Published at Theya Research. Follow Joe on X.

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

the cliff-notes:

- Bitcoin's price has surged over 170% since last October

- BTC has now broken below key levels like the 80-day moving average and is approaching the 200-day moving average

- Volatility is back—long-time bitcoiners know what to do. How will the new heads on Wall Street react?

Check out today's Theya Research post in video form 👇

Bitcoin's price has been a rollercoaster since last January, bottoming after a one-year bear market before stair-stepping higher, and really rocketing up at the start of 2024. Since June, we've taken a reprieve, called a "brake run" on rollercoasters, where the coaster is slowed down temporarily so riders can catch their breath before the next big move.

That's what the current bitcoin price regime feels like. Not the start of a long tumultuous bear market, but an extended relief following an eyewatering 170%+ price rally that saw bitcoin make a new all-time high. Breaks are good, and they're necessary, but where are we now?

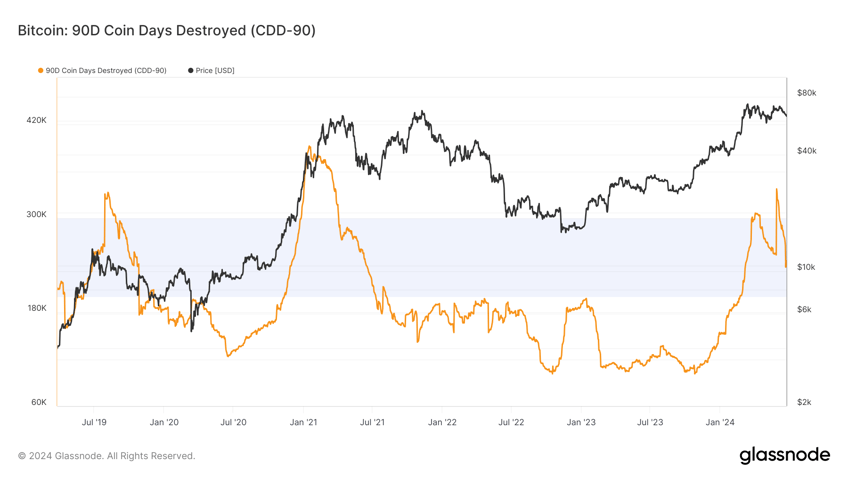

Coin Days Destroyed is rolling over after spiking in the leadup to our new all-time highs. This is a healthy signal that older coins aren't being moved (spent), indicating that long-term holders, the foundation for bitcoin's long-term price appreciation, are sitting on their hands instead of selling to short-term holders.

This can signal a reversion from buying to holding that marks the start of bear markets. It is also a healthy mid-bull market signal that preceded the run-up to brand-new all-time highs during the 2013 and 2021 double price tops. Ceteris paribus, should the bull market remain intact, we will experience that again:

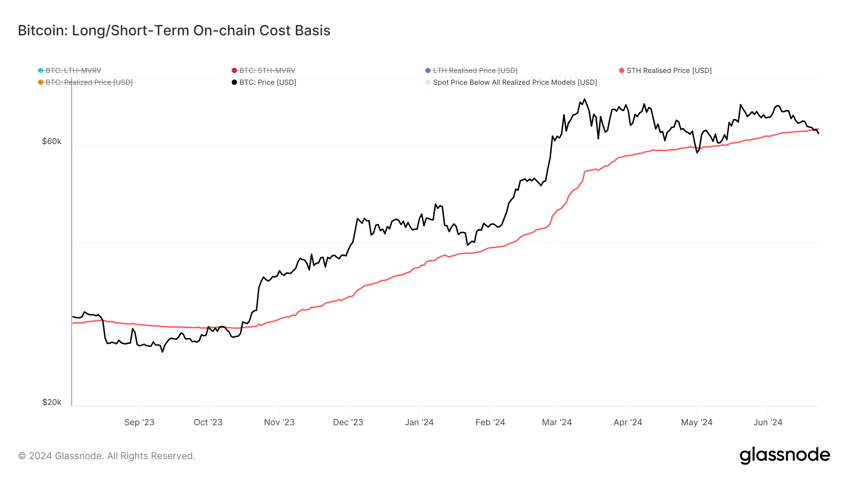

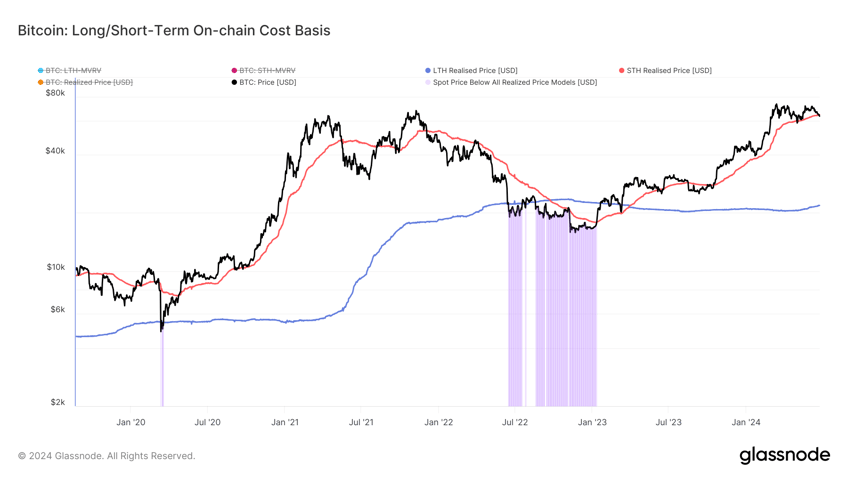

Bitcoin has cleanly broken the short-term holder cost basis, or the average entry point for young BTC owners, the dominant buying cohort during bull markets. Bitcoin's current price of $60,000 at the time of writing is more than $4,000 underneath the STH cost basis of $64,400—this is on par with the break we made underneath it at the start of this bull market, seen on the left of this chart:

Download the Theya App — Your Keys, Your Bitcoin

This price level serves as a floor during bull markets—short-term holders don't want to sell at a loss, so they staunchly defend this level by buying BTC when its market price starts approaching it. Sometimes we get a clean bounce right off of it, and sometimes we spend a little bit of time hanging out underneath it to gather momentum before escaping its orbit and breaking back above.

Since we did not have a clean bounce off of it, and as I mentioned the bull market is still intact, we may be spending plenty of time around here to gather momentum before moving higher. Bitcoin's volatility and its VVOL are both coming off of cyclical lows, so a return to volatility is here, and it's not driving the market in the direction that many hoped it would, at least for now.

Here's hoping that this is the preamble to further upside rather than downside, and we launch back above STH cost basis like the Apollo 13 slingshotting around the moon rather than breaking lower for ~$57,500 support:

Let's move away from on-chain price levels and toward more traditional price levels. They are flashing the same thing: bitcoin is clearly breaking to the downside, through key levels and approaching more of them.

Bitcoin has also broken below its 80-day moving average, another price floor during bull markets, and is heading down to its 200-day moving average at $57,500. Volatility is picking up after an extended slumber, but not in the direction that we want it to:

We broke cleanly below the 80-day moving average at $65,000, and the aforementioned STH cost basis at $64,400, and next up is the area around the 200-day moving average. This is the closest that bitcoin has been to its 200-day moving average since this bull market began in October, and a touch of break beneath it could spell trouble not just for BTC, but a warning light for all risk assets.

One thing I'll definitely have my eye on too is how the ETF investors respond to such movements. Huge bouts of volatility like this have been sparse since the ETFs launched, so investor behavior for this one will be key to analyze.

I use the ETF tracker by Apollo and their newsletter Flow State to keep tabs on the real-time and historical spot bitcoin ETF data. I'd highly recommend both.

Final thought: if there's any market that is used to catching a measly 5% falling knife, it's bitcoin.

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.