Published at Theya — the world's simplest bitcoin self-custody solution.

Theya is the simplest way to take full control of your bitcoin. With our flexible multi-sig vaults, you decide how to secure your keys.

Whether you prefer keeping all keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple devices, it's always Your Keys, Your Bitcoin.

Get started with Theya on the App Store or via our Web App.

Cliff-Notes:

- Since July, bitcoin's price has mirrored Trump’s election odds, reflecting positive investor sentiment toward his pro-bitcoin platform.

- US debt has surged to $35.8 trillion, with fiscal strain rising, positioning bitcoin as a hedge against monetary debasement.

- Regardless of the election outcome, the widening deficit and mounting interest burden will continue to fuel bitcoin’s long-term ascent as a safe-haven asset.

The 2024 US Election is here, and with all of the chaos and uncertainty as to who will take the race, there is one certainty: bitcoin has already won. Let me explain.

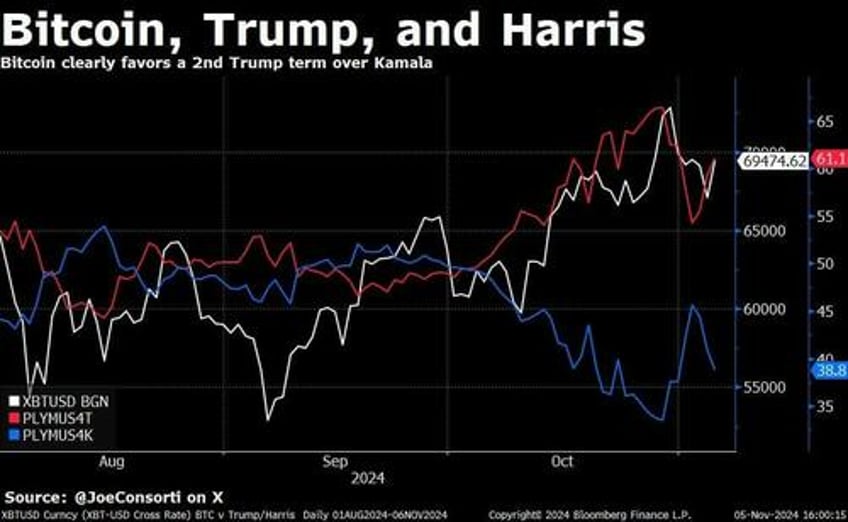

Since July, bitcoin’s price has tracked directionally with Donald Trump’s winning odds taken from Polymarket. For four months, as Trump’s odds have shifted, so too has bitcoin. Bitcoin has been serving as a proxy for the likelihood of a second non-consecutive Trump term, and it's no secret as to why.

Trump’s platform is explicitly pro-bitcoin, outlining policies to prioritize the United States as the world’s most bitcoin-friendly economy. His plan includes establishing a robust environment for bitcoin mining, stopping CBDC development, firing Gary Gensler, and creating a U.S. Strategic Bitcoin Stockpile to help manage the $35.86 trillion debt. Take a look at Trump’s odds in red and bitcoin’s price in white. Kamala Harris’s odds (inverse to Trump’s) also inversely track bitcoin’s price:

