Published at Theya. Follow Joe on X.

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

the cliff-notes:

- BTC was first transacted for pizza 14 years ago

- in the period from its first market price to being traded on exchanges, it had a whopping 66-fold appreciation

- BTC is the apex denominator for goods and services, and the U.S. is finally taking its regulatory environment seriously

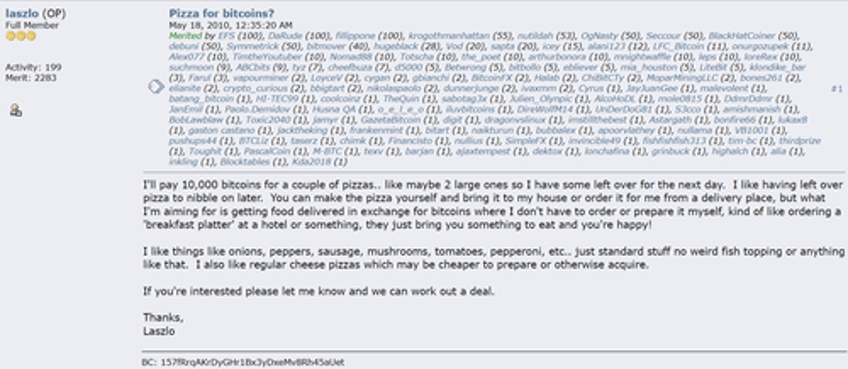

The first known commercial transaction using bitcoin was made 14 years ago from this Wednesday, on May 22nd, 2010, when 10,000 bitcoin were privately exchanged for 2 pizzas. The transaction was arranged on the BitcoinTalk forum, between a user named Laszlo and someone who agreed to buy the pizzas for him:

One user replied, "10,000... Thats quite a bit.. you could sell those on bitcoinmarket.com for $41USD right now.. good luck on getting your free pizza." At the time, invite-only P2P exchanges were the most popular way of exchanging BTC for US dollars, as there weren't large organized exchanges with liquid and active trading like there are today in 2024.

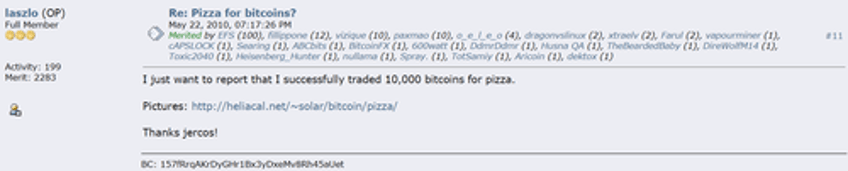

After four days of scouting for someone to take the offer, he successfully secured two large Papa John's pizzas, one with pepperoni and extra cheese, and the other with sausage, pepperoni, onions, peppers, and mushrooms. He secured them for a hefty premium, of course. The going rate for 10,000 BTC was ~$41:

This was the first documented instance of bitcoin being exchanged for physical goods or services. The first ever market price for bitcoin came 7 months earlier, on October 5th 2009, when it began trading on the New Liberty Standard exchange at an exchange rate of $0.00076 = 1 BTC. This was bitcoin's first ever market price, the beginning of bitcoin being assigned a monetary value and traded for real-world currency. Two months after Laszlo transacted in bitcoin for his two pizzas, in July 2010, it began trading on exchanges with a market price when Mt. Gox was launched and BTC had its earliest recorded price of $0.05 = 1 BTC. This marked the beginning of bitcoin's journey as a tradable asset on organized exchanges.

One bitcoin went from $0.00076 to $0.0041 to $0.05 from October 2009 to July 2010. It appreciated by 6478.95%, which is a sixty-six-fold increase.

