Submitted by GoldFix ZH Edit

Recently BOA outlined the possible paths towards a higher inflationary base from here. The theme seems to be Don't take disinflation for granted. Here are their observations bulleted. The consensus priced now into markets assumes a steady decline in inflation, which could be disrupted by any number of “imperfect endings” to the story:

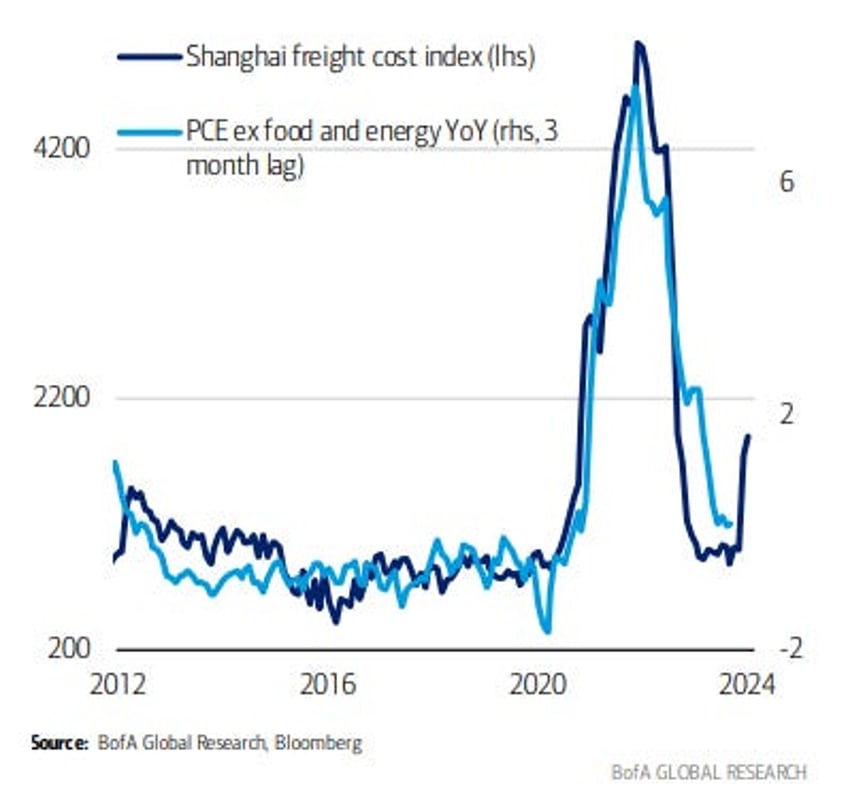

• The US-led coalition has been ineffective so far in stopping Houthi attacks on cargo ships in the Red Sea. 28% of world container trade passes through the Suez Canal. Container prices have spiked 90% in recent weeks.

• Escalation of the Israel/Hamas war could cause oil prices to spike to $150/bbl according to Francisco Blanch; recent drone strikes and attacks have raised concerns the conflict could expand into Lebanon.

• CPI core services less housing (the Fed’s “supercore” measure) remains at 3.9% and has been steady around that level since June 2023; still almost double the 2% Fed target.

• In an executive order signed just before Christmas, the White House raised wages for government employees by 5.2% for 2024.

• The rate of housing starts rose by 255k homes in the past three months, the fastest pace since July 2020.

• El Nino, Black Sea grain deals & geopolitics risk higher food prices

Continues here

Free Posts To Your Mailbox