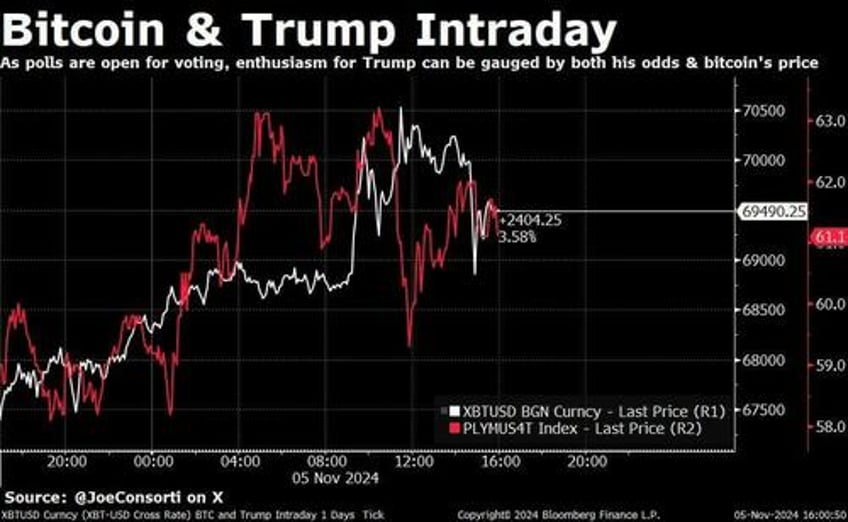

Zooming into today’s trading, this relationship is even more visible. Since the day began, bitcoin has been tracking almost 1:1, at least directionally, with Trump’s odds. Until the polls close, bitcoin’s price will likely remain an accurate real-time gauge of Trump’s standing. This correlation underscores that investors heavily prefer a Trump presidency to a Harris one given his pro-bitcoin platform:

But, this correlation does not paint the full picture. Bitcoin is geopolitically neutral, and a mathematical certainty in light of widening fiscal deficits and accelerating monetary debasement. While Trump’s stance is the most positive for bitcoin, the reality is that both would-be presidents will face the same fiscal and monetary crisis.

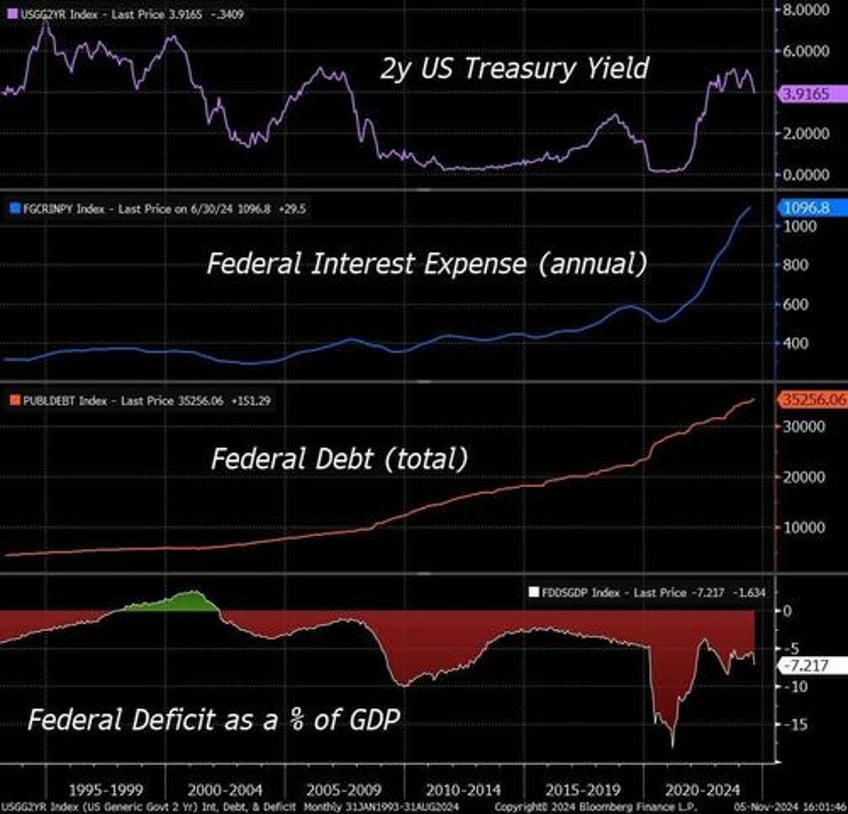

U.S. debt now stands at an eyewatering $35.86 trillion, and debt issuance is accelerating. The next chart displays the 2-year US Treasury yield, climbing from 0.25% to nearly 4% since 2021. This rise as the Fed has hiked its policy interest rates has led the annual interest expense on the national debt to soar to $1.096 trillion, now the second-largest budget item behind social security, surpassing even our National Defense budget.