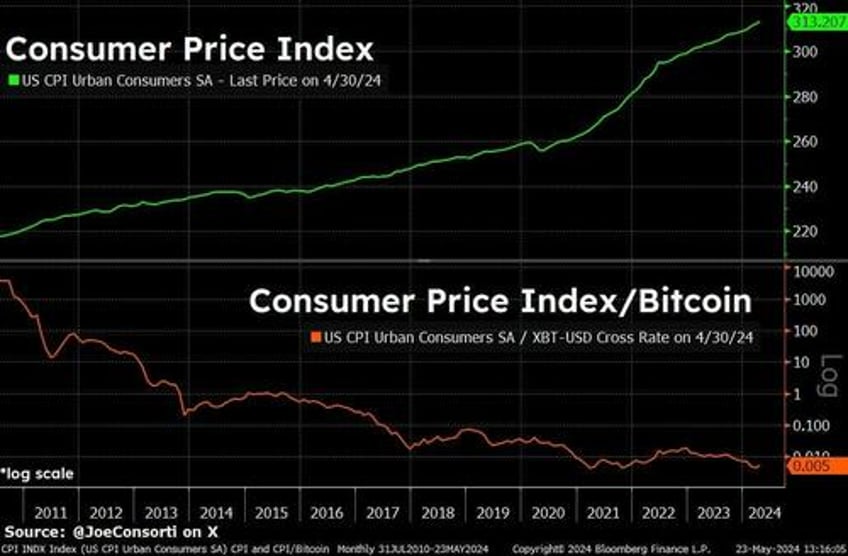

Plenty will read that and throw their hands up in the air like they missed out on something, that's both foolish and not what is being said here. Don't miss the forest for the trees: the US dollar price of BTC has soared, sure, but the major takeaway here is that bitcoin makes all of the goods and services that we enjoy cheaper over time. Whereas US dollars, and all other paper currency, all of the goods and services grow more expensive over time despite improvements in efficiency which should make them grow less expensive over time.

Bitcoin aligns with the deflationary nature of technological improvements over time by making prices just as deflationary. Here's the consumer price index in the top pane, and the consumer price index divided by BTCUSD in the bottom pane, in log scale. It's a bumpy ride, but a clear trend. Goods become less expensive when denominated in bitcoin:

For human prosperity to flourish, the dollar has absolutely failed, and bitcoin, over multi-year and multi-decade time horizons, bitcoin is winning. It is simply better money. Finally, U.S. regulatory bodies are recognizing this reality, and sprinting so that the foremost global superpower isn't left behind in fostering its development.

House passed FIT21, or the Financial Innovation and Technology for the 21st Century Act, which is a legislative proposal aimed at providing clear regulatory guidelines for the "crypto" industry in the United States.

We are bitcoin-only, and don't view this universe of adjacent assets as worthwhile, so that's why we care about this bill getting passed. There will be a time when bitcoin as an asset and network is fully distinct in the market zeitgeist from all the other stuff, and that process is already underway, but for now "crypto" is joined at the coattails of BTC at the regulatory level.

Nevertheless, the bill is yet another massive leap in making the United States the most competitive regulatory environment for bitcoin-native companies. In fact, it is the latest in a long series of bills in the last 10 days that have aimed at bettering the environment for consumers and businesses alike that use and build on bitcoin here in the U.S. Just yesterday, the House also passed a bill to block the Federal Reserve from ever creating a CBDC.

The cherry on top, of course, is Donald Trump accepting bitcoin for campaign donations this week, a landmark development in the political landscape that has clearly drawn the pro- and anti- battlelines between the Republicans and Democrats.

The United States recognizes bitcoin as better money. Senator Thomas Massie even crafted a bill to abolish the Federal Reserve this week. While it likely won't get traction, it is yet more confirmation of this reality that today's post is centered around: the US dollar has failed the American people, and sound money alternatives like bitcoin are a check on that failure.

71 House Democrats voted in favor of this bill. The momentum is picking up and crossing party lines. Anti-crypto is a losing platform not just this election cycle, but in all future election cycles. The United States is planting its flag in the sand, signaling that it wants Bitcoin companies to thrive here. Better money is here. U.S. leadership is waking up to this fact and, even if it's simply to buy votes, ensuring a future where bitcoin is built here, not elsewhere:

Final thought: I'd hate to be the guy who's still on zero right now.

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.