Submitted by GoldFix ZH Edit;

BOA's Gold CTA Comment

Good morning:

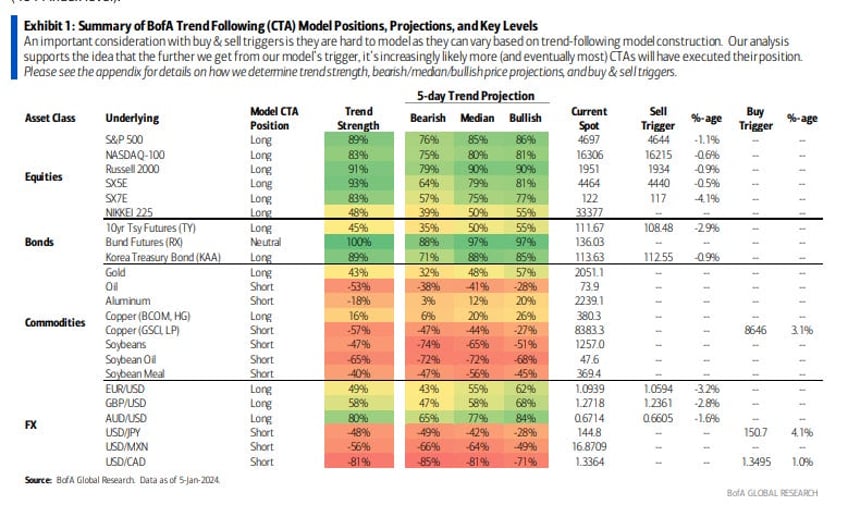

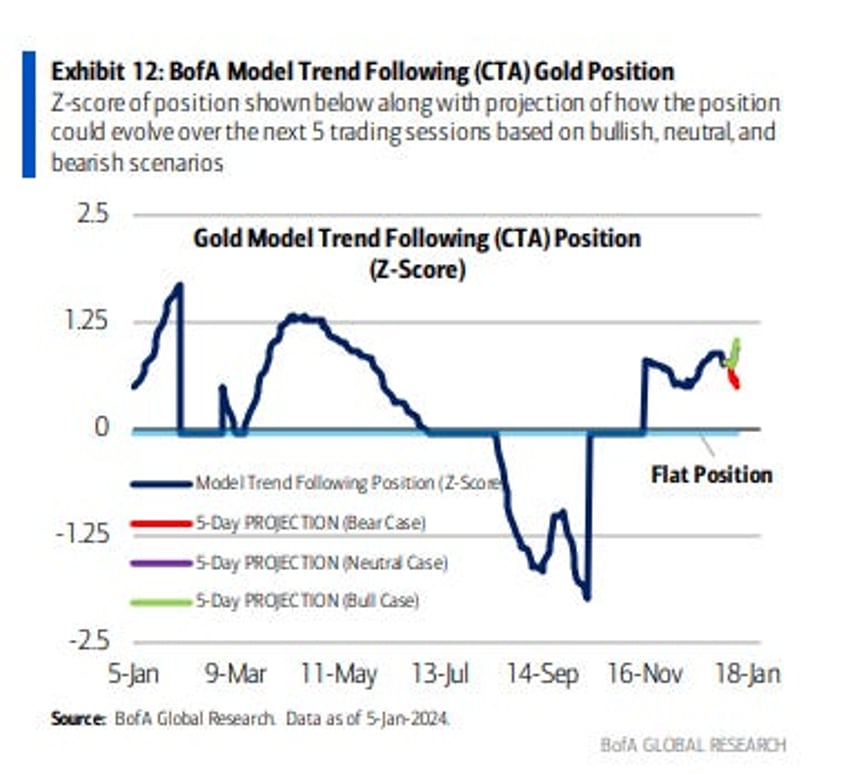

Trend followers are likely short Oil but next week according to our model their positions could see covering and notably in any price path. In other commodities, we have CTAs long Gold with that position to move with spot and Soybeans shorts could see continued increases in size.

Here is last week’s video on how to get the most out of these reports: Masterclass: BOA's Report CTA Walkthrough (with transcript).

Gold CTA Longs continue to be close to max long, but making money. Oil CTA Shorts are making money. Noone seems to be close to panic.

Gold Behavior will follow Spot with no real urgency...

Gold is being driven by macro discretionary buyers, not CTAs right now. Absent a rally, CTA types above will start to get impatient in both commodities. Some will close as CPI approaches. How hard and how much is the question to ask. Long term factors are as good or better than ever for Gold.

Bitcoin's Effect on Gold Muted This Time... For Now

Consider how Bitcoin’s recent rally has not hurt price in gold (yet) even though it is sapping analytical interest right now, (see the headlines below) just like last year. Crypto/BTC is a bank feeding frenzy now and people have only so much money to play with . They are being told to buy BTC on ETF launch.

BTC Buyers have stopped picking on Gold this time around...

We are thinking as the BTC launch approaches gold can suffer from hot-money reallocating…history repeats itself. Frankly, The fact Gold has not gotten killed by all this hype so far is encouraging.

Cryptocurrency GlidePath Headlines

(Via Goldman Sachs Digital Asset Mgt)

• Vitalik Buterin shares updated 2024 roadmap for Ethereum • CBOE Digital sees Bitcoin spot ETFs drawing new institutional investors

• MicroStrategy co-founder Saylor to sell $216 million worth of company shares

• Crypto exchange volume cracks $1 trillion for first time since late 2022

• Derivatives body ISDA updates master agreement for tokenized collateral

• Fidelity sets Bitcoin ETF fee at 0.39% ahead of expected SEC approvals

• Franklin Templeton-backed RDC plans bitcoin securities exempt from SEC registration

• Bitcoin gives up New Years surge after ETF fever breaks

• Bitcoin call options concentrate on $50,000 for January 26 expiry on Deribit

Blockchain Applications / Digital Asset Growth

• Tokenization: Bain, JP Morgan see $400bn opportunity in alternative funds

• ECB issues vendor call, progress report on digital euro rulebook • Moody's rates first fund to use Standard Chartered unit's tokenization platform

• India’s digital rupee crossed a mullion transactions in 1 day with some help from banks

Continues here

Free Posts To Your Mailbox