Reducing debt through spending cuts would trigger a recession on a scale not seen since the Great Depression. With a federal deficit of 7.21% of GDP—the widest we've ever experienced during a non-recession period—the U.S. can’t cut spending without cratering GDP growth. Instead, the Treasury and Fed have elected to a different strategy: keeping rates negative relative to inflation, letting debt devalue over time. This option favors asset price inflation, where bitcoin—highly sensitive to global money supply—stands to benefit most as the deficit widens and the Fed increasingly becomes the marginal buyer of US Treasuries as issuance accelerates:

The 10-year US Treasury yield, a proxy for growth and inflation expectations, has climbed 68 basis points since the Fed’s 50-bps rate cut on September 18th. Over that same period, bitcoin has climbed from $60,000 to $70,000, and gold has had a similar rally as markets brace for a potential growth and inflation re-acceleration and allocate to the proven hedges against it.

The next chart shows 10s in the top pane, the Fed Funds rate in the middle, and bitcoin’s price in the bottom. A red dashed line marks the Fed’s 50-basis-point rate cut, and with another 25-bps cut expected at tomorrow's FOMC meeting, bitcoin will continue tracking this inflationary environment.

Regardless of who wins, the global easing impulse from central banks has been set in motion, and bitcoin stands to gain:

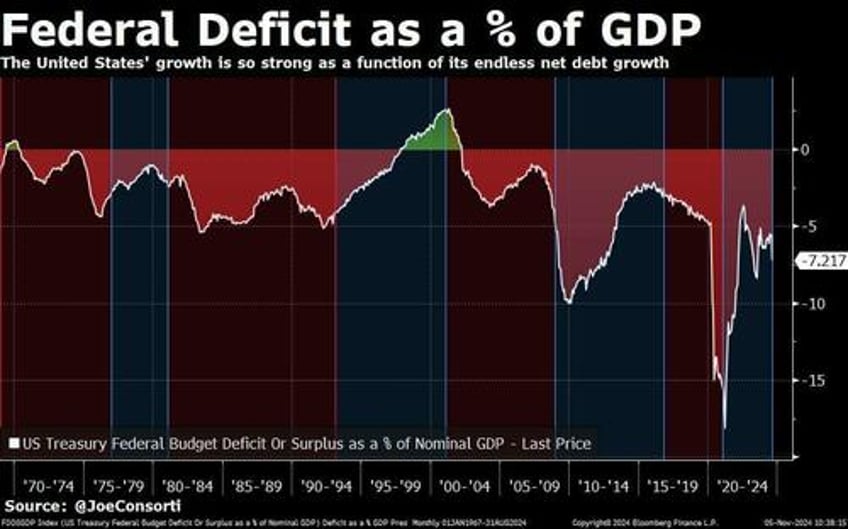

The final chart highlights the deficit as a percentage of GDP, segmented by party in power since 1969. The pattern is clear: deficits have persisted since 2002, and they’re set to widen no matter who takes office. Inflation will continue to be the chosen route to manage our debt load, bringing asset prices up with it. Bitcoin stands as the most responsive asset to these conditions.

The deficit widens either way. The realities of the US interest burden don't evaporate following a Trump or Harris victory. Treasuries will continue to be issued at an accelerating pace in order to fund the US' out-of-control spending, of which the interest expense is nearing existential levels. Study this chart:

Red or blue, the debt grows, the deficit widens, and bitcoin continues to serve as the single-greatest check on monetary and fiscal tomfoolery known to man. US economic growth is increasingly reliant on debt, and over time, the Fed will monetize more of this debt and expand the money supply in doing so, pumping asset prices.

Bitcoin is here to stay, and it’s ready to ride the fiscal tide no matter the election’s outcome. Bitcoin wins the 2024 US Election.

Take it easy,

Joe Consorti

Theya is the simplest way to take full control of your bitcoin. With our flexible multi-sig vaults, you decide how to secure your keys.

Whether you prefer keeping all keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple devices, it's always Your Keys, Your Bitcoin.