Published at Theya Research. Follow Joe on X.

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

the cliff-notes:

- Bitcoin ETF holdings have remained stable despite the recent 15% drop in price, indicating long-term and institutional investors are holding firm.

- BlackRock continues to be the strongest buyer of Bitcoin for its clients.

- The correlation between Bitcoin and the S&P 500 remains high, suggesting Bitcoin's bull run may resume alongside continued strength in US stocks through 2024 and into 2025.

Check out today's Theya Research post in video form 👇

Good afternoon everyone, Happy 4th of July week! I hope you've got plenty of time planned with loved ones to celebrate America's 248th birthday with food, fun, and fireworks.

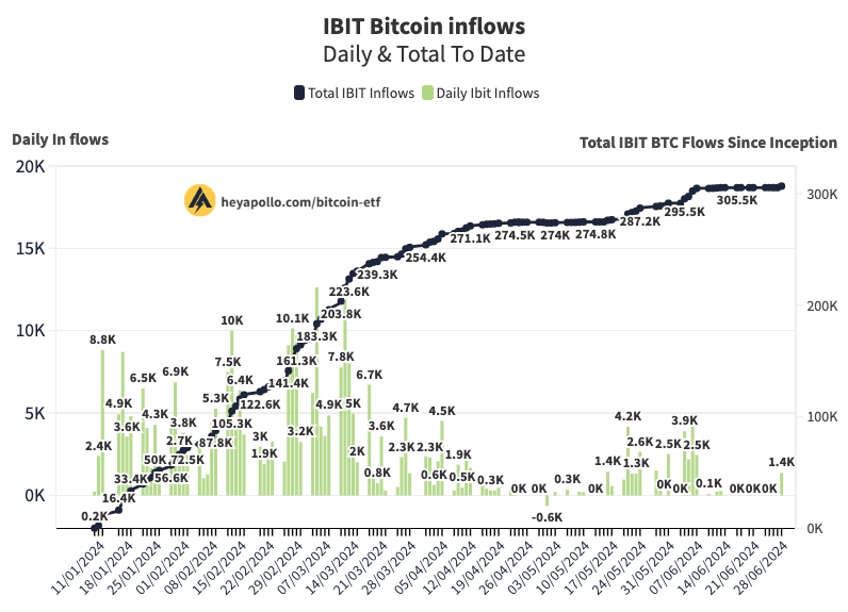

Bitcoin ETF holdings have held up very nicely despite the 15% drawdown in BTC over the last 4 weeks.

As you can see in the chart below, the price of BTC (orange) moves almost in lockstep with the total AUM (white) of the 10 US-based spot bitcoin ETFs—ebbing and flowing with BTC's price as it rises and falls.

Recently, however, the ETF's bitcoin holdings have remained flat even as bitcoin's price has dropped substantially. Long-term and institutional investors, the main clientele for exchange-traded funds, are staying strong. The last 3 weeks, roughly a week after the drawdown began. have seen no massive in/outflows from all 10 vehicles. These people, on net, are sitting on their hands.

Not selling their bitcoin in a panic, like a lot of the short-term areas of the market do during drawdowns, is an encouraging sign for bitcoin's maturation as an asset and its long-term stability:

The break in correlation between bitcoin's spot price and its ETF in/outflows may be drawing to a close. Inflows are picking back up again, which could be a signal that investors expect bitcoin's price to begin rising again soon.

After several weeks of no net in/outflows, BlackRock, the largest spot ETF, saw an inflow of 1368 BTC on Friday. The slump in bitcoin's price may very well be coming to a close, and spot ETF investors are leading the dance:

Download the Theya App — Your Keys, Your Bitcoin

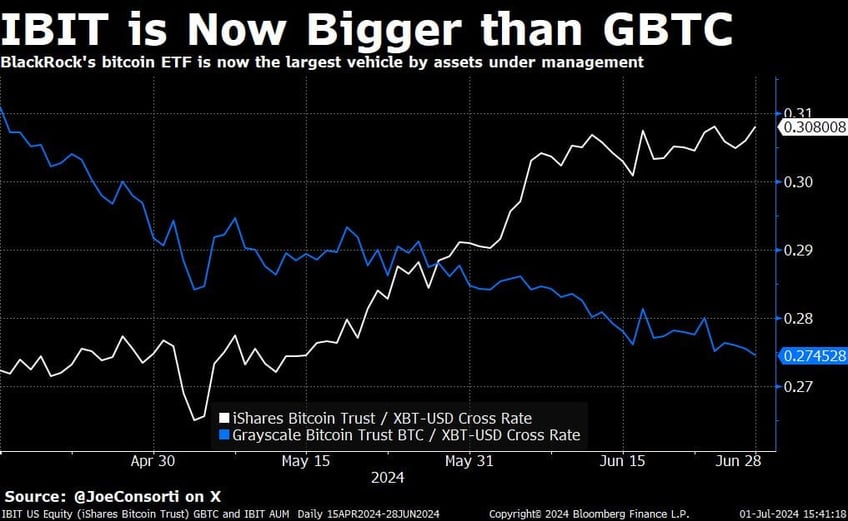

Larry Fink and Co. at BlackRock have taken over the position as market leader and show no sign of slowing down.

Back in May, their iShares Spot Bitcoin ETF overtook the former market leader, Grayscale's GBTC, as the largest spot bitcoin ETF by total assets under management.

Grayscale's product has been hemorrhaging badly due to its comparatively insane 1.5% management fee (BlackRock's is only 25 bps), and BlackRock has the benefit of its size and reputation as the world's largest asset manager.

BlackRock has been the strongest single-buyer of BTC on behalf of its clients, it held the line during the recent price downturn, and is once again buying:

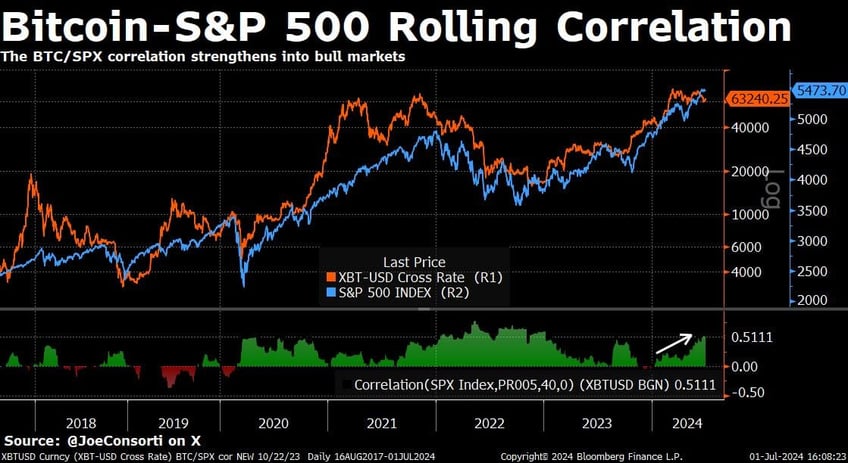

All of this to say: bitcoin looks primed to end its prolonged correction and resume the bull market that the S&P 500 and other US stock indices never paused.

The rolling 40-day correlation between the S&P 500 and bitcoin is still rising, as it has throughout this entire run-up since last October. Not faltering during bitcoin's last 40 days tells me that a) bitcoin isn't underperforming nearly as much as the headlines and standard market pricing will have you think, and b) bitcoin's bull run looks like it's slated to resume, joining its highly-correlated friends in the US stock market who have very good forward earnings and are slated to continue doing well through the end of the year and into 2025:

Final thought: America is the greatest country on Earth.

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.