Originally published at Theya Research. Subscribe here.

Good afternoon readers,

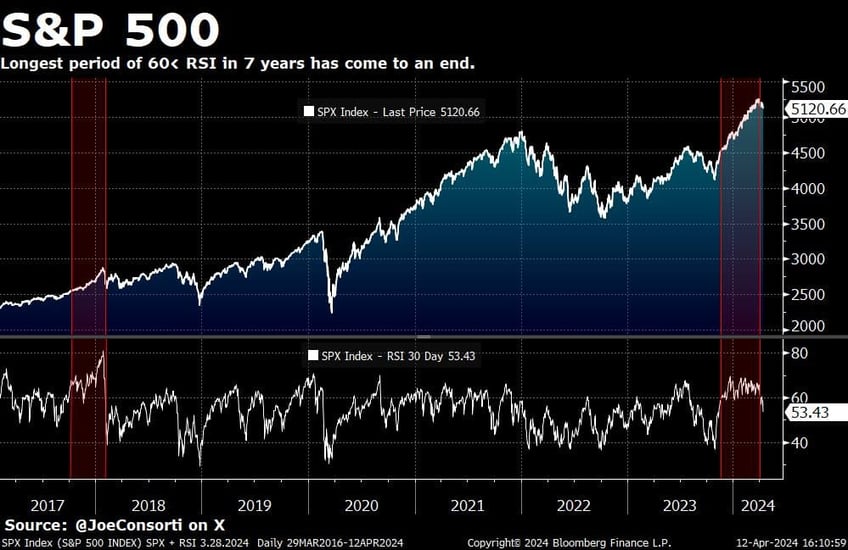

The S&P 500 cratered into this week's close, falling 93 points on Friday to wrap the week at its lowest level since March 15th. SPX has been on a tear for months. It went on its longest continuous run with an RSI above 60 since 2017—for the better part of 6 months, unabashed strength has been the name of the game. CBOE options volatility, a popular stock market fear gauge, spiked today to its highest level in 2024, above an index value of 18. The run has drawn to a close, and fear is creeping back into the market in its stead:

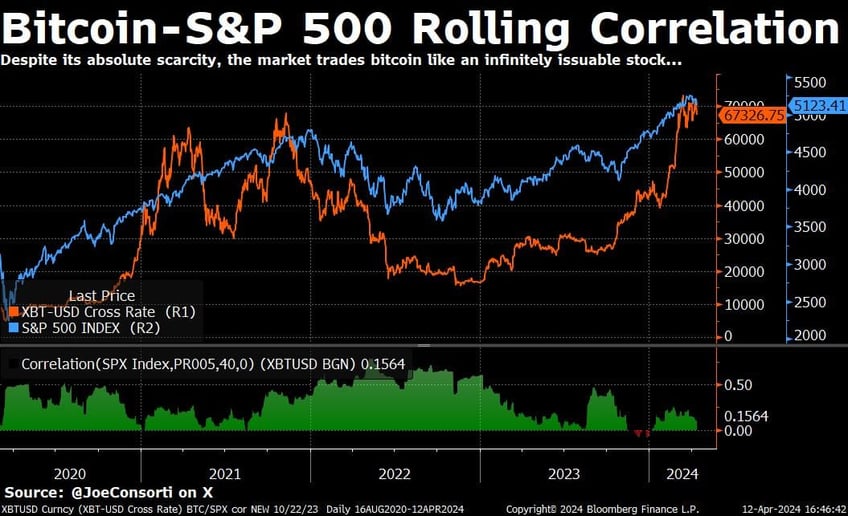

Bitcoin is making the same move, albeit more volatile due to it being 1/33rd the size of the S&P 500. Its tight correlation with the S&P 500 has not been broken this cycle; it still trades like a high-beta risk-on asset despite its immutable scarcity making its monetary properties more akin to an asset like gold. Note how this tight positive correlation wanes during the bull market as bitcoin experiences outsized % gains compared to the S&P 500, and widens back out during the bear market:

