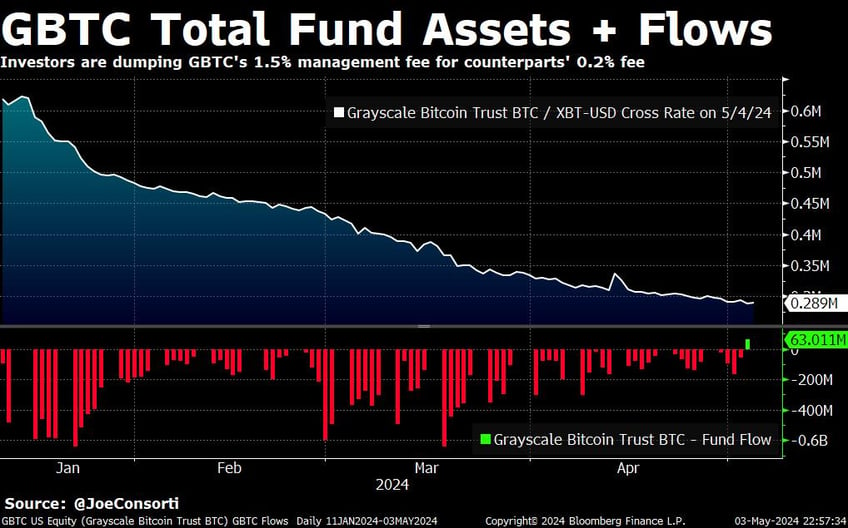

Perhaps the most earth-shattering news of the day: GBTC had a net inflow. This calls for champagne. GBTC has had an 80-trading-day streak of net outflows as investors flock to cheaper options or straight into cash, but they finally seem to be stabilizing.

It has sold 314,000 BTC since it converted to a spot ETF, or some 52% of its holdings. The small $62-million net inflow is by no means a tailwind for bitcoin’s price, but it marks one less net seller in the market:

Block announced it will be dollar cost averaging into bitcoin every month, following in the footsteps of the BTC corporate treasury strategy popularized by Michael Saylor. Bitcoin’s superior risk-adjusted and absolute returns and the benefits it can bring to stale corporate balance sheets as a result have become too much to ignore. The bitcoin corporate treasury strategy will become less of a news event and more of a given over the next several decades:

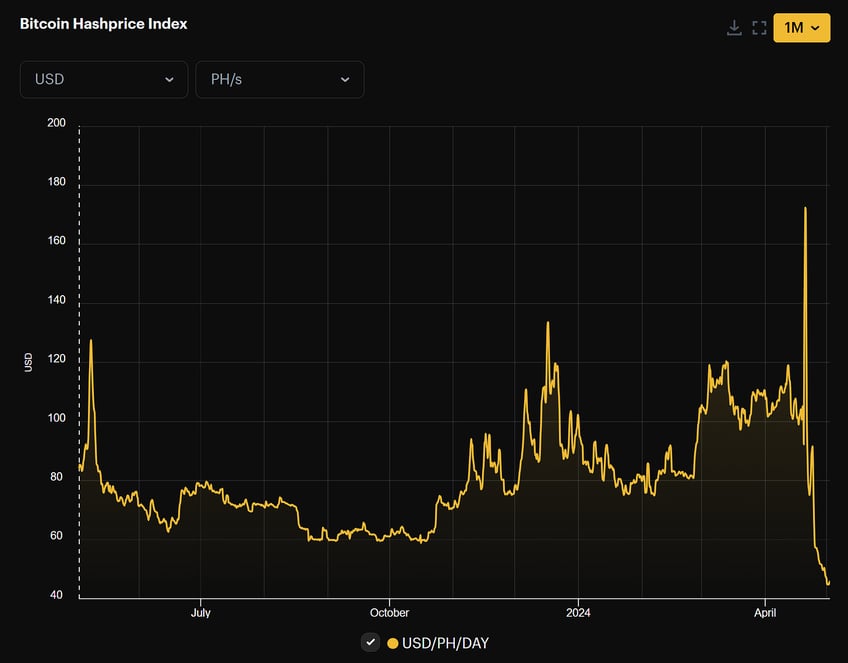

And finally, an update on the miners. Marginal miner revenue is still at all-time lows, up slightly from $44.50/PH/day to $48.30/PH/day. Not a great situation for miners to be in, but one that they absolutely prepared themselves for. The halving is a known event in bitcoin, and it is the most significant event outside of new machine development in the entire bitcoin mining industry—mechanically, holding prices constant, miner revenue unilaterally halved on April 19th.

