RATE RISES DONE?

There has been a lot of talk about how we have seen a top in rates and inflation…

As The Wall Street Journal reports:

Asset managers have been counting on what BlackRock calls a “generational opportunity” in the bond market, now that yields are at decade-plus highs.

Investors ranging from pension funds to retirement savers should be buying longer-term bonds to lock in higher rates, their thinking goes, spurring a flood of inflows to bond funds. BlackRock, for one, has projected assets under management at its bond exchange-traded funds to triple to $2.5 trillion by 2030.

So what is to stop yields doubling from current levels?

As we have said many times before, we think that yields are in a multi-year bull market with the duration and magnitude of this bull market likely to surprise everyone, including ourselves. Perhaps we will see a repeat of 1960-1980. Higher energy prices are almost certain to happen.

The US long-dated treasury ETF (TLT) has in the past two years lost all the gains made in the last 20 years. Owners of bonds (or bond funds) have been decimated, but they haven’t thrown in the towel yet. But eventually they will, at which time we are likely to be looking for bargains.

It is bizarre how investors haven’t thrown in the towel yet, and it seems like they are a long way from doing so. Perhaps this is a reflection of most/all investors only knowing a falling rate environment (for some 40 years).

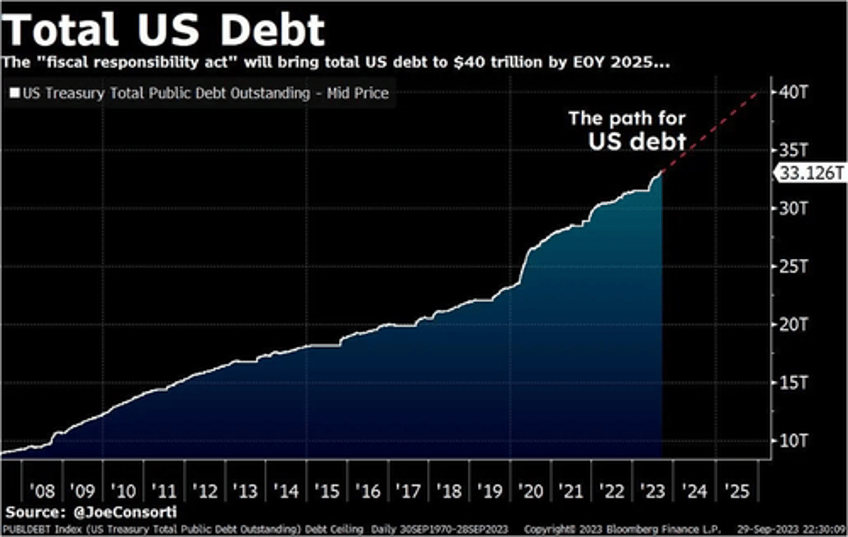

Here is an interesting thought: a tripling of US debt since 2008 or a doubling over the last 10 years?

But what has the US got to show for all this debt accumulation? I mean where are the “Hoover Dams”?

We wonder if there had not been all this debt expansion, would ESG and wokeism have taken hold? Would there be all this uncertainty about what a woman is? Pronouns? Would the “renewable” theme have taken off? Would COVID lockdowns have occurred?