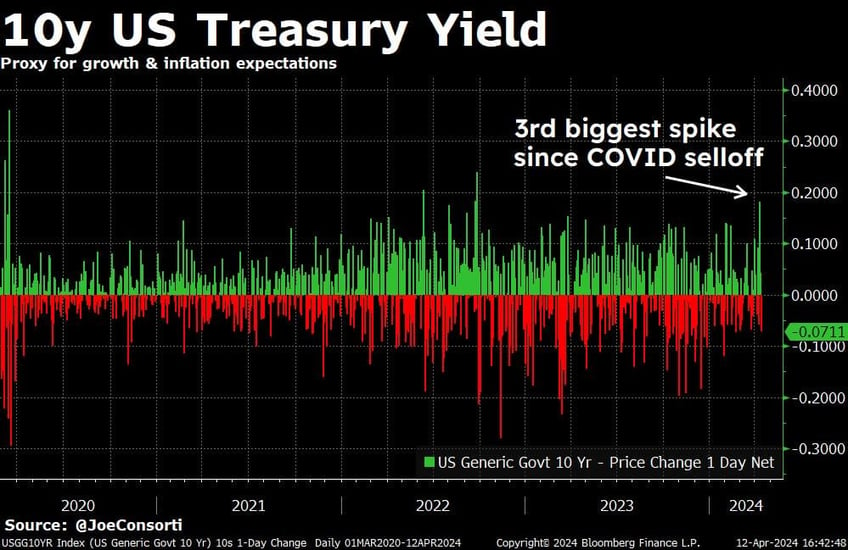

Two main reasons come to mind for this sustained sell-off in risk, the first being Wednesday's CPI print and the yield response that followed. Price inflation beat expectations of an acceleration from 3.2% to 3.4%, coming in at 3.5%. The report also contained the disconcerting news that supercore inflation, which closely reflects consumer spending behavior, has been accelerating for a few months now. This high-growth, hot-inflationary environment has driven yields higher on higher growth, inflation, and Fed policy rate expectations. I talked about this in Monday's post, now that 10s have breached the 4.5% level, it's a rather short trip to challenging last year's highs and even gunning for 5%. Yesterday saw the 3rd biggest 1-day spike in 10s since COVID, closing 18 bps higher, correcting slightly today by 6 bps after a geopolitical flare-up in the Middle East:

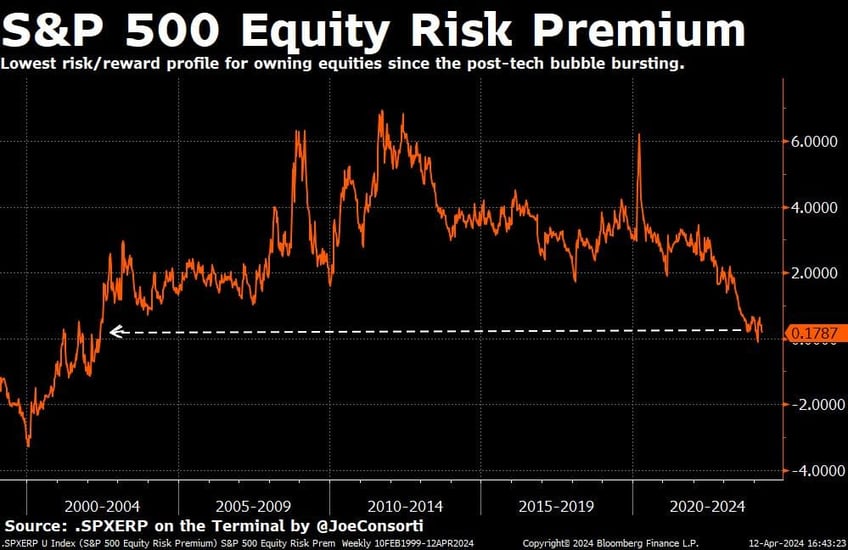

Wednesday's spike in 10s sent the equity risk premium for the S&P 500 even lower, keeping it stuck at its current 25-year lows of just 17 basis points relative to 10s. We derive this by comparing the S&P 500's earnings yield to the yield on the 10-year US Treasury. Stocks haven't been this unattractive compared to owning bonds in two and a half decades, and the risk-reward tradeoff at the index level is almost negative. Why capture less than 25 bps in a stock index with all of the additional corporate risk on top of it when you could just go get 5% on the short-end, sell in a few years when we once again have ZIRP for a huge markup, and bid equities after they've deflated from their obscene multiples? I'm guessing this is the sentiment permeating equities desks all across the country at the moment:

The 10-month limbo of CPI inflation at 3.5% paired with leading data like ISM prices paid which suggests price increases will remain elevated has Fed speakers walking back rate cuts. Cuts for financial maintenance were an absolute certainty at the start of the year, now members are split between one and none in 2024. The case for yields melting up solidifies as the days march on with no sign of price inflation receding down to the Fed's long-run target, making the case for stocks to eventually melt down when financial conditions do tighten all the more plausible. Higher for longer is the pain trade in markets right now. The second of two reasons for stock weakness persisting is the large flight to safety today amid war fears with investors dashing to USTs and gold over risk:

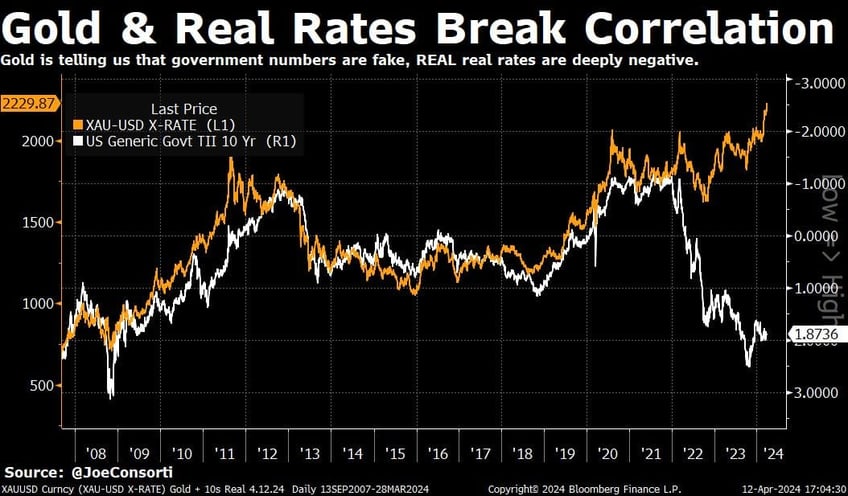

Gold is up 13% this year, rising as much as 2.52% (an eyewatering rally for the shiny rock) today before erasing its gains and falling 1.15% to close out Friday. Still, the near-15% rise in gold is very telling about the global investing landscape. Investors are seeking to shield themselves not only from the US Treasury's fiscal deterioration and the near-certainty that the Fed will step in to help them out, but also from growing geopolitical tensions and the currency strife that can come with it. This flight to safety comes at the expense of risk, stocks and bitcoin both falling into that bucket. Gold historically carries a negative correlation with US real yields, with demand for gold rising as real rates fall and vice versa. Notably, this correlation has completely broken over the past 2.5 years, with gold being in a secular uptrend even as the 10y real yield has risen from -1% to 1.87% today. Why? Perhaps reporting on CPI has cooked real rates beyond belief that they're no longer an accurate proxy for risk-on/risk-off shifts in the market. It could also be the war. It could also be that fiscal dominance has shattered all correlations, and gold is the only remaining proxy for risk-on/risk-off shifts:

Don't forget: fiscal dominance is the driving narrative across markets right now. Tech, AI, and even geopolitics to a large degree take a backseat to the face-melting state of US fiscal policy. Understand it, and understand how to insulate yourself from it.

Final thought: spring is really beginning in earnest up here in New England. Make sure you spend plenty of time outside and enjoy it.

Take it easy,

Joe Consorti

Thanks for reading. Follow Joe on X here.