Even though incremental miner revenue is at all-time lows, this dynamic was definitely something companies prepared themselves for in advance, unlike an extraneous shock where miners would be caught off guard and likely to shut off their machines and/or sell bitcoin to keep the lights on. It can’t last forever, though. The longer this goes on, the more that the risk of a miner-driven BTC selling spree rises:

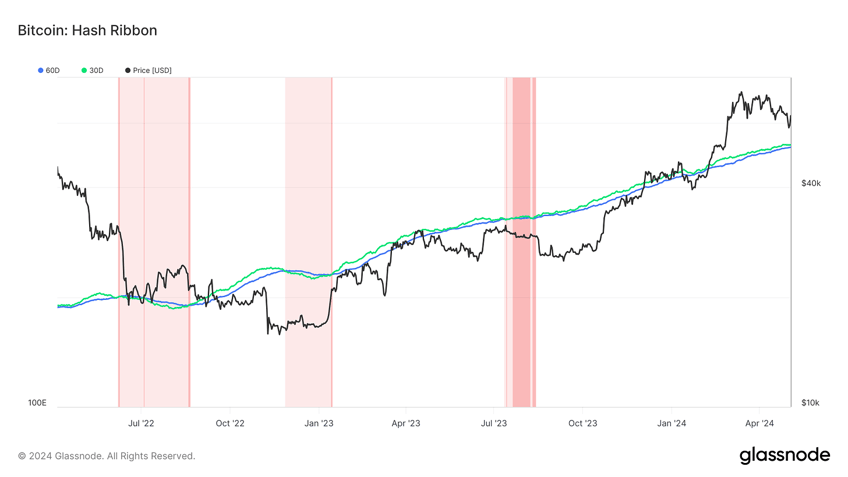

Hash ribbons are in agreement that a miner capitulation event is a ways off. The shorter moving average of bitcoin’s hash rate is not faltering and falling below the longer moving average, meaning that miners aren’t shutting off their machines en masse due to lowered profitability. Miners expect the bull market to remain intact—if they didn’t, they’d likely be battering down the hatches, shutting off machines, and we’d see a rolling decline in hash rate like the 2022 market top. We are not seeing that right now. Miners view this as nothing more than a correction, which is further confirmed by hashprice futures being higher than spot hashprice, meaning that miners expect revenue to rise. Ceteris paribus, that will be due to bitcoin’s price rising:

Next Week with Nik

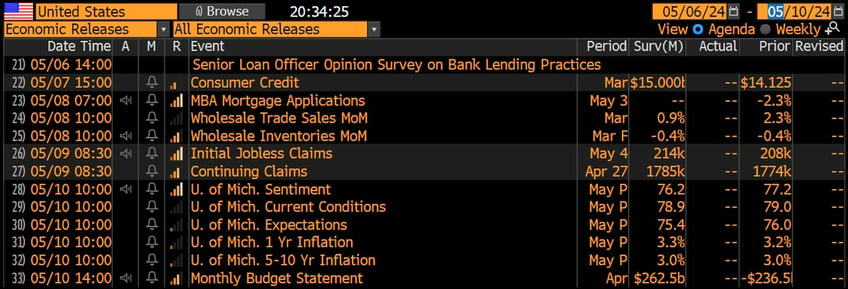

In the week ahead, markets get a reprieve from tier-one economic news. After a week of ISM, NFP, FOMC, and QRA, everybody needs a break from acronyms. Unfortunately, markets have a cruel sense of humor, delivering us the longest of the fixed-income acronyms, the SLOOS report on Monday. SLOOS tells us how willing banks are to lend—after the fall of Silicon Valley Bank last year, this measure slumped materially but has since recovered. We are aware that the rates market will certainly glance at SLOOS on Monday, and we’ll be sure to relay anything material. On Thursday, jobless claims arrive, but at this point we aren’t sure if that formula still works at the BLS, as weekly claims seem to be literally pegged in the 210,000 range. For now, we’ll have to rely on the monthly ISM employment and JOLTS data, both printing terribly this past week, instead of an oddly fixed jobless claims data series:

Markets will be most interested in the performance of Treasury auctions this coming week, with 10s and 30s hitting dealers’ desks in size. Settlement comes on the 15th, so nothing to worry about from a money markets perspective. We feel vindicated in our obsession over settlement days and SOFR watching—with the Fed’s announcement to curtail the pace of Quantitative Tightening, it seems we aren’t the only ones acutely aware of the ample reserves framework and how important it is to keep markets functioning properly. Slowing QT from $60 billion per month to $25 billion per month (Treasuries) doesn’t really address the issue that more reserves, not less, will be needed. The drivers? Nominal GDP increasing by at least 5% per year and Treasury issuing a few trillion here and there as if Treasury bills and everything frankly out to 5-year notes were burning a hole in Yellen’s pocket. Let us at TBL keep watching repo rates on your behalf. Trust me, it’s second nature.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Subscribe to The Bitcoin Layer

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

In this episode, Nik breaks down the current devaluation of the Japanese yen. With a 27% decline since the beginning of 2022, the weakening yen is a policy decision by the government to attempt to inflate away its debt. Nik goes through charts on Japan's debt to GDP, speculates on whether this move is influenced by the United States in an effort to impact China's economy, and concludes with a chart of bitcoin priced in JPY.

Check out—Japanese Yen MEGA DEVALUATION: What's Next?

Wednesday

The end of the world as we know it? No.

Check out—Bitcoin Below $60k as Miner Capitulation Risk Looms Heavy

Thursday

In this episode, Nik is joined by international economist and Copenhagen Business School professor Lars Christensen. Lars presents a masterclass on foreign exchange rates, currency movements, and the international monetary system. The audience will learn about secular shifts in the Japanese economy driving currency devaluation, China's predicament of below-trend growth, why the AI revolution is boosting the natural growth rate in the United States, and how the global economy will be impacted by it all.

Check out—The AI REVOLUTION & Its Impact On The World Economy with Lars Christensen

Before settling in to write you these letters, I usually spend several hours preparing charts and bullet points so that I can deliver to you a cohesive picture of what matters in bitcoin and global macro. Generally, five to seven narratives speak the loudest from across our wheelhouse. Today, I listed out a dozen but had to stop myself after one of the busiest markets days in memory—a function of either luck, the calendar, or the building of a volatility event. We’ll only know if it’s the latter as time progresses.

Bitcoin finally dipped 20% in another bout of extremely high correlation with the stock market, Treasury told us how much long-term debt will be issued, Powell did an Irish jig and waved a magic wand hoping everyone would applaud, and Japan intervened in the USDJPY cross—but that barely scratches the surface of today’s signal. Also, included are my deep and unfortunately dark thoughts about the oppressively soul-sucking financial repression being imposed on society by today’s governments—is there a light at the end of the tunnel, setting aside the interim solution of holding seizure-resistant property such as bitcoin in self custody?

Check out—Prepare yourself for what's coming

Friday

In this episode, Nik brings us a global macro update, focusing on bitcoin's correlation with the stock market, the US government's intentions on inflation, and recent weak economic data. He presents 18 charts to recap an eventful week in currency markets, what was said at the FOMC meeting and Jerome Powell press conference, and the latest US Treasury deficit funding needs.

Check out—Global Macro Update: Bitcoin Bounces 10%, Economy Falters

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Subscribe to The Bitcoin Layer

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.