A Hot Summer

The economic data we have seen so far for the third quarter is nothing short of sizzling.

Industrial production rose by a remarkable one percent in July, rebounding from two straight months of declines. Economists had forecast a much milder 0.3 percent gain.

The prior month was revised to show a bigger decline, somewhat offsetting the strong July figure. The Federal Reserve now says that industrial production shrank 0.8 percent in June, worse than the 0.5 percent contraction estimated earlier. But that only makes the turnaround all the more notable. What appeared to be the beginning of a deep and possibly lasting contraction for manufacturing may be turning out to be the bottom of the cycle.

Motor vehicle and parts production jumped by 5.2 percent, bouncing back from the 3.9 percent decline in July. Compared with a year ago, production is up 10.3 percent. Car and truck assemblies rose from an annualized rate of 10.9 million to 11.9 million. That’s one million more than the 2019 monthly average. Very clearly, whatever lingering supply chain problems might have been weighing on automaking have been resolved.

This is also good news from the perspective of inflation. If inflation is too much demand chasing too little supply, adding to supply should bring down inflation. The increase in auto manufacturing should lead to moderation in both new and used car prices. In the July report on the consumer price index, new vehicle prices fell 0.1 percent after holding steady in June and falling 0.1 percent in May. Used car prices fell 1.3 percent, the second straight monthly decline after the 4.4 percent jump in May.

That said, inventories are still very low by historical standards. And additional auto production will likely generate upward pressure on manufacturing employment, likely boosting wages. That will worry Federal Reserve officials concerned that a tight labor market will reignite inflation.

Autoworkers assemble the F-150 Lightning at Ford’s Rouge Electric Vehicle Center in Dearborn, Michigan, on September 8, 2022. (JEFF KOWALSKY/AFP via Getty Images)

Overall manufacturing production soared 0.5 percent—impressively exceeding expectations for manufacturing output to be unchanged from the prior month. (Again, this was somewhat tempered by the revision showing the prior month’s output fell by 0.5 percent, worse than the 0.3 percent previously estimated.) Excluding autos, manufacturing output rose by a more modest 0.1 percent. In our view, however, that supports the argument that manufacturing has bottomed and monetary policy’s drag is fading.

There was a lot of evidence of literal heat in the economy in July. Utilities production jumped 5.4 percent as above-average temperatures sent Americans to crank the air-conditioning. Electricity prices were up three percent in July compared with a year ago, according to the Labor Department’s most recent consumer price index. This means American households are paying more and using more electricity, which could put stress on some constrained household budgets and weigh on inflation for other consumer goods.

Gimme Shelter

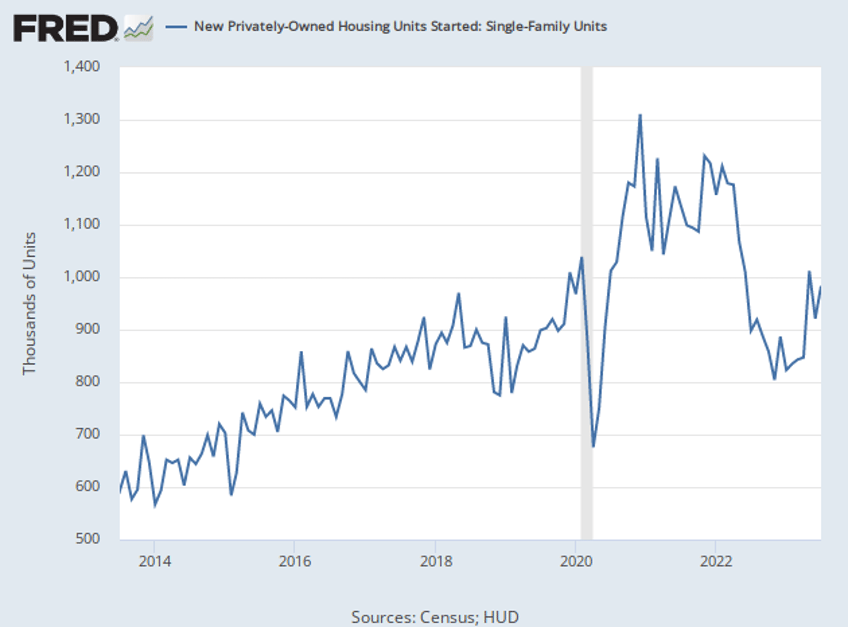

Housing starts also rose in July, climbing 3.9 percent for the month to a seasonally adjusted 1.452 million annual rate. June starts were revised down to 1.398 million. Single-family starts were the driver of the increase, as multi-family starts declined. Single-family starts improved by an impressive 6.7 percent despite mortgage rates climbing above seven percent. This indicates that the housing sector has not only bottomed but is also likely in the early stages of recovery.

It’s notable that although single-family starts have declined from the post-pandemic peak, they remain elevated compared with the decade preceding the pandemic.

GDPNOW Keeps Rising and Rising

The Atlanta Fed’s GDPNOW economic barometer jumped to a jaw-dropping 5.8 percent on Wednesday, boosted by both housing starts and industrial production. The nowcast sees real gross private domestic investment rising at a 11.4 percent rate and real household spending rising 4.8 percent. These are extremely strong numbers.

Of course, the third quarter is only halfway through, and the data we have is quite limited and mostly confined to just the first month of the quarter. No doubt, by the time the first official estimate of GDP comes in, it will be far below today’s 5.8 percent nowcast. But with the number running this hot, it increasingly looks like GDP growth with a three-handle is not improbable.